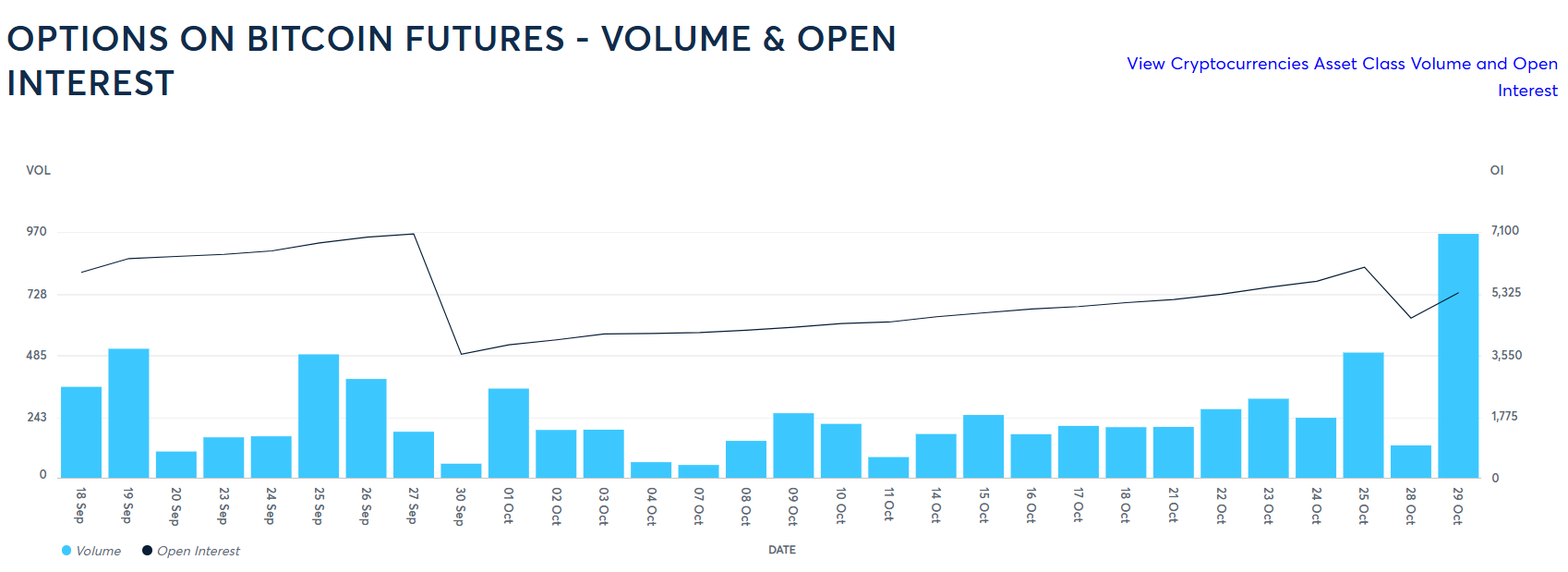

Institutional merchants are betting that Bitcoin will surge to $79,300 by the top of November. This bullish sentiment is clear in latest buying and selling actions on the Chicago Mercantile Trade (CME), the place Bitcoin choices have skilled a few of their highest buying and selling volumes forward of the US presidential election.

Bitcoin To Rise Above $79,300?

Joshua Lim, co-founder of Arbelos Markets—a buying and selling agency offering liquidity throughout cryptocurrency derivatives markets—shared insights on X about these notable trades. “CME Bitcoin choices simply skilled a few of its largest quantity days ever, forward of the US election,” Lim said.

He highlighted two substantial transactions that occurred up to now week. On Friday the twenty fifth, merchants bought 1,875 Bitcoin items of the 29-November $70,000 strike calls. In choices buying and selling, a name possibility offers the client the correct, however not the duty, to buy an asset at a specified strike value earlier than the choice expires. On this case, the strike value is $70,000, which means the patrons are betting that Bitcoin will exceed this value by the top of November. Lim detailed that on the time of the commerce, “$8.3 million of premium was paid, $147,000 of vega, $65 million of delta.”

Associated Studying

Then, on Tuesday the twenty ninth, one other vital commerce occurred with the acquisition of three,050 Bitcoin items of the 29-November $85,000 strike calls, the place the strike value is $85,000. Lim famous that “$4.6 million of premium was paid, $173,000 of vega, $42 million of delta” on the time of the commerce.

The quantities of $8.3 million and $4.6 million point out substantial funding, reflecting robust confidence in Bitcoin’s potential rise. The excessive vega means that the merchants count on vital volatility, which could possibly be large across the US election. Delta represents how a lot the choice’s value is anticipated to vary with a $1 change within the value of the underlying asset. Excessive delta values of $65 million and $42 million suggest substantial publicity to Bitcoin’s value actions.

The overall notional worth of those positions—the whole worth of the underlying property represented by the choices—is roughly $350 million. Lim identified that that is “massive even within the context of Deribit,” referring to the world’s largest crypto choices alternate.

Associated Studying

The breakeven level for these positions is slightly below $79,300. Because of this for the merchants to start out making a revenue, Bitcoin’s value must exceed this stage by the choice’s expiry date. This value represents a few 16% enhance from Bitcoin’s value when these trades have been executed.

“Very bullish positioning into the election, and nice to see establishments sizing up like this on CME,” Lim commented. He added, “Maybe a very good signal that there’s and will likely be rising liquidity within the crypto derivatives markets because the asset class matures.”

The timing of those trades is especially noteworthy. With the US presidential election imminent, market volatility is anticipated to extend, probably impacting the whole Bitcoin and crypto market. Total, the vast majority of specialists imagine {that a} Trump victory is bullish for the BTC value.

At press time, BTC traded at $72,382.

Featured picture created with DALL.E, chart from TradingView.com