Signing on the dotted line screams large dedication for a purchaser and excellent news for a vendor.

The quantity of offers a enterprise can efficiently shut is clearly a key worth to measure for B2B firms. It signifies that your gross sales workforce effectively reels in priceless prospects, earns their belief, and will get them to purchase your resolution.

However what in regards to the typical worth behind these closed-won offers? When a contract is signed, how do you assess the monetary impression on your small business? That is the place annual contract worth (ACV) comes into play, serving to you perceive what to anticipate from every contract.

Use a gross sales efficiency administration device to watch your gross sales progress and course right.

What’s annual contract worth?

Annual contract worth (ACV) is the common annual income generated from every buyer contract, excluding any one-time charges. It is primarily utilized by software-as-a-service (SaaS) firms that provide options by annual or multi-year subscription plans.

Measuring ACV by itself doesn’t provide that a lot worth to companies. It’s mostly in contrast in opposition to different gross sales metrics which might be associated to bills, like buyer acquisition value (CAC). For those who examine ACV and CAC, you may see what number of contracts have to be signed to generate sufficient income to cowl the price of buying prospects.

Methods to calculate ACV

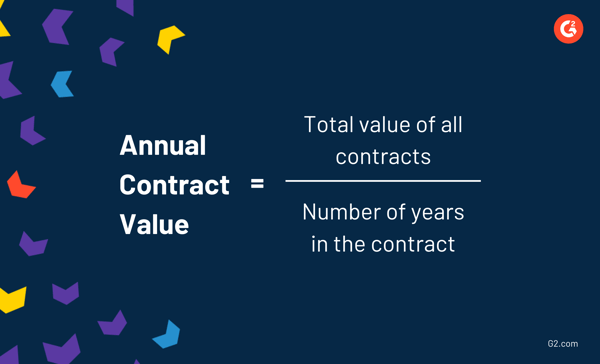

Annual contract worth consists of the worth of all income from subscriptions normalized throughout one 12 months. To calculate your ACV, take the whole worth of your whole contracts and divide that quantity by the whole variety of years within the contract. The ACV method is as follows:

Further ACV elements

Sadly for these on the lookout for good consistency in each gross sales metric, ACV doesn’t present that. Every enterprise might need their very own particular person methodology of calculating ACV.

Some may use the fundamental equation given above, however others may take the next values under consideration:

- One-time charges: Issues like coaching, onboarding, and implementation charges additionally generate income for a enterprise, so some may embrace it of their ACV calculation. Since these charges are solely paid as soon as within the first 12 months of the contract, the ACV for companies that take these charges under consideration will probably be larger in 12 months 1 than in 12 months 2, 3, and so forth.

- Growth: Buying new prospects can lead to the revenue you acquire from them rising over time by up-selling and cross-selling strategies.

- Churn: The lack of current prospects devalues your funding of buying them.

Calculating annual contract worth: examples

With that method in thoughts, let’s have a look at an instance of how you can calculate ACV with each a short-term and long-term buyer.

Your long-term buyer, Faux Firm 500, has signed a 5-year contract with your small business price $125,000. Faux Firm 500 pays an annual price to your resolution. The ACV for Faux Firm 500 can be $25,000 per 12 months.

$125,000 / 5 years = $25,000 per 12 months

Say you could have one other buyer, Actual Firm ABC, that’s extra all in favour of a brief time period dedication. They signed a 6-month contract price $4,000 and will probably be making funds month-to-month. Since ACV is averaged over the 12 months, versus the size of the contract, the ACV for Actual Firm ABC is $4,000 per 12 months.

$4,000 / 6 months = $4,000 per 12 months

The easiest way to seek out your ACV throughout all present buyer accounts is to take action whereas evaluating it to annual recurring income, which will probably be mentioned subsequent.

Why is ACV necessary?

As a result of it’s merely a further methodology for representing income in a roundabout way or one other, common contract worth isn’t that nice of an perception standing alone. Companies measure ACV to see how they’re performing in different key areas – a preferred one being CAC.

CAC is the fee related to convincing somebody to buy your resolution. Evaluating revenue-adjacent values in opposition to CAC is an efficient method to measure the profitability of a enterprise. For instance, companies will examine CAC to buyer lifetime worth (CLV) and decide if the worth of a long-term relationship with a buyer is sufficient to account for the price of buying them.

The comparability of ACV and CAC asks the query: “What number of offers do I would like to shut to cowl my buyer acquisition value?”

As a result of ACV is averaged throughout all present subscriptions, it gives perception into what number of offers a enterprise wants to shut to make a sure amount of cash. Companies will have a look at CAC and decide what number of offers they should near cowl it (primarily based on ACV).

