Keep in mind the Pythagorean theorem? When you simply broke out in a sweat, attempting to convey again your Grade 12 math, we really feel you: math is type of ‘that sort’ of 4-letter phrase for an entire heckuva lot of individuals. However when you personal a enterprise, you possibly can’t stick your head within the sand about some actually necessary calculations—like find out how to calculate margins.

Understanding revenue margins is tremendous necessary for small companies. They assist you determine how a lot cash you’re really making after overlaying all of your prices. Consider revenue margins because the lifeline of what you are promoting—they present how effectively you’re turning income into revenue.

On this article, we’ll break down what revenue margins are, find out how to calculate margins, and methods to spice up earnings. By the tip, you’ll have the know-how to deal with your monetary choices and develop your earnings.

Choose up your calculator and let’s do some math. We promise to make it painless.

What’s a margin?

The very first thing you want to perceive is what a margin is. A margin is principally the distinction between how a lot you promote a services or products for and the way a lot it prices you to supply it. It’s like a snapshot of your profitability.

Margins are proven as a share, supplying you with an thought of how a lot revenue you’re making on every greenback of gross sales. For instance, when you promote one thing for $100 and it prices you $70 to make, your margin is $30, or 30%. Completely different margins, like gross, working, and internet, offer you insights into totally different components of what you are promoting’s monetary well being.

Are margin and revenue the identical factor?

It’s simple to get margins and earnings confused as a result of they provide the identical info, simply in several codecs. Revenue is the precise amount of cash you make written as a greenback quantity. Margin is a share that exhibits how a lot of every greenback of gross sales is revenue. Consider revenue because the {dollars} in your pocket and margin as how environment friendly a enterprise is at making these {dollars}.

What are the advantages of realizing your margins?

1. Margins enable you make good choices in what you are promoting

Realizing your margins will help you make knowledgeable choices about find out how to worth your services or products, find out how to management prices, and find out how to allocate sources. You’ll be capable to simply determine what services or products are essentially the most worthwhile and double down on them to usher in much more earnings. This fashion, you’re not simply guessing—you’re making strategic strikes that transfer that backside line.

2. Get perception into what you are promoting’ monetary well being

Understanding your margins provides you an general clear image of what you are promoting’ monetary well being. It helps you monitor profitability tendencies over time so you can also make changes to both preserve or enhance earnings. It’s like having a monetary well being check-up everytime you want it.

3. Give your self a leg up on the competitors by reviewing margins

Are you fighting realizing precisely what to cost your services or products? Calculating your margins will help. By realizing your margins, you possibly can worth competitively with out sacrificing your earnings. You may reply strategically to market adjustments and keep forward of your opponents. Plus, it provides you the arrogance to make daring strikes when wanted.

4. Margins enable you create higher budgets and forecasts

With your whole margins calculated, you create extra correct budgets and monetary forecasts. This makes positive you have the appropriate sources in place to develop what you are promoting—whether or not that’s extra labor or extra product. For instance, extra information about revenue means you possibly can add extra employees after which add much more earnings by extending your hours or providing higher customer support. See what we’re getting at? With strong information, you can plan for future development with much less stress.

calculate margins

There are many various kinds of revenue margin equations you’re going to wish to know to get the total image of what you are promoting’ funds. We’ll present you what kinds of margins it is best to calculate, find out how to calculate them, and offer you clear examples so you possibly can see these calculations in motion. Let’s pull out these calculators.

