Small companies are experiencing a cool-down interval because of the early summer season warmth. Heatwaves have dampened the tempo of enterprise restoration, with each companies and staff feeling the impression.

Noteworthy tendencies this month:

- Small enterprise homeowners noticed the lowest variety of staff working in June over the previous three years. This knowledge is predicated on the distinct variety of hourly employees with no less than one clock-in.

- Southern and Western states had been hit the toughest, however Northern and Midwest states additionally skilled a slowdown due to the irregular temperatures.

- All industries are feeling the labor impression, with fewer staff working in comparison with earlier years. The leisure & hospitality industries proceed to outpace different industries when it comes to progress, even with temperatures rising.

Worker exercise

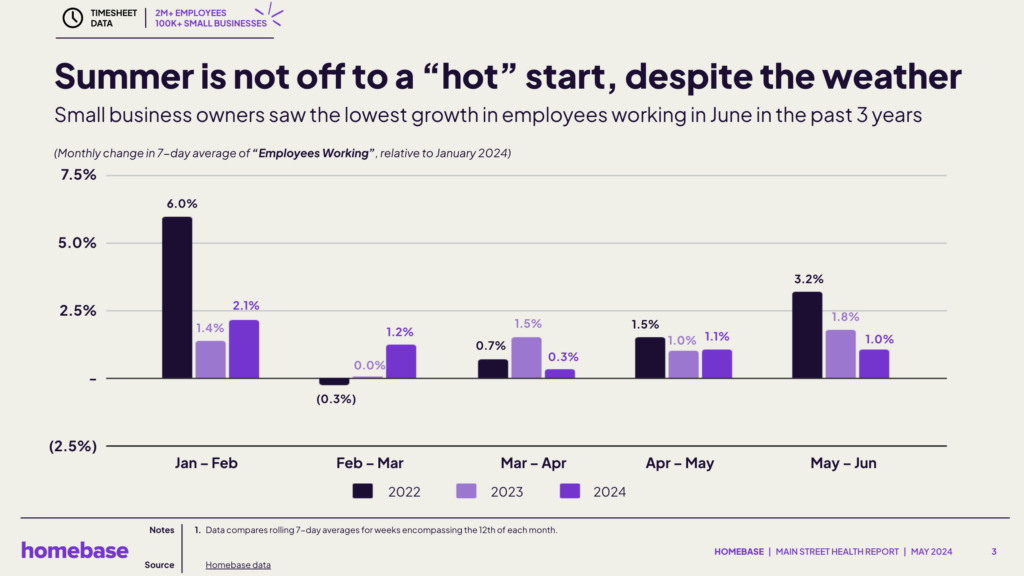

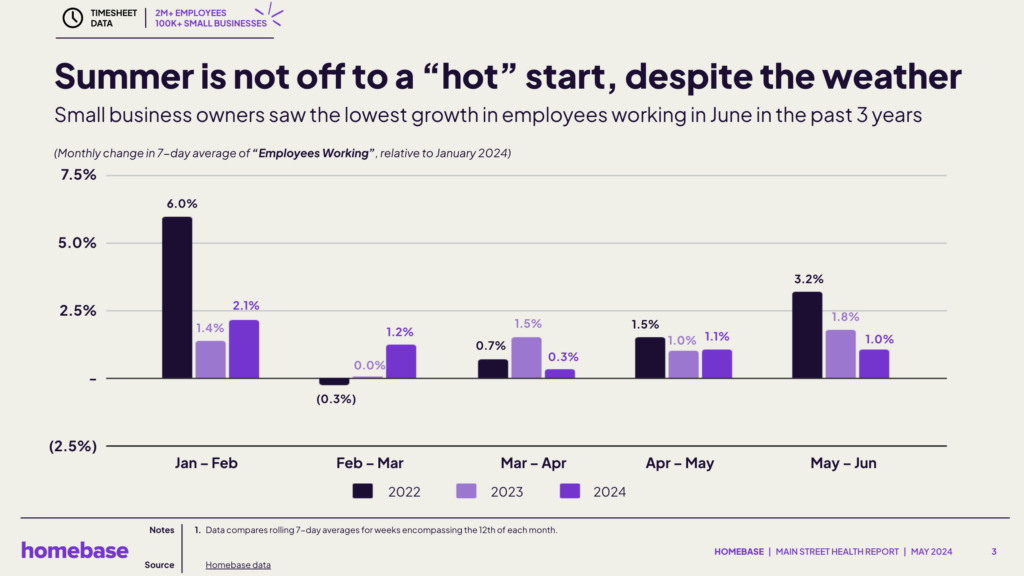

Small enterprise homeowners noticed the bottom progress in variety of staff working in June previously three years.

