Bitcoin at the moment ranges between $65,000 and $69,500 following two weeks of bullish value motion, sparking renewed optimism amongst analysts and buyers. The prevailing sentiment is that BTC is on the verge of reaching new all-time highs within the coming weeks, with confidence constructing that March’s cycle high predictions could have been untimely.

Associated Studying

Key metrics from CryptoQuant reveal that Bitcoin continues to be removed from typical cycle-top situations, as a substitute signaling a bullish outlook as we transfer into November. Because the U.S. election approaches November 5 and macroeconomic components proceed to shift, value motion is predicted to stay unpredictable and risky.

Market contributors are watching intently, anticipating that geopolitical and financial occasions may affect BTC’s trajectory. Given this context, many consider the subsequent main transfer for Bitcoin may catalyze a recent leg up, doubtlessly breaking via earlier highs.

Bitcoin Calm Earlier than The Storm?

Bitcoin is holding agency above $67,000, displaying resilience because it edges to a possible breakout above $70,000. Nonetheless, the present value motion signifies that Bitcoin could consolidate beneath this key degree earlier than shifting as much as new highs within the subsequent leg. Market contributors intently watch BTC’s habits round these value ranges, as a sustained push above $70,000 may set the stage for vital positive aspects.

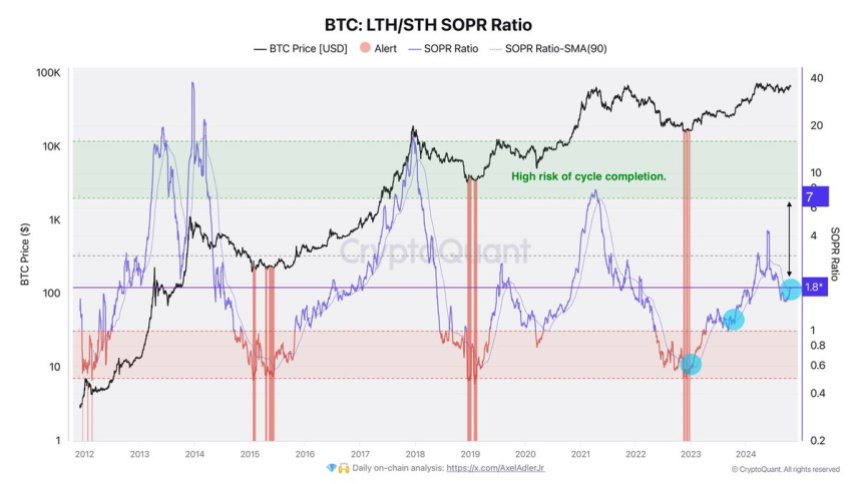

CryptoQuant analyst Axel Adler not too long ago shared important insights on X, highlighting the present Lengthy-Time period Holder (LTH) to Quick-Time period Holder (STH) SOPR Ratio, which sits at 1.8. This metric is usually used to gauge promoting strain and market sentiment, with greater ranges indicating elevated profit-taking that might sign a market peak.

In keeping with Adler, when this ratio climbs to round 7, Bitcoin will probably be nearing a cycle end result. The ratio’s bullish cross with its 90-day shifting common displays a optimistic outlook, supporting the narrative that BTC stays effectively beneath its cycle high.

Associated Studying

This metric’s motion and broader market power paint a positive image for Bitcoin’s value motion within the coming weeks. The info means that Bitcoin nonetheless has room to develop inside this cycle, offering confidence to long-term holders and buyers on the lookout for continued upside.

BTC Technical Ranges

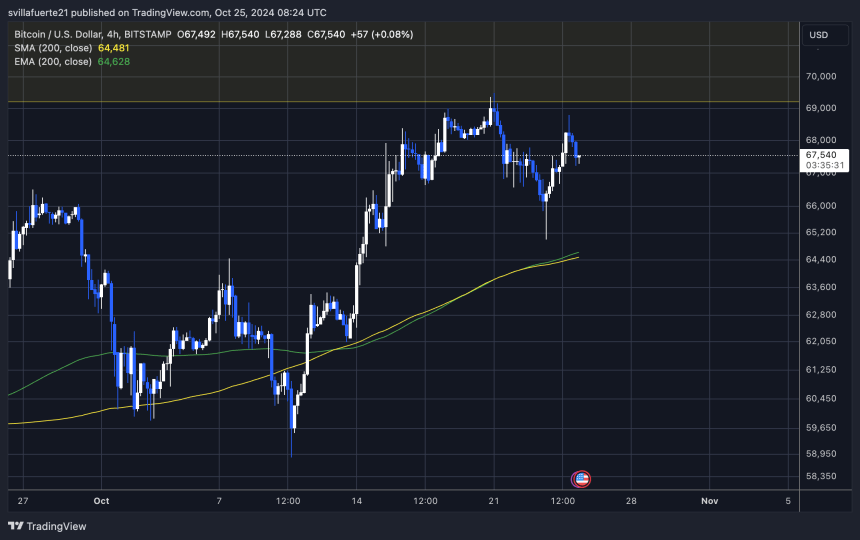

Bitcoin is buying and selling at $67,500, dealing with challenges after failing to take care of its bullish construction on the 4-hour chart. The value couldn’t set a brand new excessive above $69,500, marking a possible shift in momentum. An important help degree now sits at $65,000, the native low that beforehand held the bullish pattern intact. Holding above this degree is important to forestall a broader retrace and keep confidence amongst bulls.

Presently, value motion stays indecisive, leaving the route for the approaching days unclear. A breakout above $69,500 would restore the bullish construction, possible drawing extra consumers into the market and signaling one other rally try. Conversely, a break beneath the $65,000 help would sign a retrace, doubtlessly main BTC to decrease demand zones as bulls look to regroup.

Associated Studying

The present consolidation section highlights the significance of those ranges in figuring out Bitcoin’s short-term trajectory. With each bulls and bears vying for management, BTC’s potential to carry above $65,000 will probably be essential to retaining bullish sentiment.

Featured picture from Dall-E, chart from TradingView