“Are we getting worth from our martech?” This million-dollar query plagues entrepreneurs, martech managers and C-suite executives alike. Because the advertising know-how panorama expands, martech managers will discover themselves in a susceptible place when confronted with potential price range cuts.

To evaluate the actual affect of martech on firm worth right this moment, it is best to:

- Deal with effectiveness, not effectivity metrics. Deal with success, not failure. Present martech metrics usually are not doing the job.

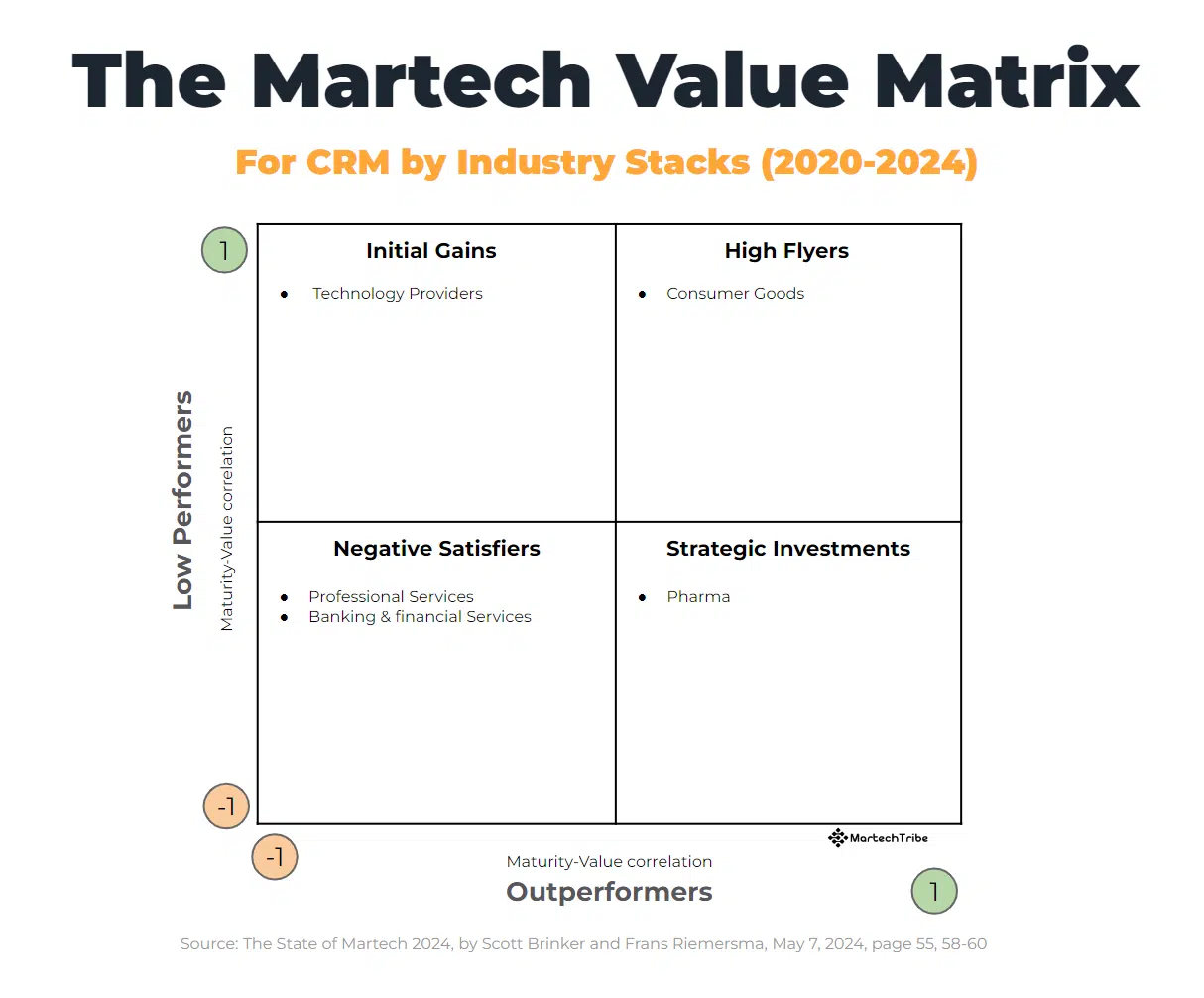

- Cease treating martech alike throughout industries. The Martech Worth Matrix exhibits the place martech maturity will increase or reduces firm worth.