In 2024, progress has slowed by mid-year, reflecting the broader impression of heatwaves on small companies. Could-June of this yr noticed progress of 1.0%, a noteable drop in comparison with earlier years (1.8% in 2023 and three.2% in 2022).

Key statistics:

- January – February: 2.1% progress, down vs. 2022 however the highest of 2024.

- February – March: A yr over yr enchancment of 1.2%.

- March – April: A drop in progress to 0.3%.

- April – Could: Noticed a 1.1% improve, indicating some restoration and regular YOY.

- Could – June: Development of 1.0%, regular vs. Apr-Could however down from 1.8% in 2023 and three.2% in 2022.

Hours labored

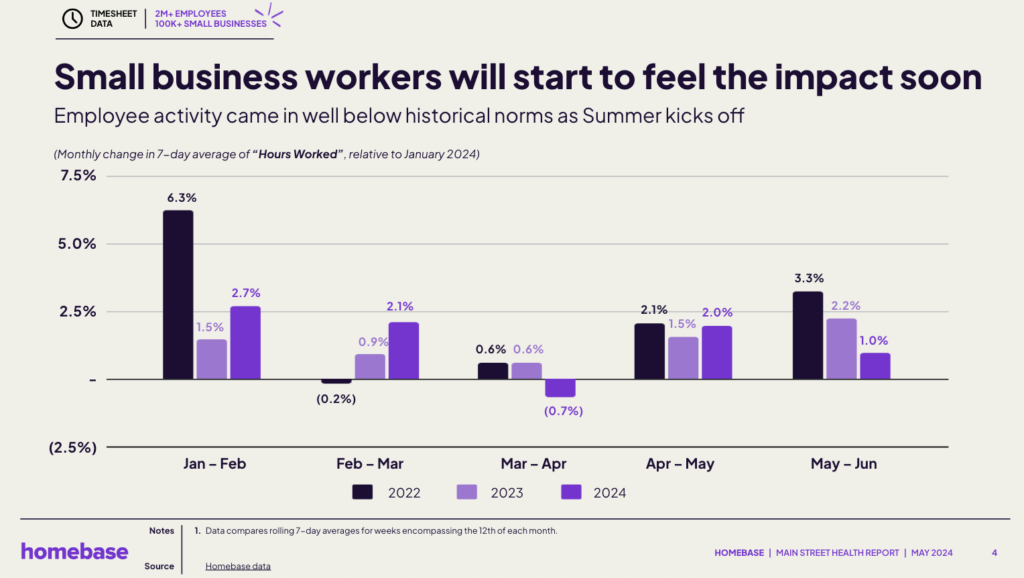

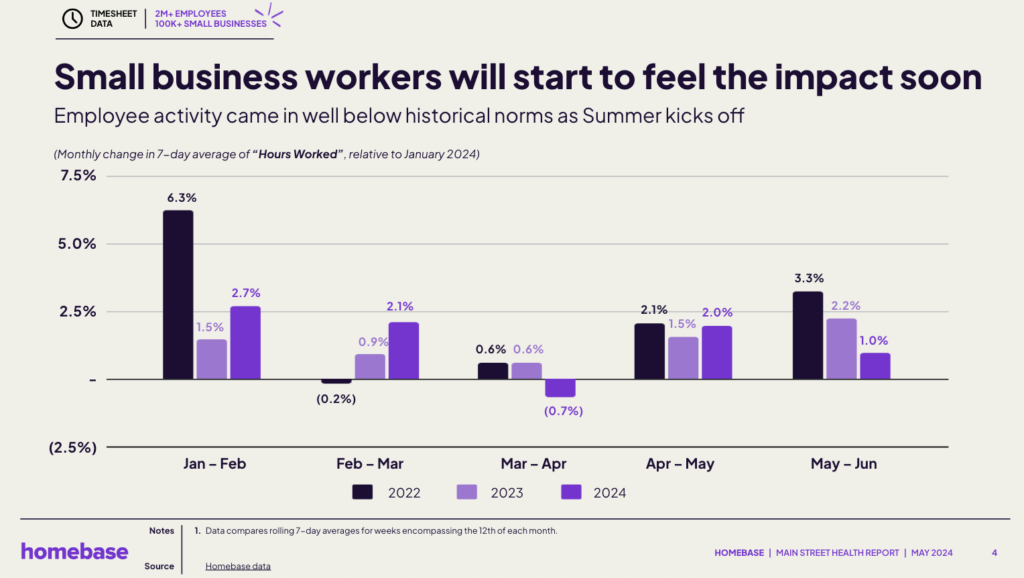

Worker exercise got here in effectively under historic norms as summer season kicks off. The month-to-month change within the 7-day common of “Hours Labored,” relative to January 2024, highlights this development. Hours labored is calculated from hours recorded in Homebase timecards.

Regardless of a powerful begin, 2024 noticed fluctuations in hours labored with a big drop in early spring (-0.7%) and one other slowdown by the beginning of summer season (1.0%).

Key statistics:

- January – February: Small enterprise worker exercise noticed a 2.7% rise, indicating a constructive begin to the yr vs. 2021.

- February – March: Exercise held comparatively regular with a 2.1% improve, out-performing earlier years.

- March – April: A drop to -0.7% suggests challenges throughout this era, though earlier years confirmed slowed progress.

- April – Could: A wholesome rebound to 2.0% displays some restoration.

- Could – June: One other drop to 1.0%, displaying minimal progress versus earlier years and the second lowest interval of 2024.

