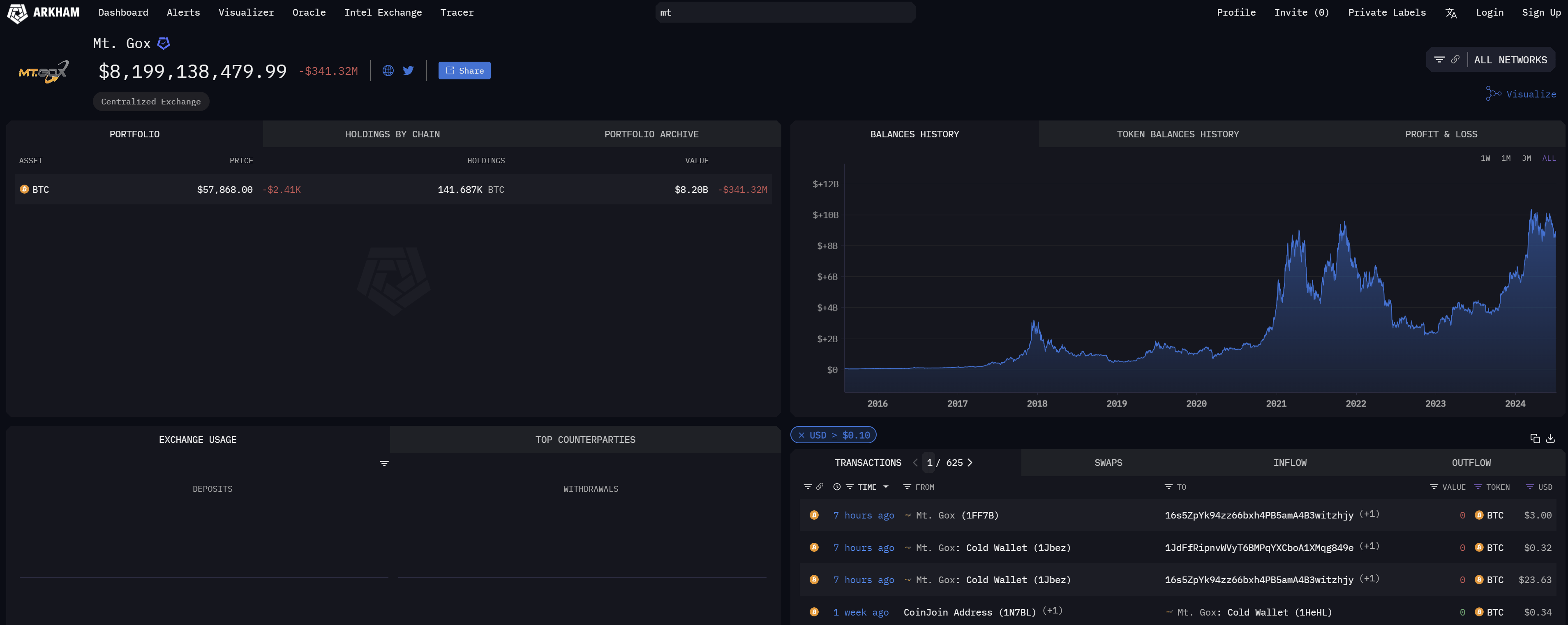

In response to information from Arkham Intel, Mt. Gox has initiated the method of repaying collectors by transferring a nominal quantity of Bitcoin to one of many designated exchanges. This improvement follows months of hypothesis and planning in regards to the disbursement of roughly $8.2 billion in Bitcoin owed to collectors of the defunct change.

Are Mt. Gox Bitcoin Repayments Starting?

Early at present, three wallets traditionally linked to Mt. Gox executed three transactions. Probably the most vital of those concerned the switch of $24 in Bitcoin to a pockets which then proceeded to ship these funds to Bitbank’s scorching pockets. Bitbank, listed as one of many exchanges licensed to facilitate repayments, alongside Kraken, Bitstamp, SBI VC Commerce, and Bitgo, is ready to make these funds out there to its prospects inside a timeframe extending as much as 90 days from receipt.

Associated Studying

Nevertheless, there may be some uncertainty surrounding these transactions, because the funds weren’t moved instantly from the first Mt. Gox wallets. Observers speculate whether or not this exercise may very well be a preliminary take a look at forward of bigger transfers supposed for creditor reimbursement. The Mt. Gox Rehabilitation Trustee has beforehand indicated that the reimbursement course of was scheduled to start from the start of July, though particular dates for the transfers haven’t been disclosed publicly.

The opposite two transactions, one switch of BTC value $3.00 and one other value $0.32, was transferred to a brand new pockets.

This delicate motion of funds happens amidst a turbulent interval for Bitcoin, which has seen its value plummet by greater than 20% since reaching $72,000, now hovering round $57,700.

What To Count on

Peter Chung, Head of Analysis at Presto Analysis, lately offered insights into the broader implications of the Mt. Gox repayments. He outlined the anticipated dynamics between Bitcoin (BTC) and Bitcoin Money (BCH), predicting vital buying and selling alternatives.

“The Mt. Gox’s Rehabilitation Trustee plans to distribute multi-billion {dollars} value of BTCs and BCHs to the Mt. Gox collectors between July 1st and October thirty first, 2024. This may seemingly alter provide/demand dynamics in BTC and BCH throughout this four-month interval, doubtlessly opening up a pair buying and selling alternative,” he acknowledged.

Associated Studying

Chung emphasised the disparate impacts on BTC and BCH: “Our evaluation exhibits that the promoting stress for BCH will likely be 4 instances bigger than for BTC – i.e., 24% of the day by day buying and selling worth for BCH vs. 6% of the day by day buying and selling worth for BTC. This differential displays various investor bases, with BCH’s being significantly weaker and extra more likely to dump holdings.”

He suggested merchants on potential methods: “Lengthy BTC perpetuals paired with brief BCH perpetuals is probably the most environment friendly market-neutral technique to categorical this view, barring funding fee threat.” For these involved about risky funding charges, Chung really useful exploring “different approaches, comparable to short-term futures or borrowing BCH within the spot market.”

At press time, BTC traded at $57,727.

Featured picture created with DALL·E, chart from TradingView.com