1. Gross revenue margin

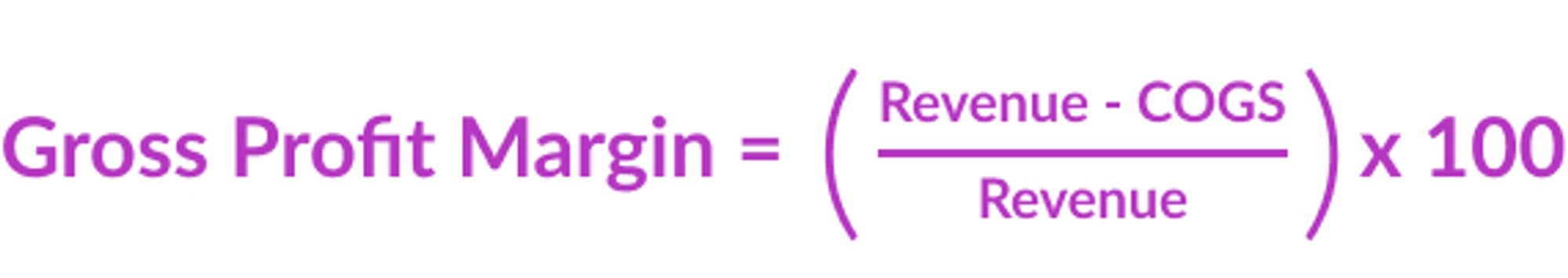

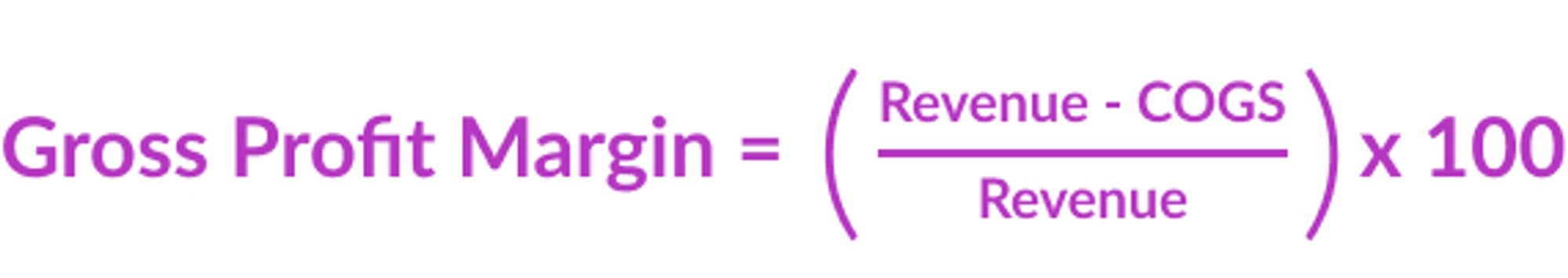

In technical phrases, the gross revenue margin exhibits the proportion of income that exceeds the price of items offered (COGS). In easier-to-understand phrases, it tells you the way a lot revenue what you are promoting makes after overlaying the direct prices of manufacturing your items or companies.

To calculate it, you subtract COGS from complete income after which divide by complete income, multiplying by 100 to get a share.

For instance, if a restaurant’s income is $100,000 and COGS (issues like wages, meals overhead, lease, and so forth.) is $60,000, your gross revenue margin is 40%. This margin helps you perceive how effectively what you are promoting is producing and promoting.

2. Working revenue margin

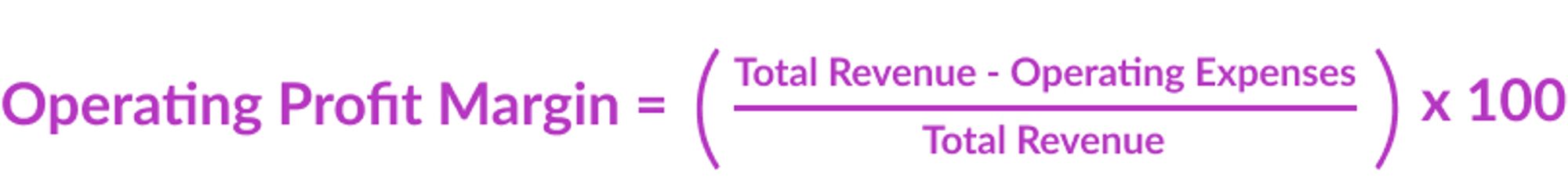

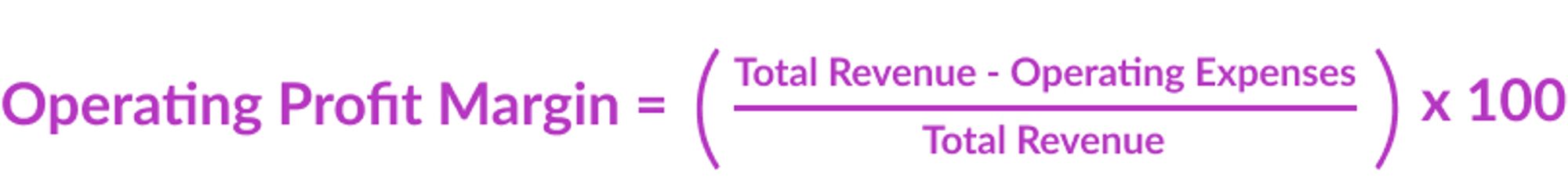

Working revenue margin is a monetary metric that exhibits the proportion of income that continues to be in spite of everything working bills are deducted. Realizing your working revenue margin provides you an thought of how effectively what you are promoting is working its core operations.

To calculate it, subtract working bills—like wages, lease, and utilities—from complete income, then divide by complete income and multiply by 100 to get a share.

