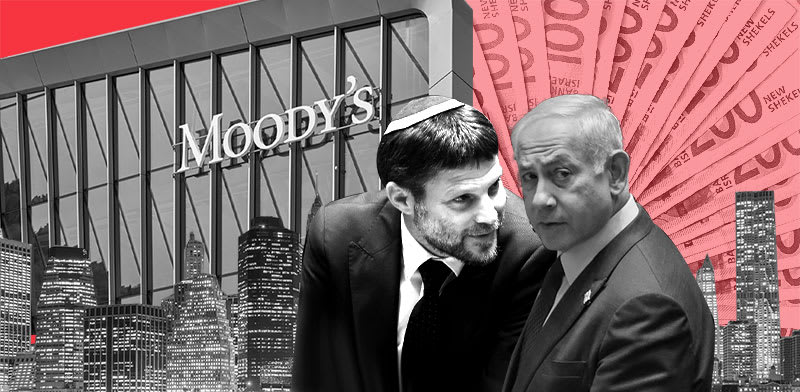

Worldwide credit score scores company Moody’s has issued a harsh score motion report on Israel’s economic system, saying in an distinctive transfer that it has downgraded the nation’s score by two notches from A2 to Baa1, with a unfavourable outlook. The brand new score places Israel on par with nations like Kazakhstan.

Moody’s wrote, “The important thing driver for the downgrade is our view that geopolitical danger has intensified considerably additional, to very excessive ranges, with materials unfavourable penalties for Israel’s creditworthiness in each the close to and long run.

Moody’s added, “Long run, we think about that Israel’s economic system will likely be extra durably weakened by the army battle than anticipated earlier. With heightened safety dangers (a social consideration), we not anticipate a swift and powerful financial restoration as in earlier conflicts. In flip, a delayed and slower financial restoration together with a extra extended and broader army marketing campaign will extra persistently affect public funds, additional pushing out the prospect of a stabilization of the general public debt ratio, in comparison with our earlier projections. In our view, the numerous escalation in geopolitical danger additionally factors to diminished high quality of Israel’s establishments and governance which haven’t absolutely mitigated actions detrimental to the sovereign’s credit score metrics.

“A extreme escalation of the battle with Hezbollah might be in line with a markedly decrease score, particularly if Israel’s financial and financial power have been to weaken additional. The danger of a broader escalation involving Iran stays, although it continues to be low. Uncertainty over Israel’s safety and longer-term progress prospects are a lot increased than is typical on the Baa score degree, with longer-term dangers to the extremely cell high-tech sector significantly related. Such unfavourable developments would have probably extreme implications for the federal government’s funds and will mark an extra erosion in institutional high quality.

Moody’s forecast, “We anticipate actual GDP progress of solely 0.5% this 12 months, and have materially lowered our expectation for progress subsequent 12 months to simply 1.5%, from 4% beforehand.

“Consequently, we anticipate the federal government debt ratio to stabilize later and at a better degree than assumed beforehand. We now forecast the debt ratio to rise in the direction of near 70% of GDP, in comparison with our forecast of a decline in the direction of 50% earlier than October 7.”

The score minimize is extra extreme than most forecasts within the markets had predicted. The downgrade itself isn’t a surprise, however most forecasts predicted a downgrade by one notch, and never a fall of two notches without delay. With this step, Moody’s completes a three-notch discount of Israel’s score inside months, after final February it introduced the first-ever downgrade in Israel’s historical past.

RELATED ARTICLES

The downgrade is principally attributed to the escalation of the safety state of affairs within the north. Lately, Moody’s representatives held talks with senior Israeli officers and figures within the economic system. Alongside the army developments Moody’s has been carefully following how the cupboard has permitted the breaking of the 2024 funds framework and delayed passing the 2025 funds, regardless of warnings from senior officers on the Ministry of Finance and Financial institution of Israel.

Accountant Normal Yali Rothenberg stated, “The choice of credit standing company Moody’s is extreme and unjustified. The power of the score motion taken doesn’t match the fiscal and macroeconomic knowledge of the Israeli economic system. It’s clear that the battle on the assorted fronts is taking a toll on the Israeli economic system, however there isn’t a justification for the score firm’s determination.

“On the identical time, decisive and fast steps should be taken to approve a state funds for 2025. The funds should result in the rebuilding of fiscal reserves, by sustaining a most deficit of as much as 4% of GDP and returning to a path of reducing the debt-to-GDP ratio. The state funds should encourage progress engines, funding in infrastructure, consideration of social wants and response to Israel’s protection necessities.”

A uncommon state of affairs has been created during which the world’s three main credit standing businesses every have completely different scores for Israel. Moody’s has the bottom score with Baa1, the equal of BBB with the opposite businesses. Fitch charges Israel one notch increased at A and S&P charges Israel at A+.

Printed by Globes, Israel enterprise information – en.globes.co.il – on September 28, 2024.

© Copyright of Globes Writer Itonut (1983) Ltd., 2024.