- Take CRM for example. CRM performs a really completely different position throughout industries.

1. Deal with effectiveness, not effectivity metrics

Sadly, martech managers lack efficient instruments to evaluate and present the affect of martech. They depend on anecdotal consumer critiques, interview-based software program overviews by analysts, and strategies like calculating the martech utilization fee and whole price of possession (TCO).

Anecdotal consumer critiques and analysts’ overviews are difficult as a result of they don’t take into account company-specific and distinctive circumstances, making them much less convincing to inner stakeholders. Firms solely use one-third of their martech capabilities. The problem with martech utilization is that it focuses on using software program as an alternative of the worth it creates for the corporate. The identical applies to whole price of possession.

These instruments don’t present the true worth of martech. They concentrate on effectivity (saving cash) reasonably than effectiveness (being profitable). Effectivity is about doing issues proper, which advantages the corporate. Effectiveness is about doing the correct issues, which advantages the shopper and makes a stronger enterprise case. Effectivity is sweet, however effectiveness is 10 occasions higher.

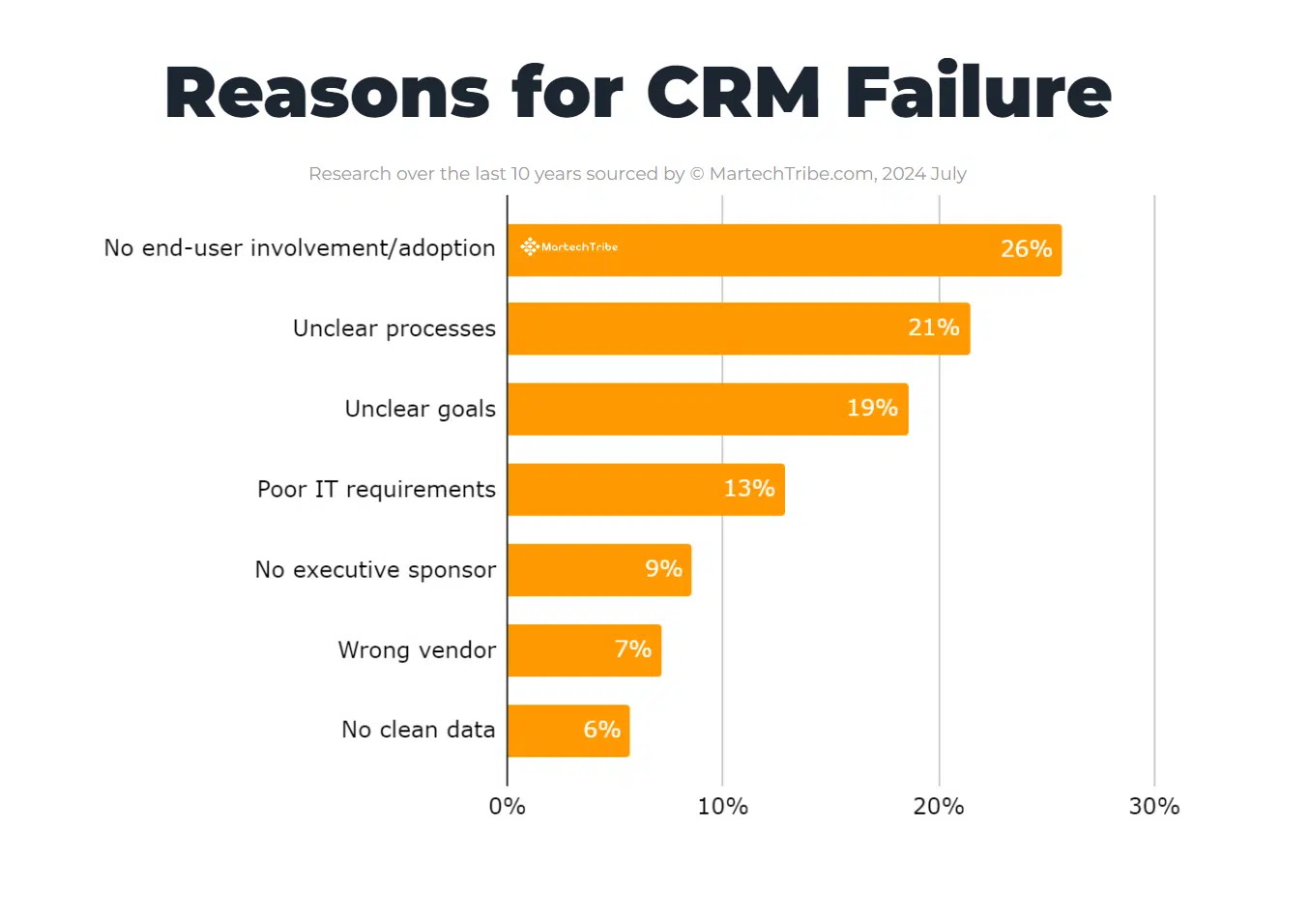

Making issues worse, there are frequent reviews of software program failures as an alternative of helpful instruments. For instance, many reviews present excessive failure charges for CRM implementations.

