Crypto buying and selling agency QCP Capital says the “shallow sell-off” in crypto markets following Iran’s current assault on Israel signifies wholesome market demand for risk-on belongings.

Crypto Market Stays Properly Bid For Danger Belongings

Regardless of Iran launching over 180 missiles towards Israel yesterday, the sell-off in conventional monetary (TradFi) belongings was comparatively muted. The S&P 500 closed 1% decrease, whereas U.S. benchmark West Texas Intermediate (WTI) oil costs rose 2%.

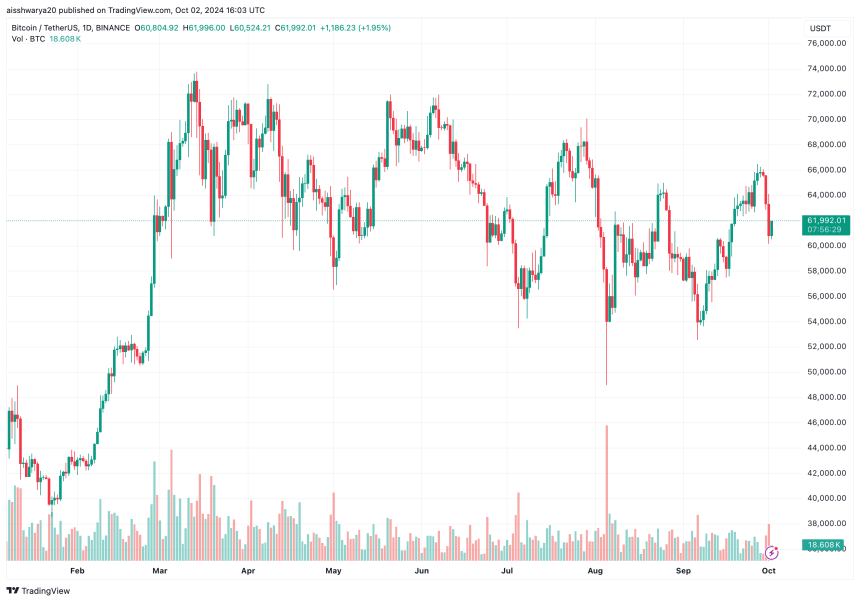

In distinction, the digital belongings market was hit comparatively tougher, with Bitcoin (BTC) sliding greater than 5% following Iran’s assault. The full crypto market cap eroded over 6% in worth whereas liquidations surpassed $550 million prior to now 24 hours, information from CoinGlass signifies.

Associated Studying

Within the report, QCP Capital says that the premier cryptocurrency appears to have discovered sturdy assist on the $60k degree. Nonetheless, the agency cautions that additional escalation within the Center East may drive BTC to drop to $55k.

Concerning the market sell-off witnessed yesterday, the buying and selling agency acknowledged:

Center East geopolitics will steal the limelight for now, however the shallow sell-off means that the market stays effectively bid for threat belongings. This minor setback shouldn’t distract from the larger image.

The report additionally remarked that China’s current financial coverage actions are much like these of Japan within the Nineteen Nineties. Notably, the Financial institution of Japan (BoJ) tackled deflation by lowering rates of interest, introducing unfavourable rates of interest, and beginning the quantitative easing program. The report added:

The flush of liquidity from the PBoC and potential fiscal assist will possible assist asset costs in China, with bullish sentiment probably spilling over globally to assist threat belongings, together with crypto.

Moreover, the report pointed to the US Federal Reserve (Fed) Chair Jerome Powell’s current dovish remarks on the Nationwide Affiliation for Enterprise Economics, signaling additional rate of interest cuts in 2024.

For context, the Fed minimize charges for the primary time in 4 years on September 18. Subsequently, monetary markets worldwide skilled a surge within the worth of risk-on belongings, reminiscent of shares and cryptocurrencies.

The report concluded that “asset costs are anticipated to stay supported heading into 2025”, buoyed by aggressive rate of interest cuts by each the most important (Fed) and third largest (Individuals’s Financial institution of China) central banks on this planet.

What To Count on From Bitcoin In This autumn 2024?

Though the Iran-Israel battle immediately impacted BTC’s worth, crypto analysts stay optimistic a couple of probably sturdy This autumn 2024. One analyst instructed that the current dip might signify BTC’s “quarterly low.”

Associated Studying

One other crypto analyst Eric Crown opined that BTC might attain new all-time-high (ATH) worth in This autumn 2024, basing his evaluation on the cryptocurrency’s historic efficiency within the months following September. Bitcoin trades at $61,992 at press time, down 1.2% over the past 24 hours.

Featured picture from Unsplash, chart from Tradingview.com