Polkadot is among the many prime blockchains, securing a spot within the prime 20. Although the platform promotes blockchain interoperability, a function wanted within the age of accelerating fragmentation, DOT costs have didn’t encourage bulls.

This state of affairs on value charts displays the final pattern throughout the board, particularly in main sensible contract platforms like Ethereum and Solana.

Polkadot Treasury Reserves Down To All-Time Lows

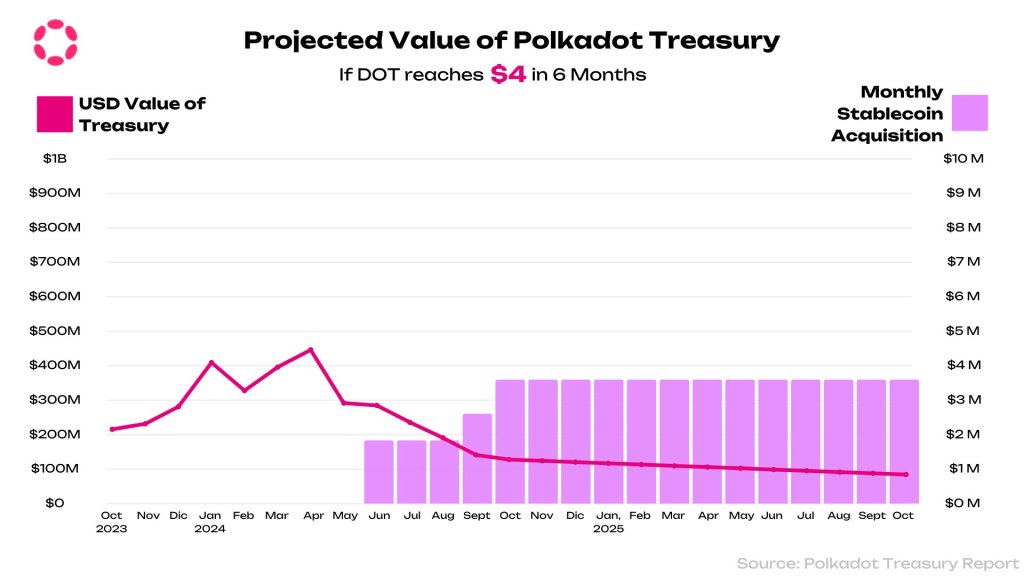

Unyielding bears have been forcing costs decrease over the months since DOT rose to round $10 in Q1 2024, depleting the Polkadot Treasury Reserves.

In early November, one observer on X stated they stood at all-time lows. Nonetheless, it might worsen for Polkadot ought to the bears of Q3 2024 stream again, forcing costs under native help ranges.

The each day chart exhibits that DOT has essential help at round $3.8. This stage marks September and October lows. Then again, the coin is going through sturdy liquidation stress at $4.6 and $5.

Because the coin ranges, the path of the breakout might form the brief—to medium-term pattern but additionally affect the Polkadot Treasury.

So much is determined by whether or not DOT costs will get better, which can, in flip, assist the Polkadot Treasury reserves get better. Technically, costs play an enormous position. When bulls take over, the reserve, denominated in DOT, will increase in USD phrases, easing stress on the workforce.

Coverage Intervention To Increase Funds

To additional improve inflows into the Treasury Reserves, the Polkadot neighborhood handed a coverage to cut back inflation. Particularly, the neighborhood voted to drop DOT annual inflation from 10% to eight%.

With low inflation and sustained on-chain demand, DOT costs might discover help. Moreover, 15% of staking rewards distributed from stakers will likely be moved to the Treasury.

The analyst predicts these modifications might enhance the Treasury by including 1.5 million DOT. This would be the much-needed infusion of funds that will improve the Treasury Reserves after months of low earnings.

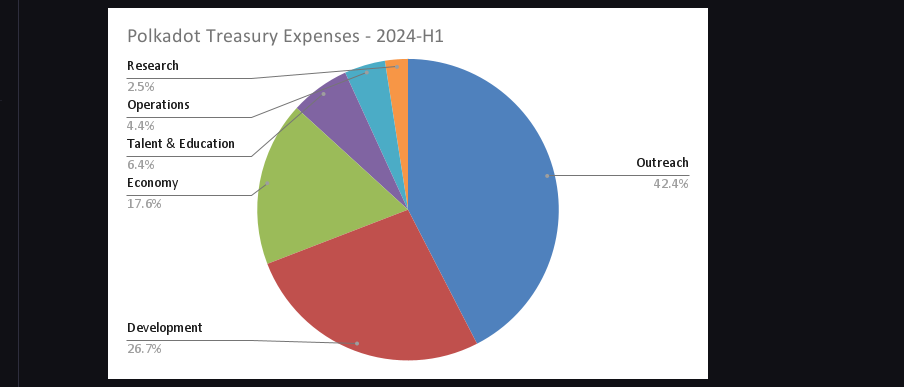

The workforce might construct higher and even strike high quality partnerships, bettering the blockchain’s ecosystem. Based mostly on H1 2024 information, the workforce spent most on outreach, whereas almost 27% went to growth.

The remainder was break up between funding analysis, operations, expertise, and the economic system. Given the valuation within the 12 months’s first half, they spent $87 million, or round 11 million DOT, in whole.