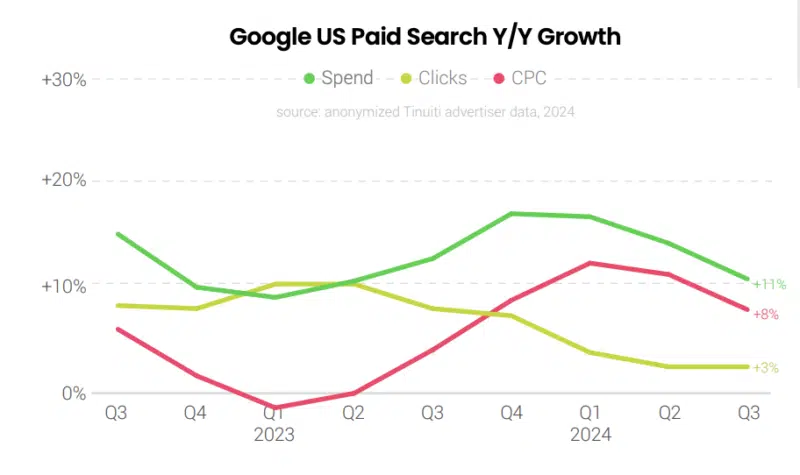

Google search promoting spending rose 11% year-over-year in Q3 2024, displaying resilience regardless of slower pricing progress and the introduction of AI-powered options in accordance with Tinuiti’s newest Digital Adverts Benchmark Report.

Total efficiency.

- Google search advert spending grew 11% YoY in Q3 2024, decelerating from 14% progress in Q2.

- Click on progress remained steady at roughly 3% YoY.

- Price-per-click (CPC) progress moderated to eight% YoY, down from 12% in Q2.

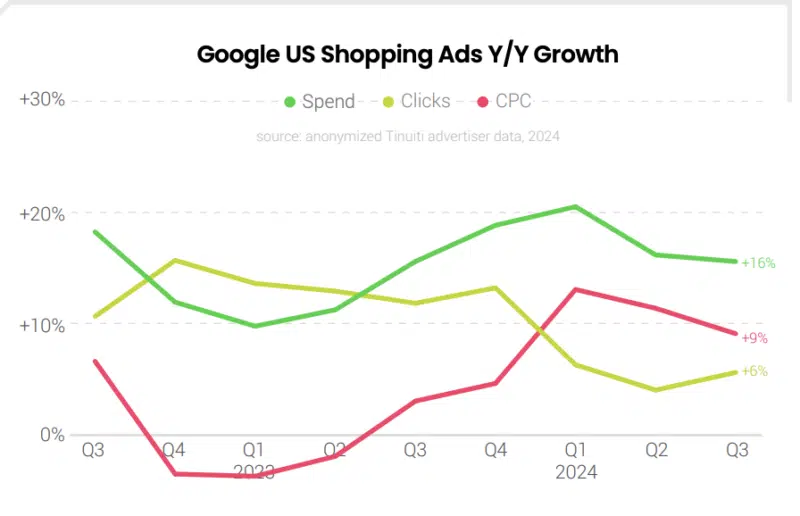

Buying Advert momentum.

- Buying advert spend maintained sturdy 16% YoY progress in Q3, matching Q2 efficiency.

- Click on quantity improved to six% YoY progress, up from 4% in Q2.

- Buying CPC progress decelerated to 9% YoY, persevering with a downward pattern.

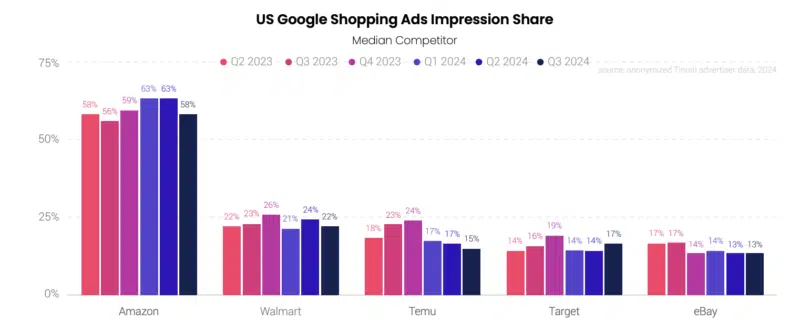

Aggressive panorama.

