Solana’s current worth conduct has sparked nervousness within the the digital foreign money market. The once-soaring blockchain has fallen considerably because of a widespread hunch. Solana native token (SOL) has been down 32% within the final 4 weeks, trailing Bitcoin’s 10% decline and Ethereum’s 15% dip. Because the community suffers with the fallout from a meme foreign money frenzy that left buyers reeling, a sudden sell-off happens.

Associated Studying

Meme Coin Mania Turns Into Catastrophe

Solana has been the epicenter of an explosive meme coin progress. Though this initially stimulated buying and selling quantity and curiosity, it has since led to extreme unfavourable repercussions. Rug pulls and failed initiatives on the community have reportedly resulted in a lack of greater than $26 million. Many builders deserted initiatives instantly after elevating funds, leaving buyers with tokens that have been of no worth.

The problem has escalated at an alarming fee. Within the span of 30 days, the Solana ecosystem has misplaced at the least 12 meme coin initiatives. The token’s worth has declined because of this surge of failures, which has additionally negatively impacted investor sentiment.

It’s over for Solana

Worse than the FTX collapse$LIBRA, #MELANIA modified every part

🧵: Right here’s what went down and what’s subsequent… pic.twitter.com/mo6TMBpift

— Xremlin (@0x_gremlin) February 17, 2025

Is Solana In Bother?

Crypto dealer Xremlin lately declared on X that “it’s over for Solana,” evaluating its decline to the FTX collapse—solely worse. He identified that Solana’s current surge in reputation was pushed by hypothesis and the rise of meme cash.

A lot of this exercise stemmed from low transaction charges, attracting merchants to platforms like Pump.enjoyable. Nonetheless, many of those tokens are seen as pump-and-dump schemes, including to the unfavourable sentiment round Solana’s ecosystem.

Ray Of Hope?

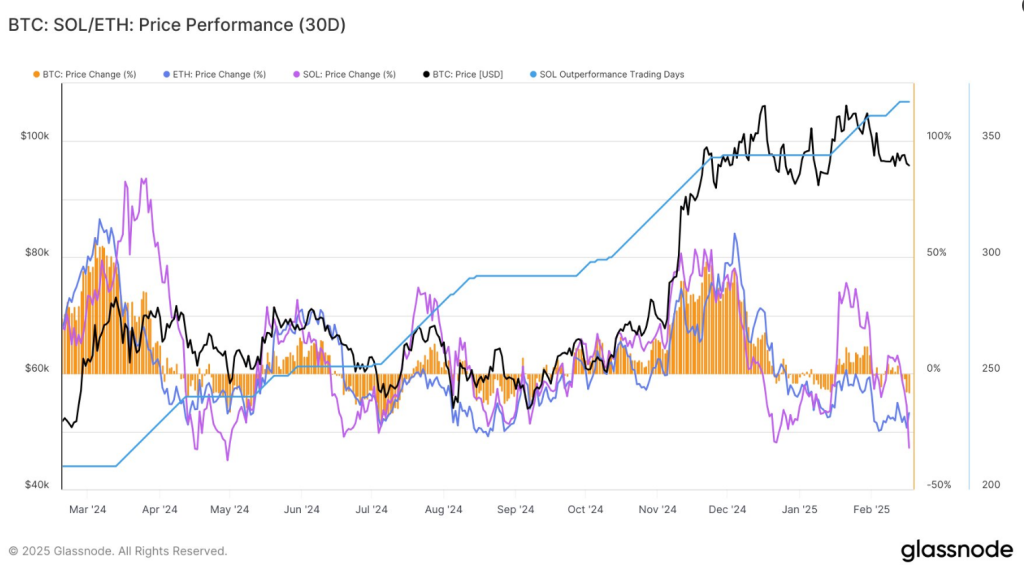

In the meantime, Glassnode information signifies that Solana surpassed Ethereum on 23 of 49 days for the reason that starting of the yr. Nonetheless, Solana has demonstrated better susceptibility to market declines.

For the reason that starting of the yr, #Solana outperformed #Ethereum for 23 out of 49 days. Nonetheless, $SOL has been extra delicate to current drawdowns, with 30D worth change clocking in at -32% as of Feb 17 (#ETH: -17%, #BTC: -8%) https://t.co/7p1xFARDLD pic.twitter.com/GE7WaV4hBi

— glassnode (@glassnode) February 18, 2025

Damaging Affect On Community

Solana’s enchantment as a low-cost, high-speed blockchain has attracted merchants who’re occupied with leveraging speculative ventures. The proliferation of meme cash that resemble scams has, nevertheless, prompted grave apprehensions.

Presently, quite a few analysts are cautioning that Solana is prone to changing into a breeding floor for pump-and-dump schemes, slightly than an ecosystem that fosters sustainable improvement.

Congestion points on the community can be one other huge difficulty. As a result of meme currencies are so widespread, the system has seen a drop in transaction speeds and occasional spikes in charges. This has prompted some customers to be annoyed and has made many marvel if Solana can maintain spikes in exercise with out slowing down.

Associated Studying

Bitcoin And Ethereum Exhibit Resilience

Bitcoin and Ethsereum have weathered the newest hunch with comparatively little harm, whereas Solana is having bother. Bitcoin has fallen by 10% within the final month, whereas Solana has fallen by 33%. Even whereas it’s nonetheless in a greater place than earlier than, Ethereum, which has additionally been below promoting strain, has seen a 17% drop.

In periods of uncertainty, buyers are progressively gravitating towards established property. Bitcoin and Ethereum have been capable of preserve the next stage of market confidence by primarily avoiding the chaos that has been brought on by meme coin implosions, in distinction to Solana.

Featured picture from Gemini Imagen, chart from TradingView