Welcome to The Market’s Compass US Index and Sector ETF Research, Week #522*. As at all times it highlights the technical adjustments of the 30 US Index and Sector ETFs that I monitor on a weekly foundation and usually publish each third week. Previous publications will be accessed by paid subscribers by way of The Market’s Compass Substack Weblog.

*In observence of Christmas, Hanukkah, and New Years vacation this week’s full Market’s Compass U.S. Index and Sector ETF Research would be the last Research for 2024. Many due to all subscribers, paid and free, to your consideration and suggestions to my technical observations on the US Index and Sector ETF markets by out 2024. In the present day’s examine might be despatched to all subscribers, Blissful Holidays!

Common readers will observe that I’ve eliminated the repetitive explanations of my proprietary indicators. As might be seen under they are often reviewed on The Market’s Compass web site.

To grasp the methodology utilized in developing the target U.S. Index and Sector ETF Particular person Technical Rankings go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”.

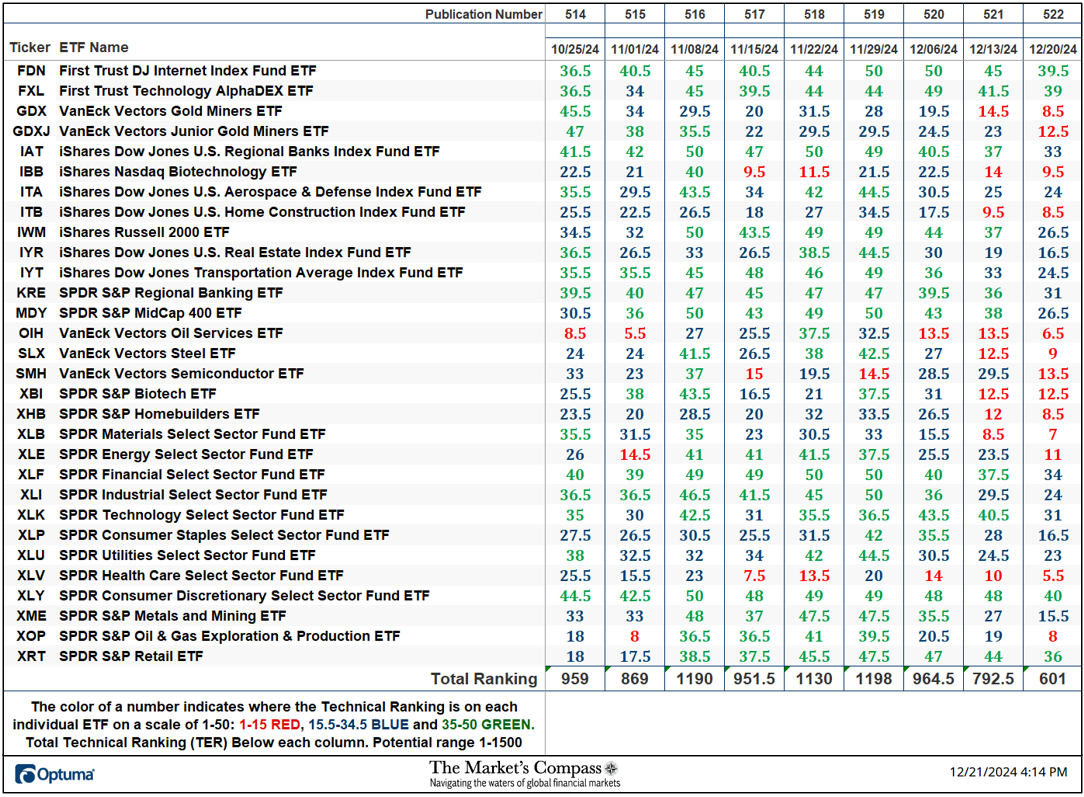

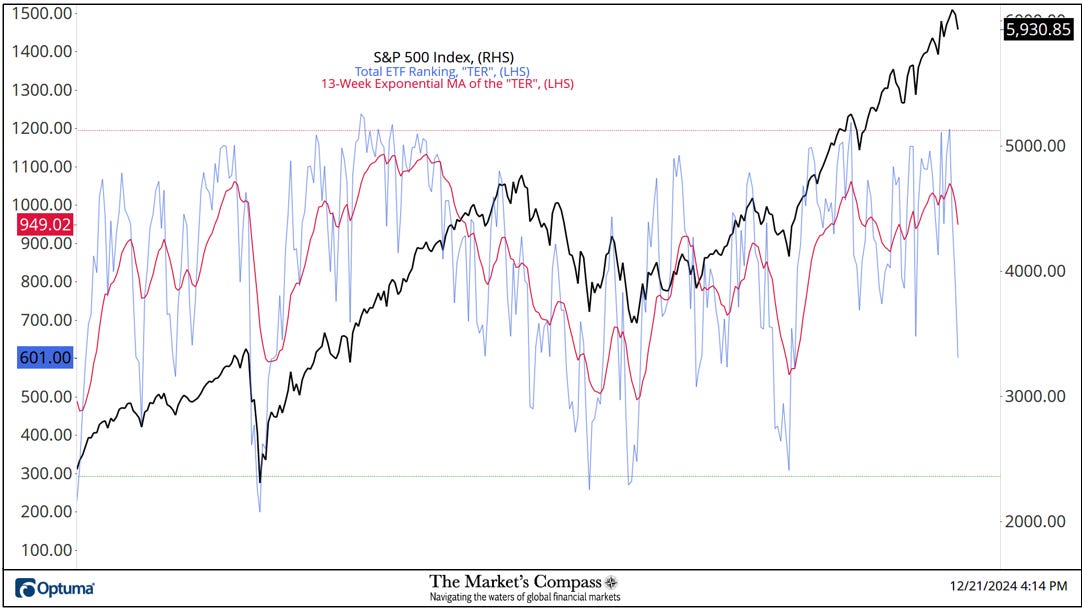

The Whole ETF Rating or “TER”, fell -24.16% final week to 601 from 792.5 the week earlier than. 4 weeks in the past, the TER registered one of the best degree since March twenty ninth studying of 1,215 and as might be seen later is that this week’s Research regardless of reaching an overbought situation the TER lastly confirmed the file weekly closing November twenty ninth excessive. It has fallen the previous three weeks

