Bitcoin surged previous the $82,000 mark on Binance, marking a considerable 17% enhance for the reason that public announcement of Donald Trump’s victory within the latest US presidential election on Wednesday, November 6. Over the previous weekend, the BTC worth staged a uncommon “weekend pump”, rallying by greater than 6%. Whereas there are a number of causes for this transfer, one clear important purpose stands out: The victory of Donald Trump.

#1 The Bitcoin “Trump Pump”

Donald Trump’s victory has considerably bolstered Bitcoin’s market sentiment, primarily as a consequence of his marketing campaign guarantees and supportive legislative initiatives. Throughout his election marketing campaign, Trump pledged to determine a nationwide Bitcoin reserve by retaining possession of the 208,000 Bitcoins confiscated by means of varied regulation enforcement actions over time.

Senator Cynthia Lummis, a Republican from Wyoming usually dubbed the “Bitcoin Senator” for her staunch advocacy, launched the Bitcoin Act. This laws goals to amass 1 million BTC inside a five-year timeframe.

As Bitcoinist reported, the Bitcoin reserve may develop into a actuality fairly quick. BTC Inc. David Bailey, who’s a key Bitcoin advisor to Trump, stated not too long ago that it could possibly be performed throughout the “first 100 days” of Trump’s time period.

In gentle of this, crypto analysis agency Matrixport writes of their newest investor observe: “With expectations that Trump will remodel US regulatory insurance policies right into a extra pro-crypto atmosphere, the bullish momentum seems troublesome to halt. Together with his inauguration set for January 20, 2025, the market has a number of weeks to maintain this rally.