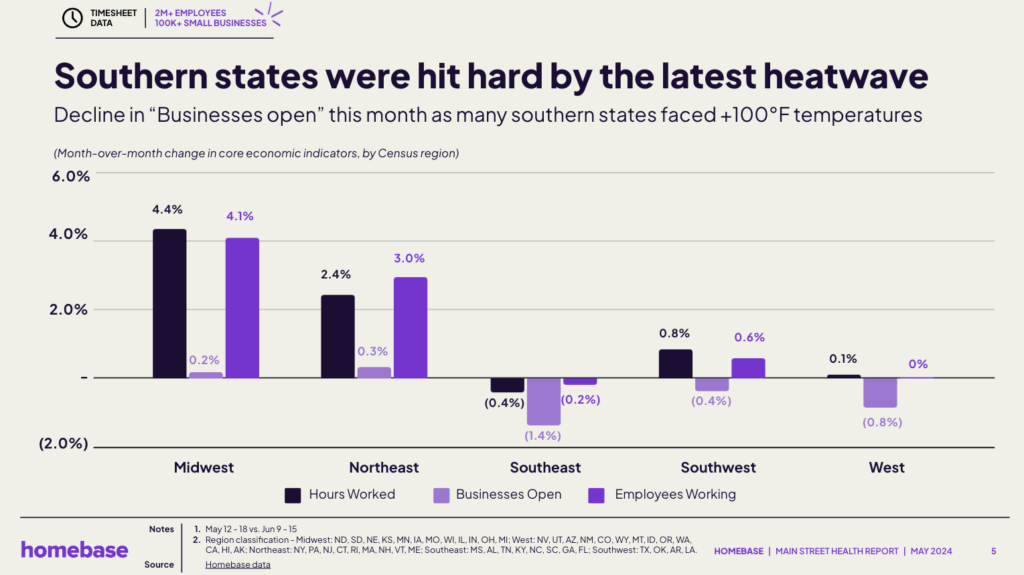

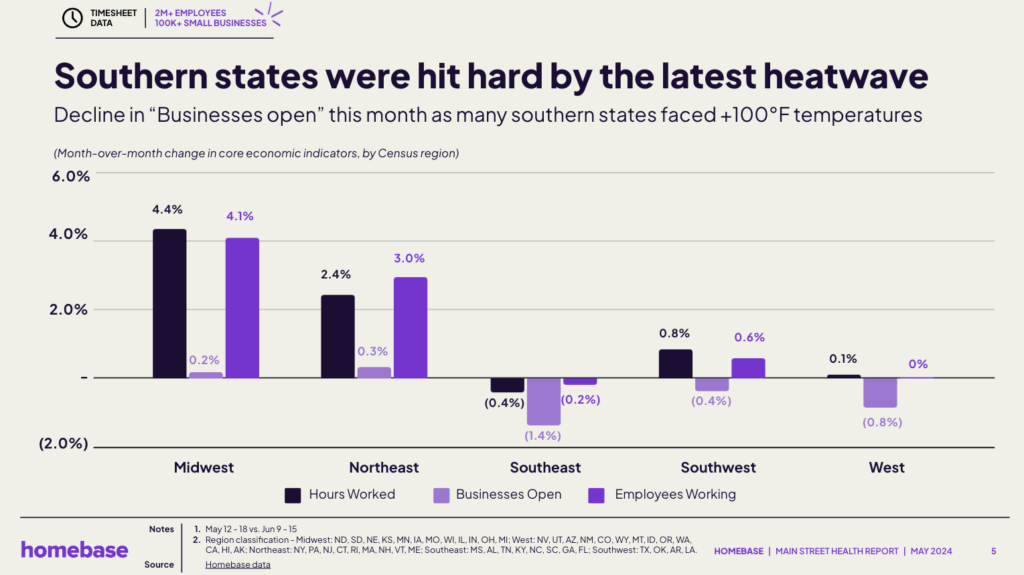

Regional impression

Southern States had been hit arduous by the newest heatwave. “Companies open” is down this month as many Southern States confronted +100°F temperatures, with different core financial indicators trending downwards (hours labored, staff working) within the Southeast.

Whereas the Midwest and Northeast confirmed some constructive core financial indicator tendencies, the Southeast, Southwest, and West areas confronted some notable declines throughout companies open and worker exercise, highlighting regional disparities attributable to climate circumstances.

Key statistics:

- Midwest: A notable 4% improve in hours labored and staff working, with sluggish progress in companies open.

- Northeast: Slight upwards development in companies open and a 3% rise in staff working.

- Southeast: Skilled important declines, displaying a -1.0% drop in companies open and -0.2% in staff working.

- Southwest: Slight improve in hours labored and staff working, with a slight decline of -0.4% in companies open.

- West: Destructive development of -0.8% in companies open and flat progress in staff working.

