Common Mills GIS can present a hedge if volatility continues to plague the S&P 500. The corporate is amid a enterprise transformation telegraphed in its value motion, which is about up for a big reversal after greater than a yr of lackluster efficiency.

The transformation contains promoting its yogurt enterprise, which can lighten the portfolio and shore up the fortress steadiness sheet. It will enable administration to give attention to core markets, worldwide development, and native gems that drive margin whereas offering regular capital returns.

The bonus is the inventory beta. Common Mills has trades with a 5-year beat of 0.1 and a 2-year beta of -.2, suggesting little to no correlation to the S&P 500; if the broad market falls, Common Mills developments might be unaffected and should even get an added increase from a flight to security.

Common Mills Submit Earnings Dip Is A Shopping for Alternative That Will not Final Lengthy

Common Mills share costs fell following the FQ1 launch, opening a shopping for alternative that may possible final solely a short while. The outcomes and steering have been good, with Q1 efficiency being higher than anticipated, and steering was reaffirmed. The issue is that Q1 energy did not carry by means of to the steering, suggesting the rest of the yr might be tepid relative to expectations. Nevertheless, the $4.85 billion in income is down just one% in comparison with final yr, outperforming by 100 foundation factors, and aligns with the outlook for turnaround, resumed natural development, and capital returns, which counts over the long run.

The margin information is simply as blended, with margins contracting however lower than anticipated, leaving earnings down in comparison with final yr however higher than forecast. The salient element is that though internet earnings are down 14%, the $580 million is adequate to maintain the fortress steadiness sheet and the capital return. The $1.07 in adjusted earnings offers a 55% quarterly dividend payout ratio, which is sustainable and anticipated to enhance because the yr progresses. It additionally leaves room for share repurchases, which have been aggressive.

The steering is nice sufficient. The corporate forecasts sequential enchancment in income and earnings and YOY natural development to return by the top of the yr, not together with the sale of the yogurt enterprise. That’s anticipated to shut in 2025 and can influence reported outcomes for the next twelve months by roughly 3% on a diluted foundation.

Common Mills Capital Return Is Prime-Tier and Anticipated to Speed up

Common Mills’ monetary situation is rock stable and permits for substantial capital return, together with dividends and share buybacks. The dividend is enticing at 3.25% and solely 16x earnings, a high-yield worth in comparison with the broad market and main shopper staples friends like Hormel HRL, Hershey HSY, and Kellanova Okay, which commerce at 20x, 21x, and almost 22x their earnings outlooks, respectively.

Steadiness sheet highlights from Q1 embrace lowered money, elevated debt, and lowered fairness, however repurchases and treasury inventory offset these components. The corporate repurchased $300 million of shares in the course of the quarter, lowering the typical depend by 4.65% yr over yr and growing the treasury holdings by almost 20%. Repurchases have slowed in comparison with final yr as a result of contraction of income and earnings, and so they might not speed up quickly. Nevertheless, buybacks are more likely to proceed at a float-reducing tempo by means of the yr’s finish, and the corporate plans to make use of proceeds from the yogurt sale to spice up exercise as soon as closed.

Common Mills Share Worth Supported by an Expectation for Decrease Curiosity Charges

Common Mills’ share value has steadily risen since mid-July, when the CPI report sparked an enormous broad-market sell-off after signaling a excessive likelihood that the FOMC would decrease rates of interest this yr. The sign is that risk-off funding {dollars}, as soon as centered on higher-yielding bonds, have turned to high quality dividend development shares like Common Mills, which nonetheless current worth and yield for traders at present.

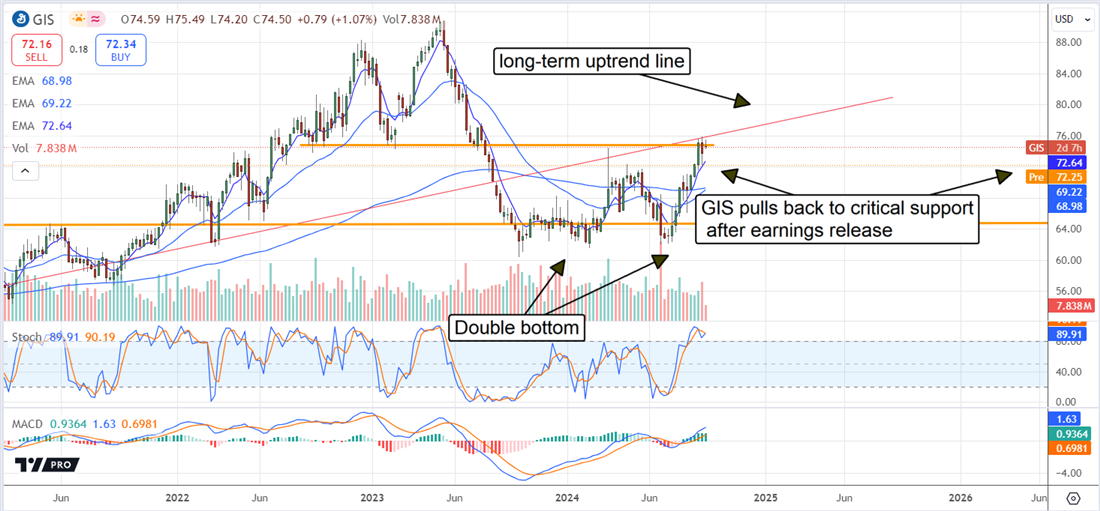

The technical motion since July suggests a double-bottom reversal sample is now in play, and value motion has retreated to a vital help goal. The vital goal is the 30-day EMA, which aligns with highs earlier this yr. If help is confirmed at this degree, traders can count on GIS inventory to proceed increased and full the reversal by yr’s finish. If not, GIS inventory might fall to the $70 degree or decrease earlier than hitting stable help.

The article “Why Common Mills Is the Good Hedge for S&P 500 Volatility” first appeared on MarketBeat.

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.