A chasm is forming between the haves and have-nots within the quickly increasing non-public credit score asset class.

Article content material

(Bloomberg) — A chasm is forming between the haves and have-nots within the quickly increasing non-public credit score asset class.

Intermediate Capital Group Plc this week wrapped up a €15.2 billion ($16.8 billion) European direct-lending fund increase, the biggest pool of capital of its variety ever secured within the area. It follows July’s record-breaking haul of $34 billion, together with leverage, by Ares Administration Corp. for the same US technique.

Commercial 2

Article content material

In the meantime, corporations comparable to Constancy Worldwide and Boca Raton-headquartered Polen Capital have halted their early European direct lending actions this yr after struggling to get them off the bottom. The contrasting fortunes are an indication that the growth within the $1.7 trillion non-public credit score business is being loved by fewer and fewer credit score managers.

“If you wish to discuss to the most important firms then you definitely want the most important pockets of capital,” Rob Seminara, Apollo International Administration Inc.’s head of Europe, mentioned on the IPEM convention in Paris this previous week. “We are going to proceed to see larger managers develop in scale as they’re way more related to the most important firms on the earth. Personal credit score is an actual enabler to them.”

Trade titans comparable to Blackstone Inc., Apollo and the asset administration unit of Goldman Sachs Group Inc. are scaling their franchises into so-called ‘one-stop-shops’ for debt financing, with the power to supply financing throughout the capital construction. This performs to their benefit with regards to relationships with debtors, in line with Seminara.

Article content material

Commercial 3

Article content material

Extra Discerning

Buyers have gotten extra discerning about asset managers as a result of a chronic interval of upper charges has created a double-edged setting for credit score funds, the place there are increased returns to be gained however better threat of stress for the businesses to which they lend. As competitors for capital intensifies, a number of mid-tier fund managers are struggling to lift cash for brand spanking new funds, individuals with data of the matter mentioned.

Market individuals additionally count on efficiency amongst lenders to begin to diverge as every supervisor’s portfolio is examined.

“As markets change into trickier to navigate, buyers are selecting to again direct-lending funds with good observe data, and the size and capability to speculate via credit score cycles,” Mathieu Vigier, co-head of ICG’s direct lending franchise, instructed Bloomberg Information in an interview.

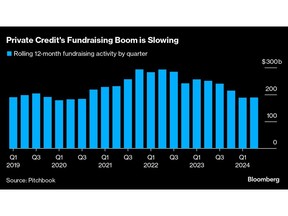

Certainly, cash raised via funds focused to institutional buyers, together with asset managers and pension funds, is predicted to be about flat this yr, in line with knowledge compiled by PitchBook. About $91 billion was raised from 59 non-public credit score funds within the first half of 2024, the info reveals. Throughout the identical interval final yr, 68 funds closed with $98.9 billion.

Commercial 4

Article content material

“Personal credit score asset managers are reworking the panorama for company debt, taking market share each from business banks and from the syndicated lending market, but additionally reaching new debtors that these conventional intermediaries considered as too dangerous,” Jared Elias at Harvard Regulation Faculty and Elisabeth de Fontenay at Duke College Faculty of Regulation wrote in a July analysis paper.

“In consequence, there’s a small elite membership of maybe a dozen or so asset managers who play an more and more crucial position in company finance.”

Week in Overview

- International bond yields slid to a two-year low this week as a result of concern over slowing development in main economies and growing expectations for interest-rate cuts.

- A flood of issuance is constant out there for junk-rated debt and debtors are making the most of a starved investor base to convey riskier offers, together with for dividends and leveraged buyouts.

- Banks are shopping for again their Extra Tier 1 bonds at ranges not seen earlier than, emboldened by regulatory readability and a purchaser base keen to soak up a document movement of latest issuance. In the meantime, Australia’s banking regulator has proposed lenders scrap the usage of AT1 bonds in capital necessities, probably changing into the primary jurisdiction to part out the securities that have been worn out after Credit score Suisse’s collapse final yr.

- A few of China’s most intently watched property builders slid by probably the most in months, after house gross sales knowledge underscored a worsening actual property stoop.

- JPMorgan Chase & Co. is main a historic retreat from most well-liked shares as Wall Road lenders re-jig their steadiness sheets forward of latest guidelines that shall be considerably watered down.

- Hewlett Packard Enterprise Co. tapped the US investment-grade bond market to assist fund its pending acquisition of Juniper Networks Inc. Additionally within the high-grade market, a Blue Owl Capital Inc. fund bought $1 billion of debt, and Oneok Inc. bought bonds lower than two weeks after saying it was shopping for a competitor and a controlling stake in a unique firm.

- Within the US leveraged mortgage market, hen finger chain Elevating Cane’s Eating places LLC bought a $500 million deal after tightening pricing on the debt. Individually, Goldman Sachs Group Inc. is holding conferences with leveraged finance buyers to gauge urge for food for debt from Wayfair, and Components 1 priced a $2.55 billion bundle to assist finance proprietor Liberty Media Corp.’s acquisition of MotoGP World Championship.

- Goldman Sachs Group Inc. is promoting a big threat switch tied to a portfolio of about $3 billion of leveraged loans.

- Within the $1.3 trillion world of collateralized mortgage obligations, hedge fund Chatham Asset Administration is launching a platform that may handle and put money into the securities, whereas Palmer Sq. Capital Administration is launching a pair of exchange-traded funds that may purchase CLOs and different property.

- TC Vitality Corp. will present compensation to patrons of a C$1 billion ($735 million) Aspen Investments bond deal that failed to shut.

- Low cost retailer Large Tons Inc. has filed for chapter safety and plans to promote the agency’s property and ongoing enterprise in a court-supervised course of.

- Retailer J. Crew is seeking to woo buyers with a hefty yield of greater than 11% together with key investor protections on a $450 million time period mortgage, because it goals to refinance debt.

Commercial 5

Article content material

On the Transfer

- Financial institution of America Corp. named Rashaan Reid head of Americas fixed-income, currencies and commodities gross sales buying and selling. Reid joined the financial institution in 2001, and has spent a lot of her profession within the mortgage and securitized gross sales enterprise.

- BDT & MSD Companions’ co-head of actual property credit score, Adam Piekarski, is leaving the corporate to start out his personal funding agency targeted on business actual property debt.

- Om Pandya joined Clifford Likelihood as companion in its capital markets follow in Houston.

- Lengthy Hall Asset Administration Ltd. has employed Kenny Wu, the previous head of China credit score analysis at one other hedge fund BFAM Companions (Hong Kong) Ltd.

—With help from Kat Hidalgo and Francesca Veronesi.

Article content material