Oblique value restoration (ICR) looks like a boring, technical funds topic. In actuality, it’s a main supply of the long-running funds crises at public analysis universities. Misinformation about ICR has additionally confused everybody in regards to the college’s public advantages.

These paired issues—hid funds shortfalls and misinformation—didn’t trigger the ICR cuts being carried out by the NIH appearing director, one Matthew J. Memoli, M.D. However they’re the premise of Memoli’s rationale.

Trump’s folks will maintain these cuts except lecturers can create an trustworthy counternarrative that evokes wider opposition. I’ll sketch a counternarrative under.

The sudden coverage change is that the NIH is to cap oblique value restoration at 15 % of the direct prices of a grant, whatever the present negotiated fee. A number of lawsuits have been filed difficult the legality of the change, and courts have quickly blocked it from going into impact.

Memoli’s discover of the cap, issued Friday, has a story that’s unsuitable however internally coherent and believable.

It begins with three claims in regards to the $9 billion of the general $35 billion analysis funding funds that goes to oblique prices:

- Oblique value allocations are in zero-sum competitors with direct prices, due to this fact decreasing the overall quantity of analysis.

- Oblique prices are “troublesome for NIH to supervise” as a result of they aren’t fully entailed by a particular grant.

- “Personal foundations” cap overhead costs at 10 to fifteen % of direct prices and all however a handful of universities settle for these grants.

Memoli presents an answer: Outline a “market fee” for oblique prices as that allowed by non-public foundations (Gates, Chan Zuckerberg, some others). The implication is the foundations’ fee captures actual oblique prices somewhat than inflated or wishful prices that universities skim to pad out bloated administrations. On this analytical foundation, presently wasted oblique prices can be reallocated to helpful direct prices, thus rising somewhat than lowering scientific analysis.

There’s a false logic right here that must be confronted.

The technique thus far to withstand these cuts appears to give attention to outcomes somewhat than on the precise claims or the underlying budgetary actuality of STEM analysis in the US. Scientific teams have known as the ICR fee cap an assault on U.S. scientific management and on public advantages to U.S. taxpayers (childhood most cancers remedies that can save lives, and so forth.). That is all vital to speak about. And but these claims don’t refute the NIH logic. Nor do they get on the hidden funds actuality of educational science.

On the logic: Oblique prices aren’t in competitors with direct prices as a result of direct and oblique prices pay for various classes of analysis elements.

Direct prices apply to the person grant: prices for chemical compounds, graduate pupil labor, gear, and so forth., which can be solely consumed by that exact grant.

Oblique prices, additionally known as services and administrative (F&A) prices, help infrastructure utilized by everyone in a division, self-discipline, division, college or college. Infrastructure is the library that spends tens of 1000’s of {dollars} a yr to subscribe to only one vital journal that’s consulted by a whole bunch or 1000’s of members of that campus neighborhood yearly. Infrastructure is the accounting employees that writes budgets for dozens and dozens of grant functions throughout departments or faculties. Infrastructure is the constructing, new or outdated, that homes a number of laboratories: If it’s new, the campus remains to be paying it off; if it’s outdated, the campus is spending a lot of cash preserving it operating. These items are the tip of the iceberg of the oblique prices of up to date STEM analysis.

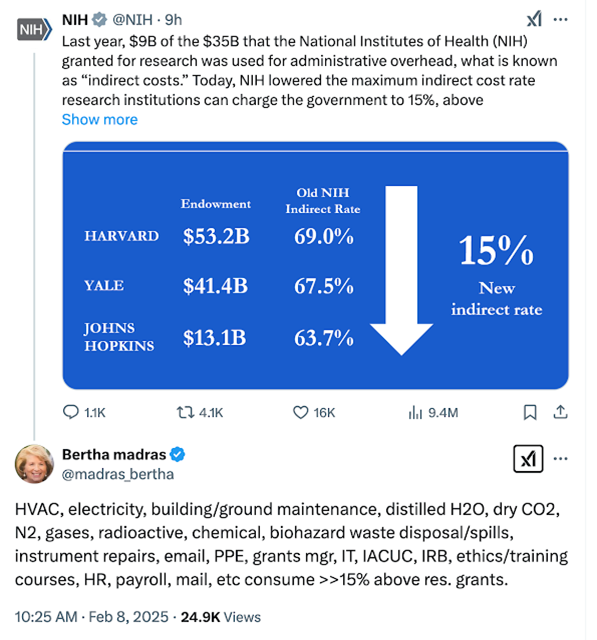

In response to the NIH’s social media announcement of its oblique prices fee minimize, Bertha Madras had a very good starter listing of what indirects contain.

