As rates of interest fluctuate and inflation impacts on a regular basis prices, understanding methods to take out a mortgage is extra essential than ever.

Whether or not you are searching for funds for schooling, a house, or a brand new enterprise enterprise, figuring out your choices can prevent hundreds in the long term. Sadly, lending establishments can prey on the weak, which is why I’m right here to elucidate the method to you beforehand.

How can I take out a mortgage?

Typically, it’s best to start by checking your credit score rating, as a better rating can enhance your eligibility and the phrases provided. Then, store round and get pre-approved by evaluating choices from varied lenders, corresponding to banks, credit score unions, and on-line platforms. Should you face issues in getting mortgage approval, it is best to work on bettering your credit score rating.

Instruments like mortgage origination software program can simplify the applying course of, making it sooner and extra clear. However with a number of sorts of loans out there, from private and auto loans to mortgages and enterprise loans, it is essential to understand how to decide on the correct one to your particular wants and circumstances.

This information will equip you with the information to make knowledgeable borrowing selections that align together with your monetary objectives.

Which sort of mortgage do you want?

The kind of mortgage you want will immediately affect the paperwork you fill out, your compensation plan, and the repercussions of missed funds.

Kinds of loans

- Private mortgage

- Bank card mortgage

- Residence mortgage

- Small enterprise mortgage

- Auto mortgage

- Scholar mortgage

Let’s go over the sorts of loans from which you’ll select, in addition to methods to apply for or “take out” every.

Find out how to get a private mortgage

Private loans are for people who would really like assist paying off an merchandise or objects of comparatively low worth—low when in comparison with, say, a house. You may get a private mortgage if you happen to want to pay for a pleasant new gadget or, within the case of these dwelling within the US, repay a hospital invoice.

These wanting to use for a private mortgage ought to first assess their credit score to find out in the event that they qualify. If their credit score rating is low, they might wish to take steps to construct it up earlier than they search out a private mortgage.

As soon as your credit score rating, you possibly can test a mortgage calculator to pre-determine what you may qualify for. Pick a lender and see in the event that they’ll pre-qualify you for a mortgage. This helps you identify which lenders are more likely to say sure earlier than you undergo with the whole mortgage utility course of.

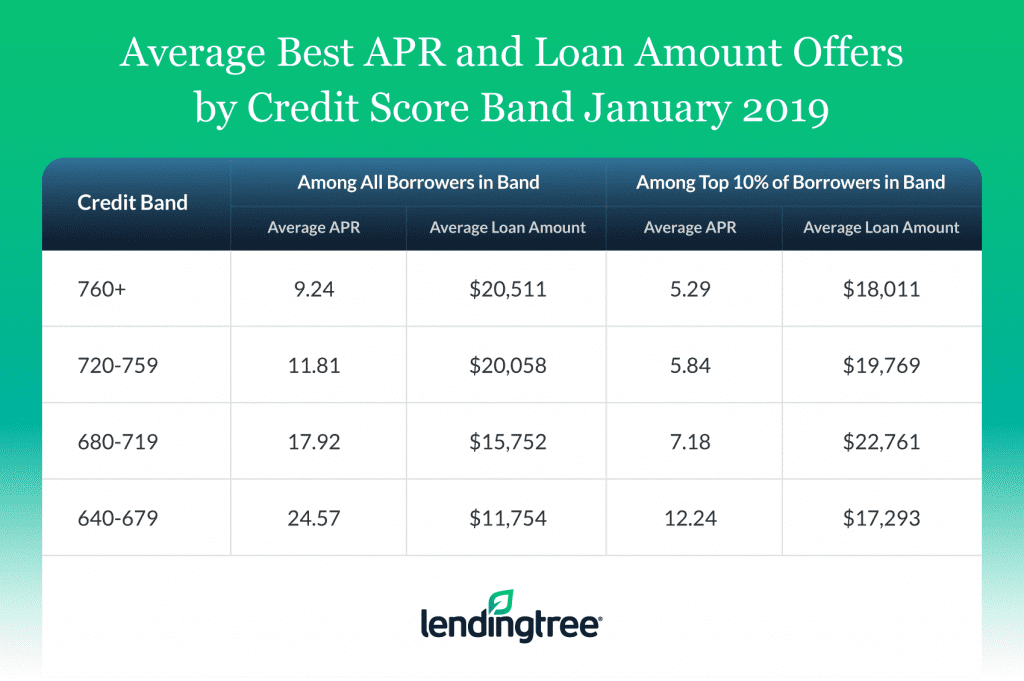

Picture courtesy of LendingTree

When you’ve pre-qualified for a private mortgage with just a few totally different lenders, examine the presents they’ve given you. You’ll want to analysis the mortgage choices at your native credit score unions and banks as properly, as their presents could be much more engaging.

