Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #175. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week the Research will spotlight the technical adjustments of the 16 cryptocurrencies that I monitor in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As at all times paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e mail*. Previous publications together with the Weekly ETF Research may be accessed by paid subscribers through The Market’s Compass Substack Weblog.

*In celebration of Groundhog Day, Free subscribers will get a take a look at this weeks unabridged model in the present day. Sadly, Punxsutawy Phil noticed his shadow signaling six extra weeks of winter. Grow to be a paid subscriber and spend the subsequent six weeks of winter studying The Market’s Compass Crypto Candy Sixteen Research.

*A proof of my goal Particular person Technical Rankings go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”.

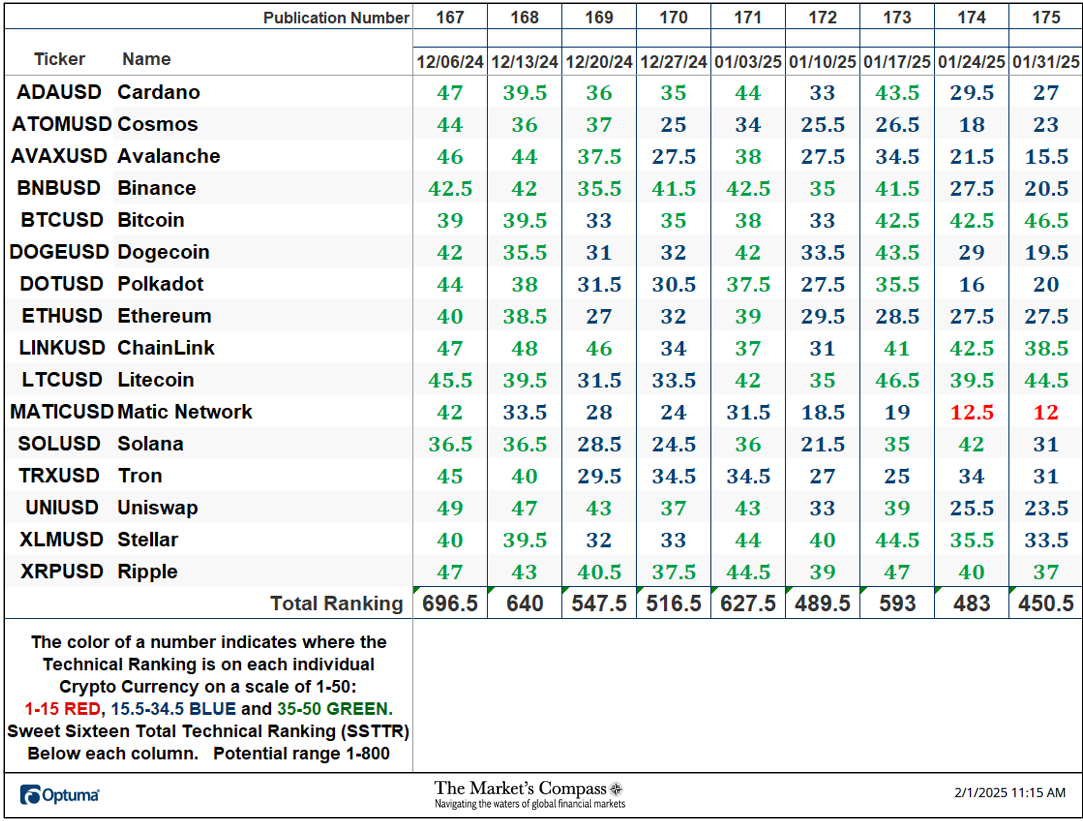

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person Cryptocurrency and the Candy Sixteen Whole Technical Rating (“SSTTR”).

*Rankings are calculated as much as the week ending Friday January thirty first

After rising 21.11% to 593 three weeks in the past the Candy Sixteen Whole Technical Rating or “SSTTR” fell -6.73% for the second week in a row to 450.5.

Final week all however 5 of the Candy Sixteen Crypto TRs fell (one was unchanged) The common Crypto TR loss final week was -2.03 vs. the earlier week’s common lack of -6.88. 4 ETF TRs ended the week within the “inexperienced zone” (TRs between 35 and 50), eleven have been within the “blue zone” (TRs between 15.5 and 34.5), and one remained within the “crimson zone” (Matic Community) vs. the earlier week when six TRs have been within the “inexperienced zone” and 9 have been within the “blue zone”.

*The CCi30 Index is a registered trademark and was created and is maintained by an unbiased group of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general development, every day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding steady cash (extra particulars may be discovered at CCi30.com).