For instance, when you run a retail retailer and your income is $100,000 and your working bills (wages, retail product, utilities, and so forth.) are $70,000, your working revenue margin is 30%. This helps you perceive the profitability of your day-to-day enterprise actions.

3. Internet revenue margin

Internet revenue margin is a monetary metric that exhibits the proportion of income that continues to be as revenue in spite of everything bills are deducted. We’re speaking the whole lot from working bills, curiosity, taxes, and another value—massive or small. The web revenue margin is the proportion of cash that’s left over after the whole lot is paid for. It’s your greatest guess for realizing what you are promoting’s precise general profitability.

To calculate it, subtract all bills from complete income, then divide by complete income and multiply by 100 to get a share.

For instance, in case your income is $100,000 and your complete bills are $85,000, your internet revenue margin is 15%. This margin provides a whole image of what you are promoting’s profitability after your whole payments are paid.

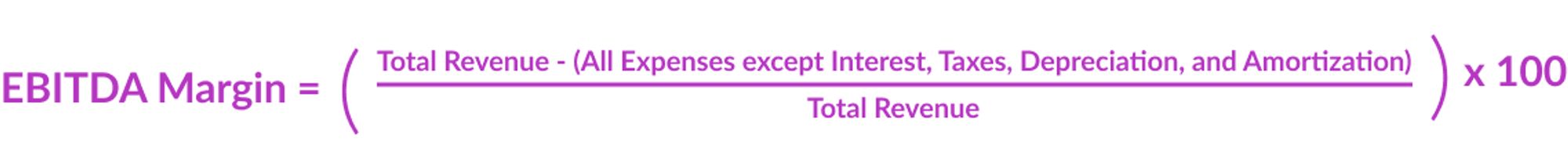

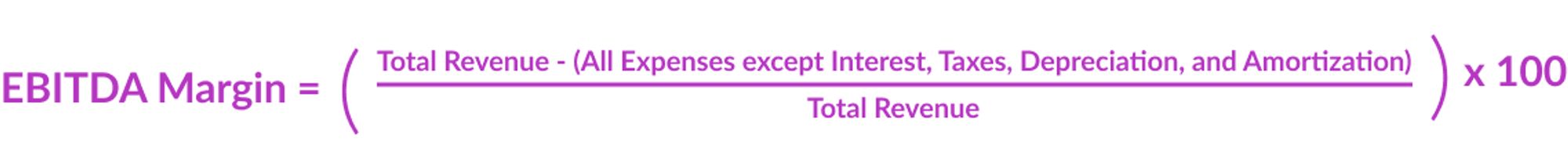

4. EBITDA margin

EBITDA margin is a monetary metric that exhibits the proportion of an organization’s income that’s transformed into earnings earlier than curiosity, taxes, depreciation, and amortization. Okay. That was a whole lot of phrases. This margin calculation helps you determine the enterprise’ operational effectivity and profitability with out the affect of economic and accounting choices.

To calculate it, subtract all bills besides curiosity, taxes, depreciation, and amortization from complete income, then divide by complete income and multiply by 100 to get a share.

For instance, in case your income is $100,000 and EBITDA is $30,000, your EBITDA margin is 30%. This margin actually helps you assess the core profitability of your organization—and evaluate it to others in your trade.

What is an effective revenue margin?

Now that we all know find out how to calculate all the numbers you want, what does all of it imply? What’s an precise good revenue margin? Properly, every trade goes to have its personal requirements. A restaurant goes to have rather more overhead than, let’s say, an ice cream truck.

*Fast be aware: we’re generalizing what we’re calling our benchmarks—unhealthy, good, higher, greatest—however you get the concept.

Listed below are some normal benchmarks for revenue margins for small companies:

A foul revenue margin.

A foul revenue margin is usually something under 5%. This margin tells us {that a} enterprise is struggling to cowl its prices and will not be sustainable in the long run. Individuals shouldn’t see this as a failure—simply room for enchancment. Issues to take a look at are excessive bills, low pricing, or inefficiencies in operations. In case your margin is under 5%, it’s a crimson flag that you want to take motion to scale back prices or enhance income so you possibly can keep away from potential monetary bother in the long term. You’ve obtained this.

A great revenue margin.

A great revenue margin is within the 10% vary. What this degree tells us is that what you are promoting is making an affordable revenue and may maintain itself. It exhibits us that you’ve got respectable management over prices and a strong place in your market. Properly executed.

A greater revenue margin.

