SLM SLM underwent evaluation by 8 analysts within the final quarter, revealing a spectrum of viewpoints from bullish to bearish.

The next desk summarizes their latest scores, shedding gentle on the altering sentiments inside the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Rankings | 1 | 5 | 2 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 0 | 3 | 0 | 0 | 0 |

| 3M In the past | 1 | 2 | 1 | 0 | 0 |

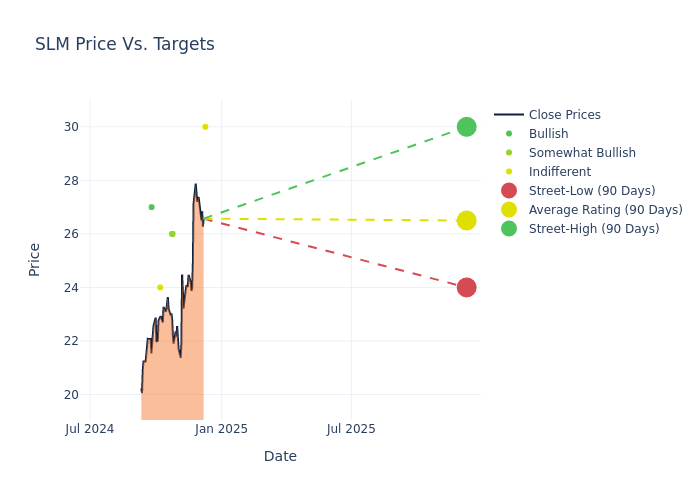

Within the evaluation of 12-month worth targets, analysts unveil insights for SLM, presenting a mean goal of $26.5, a excessive estimate of $30.00, and a low estimate of $24.00. Surpassing the earlier common worth goal of $26.14, the present common has elevated by 1.38%.

Understanding Analyst Rankings: A Complete Breakdown

A transparent image of SLM’s notion amongst monetary consultants is painted with an intensive evaluation of latest analyst actions. The abstract beneath outlines key analysts, their latest evaluations, and changes to scores and worth targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Market Carry out | $30.00 | $27.00 |

| Jon Arfstrom | RBC Capital | Maintains | Outperform | $26.00 | $26.00 |

| David Chiaverini | Wedbush | Maintains | Outperform | $26.00 | $26.00 |

| Mark Devries | Barclays | Lowers | Obese | $26.00 | $27.00 |

| Mark Devries | Barclays | Raises | Obese | $27.00 | $23.00 |

| Richard Shane | JP Morgan | Lowers | Impartial | $24.00 | $25.00 |

| Nathaniel Richam-Odoi | B of A Securities | Broadcasts | Purchase | $27.00 | – |

| David Chiaverini | Wedbush | Lowers | Outperform | $26.00 | $29.00 |

Key Insights:

- Motion Taken: Analysts adapt their suggestions to altering market situations and firm efficiency. Whether or not they ‘Keep’, ‘Elevate’ or ‘Decrease’ their stance, it displays their response to latest developments associated to SLM. This info offers a snapshot of how analysts understand the present state of the corporate.

- Score: Offering a complete evaluation, analysts supply qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These scores mirror expectations for the relative efficiency of SLM in comparison with the broader market.

- Value Targets: Analysts discover the dynamics of worth targets, offering estimates for the long run worth of SLM’s inventory. This examination reveals shifts in analysts’ expectations over time.

For useful insights into SLM’s market efficiency, think about these analyst evaluations alongside essential monetary indicators. Keep well-informed and make prudent choices utilizing our Rankings Desk.

Keep updated on SLM analyst scores.

About SLM

SLM Corp is the most important pupil lender within the nation. It makes and holds pupil loans by way of the assured Federal Household Training Mortgage Program in addition to by way of personal channels. It additionally engages in debt-management operations, together with accounts receivable and collections providers, and runs faculty financial savings packages.

Monetary Insights: SLM

Market Capitalization Views: The corporate’s market capitalization falls beneath trade averages, signaling a comparatively smaller measurement in comparison with friends. This positioning could also be influenced by elements similar to perceived progress potential or operational scale.

Adverse Income Development: Inspecting SLM’s financials over 3 months reveals challenges. As of 30 September, 2024, the corporate skilled a decline of roughly -6.1% in income progress, reflecting a lower in top-line earnings. As in comparison with its friends, the income progress lags behind its trade friends. The corporate achieved a progress fee decrease than the common amongst friends in Financials sector.

Web Margin: SLM’s internet margin is beneath trade requirements, pointing in the direction of difficulties in reaching robust profitability. With a internet margin of -12.97%, the corporate might encounter challenges in efficient value management.

Return on Fairness (ROE): SLM’s ROE is beneath trade requirements, pointing in the direction of difficulties in effectively using fairness capital. With an ROE of -2.54%, the corporate might encounter challenges in delivering passable returns for shareholders.

Return on Belongings (ROA): SLM’s ROA is beneath trade averages, indicating potential challenges in effectively using property. With an ROA of -0.17%, the corporate might face hurdles in reaching optimum monetary returns.

Debt Administration: With a excessive debt-to-equity ratio of 3.21, SLM faces challenges in successfully managing its debt ranges, indicating potential monetary pressure.

The Core of Analyst Rankings: What Each Investor Ought to Know

Analysts are specialists inside banking and monetary techniques that sometimes report for particular shares or inside outlined sectors. These folks analysis firm monetary statements, sit in convention calls and conferences, and communicate with related insiders to find out what are often known as analyst scores for shares. Usually, analysts will fee every inventory as soon as 1 / 4.

Some analysts can even supply forecasts for metrics like progress estimates, earnings, and income to supply additional steerage on shares. Traders who use analyst scores ought to notice that this specialised recommendation comes from people and could also be topic to error.

Which Shares Are Analysts Recommending Now?

Benzinga Edge offers you immediate entry to all main analyst upgrades, downgrades, and worth targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Knowledge delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.