Robinhood, a preferred American monetary companies firm, is lastly out of the woods. In its third-quarter submitting ending September thirtieth, 2024, the corporate disclosed its revenues have been up by 165%, and its total year-to-date (YTD) internet deposits elevated to $34 million.

Associated Studying

It’s a promising improvement for Robinhood Markets this quarter after dealing with loads of challenges previously. The corporate took successful in early 2021 after it determined to limit buying and selling in GameStop and different meme shares throughout a market frenzy. In a separate assertion, Robinhood shared that it’s inching nearer to a settlement with traders and merchants.

Q3 Submitting Is Firm’s Second-Greatest Income

Regardless of its difficult backstory and the SEC’s regulatory pressures, Robinhood Markets discovered its rhythm to submit a strong third-quarter efficiency. The corporate shared that its internet deposits grew to $34 billion, and income elevated 36% yearly to $367 million, with its cryptocurrency unit main the surge.

In its submitting, Robinhood acknowledged that its cryptocurrency income elevated to $61 million over the quarter or 165%. Market observers anticipated this development after the corporate accomplished its takeover of Bitstamp, thus pushing its buying and selling quantity.

Robinhood Surprises With Spectacular Development

Robinhood’s development story impressed many market observers and analysts, given its current expertise with FTX, the ‘meme frenzy,’ and run-ins with the SEC. Final 12 months, the corporate purchased again its shares from Alameda Analysis for $605 million.

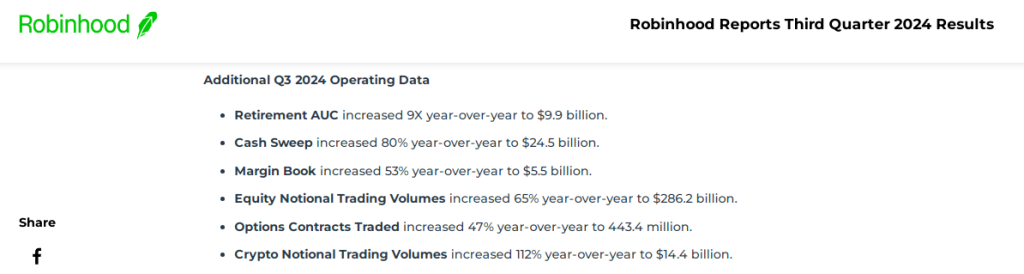

On the time of the transaction, many observers anticipated that Robinhood would keep away from cryptocurrency investments. Nonetheless, the corporate shocked analysts by making crypto a vital funding by its Robinhood Crypto unit. For its Q3 submitting, Robinhood’s Asset Beneath Custody (AUC) surged by 76% year-over-year to greater than $152 billion.

The agency reported that its holdings elevated as a consequence of larger fairness, higher crypto valuation, and sustained deposits. The corporate has a portfolio heavy on Bitcoin, and the current rise within the high crypto bodes effectively for the agency, which can proceed to earn so long as the pattern stays bullish for BTC.

Associated Studying

Robinhood Lastly Shifting Forward After Regulatory Pressures

Robinhood Markets is lastly shifting away from the challenges and points. As talked about, the corporate was embroiled in a buying and selling scandal in early 2021 over the hype on GameStop and meme shares. Final Might, the Securities and Alternate Fee (SEC) issued a Wells Discover to the corporate.

The company argued that a few of Robinhood’s cryptocurrency companies violate securities legal guidelines. Curiously, the SEC has not filed a case in opposition to the corporate.

Within the meantime, Robinhood Markets is enterprise as common. Based mostly on stories, Robinhood has listed a number of tokens and allowed transfers for belongings like SOL. Nonetheless, entry to the service is restricted to EU prospects.

Featured picture from Omar Marques/SOPA Photographs/LightRocket through Getty Photographs, chart from TradingView