For the explanation acknowledged above, ACV can also be used when setting income targets. Companies will take annual contract worth and conversion fee under consideration when forecasting income for a sure time interval.

For instance, in case your ACV is $10,000 and your gross sales workforce hovers round 4 offers 1 / 4, you may venture that your small business will generate an estimated $40,000 in income that quarter.

Tip: Buying new prospects is hard, and also you don’t wish to waste cash attempting to reel in individuals who aren’t even . G2’s Purchaser Intent Information can present you the businesses researching your small business, so you may attain out to the best particular person on the proper time.

Annual contract worth and different SaaS metrics

Along with ACV, there are different key subscription metrics within the SaaS house that assist companies perceive their income streams and progress potential. Let’s dive into annual recurring income (ARR) and complete contract worth (TCV), and see how they complement ACV to offer a full monetary image.

ACV vs ARR

Annual contract worth and annual recurring income are seen as cousins within the gross sales world. As a result of the definitions are so related and the values can typically mirror one another, annual contract worth and annual recurring income are sometimes confused for each other. Let’s set the file straight.

ACV is the common amount of cash being generated from subscription-based actions for that 12 months. ARR is the worth of recurring income of a enterprise’ subscriptions for a single calendar 12 months. Basically, it’s the yearly revenue from one subscription.

When just one buyer’s ARR and ACV are being measured, they’re usually the identical worth – the amount of cash {that a} enterprise will make from that buyer for the 12 months. Issues get a bit extra complicated when taking a look at complete ACV vs ARR.

ACV vs ARR instance

The easiest way to indicate an instance of ACV and ARR is to work with a number of prospects and measure values over a number of years.

Let’s break it down by buyer after which present the mixed complete ACV and ARR for this enterprise, utilizing Faux Firm 500 once more.

Buyer A agrees to a $2,000 contract for one 12 months. They are going to pay Faux Firm 500 yearly. Because the worth of the contract is $2,000 and the variety of years within the contract is one, ACV is $2,000. As a result of Faux Firm 500 will probably be receiving $2,000 in income for the 12 months from that buyer, ARR is $2,000.

ACV: $2,000

ARR: $2,000

Buyer B agrees to a $1,600 contract for 2 years. They are going to pay Faux Firm 500 yearly. Because the complete worth of the contract is $1,600 and the whole variety of years within the contract is 2, ACV is $800. As a result of Faux Firm 500 will probably be receiving $1,600 in income throughout two years, ARR can also be $800.

ACV: $800

ARR: $800

Buyer C agrees to a $1,200 contract for 3 years. They pay Faux Firm 500 yearly. Because the complete worth of the contract is $1,200 and the whole variety of years within the contract is three, ACV is $400. As a result of Faux Firm 500 will probably be receiving $1,200 in income throughout three years, ARR can also be $400.

ACV: $400

ARR: $400

Now, which may not appear like a lot and also you is perhaps a bit confused. Bear with me! As soon as we do a ultimate calculation for the 12 months that takes all three prospects under consideration, the distinction between ACV and ARR will make much more sense.

ARR instance

Let’s begin with ARR. To calculate ARR, merely add the worth from every contract that Faux Firm 500 will probably be receiving that 12 months.

In 12 months 1, Faux Firm 500 will obtain $2,000 from Buyer A, $800 from Buyer B, and $400 from Buyer C, leading to $3,200 in annual recurring income.

$2000 + $800 + $400 = $3,200

On the finish of 12 months 1, Buyer A’s contract has ended, in order that they’ll now not be paying a subscription. In 12 months 2, Faux Firm 500 can count on one other $800 from Buyer B and $400 from Buyer C. Their ARR for 12 months 2 can be $1,200.

$800 + $400 = $1,200

In 12 months 3, Buyer C is the one one remaining with a contract. Since they pay $400 a 12 months, the ARR for Faux Firm 500 can be $400 for 12 months 3.

ACV instance

Now let’s check out ACV.

In 12 months 1, Faux Firm 500 will generate $2,000 in income from Buyer A, $800 from Buyer B, and $400 from Buyer C. There are three contracts in query, so Faux Firm 500’s ACV for 12 months 1 is $1,067.

$2,000 + $800 + $400 = $3,200 / 3 = $1,067 per 12 months

In 12 months 2, identical to with ARR, Faux Firm 500 will solely be producing income from Buyer B, who pays $800, and Buyer C, who pays $400. The ACV for 12 months 2 can be $600.

$800 + $500 = $1,200 / 2 = $600 per 12 months

In 12 months 3, Faux Firm 500’s solely buyer is Buyer C. Since they pay $400 a 12 months, the ACV for 12 months 3 can be $400.