Earlier than selecting a lender/mortgage, be certain that all the small print are to your liking. Inquiries to ask your self are: does this lender require automated withdrawals? How versatile are their fee choices? Are there any penalties for paying off a mortgage early?

When you’ve accredited all of the positive print, it’s time to proceed with the applying course of. You’ll usually have to offer identification, proof of handle, and proof of earnings. The lender will test your credit score rating, and it’s best to have your funds inside every week after that.

Find out how to get a bank card mortgage

Bank card loans, that are simply the act of proudly owning a bank card in your identify, are for anybody who needs to open a line of credit score. Folks typically do that to enhance their credit score scores, reap the rewards a sure bank card presents, or as a riskier technique to pay for costly purchases they don’t have all the cash for at the moment.

You get a bank card mortgage just by making use of for a bank card and getting accredited. You’ll be able to apply at banks, on-line, over the mail, and at shops that supply their very own bank card, to call just a few locations.

With the intention to get accredited for a bank card, you might want to have a great credit score rating. This appears counterintuitive since you could be making use of for a bank card as a way to enhance your credit score rating. Hopefully, you’ve been capable of construct up credit score in different methods, corresponding to by paying payments and loans on time.

Should you’re rejected, you’ve got a few choices. You’ll be able to name the cardboard issuer and ask for them to rethink your utility. If they are saying no, your different possibility is to attend six months and apply once more after you’ve taken steps to extend your credit score rating.

Methods to enhance your credit score rating

- Overview your credit score report for errors: Request your credit score report from the most important credit score bureaus and overview it for inaccuracies. Errors like incorrect balances, late funds that aren’t yours, or outdated data can harm your rating.

- Pay present debt: Your credit score utilization ratio—the share of obtainable credit score you’re utilizing—makes up a good portion of your credit score rating. Attempt to preserve your utilization beneath 30%.

- Keep away from opening new credit score accounts: Every new credit score utility triggers a tough inquiry in your credit score report, which may quickly decrease your rating. Keep away from making use of for brand new traces of credit score within the months main as much as your mortgage utility.

- Turn into a licensed person: If somebody near you has a great credit score historical past, ask them so as to add you as a licensed person on considered one of their bank cards. This will add a constructive fee historical past to your report and enhance your rating.

- Settle delinquent accounts: If you’ve got any accounts in collections or late, settling them will help enhance your credit score rating. Even if you happen to can’t pay the complete quantity, negotiating a settlement or fee plan can cease additional harm to your credit score.

Find out how to get a house mortgage

Residence loans are for people who find themselves able to buy a house. Such a mortgage is usually known as a mortgage. Mortgages are long-term loans of nice worth.

With the intention to apply for a house mortgage, you need to actually have your geese in a row. An excellent place to start out is with a mortgage calculator. This can assist you to take the primary steps to find out the worth vary of properties you possibly can afford.

Amongst different particulars, anybody hoping for a mortgage this massive might want to inform their financial institution of their:

- Credit score rating, credit score report, and credit score accounts

- Obtainable money for a down fee

- Family earnings

- Obtainable funds for closing prices

- Residence worth ranges

Very like different loans, potential householders can get pre-approved by lenders, which provides them the chance to buy round for the very best mortgage supply. The usual mortgage is a 30-year mortgage with a hard and fast charge.

Picture courtesy of RefiGuide

When you’ve been pre-approved, you possibly can select the lender you wish to use and proceed with the applying course of by means of them.

The factor with mortgages is that many establishments merely received’t lend to you if you happen to don’t have a large down fee and cash for the closing prices. It’s almost unimaginable to buy a house utterly by means of borrowed cash.

Should you get denied at first, arrange a financial savings plan and check out once more upon getting sufficient cash to pay for a minimum of 20 p.c of the house out of pocket.

Find out how to get a small enterprise mortgage

Unsurprisingly, small enterprise loans can be found to anybody attempting to start a small enterprise. They’re both awarded by the Small Enterprise Administration (SBA) or a neighborhood financial institution.

Banks and lenders solely wish to grant loans to individuals they know pays them again. For that reason, it’s moderately tough to get a small enterprise mortgage, particularly if you happen to or your enterprise has no historical past of success.

With the intention to get a small enterprise mortgage, you’ll have to make sure you have good credit score. Should you don’t, it’s best to spend time working to enhance your credit score. You also needs to analysis native lenders. As a small enterprise, you could have higher luck searching for approval at a smaller, native financial institution.

Earlier than searching for out a small enterprise mortgage, be sure to have written up a marketing strategy. Lenders will wish to see this to assist resolve if you happen to’re value their funding. Additionally it is clever to make a presentation of your marketing strategy so you possibly can bodily present lenders how well-thought-out your plans are.

When you’re prepared, make an appointment with a mortgage officer to whom you may make your case. You’ll want to embody an government abstract together with your marketing strategy to allow them to skim over your work to grasp higher what you wish to do.