These reviews additionally spotlight the primary causes for failure, equivalent to ignoring the consumer and unclear targets, which make up 66% of the mentions. Nevertheless, they don’t clarify easy methods to get worth from martech. The main target is on failure, not success. Profitable martech drives firm worth reasonably than simply being higher chosen and applied.

The important thing problem is connecting martech investments to general enterprise efficiency. Our analysis at chiefmartec and MartechTribe over the previous years addresses this subject. After we focus on “firm worth,” we’re not referring to ROMI or marketing campaign ROI however to the full firm worth reported in annual reviews. This strategy gives a extra complete view of martech’s affect.

2. Cease treating martech alike throughout industries

Over the previous 5 years, our group studied the relationships amongst software program vendor measurement, firm stack measurement, income, headcount, age, {industry}, enterprise mannequin and particular martech elements. We have now carried out tons of of information experiments with our group of information scientists utilizing our martech information warehouse, which comprises 14,106 buyer know-how instruments and information from 1,356 international, real-life, cross-industry buyer know-how stacks and 4,758 necessities. Here’s what we discovered:

- Martech is used very otherwise throughout industries.

- Martech is used otherwise by enterprise fashions (e.g., B2C, B2B and B2B2C).

- Martech is used reasonably otherwise by firm measurement (i.e., income or headcount).

- Outperformers (i.e., the highest 30% of corporations ranked on revenue-per-employee ratio) present coherent martech patterns.

