Bitcoin (BTC) market tendencies point out expectations for costs to achieve report highs following President-elect Donald Trump’s inauguration on Jan. 20.

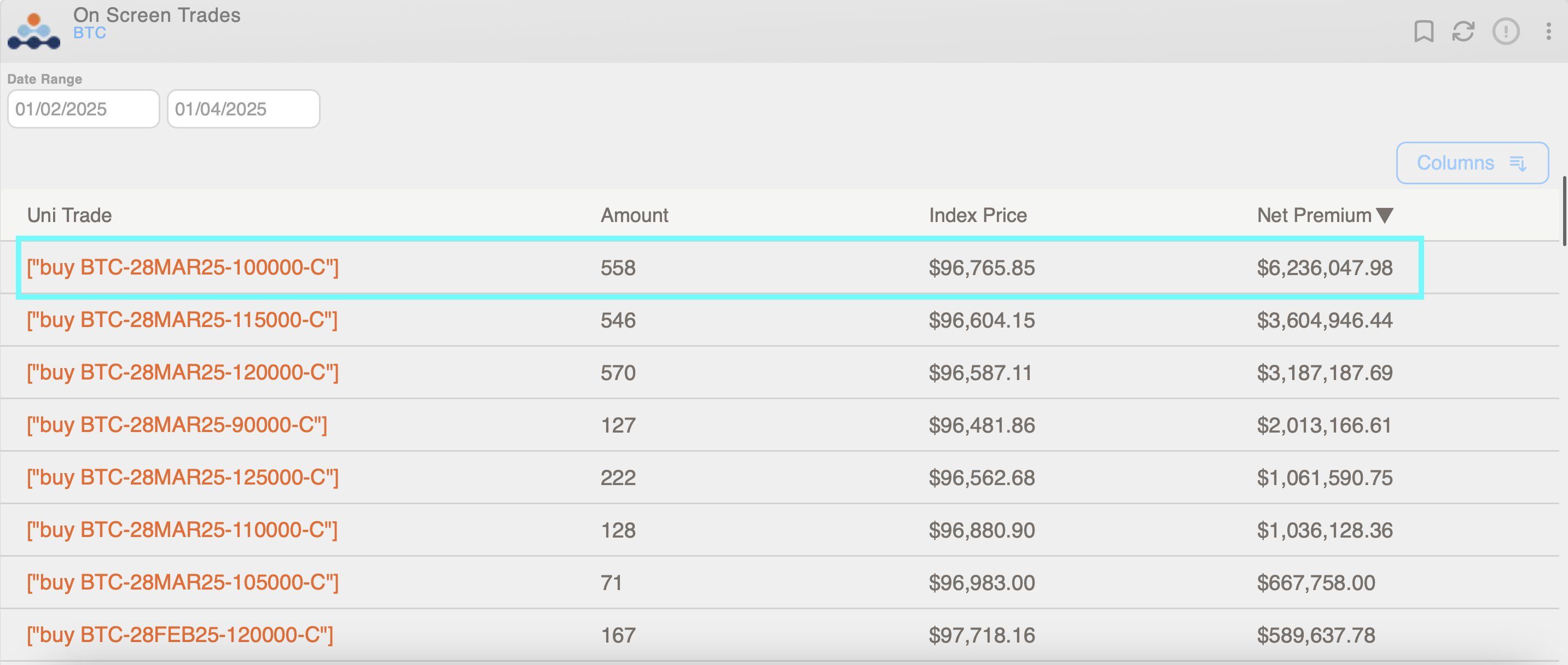

On Saturday, a dealer on crypto alternate Deribit spent over $6 million to buy the $100,000 strike name choices set to run out on March 28, in keeping with information supply Amberdata.

“This commerce anticipates that new highs for bitcoin might be damaged only a few months after Trump formally takes workplace,” Amberdata stated on X.

Merchants are additionally web consumers on the $120,000 strike, indicating robust anticipation of a rally pushing costs above that degree. The $120,000 name is the hottest choice on Deribit, boasting a notional open curiosity of $1.52 billion at press time.

A name choice offers the client the appropriate to purchase the underlying asset at a particular worth later in time. A name purchaser is implicitly bullish available on the market, seeking to make uneven positive factors from an anticipated worth rally.

The renewed curiosity within the name choices comes as BTC appears to regain the $100,000 deal with. At press time, the main cryptocurrency by market worth traded above $99,500, marking an 8% restoration from the Dec. 30 low of $91,384, in keeping with information supply CoinDesk and TradingView.

“The inauguration and proper after might be a prime-time for bullish bulletins and insurance policies that might be bullish catalysts for bitcoin to maneuver increased,” Greg Magadini, director of derivatives at Amberdata, stated in a weekly e-newsletter.

Regulated cryptocurrency index supplier CF Benchmarks voiced an identical opinion whereas warning that potential delays in coverage improvement, if any, may mood the bullish temper.

“A restructured SEC beneath procryptocurrency management could cut back enforcement dangers and foster innovation. These adjustments, coupled with streamlined compliance necessities, may improve investor confidence,” CF Benchmarks stated in an annual report shared with CoinDesk.

“We imagine that an trade framework will come, nonetheless, implementation delays or coverage shifts could mood market optimism, creating short-term volatility,” the agency added.

Expectations for pro-crypto regulatory adjustments have bolstered the crypto market sentiment since Donald Trump received the U.S. election in early November. BTC rose from roughly $70,000 to new lifetime highs above $108,000 weeks after the election. Nevertheless, the rally has misplaced steam within the second half of December, doubtless resulting from year-end profit-taking and hawkish Fed fee projections.