$400 / 1 = $400 per 12 months

Complete contract worth (TCV)

When talking on ACV, it’s necessary to the touch on complete contract worth as nicely.

TCV refers back to the complete worth of a contract, together with charges and recurring income. ACV is an efficient worth to measure when figuring out which buyer is providing probably the most constant revenue, however TCV tells you which of them contract is probably the most priceless general.

To calculate TCV, merely add the whole recurring revenues from the contract to the extra contract charges. For instance, if you happen to shut a cope with a $100 onboarding price and a $20 a month subscription for 12 months, your TCV will probably be $340.

$100 + ($20*12) = $340

ACV for SaaS companies

Annual contract worth is a extremely valued metric for SaaS companies. As a result of their major income is licensing software program utilizing contracts, the standard worth related when closing a deal will have an effect on the remainder of the enterprise.

SaaS companies like to grasp the benchmark worth of any metric for his or her trade and ask questions like, “What is an efficient ACV for my enterprise?” And naturally, the reply is that it relies upon. Companies might be profitable with each excessive and low ACVs.

As a result of the important thing objective of ACV is to behave as a worth to match different metrics in opposition to, the reply depends upon the worth of that second metric. As talked about above, the most typical metric to match ACV with is buyer acquisition value. If your small business has a low CAC, then an ACV on the decrease finish is alright. So long as your ACV can outweigh your CAC, you’re in fine condition.

Take into consideration a enterprise like Adobe, whose merchandise might be bought to particular person customers. When promoting to this viewers, the ACV goes to be low as a result of one license is being bought to 1 shopper, however since the price of buying new prospects can also be low, the enterprise can nonetheless be worthwhile.

Alternatively, there are companies like HubSpot that promote to complete firms. Since HubSpot’s options are dearer and contain an extended gross sales cycle, their CAC goes to be fairly excessive. Nonetheless, their ACV can also be fairly excessive, to allow them to nonetheless see a revenue.

It’s necessary to remain targeted on your small business and your small business alone when excited about what a “good” ACV is.

Methods to improve SaaS ACV

Now that you know the way to measure your annual contract worth and perceive which metrics to match it in opposition to, you may’ve realized that your ACV may use a bit assist.

As a result of ACV relies upon so closely in your particular resolution and marketing strategy, it’s arduous to spherical up a gaggle of things that may be modified to constantly end in the next ACV. One thing that works for one enterprise might be utterly improper for one more.

Nonetheless, there are two issues you are able to do to spice up your ACV which may appear apparent, however are price noting.

1. Concentrate on up-selling

As your prospects and their companies develop, so will their software program wants. Discovering alternatives to up-sell, which is a gross sales approach the place a rep makes an attempt to persuade the shopper to purchase a dearer resolution, is an effective way to extend the worth of your common contract. More cash equals extra worth.

Nonetheless, you have to watch out when up-selling to your prospects. Sure, it’s your job as a gross sales rep to shut offers for your small business and generate as a lot income as doable, however you’re additionally there to serve the shopper. In the event that they really feel pressured to make a buying resolution they aren’t prepared for, you can lose their enterprise altogether.

Acquire a deep understanding of their enterprise, look ahead to progress, and current the chance when it makes probably the most sense for them, not you.

Tip: The easiest way to up-sell is to grasp your prospects and anticipate their wants. CRM software program might help you construct that obligatory relationship, so when the time comes for them to improve to a brand new resolution, you’ll be prepared.

2. Elevate your costs

This one can’t be elaborated on an excessive amount of – elevating your costs will improve your ACV. Once more, more cash equals extra worth.

Whereas the thought is easy, the method of doing so isn’t. When elevating costs, there are some issues that may make your prospects indignant and stingy with their wallets. Not giving them sufficient discover or tricking them into signing a contract with out stating the value change can lead to these prospects strolling away and not using a second thought.

You may be capable of get away with elevating your costs, however by no means ever achieve this maliciously. Deal with your prospects the way in which you prefer to be handled as a purchaser.

Don’t sleep on annual contract worth

Annual contract worth is an usually missed and underestimated gross sales metric. Whereas it doesn’t imply a lot standing alone, evaluating ACV in opposition to different values supplies priceless insights when making enterprise selections.

Keep knowledgeable by getting an excellent grip on what ACV is sensible for your small business and by no means lose sight of it – otherwise you may undergo the results.

ACV can be utilized to tell numerous different components of your promoting technique, together with quotas. Be taught how you can set gross sales quotas that align along with your ACV, profit the enterprise, and inspire your reps.

This text was initially revealed in 2020. It has been up to date with new info.