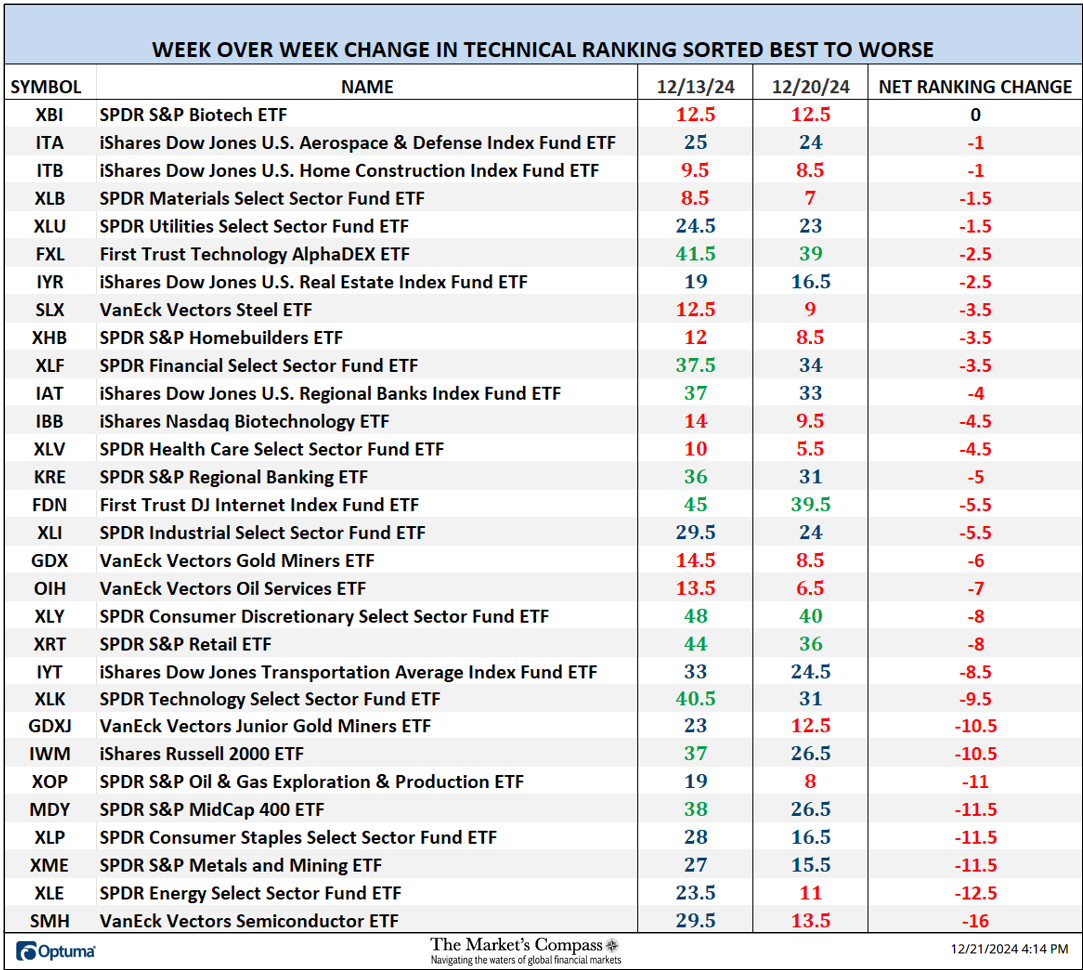

On the finish of final week, Twenty-nine ETFs registered losses of their TRs, and one was unchanged. Eight ETFs registered double-digit TR losses. On the finish of the week solely 4 of the ETF TRs have been within the “inexperienced zone” (TRs between 35-50), 13 ETF TRs have been within the “blue zone” (TRs from 15.5 -34.5), and 13 ended within the “purple zone” (TRs between 0-15) versus the week earlier than when there have been ten within the “inexperienced zone”, eleven have been within the “blue zone”, and 9 have been within the “purple zone” (TRs between 0-15). Final week marked a deterioration in particular person TRs week over week.

*To grasp the development the of The Technical Situation Elements go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”.

One technical takeaway can be if the DMC Issue or DMCTF rises to an excessive between 85% and 100% it could counsel a short-term overbought situation. Conversely a studying within the vary of 0% to fifteen% would counsel an oversold situation was growing. This previous week a studying of 9.52% was registered within the DMCTF or 20 out of a doable complete of 210 optimistic factors which left the DMCTF in oversold territory

As a affirmation software, if all eight TCFs enhance on every week over week foundation, extra of the 30 ETFs are bettering internally on a technical foundation confirming a broader market transfer greater (consider an advance/decline calculation). Conversely if all eight TCFs fell over the week it confirms a transfer decrease within the broader market. Final week seven TCFs registered losses and one was unchanged serving to to verify the selloff within the broader market.

A proof of the The Whole ETF Technical Rating Indicator go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”.

Earlier than the precipitous drop within the TER over the previous three weeks, the TER edged out a confirming excessive vs. December sixth closing worth excessive however the 13-Week Exponential Transferring Common failed to take action and has been monitoring decrease since.