A brand new martech worth metric

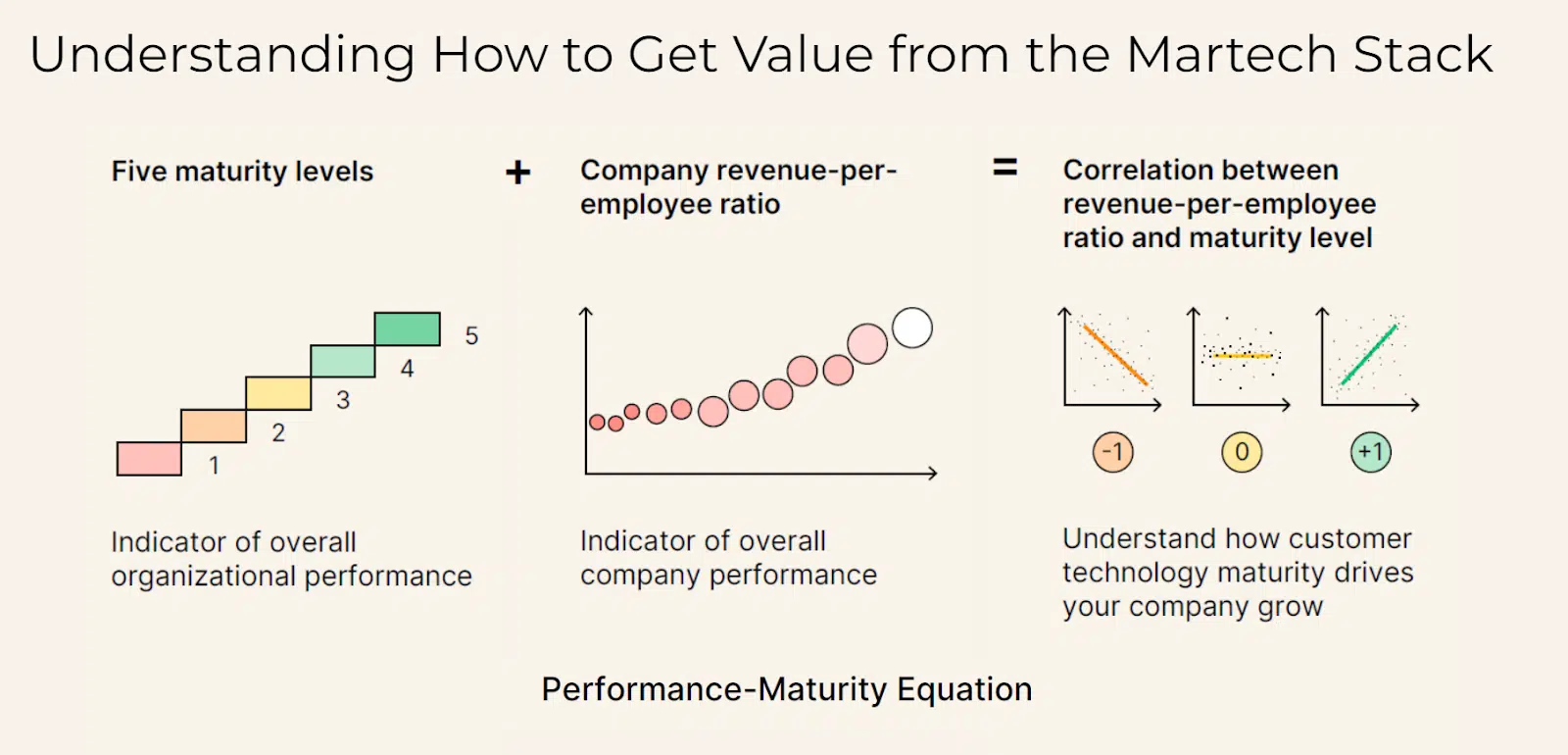

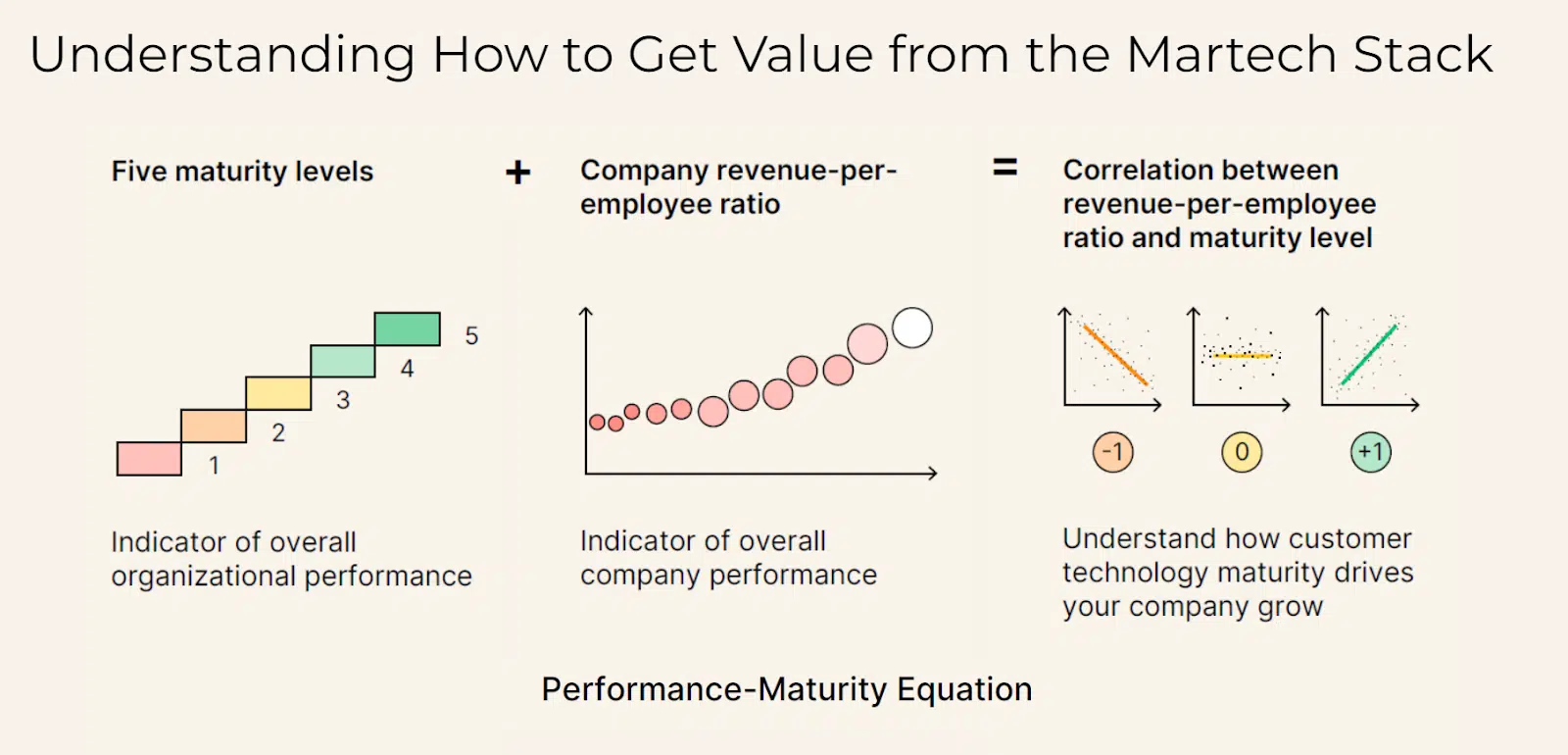

We discovered a martech worth metric that mixes all 4 insights. It’s only a begin, however it’s already very promising and insightful. The metric combines exterior and inner firm efficiency.

- Exterior efficiency: Measured by the revenue-per-employee ratio, this metric (a.okay.a. internet revenue per worker (NIPE) gives a comparative view of firm efficiency inside its {industry}.

- Inner efficiency: Using a Likert scale primarily based on the Functionality Maturity Mannequin from Carnegie Mellon College, figuring out 5 maturity phases: Preliminary, Managed, Outlined, Quantitatively Managed and Optimizing.

By correlating these two metrics, we will establish whether or not growing martech maturity correlates with improved enterprise efficiency. There are three potential correlation outcomes:

- Optimistic correlation: Elevated maturity correlates with the next revenue-per-employee.

- Unfavourable correlation: Elevated maturity pertains to a lower in revenue-per-employee.

- No vital affect: Maturity just isn’t considerably linked to the revenue-per-employee ratio.

If we need to perceive what profitable corporations do, we have now to have a look at what the outperformers do. By evaluating their funding conduct with that of low performers, we see a matrix emerge.

