Probably the most oversold shares within the shopper staples sector presents a possibility to purchase into undervalued firms.

The RSI is a momentum indicator, which compares a inventory’s power on days when costs go as much as its power on days when costs go down. When in comparison with a inventory’s value motion, it can provide merchants a greater sense of how a inventory could carry out within the quick time period. An asset is usually thought of oversold when the RSI is under 30, in keeping with Benzinga Professional.

This is the most recent listing of main oversold gamers on this sector, having an RSI close to or under 30.

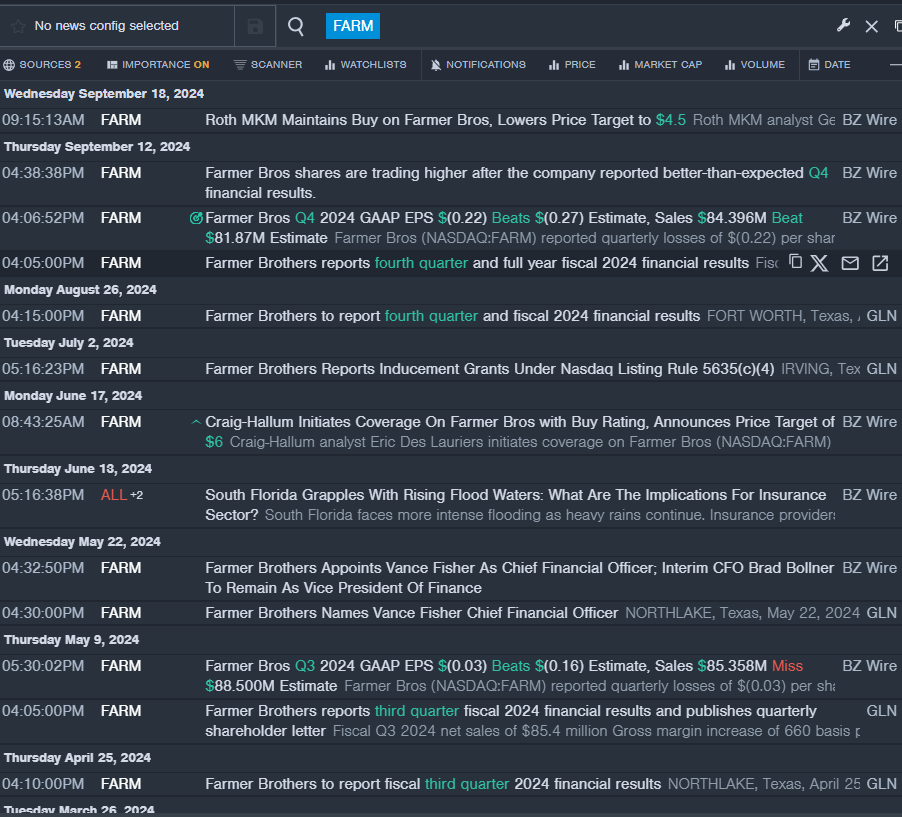

Farmer Bros Co FARM

- On Sept. 12, Farmer Bros reported better-than-expected fourth-quarter monetary outcomes. “This previous 12 months was a transformative one for Farmer Brothers,” stated President and Chief Govt Officer John Moore. “The choice to promote our direct ship enterprise and deal with our extra worthwhile DSD enterprise helped considerably enhance our gross margins and drive adjusted EBITDA profitability and total operational effectivity.” The corporate’s inventory fell round 30% over the previous month and has a 52-week low of $1.85.

- RSI Worth: 27.27

- FARM Worth Motion: Shares of Farmer Bros fell 2.1% to shut at $1.89 on Thursday.

- Benzinga Professional’s real-time newsfeed alerted to newest FARM information.

British American Tobacco PLC BTI

- On July 25, British American Tobacco posted H1 adjusted EPS of 169.3p down from 181.6p within the year-ago interval. The corporate’s inventory fell round 6% over the previous 5 days. It has a 52-week low of $28.25.

- RSI Worth: 24.49

- BTI Worth Motion: Shares of British American Tobacco fell 2.4% to shut at $35.11 on Thursday.

- Benzinga Professional’s charting device helped establish the development in BTI inventory.

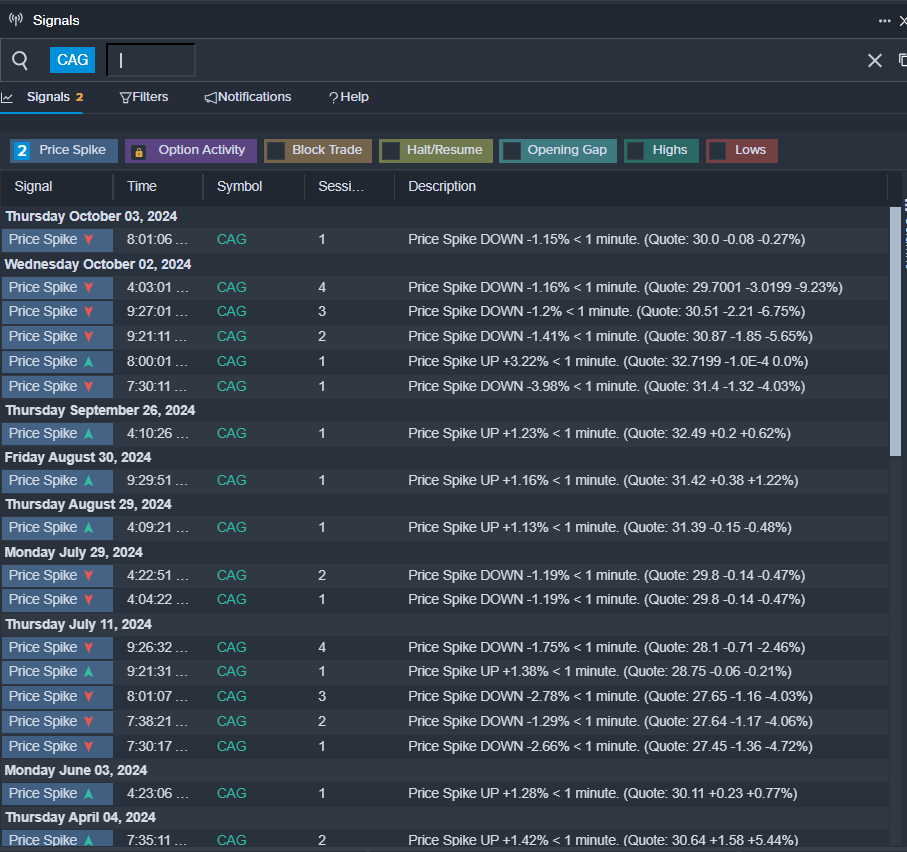

Conagra Manufacturers Inc CAG

- On Oct. 2, ConAgra Manufacturers reported worse-than-expected first-quarter monetary outcomes. Conagra Manufacturers reaffirmed its fiscal 2025 steering, projecting natural internet gross sales to be between a decline of 1.5% and flat in comparison with fiscal 12 months 2024, and expects adjusted earnings per share (EPS) to be between $2.60 and $2.65, in comparison with an estimated $2.61. The corporate’s shares fell round 10% over the previous 5 days and has a 52-week low of $25.16.

- RSI Worth: 25.52

- CAG Worth Motion: Shares of Conagra Manufacturers fell 2.4% to shut at $29.35 on Thursday.

- Benzinga Professional’s indicators characteristic notified of a possible breakout in CAG shares.

Learn Subsequent:

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.