Market volatility has seemingly calmed, with the S&P 500 posting its largest weekly achieve since November

Article content material

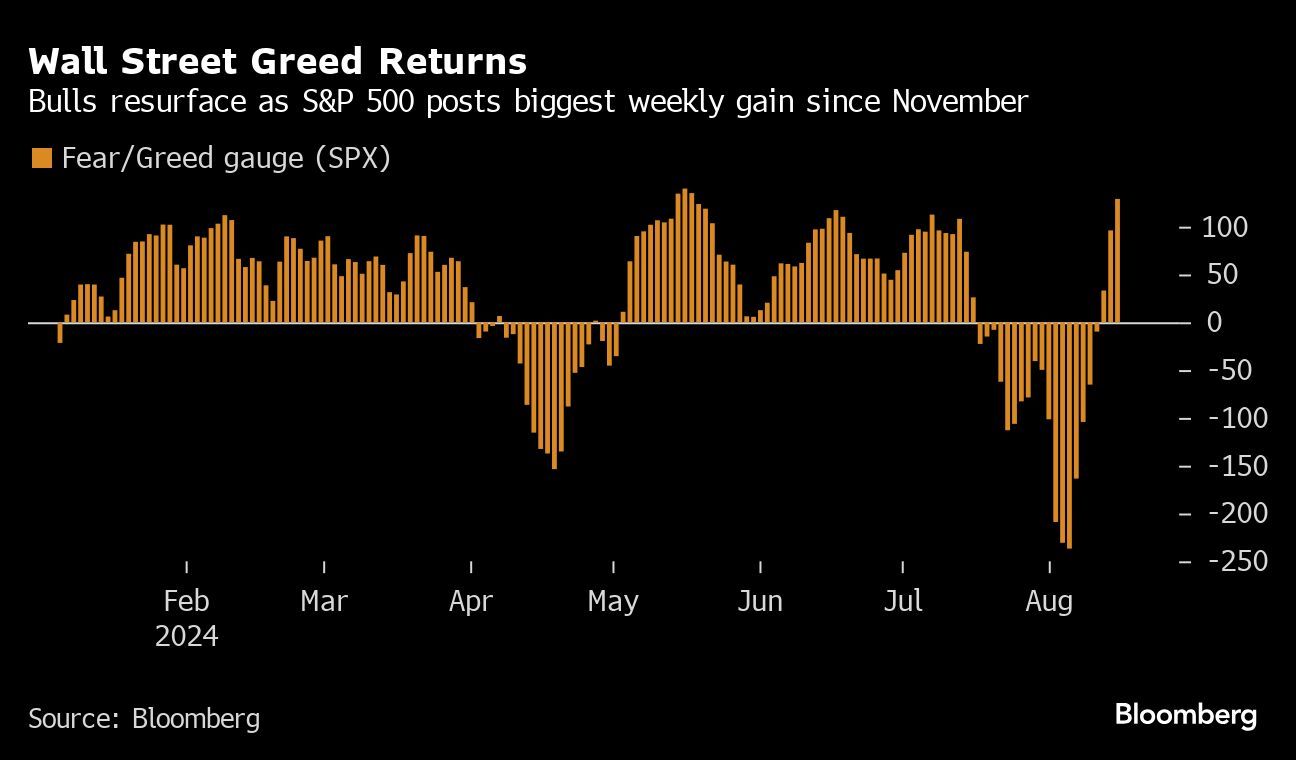

Greed has overcome worry on Wall Avenue — and the market cataclysm that shook up the world in latest weeks could nicely show a mere blip on long-term value charts.

But the summer time rout can even go down as a very excessive instance of a development that’s formed fashionable finance for years now: More and more frequent shocks blowing up with little warning.

As quick as volatility erupted, it has calmed, with the S&P 500 posting its largest weekly achieve since November, junk bonds scoring every week of beneficial properties and Treasury yields stabilizing. In a single particularly vivid instance, the VIX Index, Wall Avenue’s “worry gauge,” has simply damaged two information: the fastest-ever spike of 25 factors or extra, and the quickest comeback from the spike, in accordance with UBS Group AG.