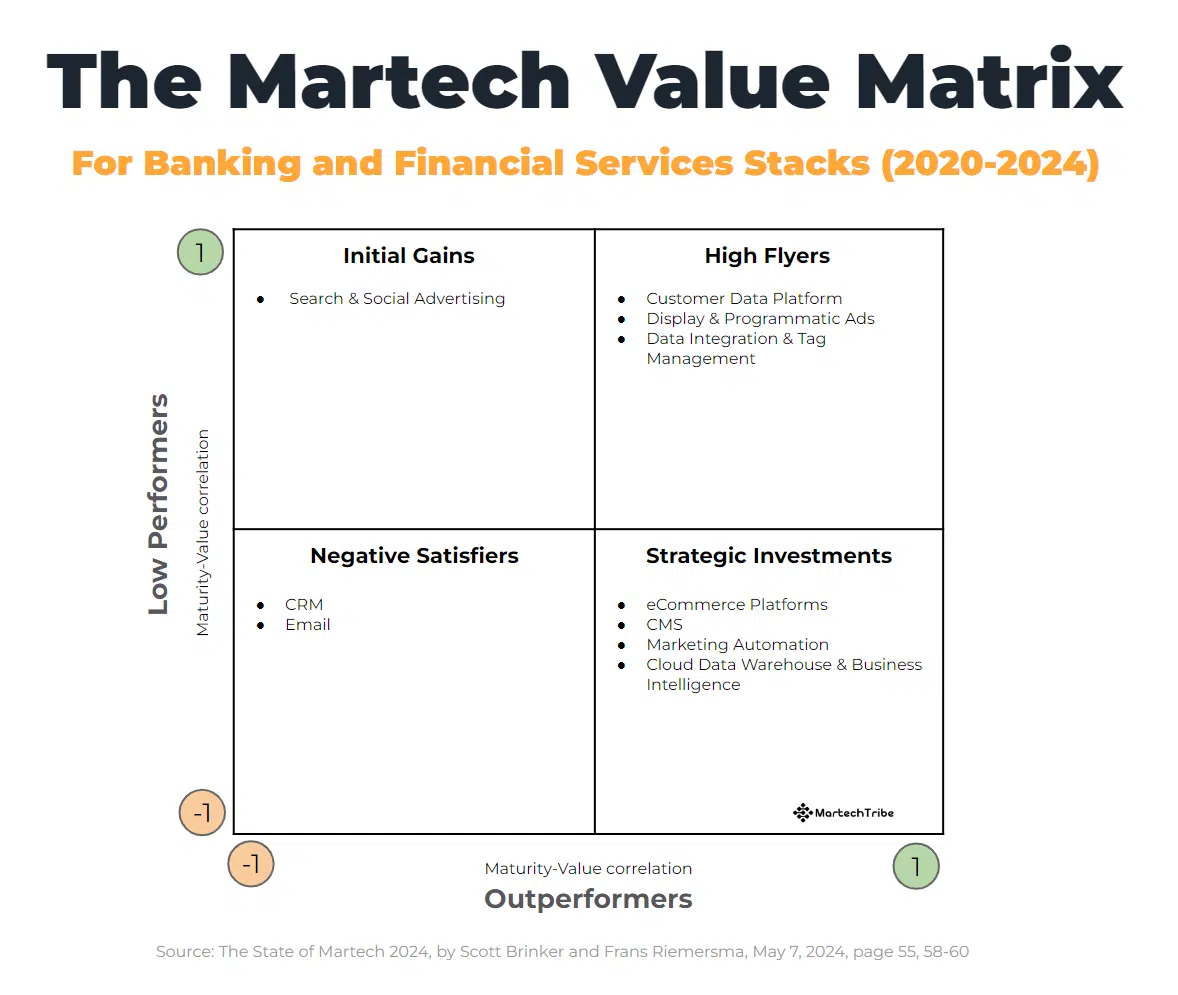

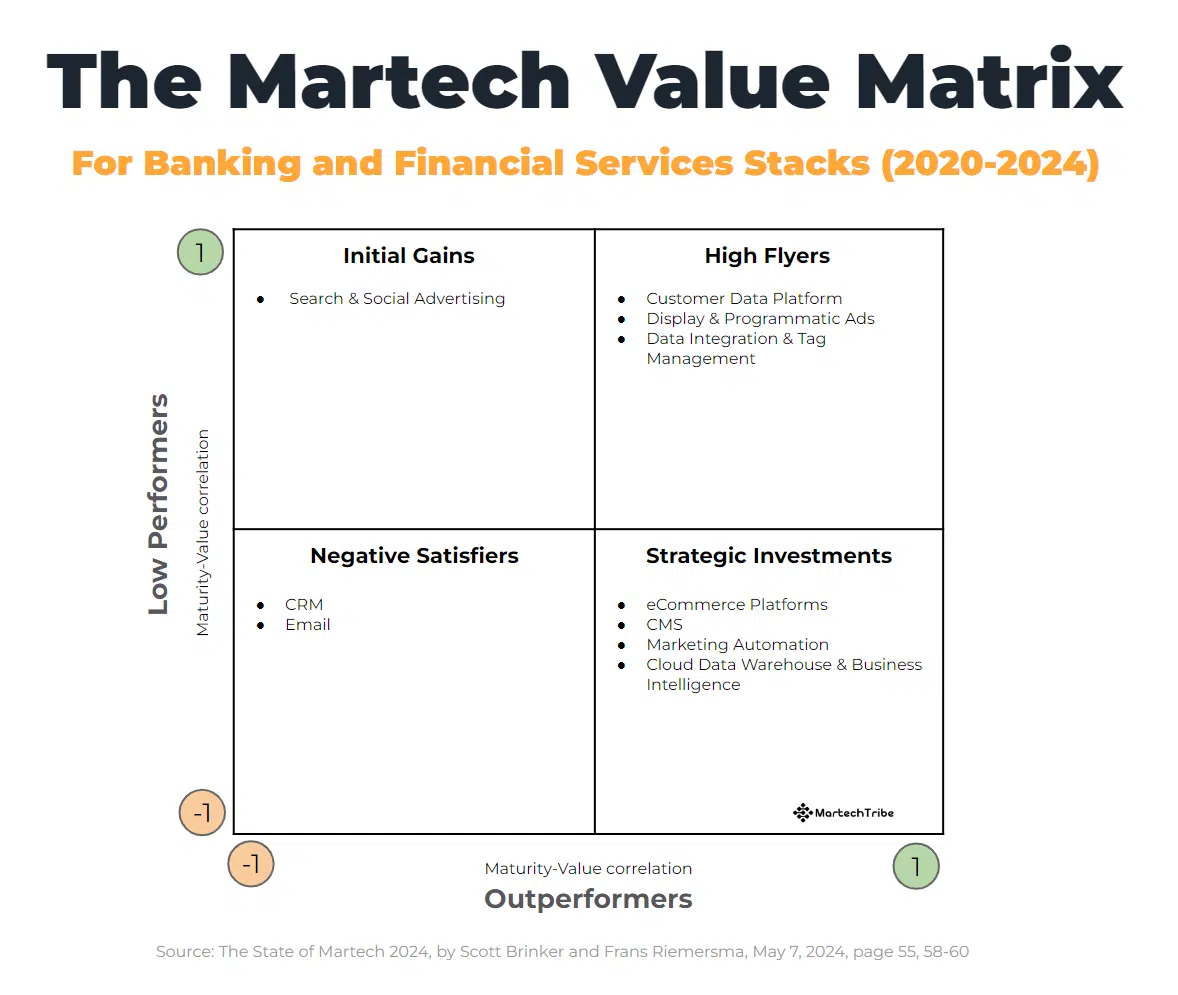

The Martech Worth Matrix combines the optimistic and adverse correlations of each outperformers and low performers. The 4 potential mixtures inform us how martech is utilized in particular industries. Beneath is a (collection of) the correlations of martech used within the banking and monetary companies {industry}.

Studying the matrix clockwise, we see that particular martech performs very otherwise inside the {industry}.

- Martech excessive flyers

- Each outperformers and low performers profit from elevated maturity.

- When low performers turn into outperformers, they are going to doubtless substitute search and social promoting with programmatic advert shopping for.

- Strategic martech investments

- Outperformers profit, however low performers want to handle foundational points first.

- Ecommerce platforms deal with each net and cell app banking companies. Low performers don’t use these platforms as successfully as excessive performers do.

- Unfavourable satisfiers

- These are important instruments, however they are often over-engineered and result in over-investment. It’s greatest to concentrate on getting the fundamentals proper.

- Electronic mail advertising options are required however shouldn’t be overutilized. The outperformers discovered it efficient to stay to the core operate of e mail advertising instruments: excessive deliverability of their value-driving newsletters.

- Martech for preliminary positive factors

- Low performers see preliminary advantages, however positive factors taper off as maturity will increase. Low performers appear to profit from growing maturity however not outperformers.

- On this case, search and social promoting provides a comparatively cost-effective method to achieve (preliminary) traction and market share.

