Chainlink (LINK) is at an important stage after a pointy 22% retrace from latest native highs, sparking concern amongst traders and analysts. The latest downturn is compounded by unsettling on-chain knowledge that implies Chainlink’s community exercise might weaken, including to the uncertainty surrounding the asset. This decline in exercise, coupled with broader market volatility, has heightened fears of additional losses.

Associated Studying

If the present bearish sentiment persists, LINK will seemingly take a look at the subsequent vital demand stage across the decrease $9 mark. This stage is vital for figuring out the asset’s short-term future. A break under might sign deeper declines, whereas a profitable protection may present a basis for restoration.

Buyers are carefully watching these developments, as the approaching days might be pivotal for Chainlink’s worth course and general market sentiment.

Chainlink Pushed By Low Community Exercise

Chainlink (LINK) has lately confronted vital promoting stress pushed by extra than simply market hypothesis. A decline in community exercise additionally performs an important position within the ongoing bearish development.

In response to key knowledge from Santiment, the price-Each day Lively Addresses (DAA) divergence at present stands at -56.35%. This destructive divergence suggests a disconnect between Chainlink’s worth and consumer engagement, signaling potential bother.

The DAA metric is important for understanding whether or not community exercise helps worth actions. Typically, when energetic addresses, which measure consumer participation on a blockchain, improve with the value, it signifies robust underlying demand. It will possibly recommend that the cryptocurrency is poised for greater values. However, if community exercise rises whereas the value declines, it typically presents a shopping for alternative, signaling that the market might quickly reverse.

Associated Studying

Nevertheless, the present lower in DAA for Chainlink paints a much less optimistic image. This drop signifies that consumer engagement isn’t supporting latest worth motion, a usually bearish issue. A rise in community exercise is important for LINK to see any significant consolidation and potential restoration.

And not using a corresponding rise in DAA, the cryptocurrency might battle to interrupt free from its present downtrend. Buyers are carefully monitoring this metric, as a continued decline in community exercise might result in additional downward stress on Chainlink’s worth, probably pushing it towards decrease help ranges.

LINK’s $9 Lifeline

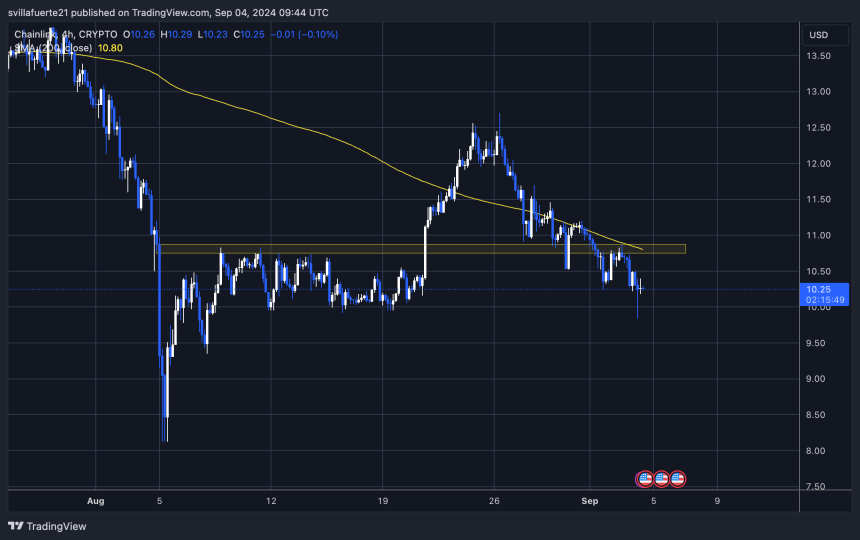

Chainlink (LINK) is at present buying and selling at $10.24, following a dip under the August 16 low of $9.92. LINK shortly recovered after briefly touching $9.84, signaling demand at this stage. Nevertheless, regardless of this bounce, LINK stays under the 4-hour 200 shifting common (MA), a vital technical indicator at present at $10.80.

Analysts see this MA as a key stage, and a profitable transfer above it might point out a shift in momentum, doubtlessly pushing LINK towards the subsequent resistance at round $11.50.

Conversely, if LINK fails to carry its present place and slips additional, a deeper correction might drag the value to sub-$9 ranges. This could sign continued bearish stress, with merchants and traders carefully monitoring the value. LINK’s skill to reclaim the 200 MA or break under its latest lows might be essential in figuring out its subsequent vital transfer.

Associated Studying

Featured picture from Dall-E, chart from TradingView