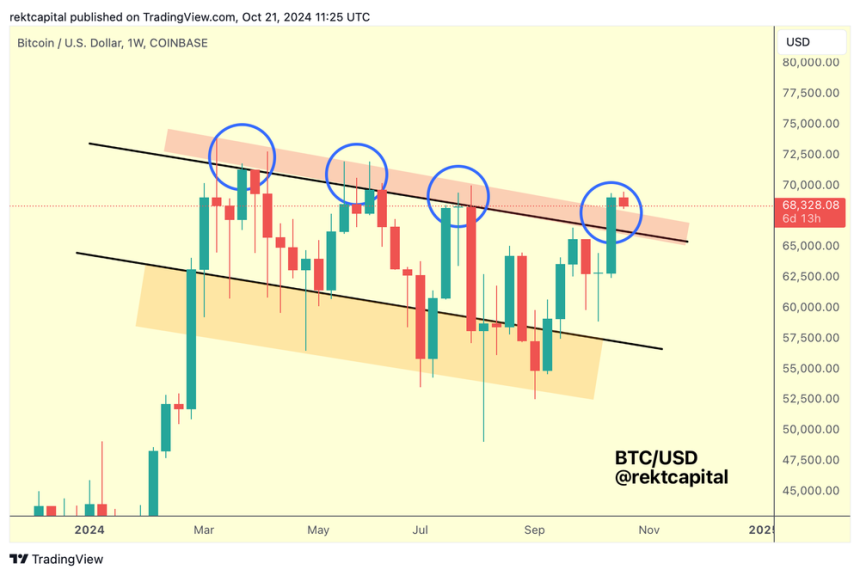

Since July 29, the Bitcoin value has been struggling to regain the $70,000 mark, which has confirmed to be a formidable resistance barrier for the main cryptocurrency. This resistance has been in place for the final two quarters of the yr, after BTC hit an all-time excessive of $73,700 again in March this yr.

Since then, the market has skilled value corrections and durations of consolidation, however latest bullish sentiment has sparked hope for a value resurgence because the yr progresses.

May $70,000 Be Inside Attain?

Market analyst Rekt Capital has offered insights into Bitcoin’s present trajectory, emphasizing the latest uptrend and the potential for the cryptocurrency to regain the $70,000 mark.

Notably, Rekt identified that Bitcoin has damaged by means of a downtrending channel after surpassing the $65,000 stage earlier this month, successfully invalidating a sequence of decrease highs that had been established since mid-March.

Associated Studying

This breakout signifies the tip of the earlier downtrend. Rekt famous that Bitcoin had repeatedly failed to interrupt above the channel’s resistance, however the newest weekly shut has shifted market sentiment.

In his evaluation, Rekt explains that Bitcoin is at present retesting its former resistance level above $69,000, suggesting {that a} profitable retest might verify the breakout and pave the best way for additional upside momentum.

Rekt additional explains that the present retest of decrease help flooring might see Bitcoin’s value dip to round $66,300, which is the channel high. This stage has beforehand served as a major barrier, stopping the value from reaching larger ranges.

Rekt identified that final week’s efficiency demonstrated the significance of this space, as Bitcoin closed above the decrease excessive, setting the stage for a potential transition to larger ranges if the aforementioned help holds.

Key Resistance Problem Forward For Bitcoin

If Bitcoin efficiently retests this help stage, the analyst expects that the following goal can be the vary excessive at roughly $71,500. This stage marks an important problem for Bitcoin, as it could signify the primary try and breach the highest of the re-accumulation vary since June.

Rekt goes on to argue {that a} profitable transfer in direction of the realm excessive above these ranges would exhibit that the earlier resistance is weakening, additional boosting BTC’s prospects of reaching larger ranges.

Nevertheless, the query stays: how deep will any potential retracement be if Bitcoin faces rejection on the vary excessive? Traditionally, since mid-March 2024, Bitcoin has encountered deeper rejections, with declines of 21% to 25% on August 5 and September 6 respectively.

Associated Studying

Rekt concludes that BTC is shifting deeper into a previous resistance space at $66,000, which can quickly remodel into help. A profitable retest of this stage might precede a major reversal again to the $70,000 mark, reinforcing the bullish outlook for Bitcoin because it navigates by means of these vital value ranges.

On the time of writing, BTC is buying and selling at $67,350, registering a retracement of two% within the 24-hour timeframe.

Featured picture from DALL-E, chart from TradingView.com