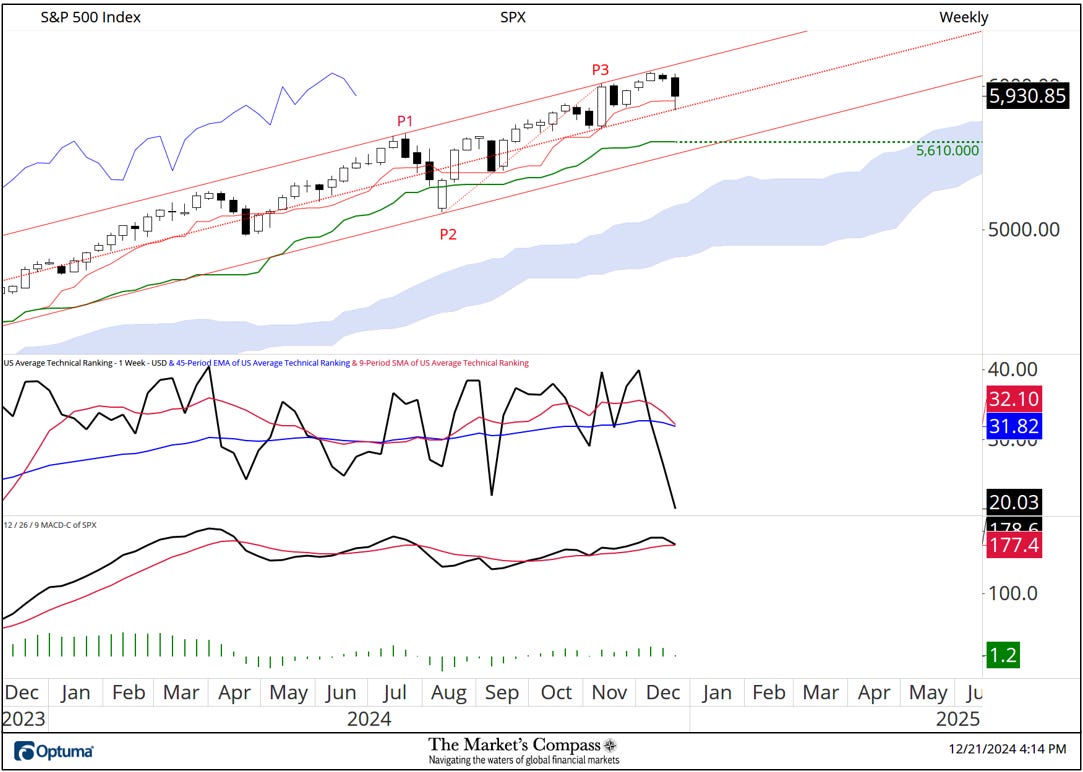

The Weekly Common Technical Rating (“ATR”) is the common Technical Rating of the 30 US Index and Sector ETFs we monitor. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.

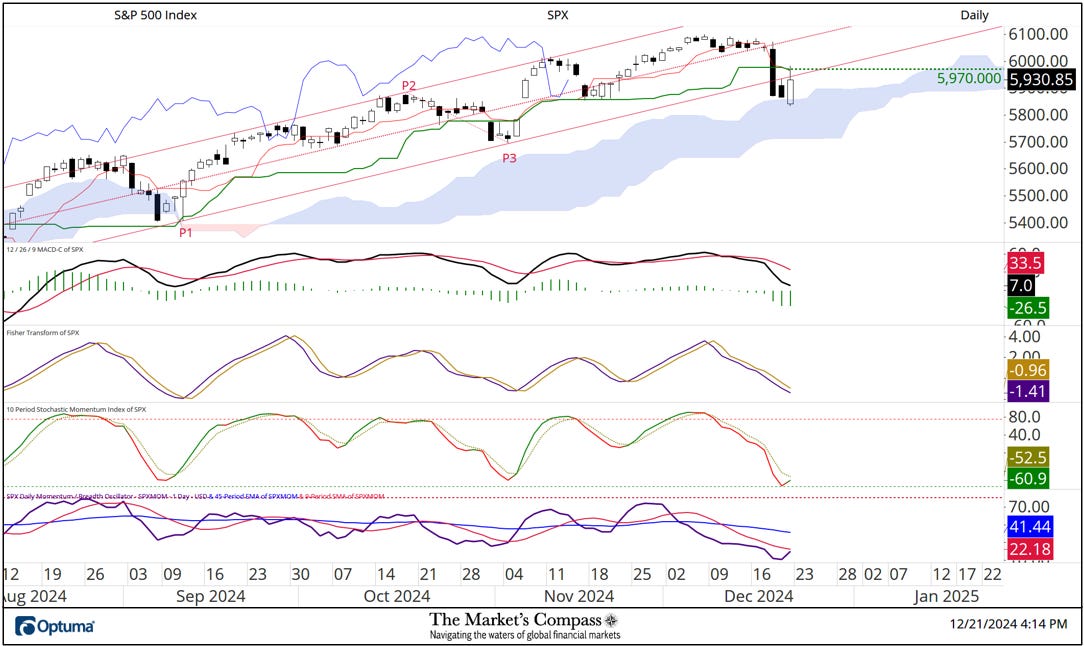

Unsurprisingly, after reaching an overbought excessive (as did the TER) the ATR has fallen sharply thorough each shifting averages and now has reached an oversold situation. The one optimistic technical characteristic is that the big cap index held help supplied by the Median Line (purple dotted line) of the Customary Pitchfork (purple P1 by P3) on an intra-week foundation. That stated Weekly MACD is simply one other dangerous week away from violating its sign line. Extra in “Ideas on the short-term technical situation of the SPX Index” however first…