Commercial 2

Article content material

The reversals are a nightmare for anybody attempting to connect smart explanations to the movement of markets. Was the set off for the August swoon technical in nature, or one thing extra sinister like worry of a United States Federal Reserve coverage failure and an oncoming AI bust? No matter your view, febrile markets are periodically transferring from euphoria to despair — and again once more simply as quick — amid an interconnected herd of leveraged merchants.

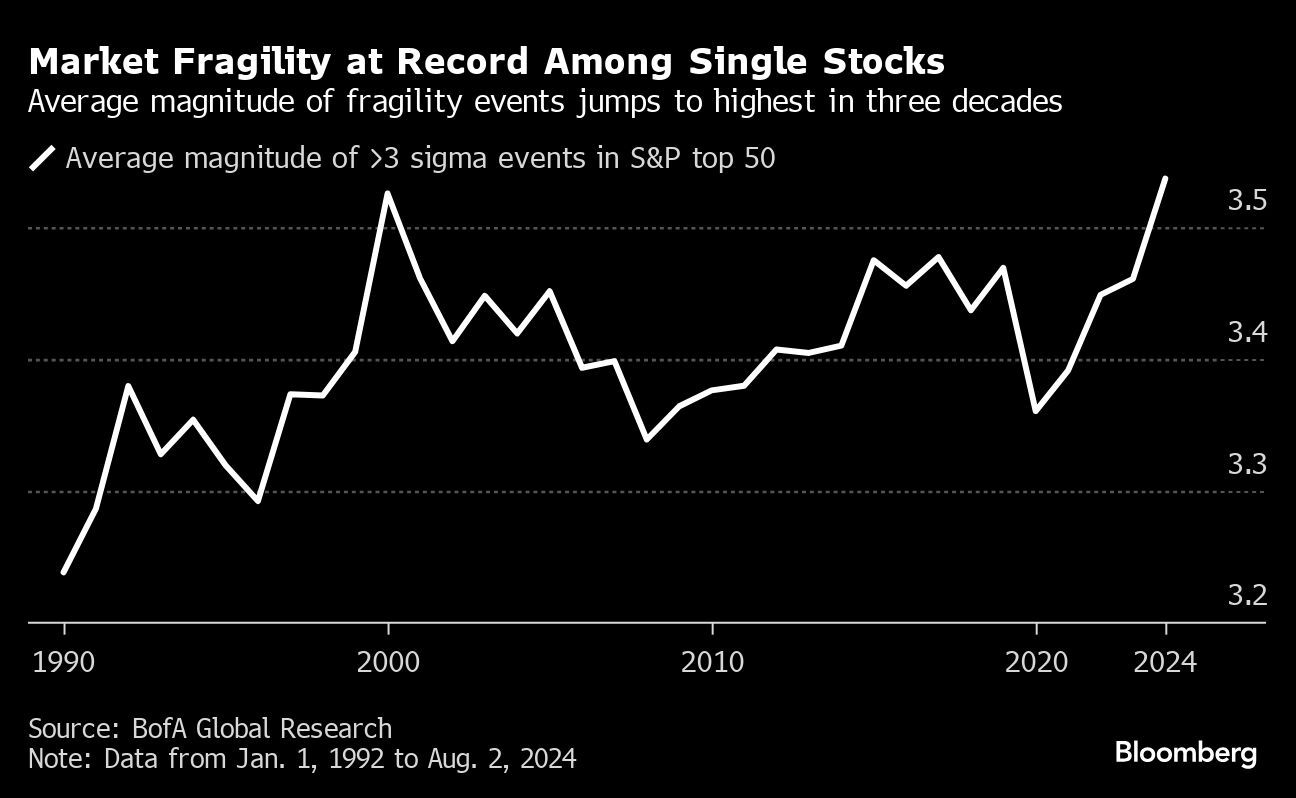

Certainly, the rising frequency of fast-reversing value spasms has been an increasing wing of monetary analysis since at the very least 2019, when Financial institution of America Corp. strategists used the time period “fragility” to explain occasions which have change into 5 occasions extra widespread than within the earlier century. They embrace the 2015 China devaluation scare, 2018’s Volmageddon trauma and the COVID-19 crash.

