Earlier than the buying and selling day begins we deliver you a digest of the important thing information and occasions which can be more likely to transfer markets. In the present day we have a look at:

Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

- Reliance AGM nears

- India IPOs outshine US

- Birla’s paints foray

Good morning, this is Chiranjivi Chakraborty, an equities reporter in Mumbai. Indian stocks are set to follow Asian markets higher, as the prospect of Federal Reserve interest-rate cuts boosted sentiment. The upbeat backdrop should keep Indian bulls in high spirits as we kick off the final week of August. It’s going to be an eventful one, with Reliance Industries’ AGM, the June-quarter GDP data, and the monthly derivatives expiry all on the agenda.

Advertisement 2

Article content material

All eyes on Reliance AGM; Jio, Retail itemizing in focus

The week is all about Reliance Industries, because the nation’s most dear firm gears up for its much-anticipated annual shareholder assembly on Thursday. Though the gathering is going on later than common — blame the lavish marriage ceremony within the Ambani household — expectations stay fairly just like final 12 months. You’ll be able to see that in Reliance’s share worth, which has stayed nearly flat over the previous month. Sanford C. Bernstein expects the AGM may reveal a possible itemizing date for Mukesh Ambani’s client companies, Jio and Reliance Retail, together with a timeline for the rollout of the corporate’s new power tasks.

India’s IPO market returns outshine US, Europe

Returns from IPOs in India are outpacing these within the US, as buyers flock to the nation’s booming tech startups. This 12 months, 195 firms have gone public, together with notable choices like E-scooter maker Ola Electrical, they usually’ve delivered a median return of 58%. This achieve is much forward of the 12% imply for US IPOs and 18% for European ones, information compiled by Bloomberg present. At the least 20 extra firms, together with Hyundai Motor’s India unit, are gearing as much as faucet into the market’s ample liquidity. No marvel the BSE’s index of newly listed corporations is up 33% this 12 months, outshining the 14% achieve in the principle Sensex.

Commercial 3

Article content material

Birla’s paints entry unlikely to disrupt prime gamers

The Birla Group’s daring foray into the paint business initially put some stress on current gamers, however market watchers are seeing house for brand spanking new opponents. Nuvama Institutional Equities doesn’t count on Grasim Industries’ entry to disrupt the market, prompting it to take an “anti-consensus” purchase stance on the business’s three foremost gamers. With a probable rebound in pricing energy and indicators of rural demand development, the sector appears set for a lift. Prime participant Asian Paints is up 8% this quarter, after slipping 14% within the first half.

Analysts actions:

- Bansal Wire Rated New Purchase at Investec; PT 440 rupees

- Devyani Reduce to Maintain at KR Choksey; PT 185 rupees

- ITC Reduce to Accumulate at KR Choksey; PT 545 rupees

- Polycab India Reduce to Maintain at Systematix Shares & Shares

Three nice reads from Bloomberg right this moment:

- Low cost AI Voice Bots Are Taking Off With Companies in India

- Powell’s Pivot Leaves Merchants Debating Dimension, Path of Charge Cuts

- Mpox Outbreak: How a Preventable Virus Turned a World Menace

And, lastly..

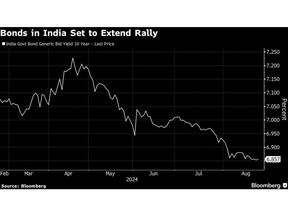

The rally in authorities bonds appears set to increase as foreigners proceed to snap up the notes amid the prospect of rate of interest cuts. The yield on benchmark 10-year bond might decline to about 6.50% by March 2025, in accordance with PGIM Mutual Fund, implying a drop of 36 foundation factors from Friday’s shut. The securities, which not too long ago joined a key JPMorgan Chase & Co.’s gauge, are among the finest performing in Asia this 12 months.

—With help from Malavika Kaur Makol.

Article content material