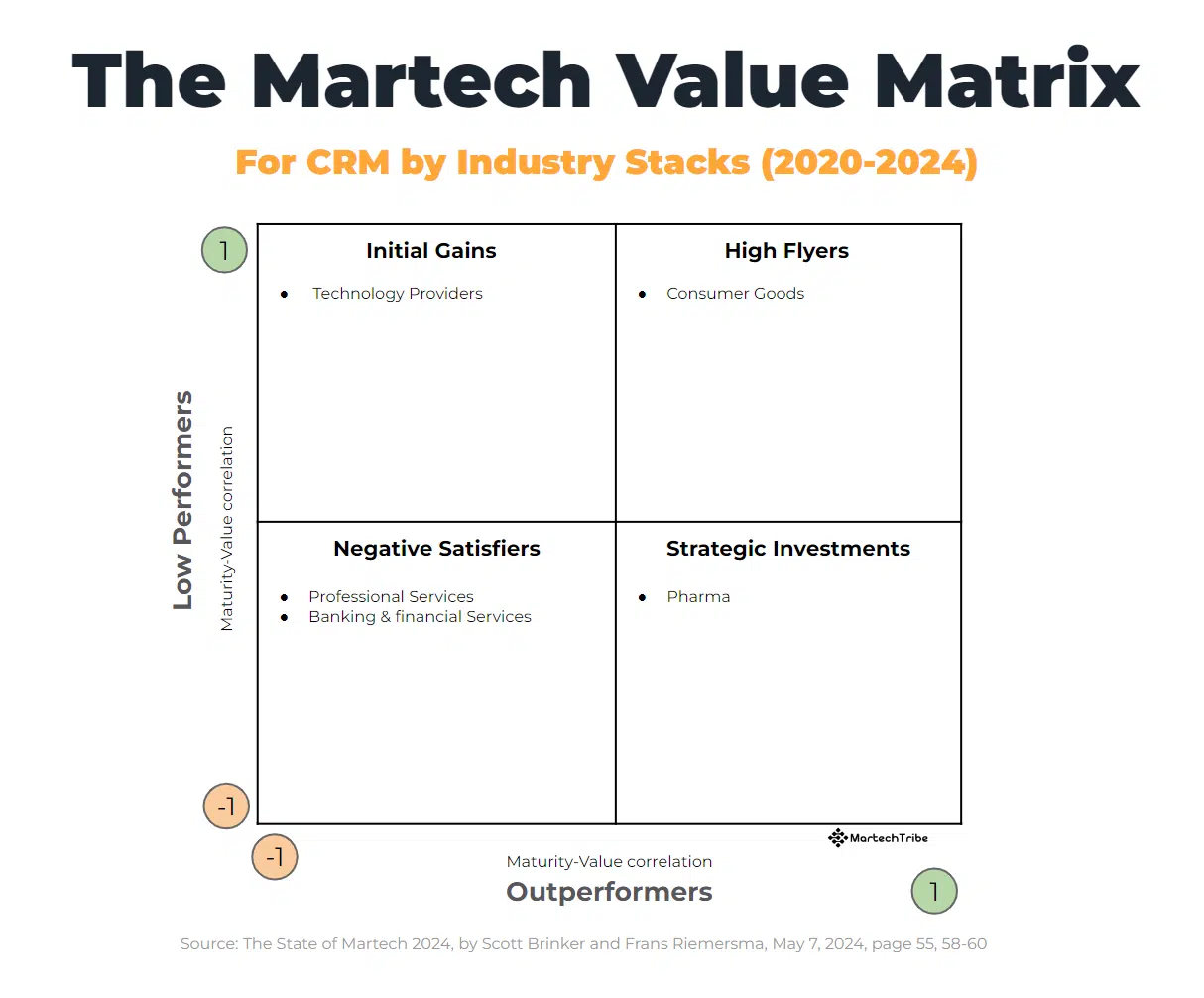

3. Take CRM for example: The CRM Worth Matrix

Reflecting on the explanations for CRM implementation to fail, the CRM Worth Matrix provides some nuanced insights.

- CRM is a adverse satisfier within the case of the banking and monetary companies {industry}. A

“Unfavourable satisfier” refers to a martech answer that’s indispensable in a stack however shouldn’t be over-engineered. On this case, 73% of the outperformer banking stacks embrace a CRM. That top share exhibits CRM is used as a cornerstone with out having to implement it in its fullest capability. This could be reported as a CRM failure for not implementing all modules throughout all enterprise items, however it’s, in truth, an instance of excellent use. - Outperforming pharmaceutical corporations use CRM as strategic martech investments. The various country-specific authorized constraints drive pharmaceutical corporations to make use of CRM in a really subtle method or else fail. Right here, we frequently see extremely custom-made CRMs or CRMs which can be country- or industry-specific.

- Skilled companies corporations equivalent to consultancies stripped CRM to its naked minimal, serving as a digital Rolodex with some modest gross sales forecasting. As account managers have established one-on-one relationships with their shoppers, they’re prone to maintain documentation and note-taking to a minimal. Handovers to colleagues will be finished verbally at will.

Contributing authors are invited to create content material for MarTech and are chosen for his or her experience and contribution to the martech neighborhood. Our contributors work underneath the oversight of the editorial employees and contributions are checked for high quality and relevance to our readers. The opinions they specific are their very own.