Tether’s USDT, the world’s main dollar-pegged stablecoin, has skilled the sharpest weekly decline in market worth in two years, spurring market volatility considerations.

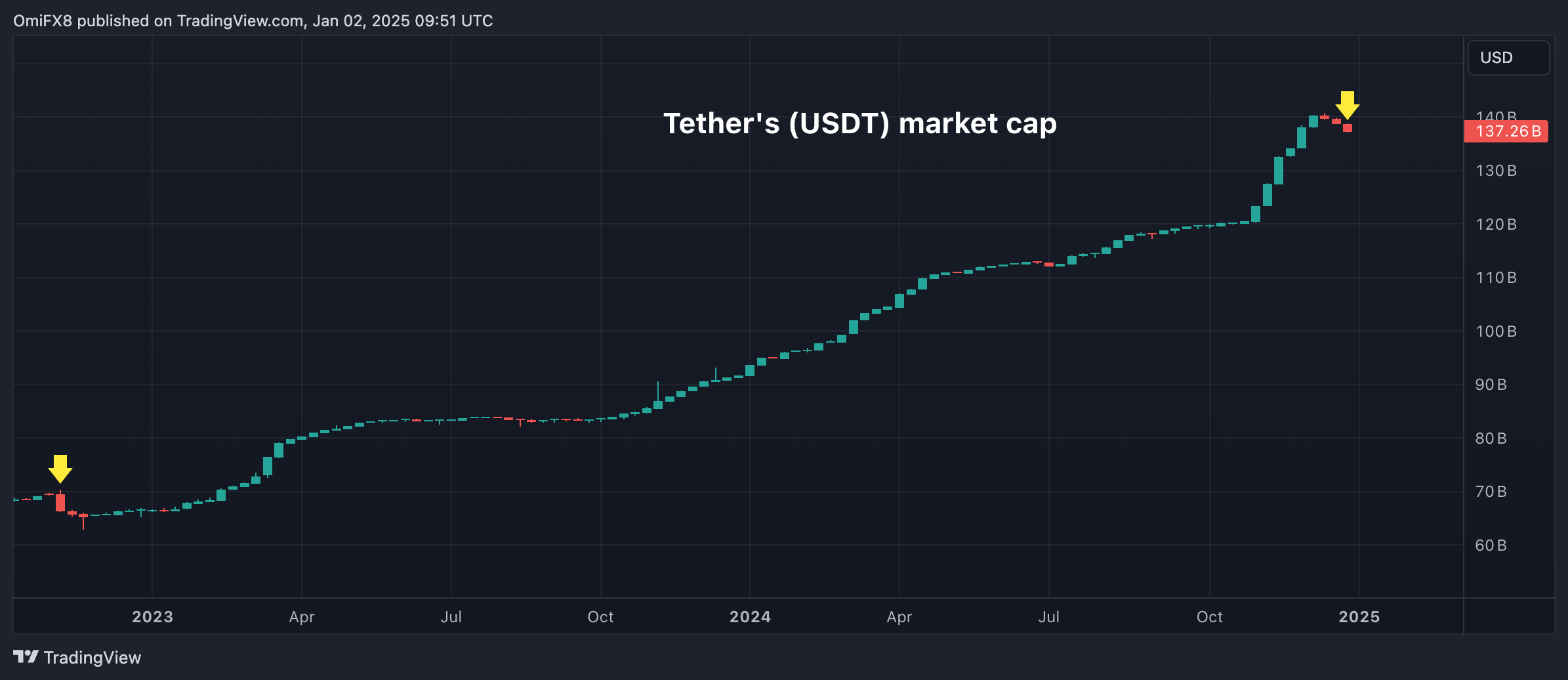

USDT’s market cap slid greater than 1% to $137.24 billion this week, essentially the most vital decline for the reason that crash of the FTX alternate within the second week of November 2022, knowledge from TradingView present. It hit a report $140.72 billion in mid-December.

The decline follows a choice by a number of European Union (EU)-based exchanges and Coinbase (COIN) to take away USDT as a result of compliance points with the EU’s Markets in Crypto-Property (MiCA) rules that took full impact on Dec. 30, although the principles on stablecoins — cryptocurrencies whose worth is pegged to a real-world asset just like the greenback — kicked in six months in the past.

The regulation requires issuers to have a MiCA license for publicly providing or buying and selling asset-referenced tokens (ARTs) or e-money tokens (EMTs) throughout the bloc. An ART is a crypto asset that appears to take care of a steady worth by referencing one other asset like gold, crypto tokens or a mix of each, together with a number of official currencies. ERTs reference a single nationwide forex, simply as USDT does.

EU-based merchants can nonetheless maintain USDT in non-custodial wallets, however cannot commerce it on MiCA-compliant centralized exchanges.

USDT is a gateway to the crypto market, with traders utilizing it extensively to fund spot cryptocurrency purchases and derivatives buying and selling. As such, the delistings and drop in market worth has sparked hypothesis of a broader crypto market slide on social media.

These considerations, nevertheless, could also be unfounded and the adverse impression, at finest, might be restricted to the euro space, Karen Tang, the top of APAC partnerships at Orderly Community, a permissionless Web3 liquidity layer, stated in a submit on X.

“Entry to @Tether_to set to be restricted within the EU as a result of MiCa regulation isn’t going to hurt USDT dominance,” Tang wrote. “EU isn’t the most important crypto market. Most crypto buying and selling quantity happens in Asia and U.S. All it will do is stunt the EU’s digital property innovation, which is already sluggish as a result of convoluted overregulation. If I might brief the EU, I’d…”

Crypto analyst Bitblaze stated Asia accounts for the enormous share of the tether quantity, downplaying the impression of MiCA-led delistings in Europe.

“USDT is the most important stablecoin, with a market cap of $138.5B and a day by day buying and selling quantity of $44B. As of at present, 80% of USDT’s buying and selling quantity comes from Asia, so the EU delisting gained’t have any extreme impression,” Bitblaze famous on X.

Tether has invested in MiCA-compliant companies StablR and Quantoz Funds in a bid to make sure regulatory alignment.