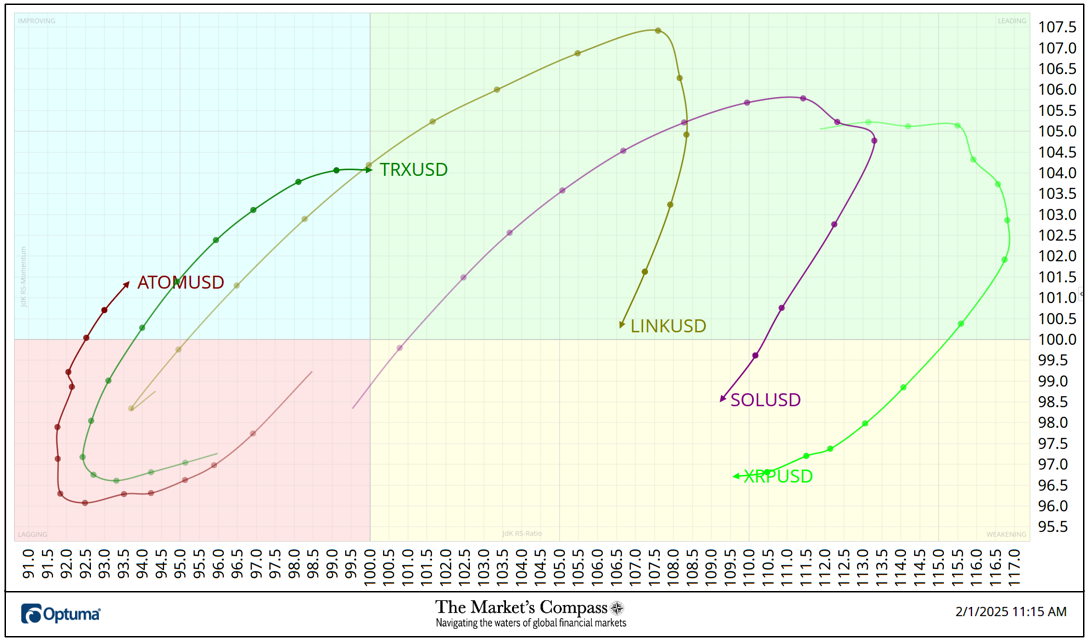

A short rationalization of how you can interpret RRG charts may be discovered at The Market’s Compass web site www.themarketscompass.com Then go to MC’s Technical Indicators and choose Crypto Candy 16. To be taught extra detailed interpretations, see the postscripts and hyperlinks on the finish of this Weblog.

The chart under has two weeks, or 14 days, of information factors deliniated by the dots or nodes. Not all 16 Crypto Currencies are plotted on this RRG Chart. I’ve achieved this for readability functions. These which I imagine are of upper technical curiosity stay.

Over the previous two weeks each Tron (TRX) and Cosmos (ATOM) have escaped the Lagging Quadrant and have entered the Enhancing Quadrant. Within the case of TRX, it’s only one good day on a Relative Power foundation from getting into the Main Quadrant though there was a slowing of Relative Power Momentum late final week. Ripple (XRP) rolled over within the Main Quadrant every week in the past final Friday and has fallen into the Weakening Quadrant. That weakening of Relative Power and Relative Power Momentum was adopted by Solana (SOL) and ChainLink (LINK) final week.

