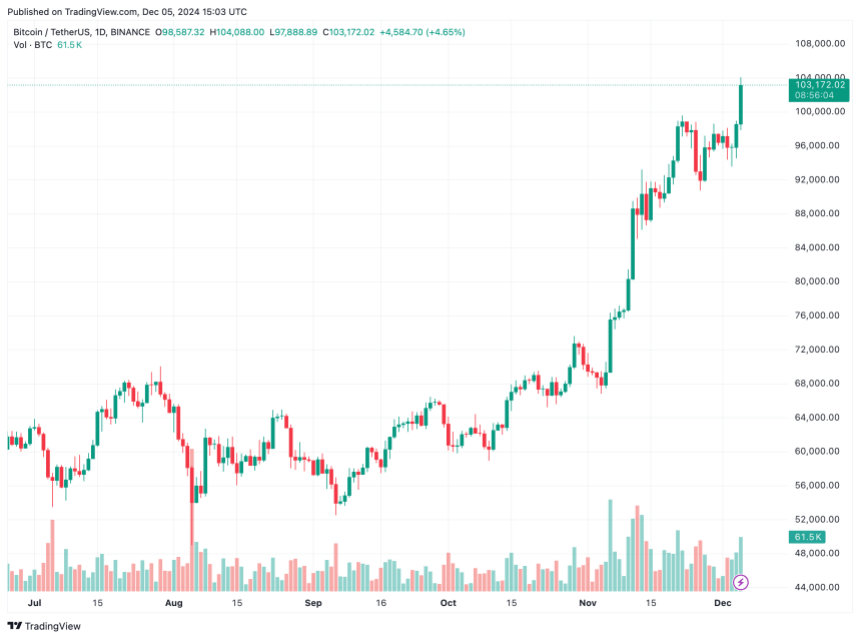

Bitcoin (BTC) shattered the $100,000 worth milestone yesterday, reaching as excessive as $104,088 on Binance crypto trade. This historic worth motion has prompted analysts on the buying and selling agency Bernstein to say that Bitcoin is well-positioned to exchange gold inside the subsequent decade.

Bitcoin Poised To Outshine Gold Over Subsequent Decade, Bernstein Says

In a consumer word launched earlier at this time, Bernstein analysts, led by Gautam Chhugani, expressed confidence that Bitcoin will ultimately assume gold’s position as a dependable safe-haven asset. The word acknowledged:

We count on Bitcoin to emerge because the new-age premier ‘retailer of worth’ asset ultimately changing Gold over the subsequent decade, and turning into a everlasting a part of institutional multi-asset allocation and an ordinary for company treasury administration.

On a year-to-date (YTD) foundation, Bitcoin is up a powerful 141%. Nonetheless, the lion’s share of those good points got here following the victory of pro-crypto Republican candidate Donald Trump within the November US presidential election.

Associated Studying

The cryptocurrency market has seen a surge in optimism following Trump’s victory, because the president-elect is predicted to create a positive regulatory setting for digital belongings. Since November 4, the full crypto market cap has climbed from $2.4 trillion to $3.9 trillion on the time of writing – a staggering 62.5% enhance.

Within the word, Bernstein predicts that BTC could rise to $200,000 by late 2025. The buying and selling agency’s forecast aligns with Charles Edwards’ – founding father of Capriole Investments – prediction that BTC can doubtlessly double in worth inside weeks, as its comparatively smaller market cap allows extra fast worth actions.

BTC Adoption Main Driver Behind Its Success

Bernstein’s bullish outlook was strengthened by Gil Luria, a D.A. Davidson analyst, who recognized mainstream adoption as the important thing driver behind Bitcoin’s success. Nonetheless, he cautioned that Bitcoin nonetheless has a “lengthy path forward” earlier than it’s broadly accepted as a medium of trade and unit of account. Luria added:

Bitcoin’s principal present software as a retailer of worth — an appreciating, low-correlation asset that replaces gold as a hedge towards a decline in financial stability.

Whereas Bitcoin is but to realize widespread use as a foreign money, it has gained important traction as a dependable asset class for company stability sheets. Lately, Hut 8, a number one crypto-mining agency, introduced plans to determine a strategic Bitcoin reserve.

Associated Studying

In November, video-sharing platform Rumble shared its plans to bolster their BTC holdings. On the similar time, declining BTC reserves on crypto exchanges are seemingly including to the asset’s provide shortage, subsequently pushing its worth upward. At press time, BTC trades at $103,172, up 7.9% previously 24 hours.

Featured picture from Unsplash, Chart from Tradingview.com