Associated Studying

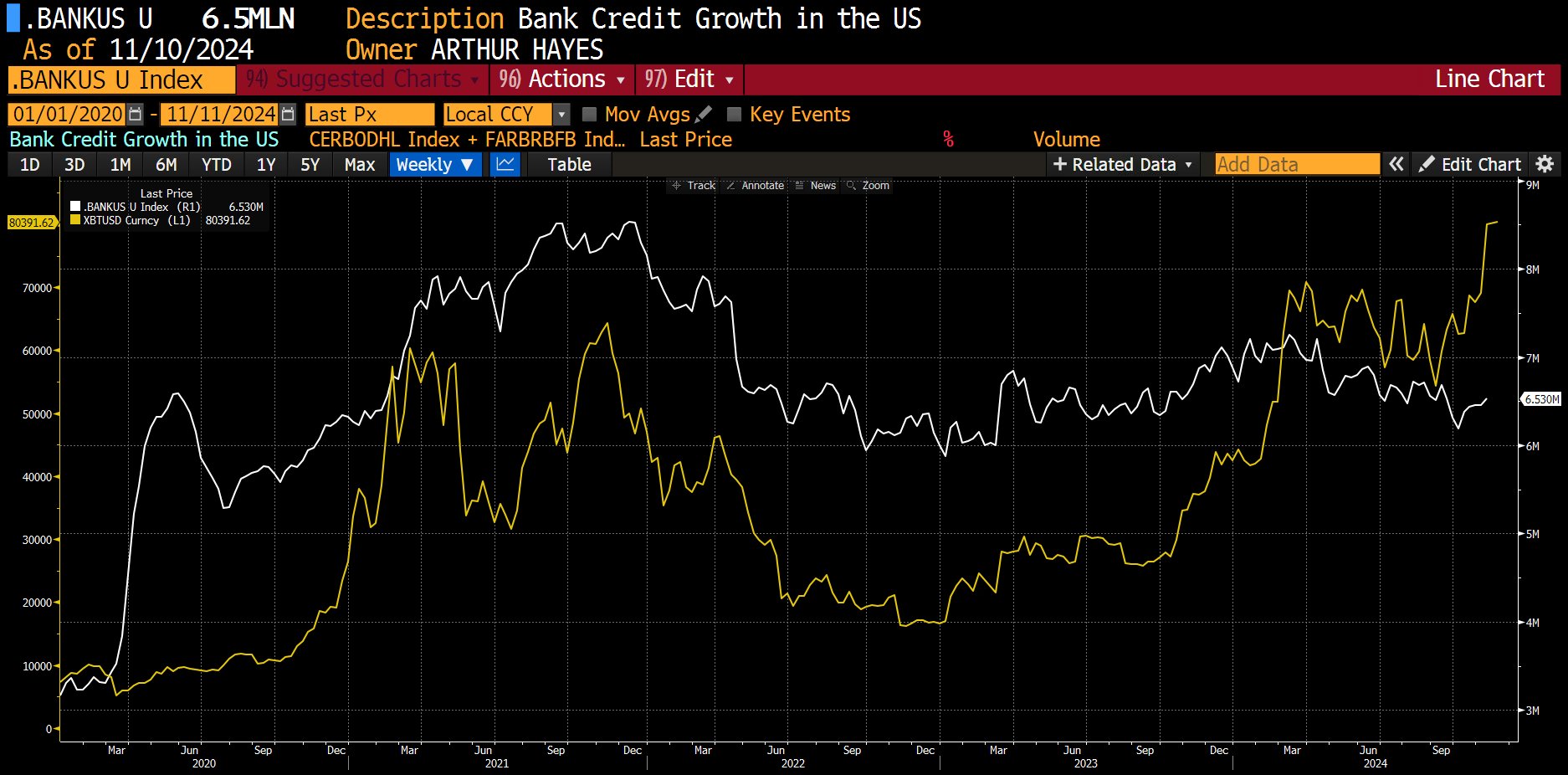

Arthur Hayes, founding father of BitMEX, echoed this optimism on X: “A few of y’all don’t consider Trump is about to trash the $ and print cash. BTC disagrees. Right here is Bitcoin main vs. my new cash provide indicator US Financial institution Credit score. The market is talking, hear up.”

Famend crypto analyst MacroScope (@MacroScope17) additional elaborated on the implications for institutional traders: “Essential for BTC merchants to know how the sport has modified for the reason that election. Within the institutional world, investments are constructed round having a thesis […] It’s exhausting to overstate how a lot the thesis has now modified for BTC by way of the coverage/political factor.”

#2 Rumors About Bitcoin Nation-State Adoption

The strategic plans to determine a nationwide Bitcoin reserve below Trump carry substantial geopolitical weight, doubtlessly igniting a international race to amass Bitcoin reserves. David Bailey remarked, “The Bitcoin Area Race has begun,” noting that “the sport idea is taking part in out sooner than anybody may have anticipated.”

Mike Alfred, founder and Managing Accomplice of Alpine Fox LP, shared his pleasure on X: “I simply received a name out of the blue. It was somebody necessary they usually stated somebody large is shopping for Bitcoin in measurement tonight. I nearly couldn’t consider it once they stated the identify. Wild. We’re going a lot larger.”

Associated Studying

Bailey commented on November 10, “There’s a minimum of one nation state that has been actively buying Bitcoin and is now a high 5 holder. Hopefully, we hear from them quickly.” His assertion, accompanied by a meme suggesting certainty over hypothesis. He added on the scale: “High 5 holder of bitcoin throughout all customers.”

There’s a minimum of one nation state that has been actively buying Bitcoin and is now a high 5 holder. Hopefully we hear from them quickly.

— David Bailey🇵🇷 $0.85mm/btc is the ground (@DavidFBailey) November 9, 2024

#3 Quick Squeeze

A major quick squeeze has additionally contributed to Bitcoin’s worth surge. Charles Edwards, founding father of Capriole Investments, commented on X: “Circa $1B of shorts squeezed! From the weekend transfer from $76 to $81K. Open curiosity on the identical stage as when BTC traded at $62K. Offered funding continues to quiet down, a really wholesome up transfer.”

Information from Coinglass corroborates this, revealing that on Sunday, $133.15 million in BTC shorts had been liquidated, with extra $33 million on Saturday. This substantial liquidation of quick positions has diminished promoting strain, thereby fueling additional upward momentum in Bitcoin’s worth.

#4 Retail Is Again

The resurgence of retail curiosity has been one other pivotal consider Bitcoin’s latest rally. Cameron Winklevoss, founding father of Gemini, noticed on X: “The street to $80k bitcoin was paved with regular ETF demand. Not retail FOMO. Little fanfare. Individuals purchase ETFs, they don’t promote them. That is sticky HODL-like capital. Flooring retains rising. The place are we within the cycle? We simply gained the coin toss, innings haven’t began.”