- Amazon dominates purchasing advert impressions with 58% share in Q3, although down from 63% in Q2.

- Notable mid-September dip to 45% share earlier than fast restoration.

- Walmart holds a distant second place with 22% share.

- Temu’s presence declined considerably in comparison with 2023.

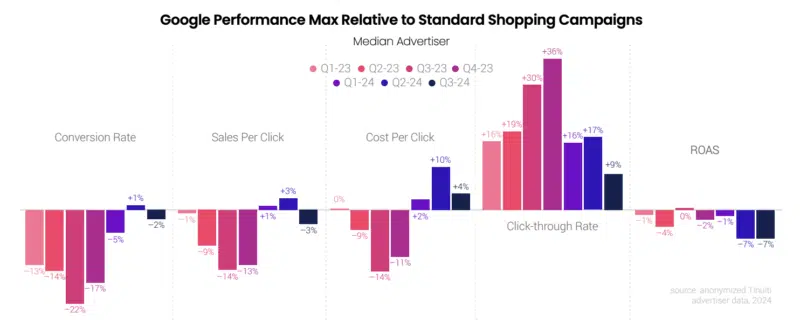

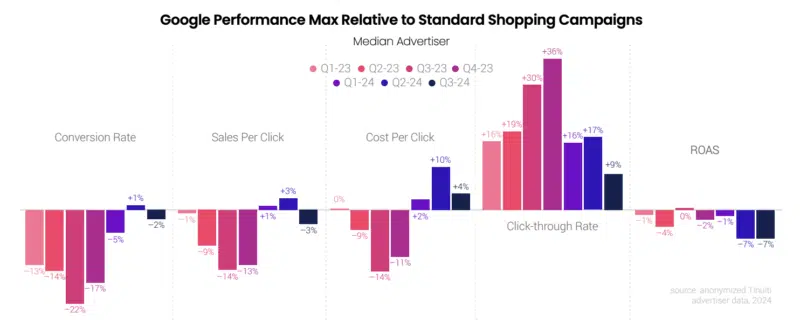

Efficiency Max (PMax) developments.

- 92% adoption price amongst purchasing advertisers in Q3, up 1 level from Q2.

- Non-shopping stock reached 29% of PMax spend in September, up from 21% in June.

- YouTube contributed simply 1% of PMax placement impressions.

- Cell apps maintained regular 10% share of impressions.

Marketing campaign efficiency metrics.

- PMax conversion charges fell 2% under commonplace Buying campaigns in Q3.

- PMax gross sales per click on shifted from +3% to -3% versus commonplace campaigns.

- Return on advert spend (ROAS) remained steady quarter-over-quarter.

- Conventional textual content advert spending grew 7% YoY, down from 13% in Q2.

Impression of Google AI Overviews.

- Cell non-branded key phrases noticed 14% CTR decline from April to July.

- CTR recovered in August and September throughout segments.

- Non-brand cell CTR stays 4% under April ranges however 6% above early 2023.

- Buying advert CTR rose 14% on cell between April and September.

Why we care. The info means that whereas Google’s AI Overviews initially impacted advert efficiency, advertisers are adapting and discovering methods to take care of progress, significantly by way of purchasing adverts and Efficiency Max campaigns.

Key takeaways.

- Buying adverts reveal resilience amid broader market adjustments.

- PMax adoption stays excessive regardless of slight efficiency deterioration.

- Main retailers preserve dominant positions in purchasing advert impressions.

- Google AI Overviews affect seems to be stabilizing.

- Cell continues to be a essential battleground for advert efficiency.

The report. Tinuiti’s Q3 2024 Digital Adverts Benchmark Report.

New on Search Engine Land