From right here, it’s actually as much as you to make the very best argument for your enterprise and for the mortgage officer to imagine in you.

Associated: Be taught extra about UCC filings and the way they have an effect on your enterprise.

Find out how to get an auto mortgage

Auto loans are for any individual trying to buy a motorized vehicle.

In most situations, you get an auto mortgage accredited by means of your financial institution or financial institution of selection. As with all different loans, step one is to test your credit score rating to be sure to’re as much as snuff.

Following that, it’s best to look to get pre-approved for auto loans from on-line lenders. This can assist you determine what a financial institution can be prepared to present you. After you’ve been pre-approved, decide a month-to-month fee that needs to be lower than ten p.c of what you are taking house every month.

Subsequent, it’s best to go automotive purchasing and examine dealership presents with what the financial institution can provide you.

Find out how to apply for a scholar mortgage

Scholar loans are reserved for anybody searching for schooling from an accredited establishment after highschool.

Usually, college students apply for scholar loans by means of FAFSA.ed.gov. FAFSA loans college students a sum of cash primarily based on their want.

If the federal authorities doesn’t award you sufficient scholar assist to make college inexpensive, you possibly can attempt to undergo a personal lender. Take a look at a few of the finest personal scholar mortgage lenders.

You’ll seemingly want somebody to co-sign on these loans, as anybody coming into into undergrad most likely doesn’t have plenty of credit score constructed up. It’s value saying that scholar loans are an enormous rip-off trade, and there are plenty of faux mortgage websites on the market wanting to steal your private data.

For that reason, it’s finest to undergo the federal authorities or a trusted lending establishment.

An alternative choice for getting a secured mortgage

A secured mortgage is an alternate possibility for acquiring a mortgage, because it usually presents decrease rates of interest in change for offering collateral as compensation assurance.

Probably the most generally used possibility is a mortgage with a automotive as collateral. Should you’re a automotive proprietor, you should use your car’s title as a pledge and get the wanted quantity to cowl your education-related wants. Simply be certain that to decide on a trusted mortgage supplier.

Inquiries to ask earlier than taking out a mortgage

Earlier than making use of for any mortgage, asking the correct questions will help you keep away from monetary pitfalls and make knowledgeable selections. Listed below are 5 important inquiries to ask:

1. What’s the whole price of the mortgage?

The overall price goes past the mortgage quantity. You must issue within the Annual Share Price (APR), which incorporates curiosity and any related charges. For instance, a mortgage with a low curiosity charge however excessive charges could price greater than a mortgage with a better charge and no charges.

You’ll want to ask for a breakdown of all prices and examine the APR moderately than simply the rate of interest, because it gives a clearer image of what you’ll pay over the lifetime of the mortgage.

2. Are there any prepayment penalties?

Some loans include prepayment penalties—charges for paying off your mortgage early. Whereas it’d sound unusual, lenders generally impose these penalties as a result of they miss out on curiosity funds once you repay a mortgage early.

Should you plan to repay your mortgage forward of schedule, affirm whether or not it will set off any further prices. Keep away from loans with prepayment penalties if attainable, as these may improve your whole prices.

3. Can I afford month-to-month funds?

Think about your month-to-month earnings, present bills, and the way a lot room you’ve got in your finances for added funds. Simply since you qualify for a mortgage doesn’t imply you possibly can comfortably afford the funds.

Overview the mortgage’s month-to-month compensation phrases and guarantee you’ve got a finances buffer. Ask your self: “If my monetary scenario adjustments, will I nonetheless be capable to make these funds?”

4. What occurs if I miss a fee?

Lacking a fee can have critical penalties, together with late charges, rate of interest hikes, or harm to your credit score rating. Understanding the penalties beforehand helps you keep away from surprises.

Ask your lender about their grace interval coverage, how they report missed funds, and whether or not they supply any deferment or forbearance choices for sudden monetary difficulties.

5. Are there higher funding choices?

A mortgage could not all the time be the best choice. Think about options like traces of credit score, credit score unions, or purchase now, pay later (BNPL) companies, which can supply higher phrases for particular wants.

Consider all out there choices and ask about flexibility in mortgage phrases, like compensation plans or refinancing alternatives. Don’t accept the primary mortgage you’re provided.

Thanks for lending me your ear

Debt is horrifying, however the fact is, it’s a necessity within the society we’ve invented. You want to have the ability to go locations, however few individuals have all of the money for a automotive sitting of their financial savings account.

Be sensible about any kind of mortgage. Speak to associates or household about their experiences borrowing cash and see if they’ve any options. Don’t take out loans until you need to, however keep knowledgeable if you happen to do.

Take a look at another methods to safe enterprise funding to your dream mission.

This text was initially revealed in 2019. It has been up to date with new data.