An excellent higher revenue margin sits within the 15% vary. This margin exhibits us that your small enterprise is prospering, and also you’re producing vital earnings. Now you possibly can take these earnings and reinvest them for development, use them to pay down debt, or distribute them as dividends. Your laborious work is paying off!

An excellent revenue margin.

When you get into that 20% or increased vary for revenue margins, you’re in what we name the ‘greatest’ vary. Hitting this margin means what you are promoting isn’t solely thriving, however excelling. You’re maximizing profitability, more than likely have sturdy model loyalty, and may simply deal with these market fluctuations which might be sure to occur. You’ve obtained sufficient wiggle room that you would be able to begin making some enterprise choices that can assist you develop, like possibly even opening a second location. Give your self a very good ol’ pat on the again.

Revenue margin examples by trade.

We’ve got generalized benchmarks for revenue margins, however what are actual life industries bringing in for internet revenue? It actually does fluctuate relying on the enterprise so let’s take a look at some examples for various kinds of companies:

Revenue margins for eating places.

Most individuals know that revenue margins within the restaurant trade will be tight. Working prices are excessive for eating places with meals and beverage coming out and in the door all day lengthy and with increased staffing wants. That is usually why eating places have totally different wage charges for his or her servers and why individuals tip. Internet revenue margins for eating places sit within the 2% – 6% vary.

Revenue margins for retail shops.

As a result of retail shops have such a variety of merchandise, the web revenue margin vary is fairly massive. Wherever from 0.5% to 9%. Retail constructing suppliers are on the upper finish of this vary and smaller clothes retailers are on the decrease finish of this vary as a result of they only don’t have the excessive quantity gross sales capability as different clothes shops.

Revenue margins for hair salons.

Hair salons are one other instance the place internet earnings can fluctuate vastly. Relying on the situation and companies they provide, hair salons have a internet revenue margin of 8% to 25%. In case your salon is in downtown Manhattan and makes a speciality of shade corrections, your salon can be on the increased finish of that vary. In case your salon is in a small city and gives males’s cuts, that revenue margin could also be a bit decrease.

enhance your revenue margin.

We’ve executed the maths, we’ve checked out unhealthy, good, higher, and greatest, and we’ve checked out some particular trade requirements, however what can we really do with all of this info? It’s time to place this information into motion by bettering margins. Listed below are some methods you possibly can enhance your margins:

1. Enhance your costs.

Chances are you’ll be saying, duh, however we all know this is usually a difficult one for enterprise homeowners. Elevating your costs, even only a bit, can actually increase your revenue margin. Take a look at what your opponents are charging and take into consideration the distinctive worth you provide. Make sure that to clarify this worth to your clients so that they perceive why costs are going up. It’s a balancing act, however executed proper, you’ll see increased income with out shedding loyal clients.

2. Scale back your prices and enhance effectivity.

Slicing down bills with out skimping on high quality is essential. Search for areas the place you possibly can lower waste or get higher offers with suppliers. Perhaps change to cheaper supplies or discover extra environment friendly methods to function. For instance, save on worker hours by automating repetitive duties like utilizing payroll software program that does the whole lot for you. Each greenback saved on prices is a greenback added to your revenue.

3. Get artistic to spice up your gross sales.

Growing your gross sales quantity helps that backside line. When you’re saying in your head, ‘I’ve tried to spice up gross sales and it doesn’t work’, let’s get artistic. Strive new advertising campaigns, loyalty packages, or particular promotions to draw extra clients. Ask your staff if they’ve any artistic concepts to usher in extra gross sales— in spite of everything, they hear from clients every single day. Extra gross sales imply higher revenue margins.

4. Negotiate higher offers.

Don’t underestimate the facility of constructing sturdy relationships with suppliers. In the event that they know you’re a daily buyer, they’re extra prone to provide higher phrases and reductions. Often evaluation your contracts and store round to be sure you’re getting the most effective offers. Decrease enter prices are going to have a direct impact in your revenue margins.

What to do with revenue margin info.

Understanding and calculating revenue margins may not be essentially the most glamorous a part of working a enterprise, but it surely’s completely mandatory. Revenue margins offer you a transparent image of how effectively what you are promoting is doing and the place you may have to make some changes. Consider them like very important indicators of what you are promoting’ monetary well being.

By realizing find out how to calculate all various kinds of margins—and realizing what all of it means—you can also make smarter choices that drive what you are promoting ahead. Whether or not it’s tweaking your pricing, slicing prices, or discovering new methods to spice up gross sales, focusing in your margins will help you flip what you are promoting right into a well-oiled—and worthwhile—machine.

So, preserve that calculator helpful and make these numbers be just right for you. Right here’s to increased earnings and a thriving enterprise.