Bitcoin surged over 5% yesterday, following a constructive day throughout the crypto market. This sudden worth increase has sparked optimism amongst traders and analysts, anticipating even greater good points within the coming months. Market sentiment is bettering alongside worth motion, fueling hopes for a sustained rally.

Associated Studying

Key information from CryptoQuant means that Bitcoin demand is rising, supporting the concept Bitcoin may proceed to climb. This rising demand and the bettering market sentiment create a positive setting for bullish momentum.

Persevering with the latest worth surge may set the stage for Bitcoin to succeed in new highs, whereas any hesitation would possibly result in additional consolidation. Both method, market individuals are eagerly awaiting the following main transfer.

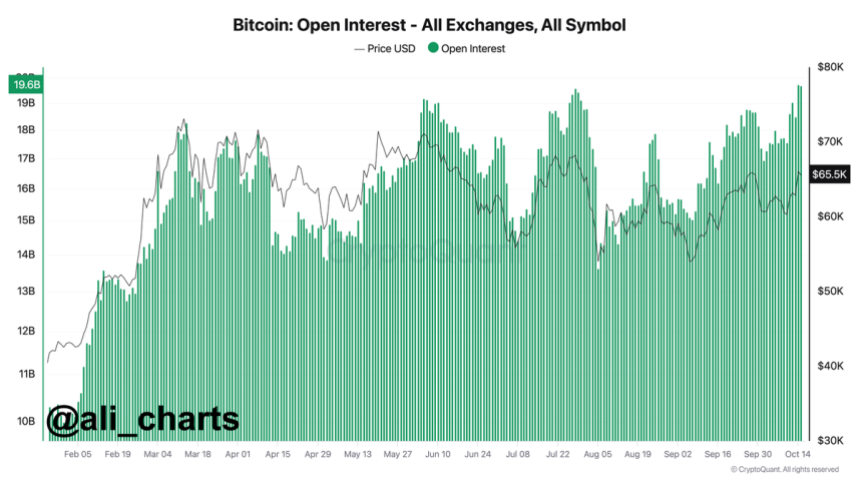

Bitcoin Open Curiosity Reaching New Highs

After surging to check native highs, Bitcoin is at a vital turning level, setting the stage for a possible rally that has analysts and traders optimistic.

The value has surged over 12% in lower than every week, reflecting renewed bullish sentiment out there. This upward momentum has sparked hopes of continued good points, with many speculating that Bitcoin is on the verge of a major breakout.

Prime crypto analyst and investor Ali Martinez not too long ago shared a compelling CryptoQuant chart, revealing that Bitcoin’s open curiosity throughout all exchanges has simply hit a brand new all-time excessive of $19.75 billion.

This spike in open curiosity usually precedes giant worth strikes, signaling heightened exercise and extra capital at stake out there. A surge in open curiosity means that merchants are positioning themselves for important worth motion, probably including extra gas to the present rally.

The information from CryptoQuant helps the rising bullish outlook for Bitcoin, because it means that traders and merchants are more and more assured within the asset’s near-term efficiency.

Associated Studying

Bitcoin might be on monitor to check new highs if this momentum continues, paving the way in which for a broader market rally. Because the market eyes this vital juncture, the following few days will likely be essential in figuring out Bitcoin’s trajectory.

BTC Pushing Native Highs

Bitcoin is buying and selling at $65,600 after consolidating following yesterday’s surge to native highs. The value is eyeing the essential $66,500 resistance degree, which, if damaged, may ship BTC to new all-time highs.

This resistance has been a key barrier for Bitcoin, and a profitable push above it will affirm the bullish momentum and certain result in additional good points.

BTC is now buying and selling effectively above its 200-day shifting common (MA) at $63,336, additional solidifying the constructive outlook for Bitcoin within the coming weeks. Holding above this MA is a robust indicator that the bulls are in management. The market is poised for a possible rally.

Nevertheless, for Bitcoin to proceed its upward trajectory, it should break the $66,500 degree and set a brand new excessive.

On the draw back, if BTC fails to surpass this resistance, a retrace to decrease demand ranges round $62,000 may happen, which might nonetheless be a wholesome correction inside the broader uptrend.

Associated Studying

The market stays optimistic, however the subsequent few days will decide whether or not BTC can keep its momentum or face a short-term pullback.

Featured picture from Dall-E, chart from TradingView