Ethereum (ETH) is gaining prominence as Bitcoin maintains its current highs. Although ETH is presently 36% beneath its all-time excessive of $4,878 from 2021, analysts anticipate that the second-largest cryptocurrency by market capitalization could also be making ready for a big shift.

Associated Studying

Ethereum’s ecosystem is a hive of exercise, with a surge in institutional investments, rising ETF curiosity, and growing transaction volumes.

From the 1.1 million recorded three months in the past, the day by day transaction volumes on Ethereum have climbed to 1.22 million, a notable rise based on essentially the most present statistics from IntoTheBlock.

Bitcoin has been the star of this rally, however what about Ethereum?

Traditionally, Ethereum has been one of many first belongings to profit from revenue rotations after Bitcoin’s transfer.

At the moment, Ethereum’s on-chain exercise reveals evenly spaced potential resistance ranges, however in… pic.twitter.com/amkbZmtEyo

— IntoTheBlock (@intotheblock) November 21, 2024

Although the rise isn’t substantial, it signifies that community utilization is constant. This constant exercise serves as the muse for Ethereum’s long-term worth and underscores its ongoing significance within the crypto sector.

Institutional Buyers Place Bets

Up to now week, institutional consumers purchased greater than $1.4 billion price of Ethereum (ETH), which induced a stir within the crypto group. Throughout the identical time-frame, $147 million has been put into Spot Ethereum ETFs. This reveals that individuals are turning into extra optimistic about the way forward for ETH.

#Ethereum whales have purchased over 430,000 $ETH within the final two weeks, price over $1.40 billion! pic.twitter.com/n7iTTADuax

— Ali (@ali_charts) November 14, 2024

The exercise surge continues; buying and selling volumes for Ethereum ETFs reached a file $1.63 billion final week, representing a 44% weekly improve.

In response to analysts, this improve is in step with the patterns noticed in Bitcoin ETFs, which skilled an preliminary interval of stagnation, adopted by a interval of sustained development.

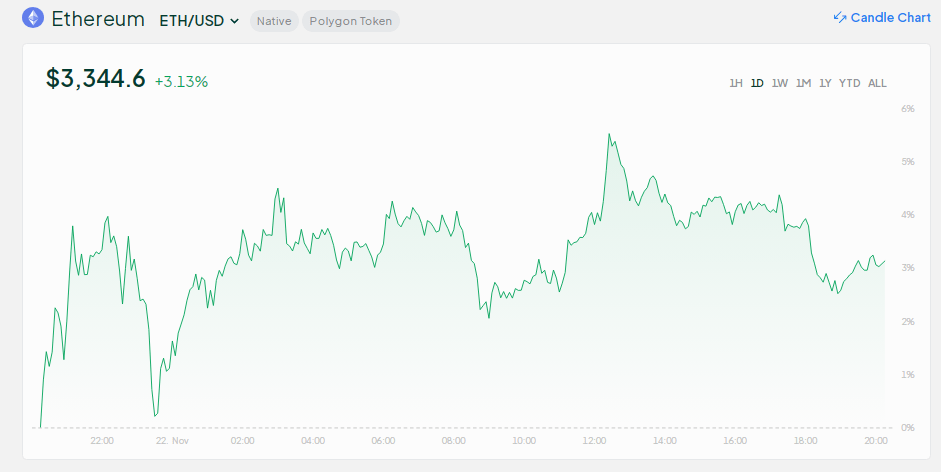

In response, Ethereum’s worth went by means of the roof, rising by 25%, which was the most important weekly acquire in six months. Many individuals see these modifications as indicators that Ethereum is gaining pace, which might probably result in extra advantages.

Shifting Panorama: Layer 2 Options

Whereas there are positives, development in Ethereum’s community sends out a combined sign. New ETH addresses created are decrease than these seen in earlier bull markets.

The rationale for that is seen by specialists as Layer 2 choices similar to Base. As a result of these applied sciences are constructed on prime of Ethereum’s infrastructure, transfers can occur extra shortly and for much less cash. This makes it much less essential to immediately connect with the primary Ethereum chain.

However, Ethereum’s significance has not been eclipsed by Layer 2 development. Tokens proceed to be indispensable within the decentralized finance (DeFi) and NFT ecosystems. In actuality, this enlargement strengthens Ethereum’s elementary perform whereas concurrently growing its scalability and accessibility.

Associated Studying

ETH is turning into much less correlated with BTC.

The 180-day BTC-ETH Pearson correlation is at a three-year low. A ten% rise in #Bitcoin might end in solely a 3% acquire for #Ethereum.

Simply because BTC is powerful doesn’t imply you can purchase ETH. Every asset is now following its personal path. pic.twitter.com/4Dn4QoInXo

— Ki Younger Ju (@ki_young_ju) November 19, 2024

Ethereum Dissociates From Bitcoin

Ethereum’s autonomy from Bitcoin is turning into more and more obvious. The 180-day correlation between the 2 cryptocurrencies has plummeted to a three-year low, falling beneath 0.5. This transformation, based on analysts, signifies that Ethereum is now extra influenced by its distinctive market dynamics than by the worth fluctuations of Bitcoin.

The need of independently assessing Ether’s potential is growing because it continues to pursue its personal course. Ethereum is demonstrating that it’s extra than simply Bitcoin’s counterpart — it’s forging its personal path within the crypto world, whether or not by means of the adoption of Layer 2 options, institutional curiosity, or growing ETF exercise.

Featured picture from DALL-E, chart from TradingView