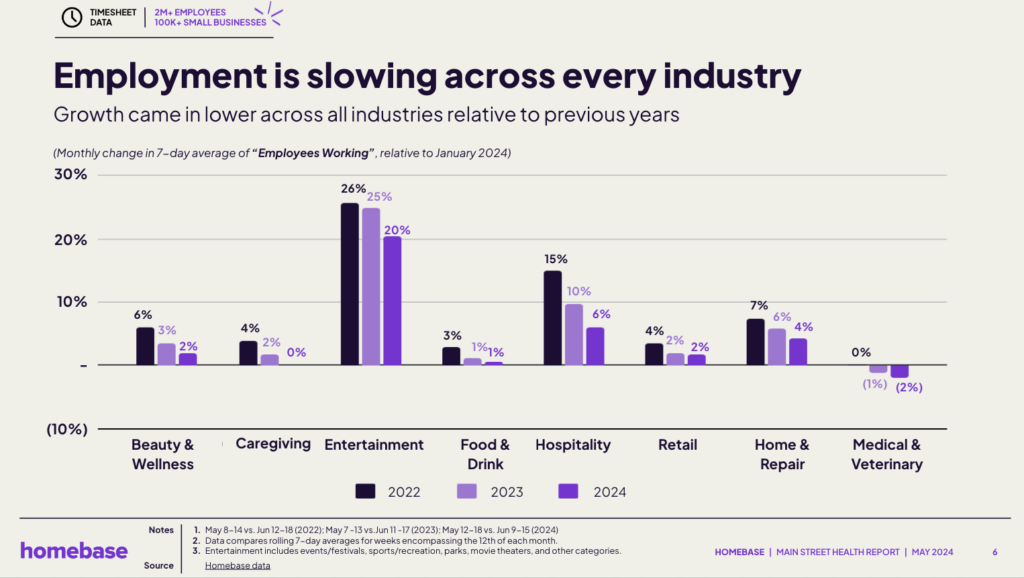

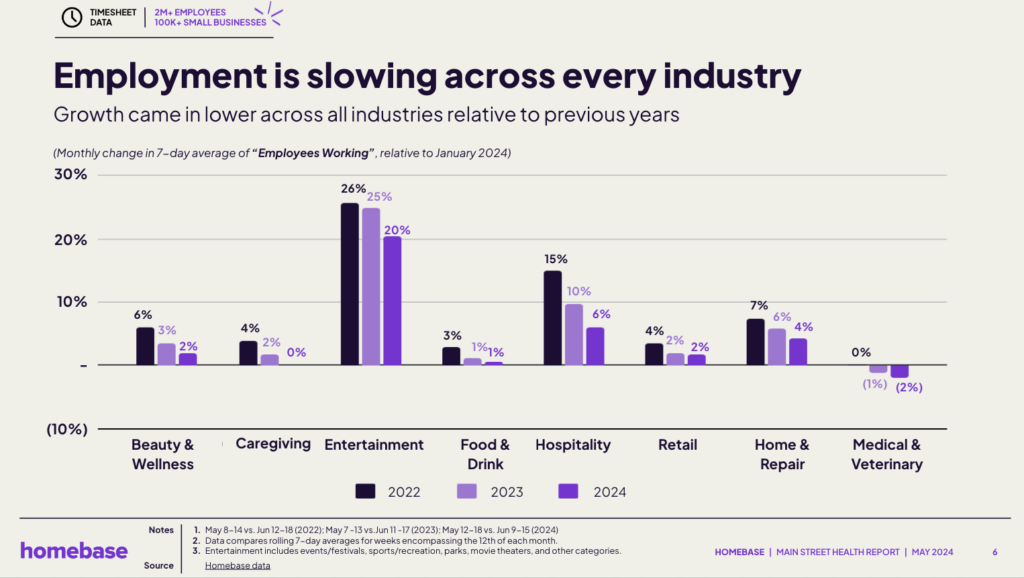

Business-specific insights

Each {industry} is feeling the labor impression currently, with progress coming in decrease throughout all industries relative to earlier years.

Whereas some industries like Leisure and Hospitality noticed progress in 2024, many sectors skilled both minimal progress or declines, highlighting ongoing challenges in numerous elements of the small enterprise panorama.

Key statistics:

- Magnificence & Wellness: 2024 noticed a 2% improve, in comparison with 3% in 2023 and 6% in 2022.

- Caregiving: Got here in flat at 0.1%, nonetheless down YOY.

- Leisure: Elevated by 20% in 2024, however nonetheless down from 26% in 2022.

- Meals & Drink: Matching 2023’s progress of 1%.

- Hospitality: Grew by 6% in 2024, a big drop from 15% in 2022.

- Retail: Just like final yr, grew by 2%.

- Dwelling & Restore: Grew by 3%, down versus earlier years.

- Medical & Veterinary: Declined by -2%, escalating the decline seen in 2023.

This June report reveals that the acute climate has impacted small enterprise operations, with notable declines in worker exercise and hours labored. Regional and industry-specific knowledge reveal the widespread results, underscoring the necessity for methods to mitigate weather-related disruptions and help enterprise restoration.

View a PDF under of our full June 2024 Major Avenue Well being Report. When you select to make use of this knowledge for analysis or reporting functions, please cite Homebase.

June 2024 Homebase Major Avenue Well being Report

Our knowledge is publicly out there in order that coverage makers and teachers can higher perceive small companies. When you’re excited about extra granular knowledge, or have questions concerning the dataset, e mail us at knowledge@joinhomebase.com