After a staggering rally exceeding 200% within the first two weeks of November, Dogecoin (DOGE) has entered a consolidation section. Crypto analyst Kevin (@Kev_Capital_TA) suggests this could possibly be the calm earlier than the storm, hinting at a possible surge much like a earlier market cycle.

Is Dogecoin Heading In direction of $4?

Kevin notes that in Dogecoin’s final cycle, the memecoin consolidated for twenty-four days after its first huge rally earlier than ascending once more to what he describes because the “macro golden pocket”—a worth vary between $3.80 and $4.00 which aligns with the 1.618 Fibonacci extension degree.He believes that if DOGE follows a related trajectory, worth might skyrocket by the top of the week, probably resulting in a brand new all-time excessive (ATH) by the top of the month.

Associated Studying

“In Dogecoin earlier cycle when it had it’s first main leg up it consolidated for twenty-four days after that transfer earlier than legging up once more to the macro golden pocket. If DOGE have been to comply with an analogous path that will imply that that the subsequent leg will begin by the top of the week and Doge will start its path the macro golden pocket which is at $3.80-$4.00,” Kevin states.

Nonetheless, he tempers expectations by acknowledging that such astronomical efficiency is difficult to foretell: “That may be astronomical efficiency although and it’s exhausting to make that sort of name. Let’s begin with making a brand new ATH by finish of month like I predicted again in September.”

The present worth place of Dogecoin is vital. Analyzing the day by day DOGE/USD chart, Kevin observes that DOGE is “actively testing this main pattern line of help on the day by day RSI.” A breach of this help might “speed up draw back. Bulls desires this to carry if potential.”

Associated Studying

He provides that whereas the RSI pattern line held on the day by day shut, “it must bounce now if we’re going to maintain it.” The affect of Bitcoin’s (BTC) worth motion could possibly be pivotal: “If BTC can leg up, it might save us,” he notes.

Bitcoin itself has been consolidating since reaching a reported ATH of $99,588 on November 22, buying and selling inside a variety of $90,800 to $98,500. Kevin describes a “tug of struggle between worth motion and this downward momentum on the indications,” because the day by day MACD exhibits elevated draw back momentum that the worth isn’t reflecting. He emphasizes that “one in all them goes to win ultimately.”

On the 4-hour BTC/USD chart, Kevin highlights a symmetrical triangle sample nearing its apex, suggesting an imminent breakout. Regardless of latest volatility, “BTC nonetheless has not damaged down and even closed a 4HR candle beneath this pattern line,” indicating robust help ranges.

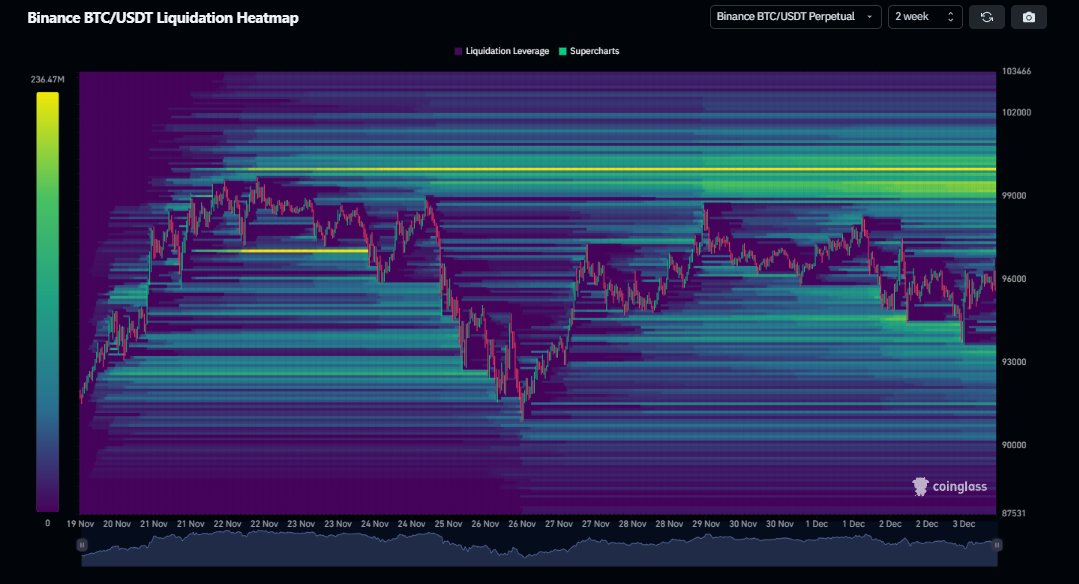

He additionally factors out vital liquidation ranges round $100,000, stating that “it’s solely a matter of time earlier than BTC decides to return up and take that liquidity at $100K.”

Such a transfer by Bitcoin might herald the subsequent main worth surge for Dogecoin, aligning with the patterns noticed within the final cycle. Kevin’s evaluation means that the interaction between Bitcoin and Dogecoin costs stays a vital think about predicting the subsequent market actions.

At press time, DOGE traded at $0.4194.

Featured picture created with DALL.E, chart from TradingView.com