*Doesn’t embody potential dividends

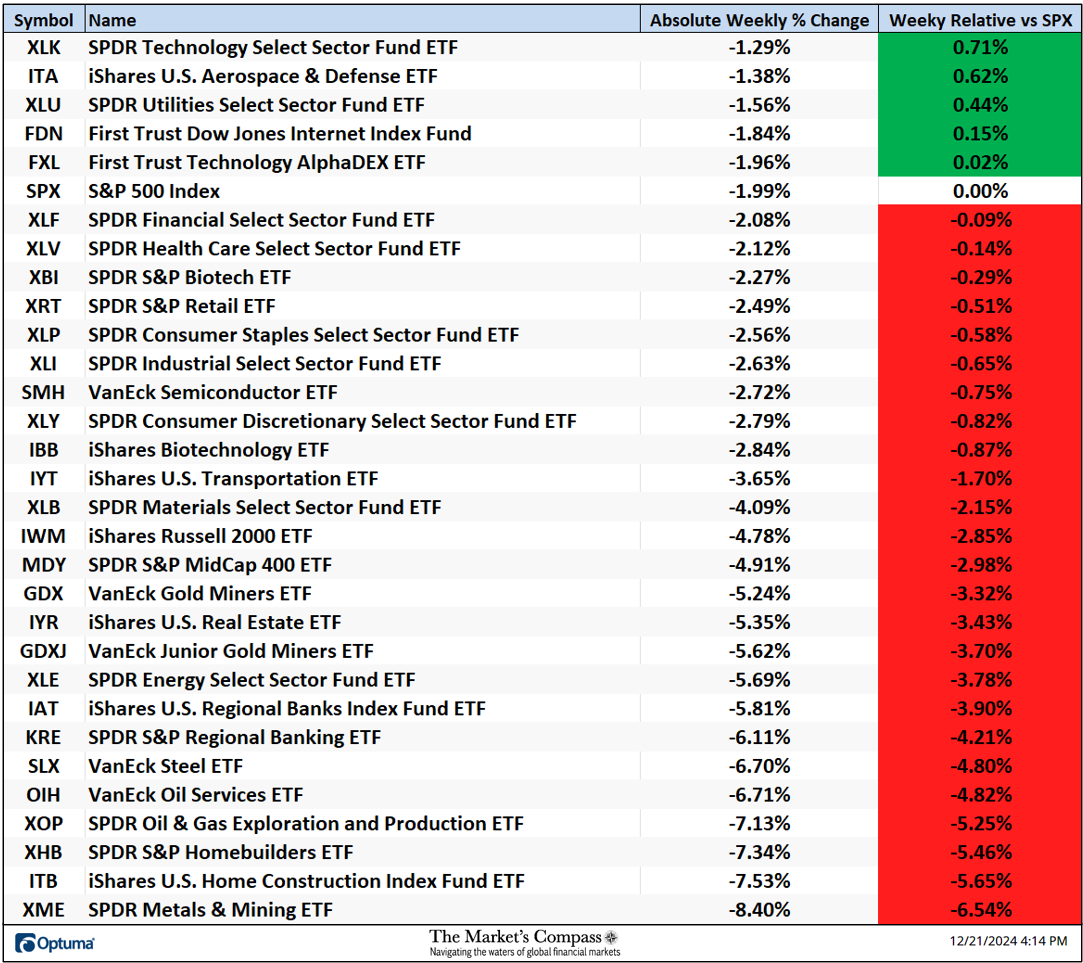

All thirty US ETFs we monitor on this weblog misplaced floor on an absolute foundation final week. The typical absolute loss final week was -4.12%, including to the common absolute loss -2.03% the week earlier than. Solely 5 ETFs outperformed the -1.99% loss within the S&P 500 Index on a relative foundation and twenty-five underperformed.

Final Wednesday the S&P 500 Index sliced by help on the Decrease Parallel (strong purple line) of the Schiff Modified Pitchfork (purple P1 by P3) and though on an intra-day foundation it traded again above it, it was capped on the damaged Kijun Plot and on Friday the large-cap index closed under it. My Each day Momentum / Breadth Oscillator has reached an oversold situation which will result in an additional reactionary worth bounce. That stated, the momentum oscillators don’t counsel something greater than that.

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of the SPX can avail themselves of a quick tutorial titled, Instruments of Technical Evaluation.

Charts are courtesy of Optuma whose charting software program permits the Technical Rankings to be calculated and again examined.

To obtain a 30-day trial of Optuma charting software program go to…