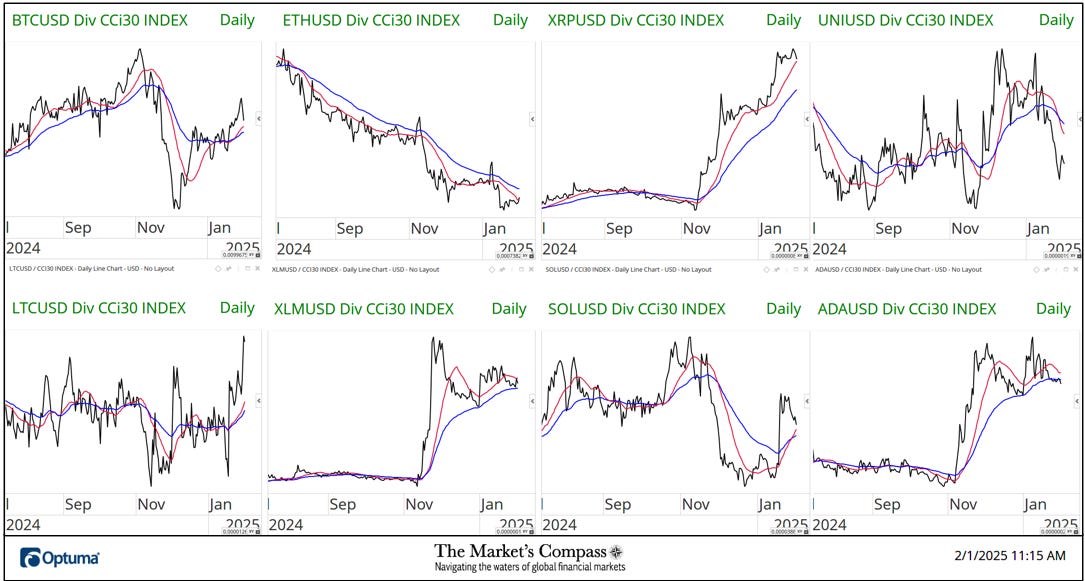

The 2 charts under are long run line charts of the Relative Power or Weak point of the Candy Sixteen Crypto Currencies vs. the CCi30 Index which might be charted with a 55-Day Exponential Shifting Common in blue and a 21-Day Easy Shifting Common in crimson. Pattern course and crossovers, above or under the longer-term shifting common, reveal potential continuation of development or reversals in Relative Power or Weak point.

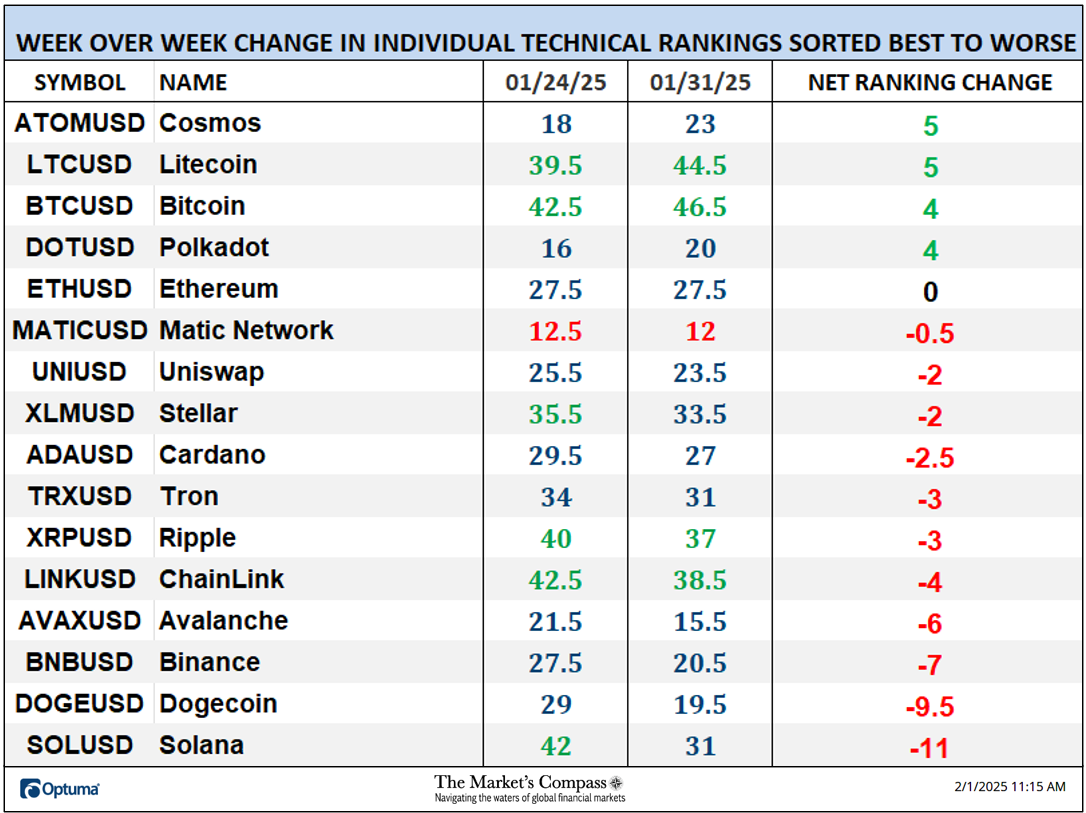

*Friday January twenty fourth to Friday January thirty first.