“We’d characterize the acute market ups and downs over the previous couple of weeks as the newest illustration of how markets have change into inherently extra fragile prior to now 15 years,” mentioned Nitin Saksena, the top of U.S. fairness derivatives analysis at BofA. “The pace with which the shock dissipated solely provides to our conviction, as fast-mean reversion is a trademark of fragility shocks attributable to their technical nature. A extra basic shock would have extra endurance.”

Article content material

Commercial 3

Article content material

Previous blowups have included crowded trades and dicey liquidity, each of which had been in proof in 2024, when a handful of artificial-intelligence-fuelled tremendous shares dominated index returns and left massive swaths of the fairness universe all however unloved. Fragility grew to become evident when the swift unwinding in widespread positions, which additionally included the yen carry commerce, quickly unfold throughout borders and morphed into market-wide disruptions.

That such disparate belongings obtained caught up within the tumult provides to Saksena’s view that one thing within the nature of markets themselves contributed. Bitcoin, the Swiss franc, investment-grade credit score, copper, Japan’s Nikkei 225 all took lumps, he notes, a lesson in “how pervasive fragility is throughout markets and the way dysfunctional markets can change into in occasions of stress attributable to excessive provide/demand imbalances.”

A slew of systematic funds sharply diminished their publicity to shares final week, and quants that chase market trades had been squeezed out. By some estimates, three-quarters of the worldwide carry commerce was unwound by final Wednesday, just for company shoppers and hedge funds to hurry again days later.

Commercial 4

Article content material

“We had a novel set of circumstances the place a mix of positioning, pricing of danger, the extent of volatility and market liquidity all lined up in a method the place you challenged the issues that had been working all yr spherical,” mentioned Ashish Shah, chief funding officer of public investing at Goldman Sachs Asset Administration. “And you actually took down the positioning round these themes.”

This week subsequently delivered the largest concerted rally of 2024 with shares, bonds, credit score rising in tandem, in accordance with Bloomberg-compiled information monitoring widespread ETFs. The S&P 500 scored its finest weekly achieve for the yr of three.9 per cent, snapping a four-week dropping streak. The world’s largest Treasury exchange-traded fund rallied about one per cent as investment-grade and junk bonds scored related wins. Gold climbed to US$2,500 for the primary time. The VIX dropped under 15 after rising above 65 on the top of the maelstrom.

![]()

A raft of latest information prompted merchants to recalibrate their Fed bets after comforting alerts on inflation. The producer value index, for instance, rose lower than forecast earlier within the week. Swap merchants are nonetheless pricing almost a share level of Fed easing in 2024, with the market gearing up for a primary discount in September. Consideration shifts to the Jackson Gap symposium for any hints on how Chair Jerome Powell is viewing the financial system.

Commercial 5

Article content material

“We went from being solely centered on Fed and charges and inflation and now it’s all in regards to the earnings and the financial slowdown and volatility,” Katerina Simonetti, senior vice chairman at Morgan Stanley Wealth Administration, mentioned on Bloomberg TV. “It’s very complicated for traders who are likely to have generally a little bit of a short-term reminiscence.”

Whereas the bond market continues to flash warnings of financial weak point, all 11 principal fairness sectors staged a concerted rally this week. With the Fed all set to chop rates of interest right into a still-expanding financial system, traders are again to worrying about lacking a rally in riskier corners — and have been unwinding the hedges they purchased simply weeks in the past.

With sentiment probably transferring again towards euphoric ranges forward, there’s a larger likelihood for one more disorderly market occasion. Framed this manner, a cohort of investing professionals — notably those who supply portfolio insurance coverage generally known as tail-risk hedging — argue that markets are ever-more fragile. Thank investor herding, questionable liquidity — and the rise of volatility-sensitive traders who purchase and promote on technical, moderately than financial, triggers.

Really useful from Editorial

“We’re on this zone of regularly making new highs, much like how we had been round another market tops,” mentioned Josh Kutin, head of asset allocation, North America at Columbia Threadneedle Investments. “That makes for a extra fragile market. It creates an environment the place persons are extra simply spooked.

With help from Lisa Abramowicz

Article content material