Screenshot by way of Christopher Newfield

And there are additionally individuals who observe all these supplies, reorder them, run the every day accounting, and so forth.—truthfully, individuals who aren’t instantly concerned in STEM analysis have a really laborious time greedy its dimension and complexity, and due to this fact its value.

As a part of refuting the declare that NIH can simply not pay for all this and due to this fact pay for extra analysis, the black field of analysis must be opened up, Bertha Madras–type, and correctly narrated as a collaborative (and thrilling) exercise.

This matter of human exercise will get us to the second NIH-Memoli declare, which includes toting up the processes, constructions, techniques and people who make up analysis infrastructure and including up their prices. The alleged downside is that it’s “troublesome to supervise.”

Very true, however troublesome issues can and sometimes have to be carried out, and that’s what occurs with oblique prices. Each college compiles oblique prices as a situation of receiving analysis grants. Specialised employees (extra oblique prices!) use a considerable amount of accounting information to sum up these prices, and so they use costly info expertise to do that to the proper customary. College employees then negotiate with federal companies for a fee that addresses their specific college’s precise oblique prices. These charges are set for a time, then renegotiated at common intervals to replicate altering prices or infrastructural wants.

The truth that this course of is “troublesome” doesn’t imply that there’s something unsuitable with it. This declare shouldn’t stand—except and till NIH convincingly identifies particular flaws.

As said, the NIH-Memoli declare that lowering funding for overhead cuts will enhance science is definitely falsifiable. (And we are able to say this whereas nonetheless advocating for decreasing overhead prices, together with ever-rising compliance prices imposed by federal analysis companies. However we’d do that by decreasing the mandated prices, not the cap.)

The third assertion—that personal foundations permit solely 10 to fifteen % charges of oblique value restoration—doesn’t imply something in itself. Maybe Gates et al. have the definitive evaluation of true oblique prices that they’ve but to share with humanity. Maybe Gates et al. imagine that the federal taxpayer ought to fund the college infrastructure that they’re entitled to make use of at an enormous low cost. Maybe Gates et al. use their wealth and status to leverage a greater deal for themselves on the expense of the college simply because they will. Which of those interpretations is appropriate? NIH-Memoli assume the primary however don’t really present that the non-public basis fee is the true fee. (In actuality, the second clarification is the perfect.)

This sort of critique is price doing, and it may be expanded. The NIH view displays right-wing public-choice economics that deal with academics, scientists et al. as easy acquire maximizers producing non-public, not public items. Which means that their negotiations with federal companies will replicate their self-interest, whereas in distinction the “market fee” is objectively legitimate. We do want to handle these false premises and dangerous conclusions time and again, each time they come up.

Nonetheless, this critique is just half the story. The opposite half is the funds actuality of huge losses on sponsored analysis, all incurred as a public service to data and society.

Take that NIH picture above. It makes no logical sense to place the endowments of three very untypical universities subsequent to their ICR charges: They aren’t related. It makes political narrative sense, nevertheless: The narrative is that fat-cat universities are making a revenue on analysis at common taxpayers’ expense, and getting even fatter.

The one solution to take care of this very efficient, very entrenched Republican story is to come back clear on the losses that universities incur. The fact is that present charges of oblique value restoration do not cowl precise oblique prices, however require subsidy from the college that performs the analysis. ICR just isn’t icing on the funds cake that universities can do with out. ICR buys solely a portion of the oblique prices cake, and the remaining is bought by every college’s personal institutional funds.

For instance, listed here are the highest 16 college recipients of federal analysis funds. One of many largest when it comes to NIH funding (by means of the Division of Well being and Human Providers) is the College of California, San Francisco, successful $795.6 million in grants in fiscal yr 2023. (The Nationwide Science Basis’s Increased Training Analysis and Improvement (HERD) Survey tables for fiscal yr 2023 are right here.)

UCSF’s negotiated oblique value restoration fee is 64 %. Which means that it has proven HHS and different companies detailed proof that it has actual oblique prices in one thing like this quantity (extra on “one thing like” in a minute). It signifies that HHS et al. have accepted UCSF’s proof of their actual oblique prices as legitimate.

If the overall of UCSF’s HHS $795.6 million is acquired with a 64 % ICR fee, which means each $1.64 of grant funds has $0.64 in oblique funds and one greenback in direct. The mathematics estimates that UCSF receives about $310 million of its HHS funds within the type of ICR.

Now, the brand new NIH directive cuts UCSF from 64 % to fifteen %. That’s a discount of about 77 %. Cut back $310 million by that proportion and you’ve got UCSF dropping about $238 million in a single fell swoop. There’s no mechanism within the directive for shifting that into the direct prices of UCSF grants, so let’s assume a full lack of $238 million.