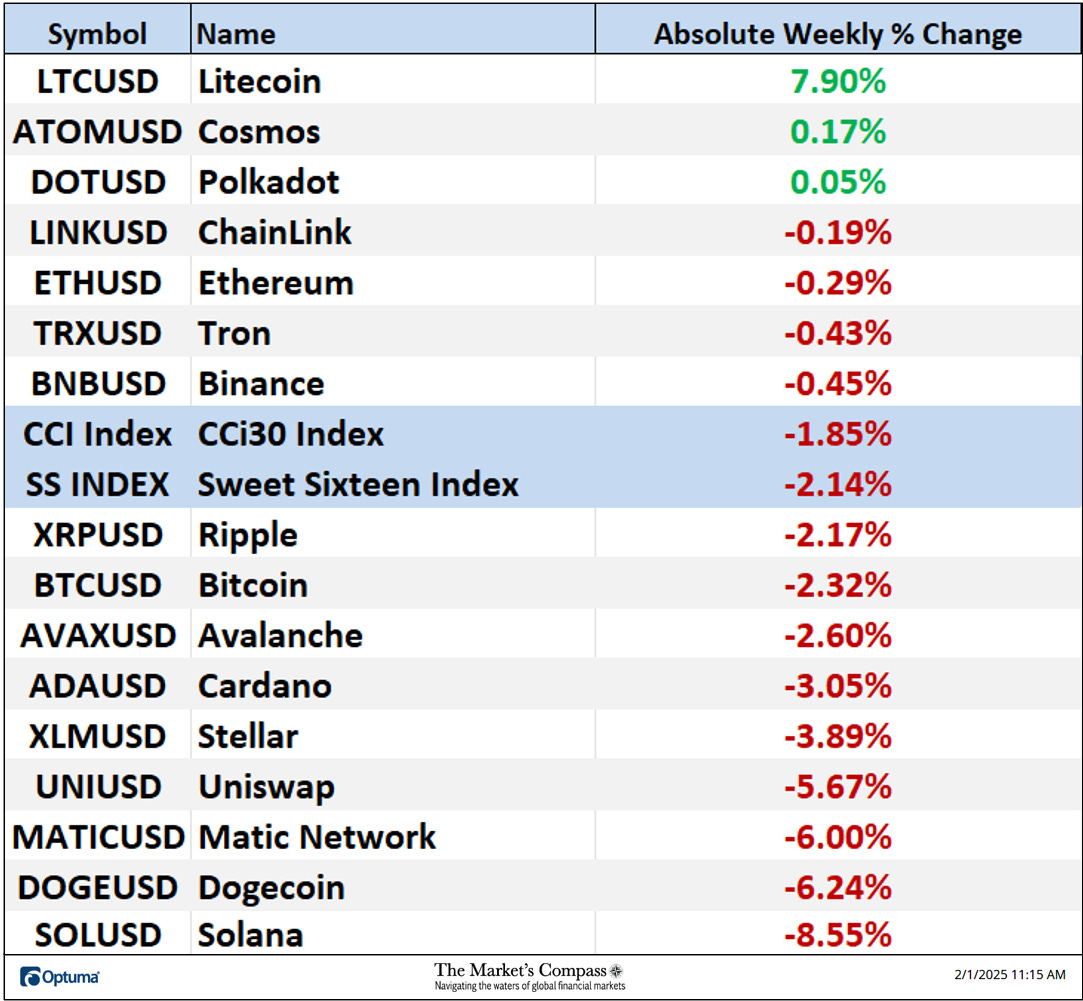

Solely three of the Crypto Candy Sixteen registered absolute positive factors final week and 13 misplaced absolute floor vs. the earlier week when 4 registered absolute positive factors and tweleve traded decrease. The seven-day common absolute worth loss was -2.11%, (with out the +7.90% acquire in Litecoin (LTC) the common loss would have been -2.78%), versus the earlier week’s common absolute lack of -5.96%.

*A proof of my Technical Situation Components go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

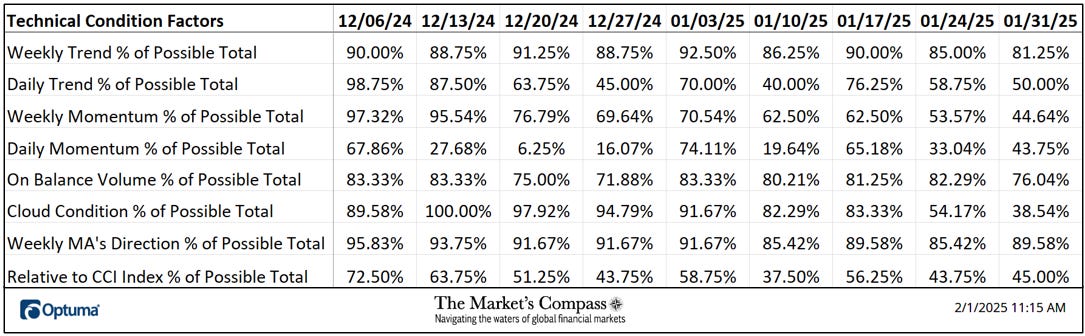

The DMTCF rose barely final week from a studying of 33.04% or 37 the week earlier than to 43.75% or 49 out of a doable 112.

