Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR) and Semler Scientific (SMLR).

Self-described bitcoin (BTC) growth firm MicroStrategy (MSTR) has elevated its bitcoin holdings to a complete of 439,000 BTC following its newest buy of 15,350 BTC with the acquisition ending on Dec. 15.

MicroStrategy disclosed that the 15,350 BTC buy got here to a complete of $1.5 billion for a median worth of $100,386 per bitcoin. This brings the corporate’s whole holdings to 439,000 BTC value $45.6 billion at present market costs. The corporate’s total common buy worth is $61,725 per bitcoin.

The most recent acquisition purchases was funded by means of share gross sales beneath the corporate’s at-the-market (ATM) program. Earlier than the announcement, MicroStrategy had $9.19 billion left of the ATM providing. Following the announcement, the corporate now has $7.65 billion left, in accordance with the newest submitting.

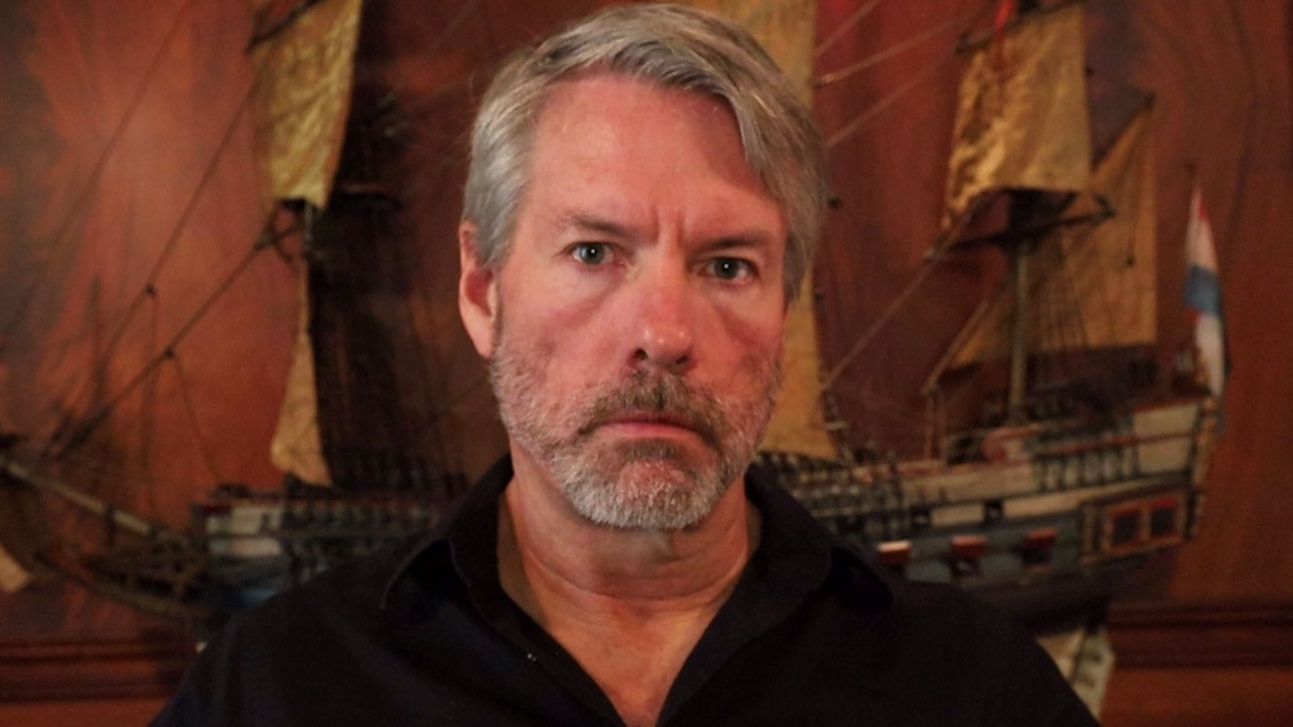

As soon as once more, Govt Chairman, Michael Saylor teased the Monday announcement with a Sunday put up.

That is now a multi week pattern that MicroStrategy has introduced a bitcoin buy on a Monday earlier than the U.S. market opens. Within the earlier 5 weeks MicroStrategy has bought 171,430 BTC for $15.61 billion, in accordance with an X put up, by @LuckyXBT__. This present ATM providing continues to be a part of MicroStrategy’s well-known “21/21 plan”. Whereas, the corporate nonetheless has $18 billion left of convertible notice choices, of which solely $3 billion has been used to this point, in accordance with LuckyXBT.

This announcement follows Friday’s information of MicroStrategy getting into the Nasdaq 100, with the index’s re-shuffling going into impact on Dec. 23.

As well as, the Monetary Accounting Requirements Board (FASB) has formally adopted honest worth accounting for bitcoin and different digital property for fiscal years after Dec. 15 2024, which handed in 2023.

Because of this digital property will be capable of account for utilizing honest worth measurement, which permits corporations to acknowledge each honest worth features and impairments on their bitcoin holdings in internet earnings. Below the earlier guidelines, corporations may solely document impairments if that asset’s worth dropped beneath its buy worth, however they might not document any features seen if the asset elevated above the acquisition worth.

Following the information of each the Nasdaq 100 inclusion and up to date bitcoin buy, MicroStrategy’s share worth is up 4% in pre-market buying and selling at $425 a share. Whereas, bitcoin is buying and selling over $104,000, after not too long ago setting an all-time excessive over $106,000.

Semler Scientific (SMLR) additionally acquired extra bitcoin, 211 BTC for $421.5 million at $101,890 per bitcoin. As of Dec. 12, Semler Scientific holds 2,084 BTC. As well as, Semler Scientific filed a second prospectus complement to its S-3 Shelf, growing its ATM providing by an additional $50 million, taking the whole providing to $150 million.