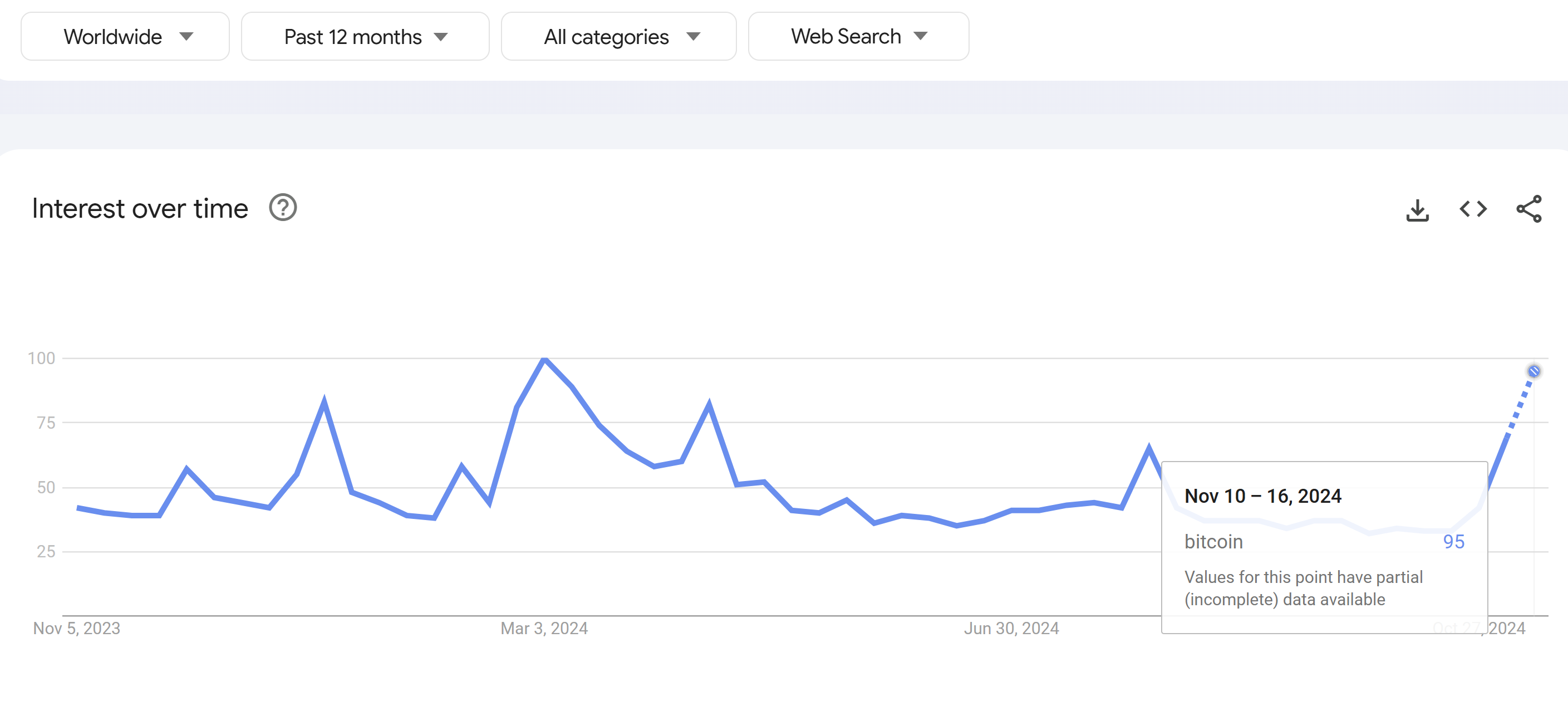

Google Developments information helps this narrative, indicating a 53% enhance in Bitcoin-related searches for the reason that first weekend of October. On November 10, Bitcoin net searches peaked at 95, up from 42 factors on the finish of October. This surge in search exercise suggests heightened retail curiosity and potential influxes of recent traders into the market.

At press time, BTC traded at $81,259.

Featured picture created with DALL.E, chart from TradingView.com