As a affirmation device, if all eight TCFs enhance on every week over week foundation, extra of the 16 Cryptocurrencies are enhancing internally on a technical foundation, confirming a broader market transfer increased (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on every week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week 5 TCFs fell, and solely three rose.

For a quick rationalization on how you can interpret the Candy Sixteen Whole Technical Rating or “SSTTR” vs the weekly worth chart of the CCi30 Index go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

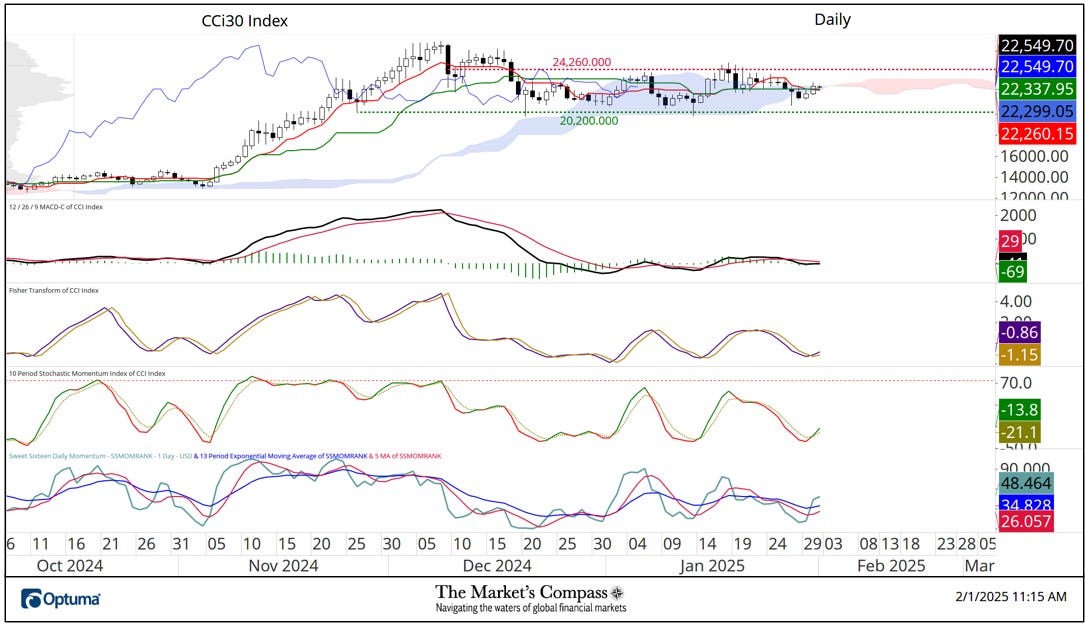

The CCi30 Index stays “trapped” in what the bulls ought to hope is a triangulating consolidation sample. Though MACD continues to mirror the plain lack of upside worth momentum it stays elevated in optimistic territory above its sign line however the shorter-term Stochastic Momentum Index continues to trace decrease after signaling an overbought situation in early January. My Candy Sixteen Whole Technical Rating (backside panel) continues to tug again from overbought territory (crimson dashed line). As I wrote final week, key to the bullish consolidation technical argument case might be that key help at 19,860 holds and costs are in a position to overtake the development of decrease highs highlighted with crimson dashed line.

The technical situation of the CCi30 Index on the every day worth chart has not modified in a major manner over the previous seven days except for a flip in short-term worth momentum as witnessed by the Stochastic Momentum Index and the Fisher Remodel retaking the bottom above its sinal line. That mentioned, solely a rally that advances the Index by means of key worth resistance on the 24,260 stage with comply with by means of would recommend that the value motion since early December has merely been a interval of consolidation previous to new highs.

All of the charts are courtesy of Optuma whose charting software program allows customers to visualise any knowledge resembling my Goal Technical Rankings. Cryptocurrency worth knowledge is courtesy of Kraken.

Most charting software program affords some type of RRG charts, however nothing comes near Optuma’s, and I urge readers to make the most of them each day. The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a fundamental tutorial on the Instruments Technical Evaluation is on the market on my web site…