The victory of President-elect Donald Trump accompanied by stronger-than-expected financial information has been in a position to shrug off the concerns from the rise in Treasury yields because the S&P 500 Index, which fell by 2.3% final week at 5,870.62 remains to be greater than its pre-election ranges of 5,712.69 factors on Monday, Nov. 4.

Nevertheless, Fed Chair Jerome Powell‘s pirouette on rate of interest discount on Thursday final week could quickly begin weighing in on the fairness markets as consultants have highlighted the attainable issues a few “tighter financial setting” if the financial system stays sturdy.

After the 25 foundation Nov. 7 price reduce, Powell mentioned that “the financial system isn’t sending any indicators that we have to be in a rush to decrease charges.”

What Occurred: Lowering rates of interest will increase liquidity within the system, thus giving a lift to funding in equities, however quite the opposite, holding the rates of interest at the next stage causes the liquidity to cut back, yields to rise, and consequently, the financial system to shrink.

Whereas the U.S. inflation and financial system exhibits no signal of cooling off, Fed officers could resolve to not reduce the charges additional of their Dec. 17-18 assembly, which can affect the fairness markets.

The U.S. two-year Treasury yield rose to 4.31%, whereas the ten-year yield jumped to 4.45% on Friday. “If yields proceed to pattern up and so they don’t discover their ceiling, I feel it can turn into an issue as a result of it can mainly translate right into a tighter financial setting,” mentioned Irene Tunkel, chief U.S. fairness strategist at BCA Analysis, to Reuters.

Additionally learn: Powell’s Hawkish Remarks Shake Markets: Shares Fall, Greenback Rockets, Bitcoin Dips

Why It Issues: “A tighter financial setting” corresponds to greater central financial institution rates of interest, decrease bond costs, and better yields. A tighter financial coverage, causes the yields to rise within the brief time period and makes borrowing dearer, steadily lowering the liquidity within the system and hampering the expansion whereas rising the worry of recession.

The Federal Open Market Committee has the behemoth job of figuring out the charges and setting the targets whereas sustaining financial development. Furthermore, a tighter financial setting is feared by fairness buyers as fixed-income and debt devices turn into extra profitable than equities.

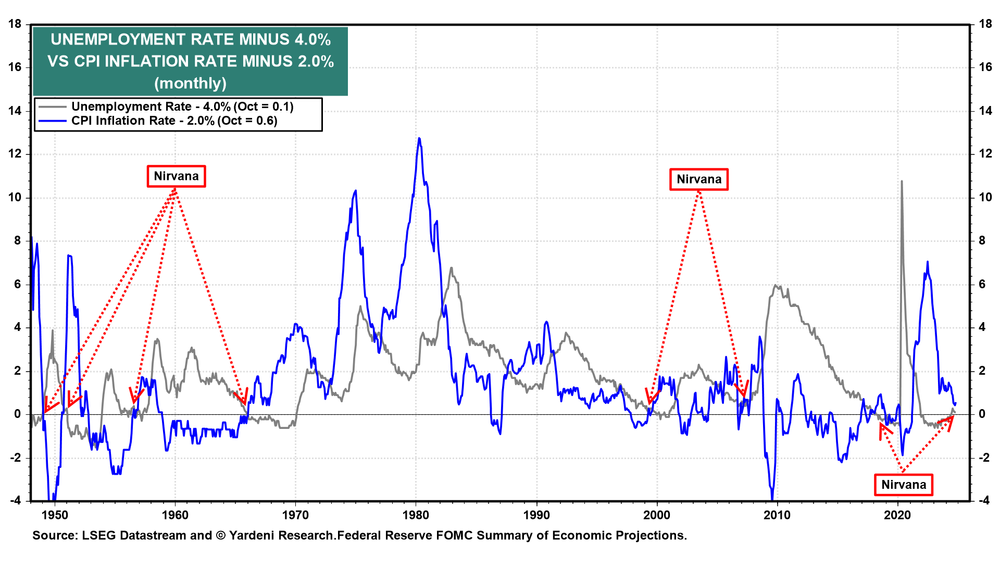

“Simply final Thursday, at his presser, he (Powell) claimed that the FFR (Federal Fund Charge) was nonetheless too restrictive and needed to be lowered to the impartial FFR. In the meantime, our new ‘Nirvana Mannequin’ exhibits that each the unemployment price and inflation charges counsel that the present FFR is on the impartial price.” mentioned Yardeni Analysis in certainly one of their fast takes.

Additionally learn: Cathie Wooden Redirects Elon Musk’s DOGE Focus Towards Nuclear Power Amid Regulatory Challenges: Right here’s How Oklo, Cameco, Centrus Power And Different Shares Carried out

Speaking concerning the two-year and ten-year Treasuries, the notice added that “we anticipate each yields to be vary sure between 4.25% and 4.75% over the remainder of this yr and presumably into subsequent yr.”

Including about equities the Yardeni Analysis notice mentioned that “this is perhaps a sign that the inventory market might expertise a correction now that the Fed would possibly pause price reducing. However, we anticipate a Santa Claus rally within the S&P 500 to six,100 factors by the tip of this yr.”

Much like the S&P 500 Index, the Nasdaq Composite fell by 3.49% final week to 18,680.12 factors however stays greater than its Nov. 4 stage of 18,179.98 factors. NYSE Composite, which was 1.46% decrease final week at 19,645.77 factors, can be greater than its pre-election stage of 19,243.39 factors. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had the same momentum in 2024.

Picture Through Shutterstock

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.