In Memoli’s narrative, this $238 million is the Reaganite’s “waste, fraud and abuse.” The remaining roughly $71 million is legit overhead as measured (wrongly) by what Gates et al. have managed to pressure universities to simply accept in alternate for the funding of their researchers’ direct prices.

However the precise scenario is even worse than this. It’s not that UCSF now will lose $238 million on their NIH analysis. In actuality, even at (allegedly fat-cat) 64 % ICR charges, they have been already dropping tons of cash. Right here’s one other desk from the HERD survey.

There’s UCSF within the No. 2 nationwide place, a serious analysis powerhouse. It spends greater than $2 billion a yr on analysis. Nonetheless, transferring throughout the columns from left to proper, you see federal authorities, state and native authorities, after which this class, “Establishment Funds.” As with most of those large analysis universities, this can be a large quantity. UCSF studies to the NSF that it spends greater than $500 million a yr of its personal inner funds on analysis.

The rationale? Extramurally sponsored analysis, nearly all in science and engineering, loses huge quantities of cash even at present restoration charges, day after day, yr in, yr out. This isn’t as a result of anybody is doing something unsuitable. It’s as a result of the infrastructure of up to date science may be very costly.

Right here’s the place we have to construct a full counternarrative to the prevailing one. The prevailing one, shared by college directors and Trumpers alike, posits the fiction that universities break even on analysis. UCSF states, “The College requires full F&A price restoration.” That is really a regulative ultimate that has by no means been achieved.

The fact is that this:

UCSF spends half a billion {dollars} of its personal funding to help its $2 billion whole in analysis. That cash comes from the state, from tuition, from scientific revenues and a few—lower than you’d assume—from non-public donors and company sponsors. If NIH’s cuts undergo, UCSF’s inner losses on analysis—the cash it has to make up—instantly bounce from an already-high $505 million to $743 million within the present yr. It is a full catastrophe for the UCSF funds. It’ll massively hit analysis, college students, the campuses’ state staff, all the things.

The present technique of chronicling the injury from cuts is sweet. However it isn’t sufficient. I’m happy to see the Affiliation of American Universities, a gaggle of high-end analysis universities, stating plainly that “faculties and universities pay for 25 % of whole educational R&D expenditures from their very own funds. This college contribution amounted to $27.7 billion in FY23, together with $6.8 billion in unreimbursed F&A prices.” All college administrations must shift to this type of candor.

Except the brand new NIH cuts are put within the context of steady and extreme losses on college analysis, the general public, politicians, journalists, et al. can’t probably perceive the severity of the brand new disaster. And it’ll get misplaced within the blizzard of a thousand Trump-created crises, one among which is affecting just about each single particular person within the nation.

Lastly, our full counternarrative wants a 3rd component: exhibiting that systemic fiscal losses on analysis are the truth is good, marvelous, a real public service. A loss on a public good just isn’t a foul and embarrassing truth. Analysis is supposed to lose cash: The college loses cash on science in order that society will get long-term good points from it. Science has a adverse return on funding for the college that conducts it so that there’s a massively optimistic ROI for society, of each the financial and nonmonetary type. Add up the schooling, the discoveries, the well being, social, political and cultural advantages: The college courts its personal countless fiscal precarity in order that society advantages.

We must also remind everybody that the one individuals who earn money on science are in enterprise. And even there, ROI can take years or many years. Business R&D, with a give attention to product growth and gross sales, additionally runs losses. Consider “AI”: Microsoft alone is spending $80 billion on it in 2025, on prime of $50 billion in 2024, with no clearly robust revenues but in sight. It is a large quantity of dangerous funding—it compares to $60 billion for federal 2023 R&D expenditures on all matters in all disciplines. I’m an AI skeptic however respect Microsoft’s reminder that new data means taking losses and loads of them.

These up-front losses generate a lot better future worth of nonmonetary in addition to financial varieties. Have a look at the College of Pennsylvania, the College of Wisconsin at Madison, Harvard College, et al. in Desk 22 above. The sector spent almost $28 billion of its personal cash generously subsidizing sponsors’ analysis, together with by subsidizing the federal authorities itself.

There’s rather more to say in regards to the long-term social compact behind this—how the precise “non-public sector” will get 100 % ICR or considerably extra, how state cuts issue into this, how pupil tuition now subsidizes extra of STEM analysis than is truthful, how analysis losses have been a denied driver of tuition will increase. There’s extra to say in regards to the long-term decline of public universities as analysis facilities that, when correctly funded, permit data creation to be distributed broadly within the society.

However my level right here is that opening the books on massive on a regular basis analysis losses, particularly biomedical analysis losses of the type NIH creates, is the one manner that journalists, politicians and the broader public will see by means of the Trumpian lie about these ICR “efficiencies.” It’s additionally the one solution to transfer towards the total value restoration that universities deserve and that analysis wants.