Knowledge reveals the cryptocurrency derivatives sector has seen a considerable amount of liquidations previously day as Bitcoin and others have loved a rally.

Each Crypto Lengthy & Brief Liquidations Have Been Excessive Right now

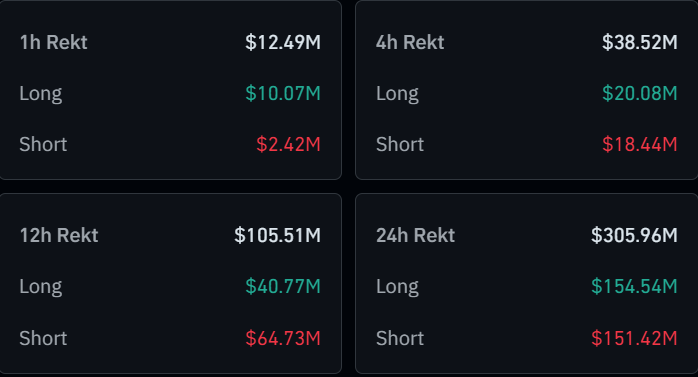

In keeping with information from CoinGlass, a big quantity of liquidations have piled up on the derivatives facet of the cryptocurrency sector following the market volatility.

“Liquidation” right here refers back to the forceful closure that any open contract undergoes after it has amassed losses of a sure diploma (the precise proportion of which can differ between platforms).

Beneath is a desk that reveals the information for the liquidations which have occurred within the cryptocurrency sector over the last 24 hours.

As is seen, liquidations have totaled at virtually $306 million on this window. Out of those, $154 million of the contracts concerned had been lengthy positions, whereas $151 million had been brief ones.

This remarkably even break up suggests no facet of the market was affected greater than the opposite, which is fascinating contemplating the context that Bitcoin and others cash have seen their costs rise in the course of the previous day.

It will seem that the merchants have been keen to put bullish positions with a excessive quantity of leverage hooked up on this restoration rally, which is resulting in any pullbacks on the best way up catching them out and including to the lengthy liquidations counter.

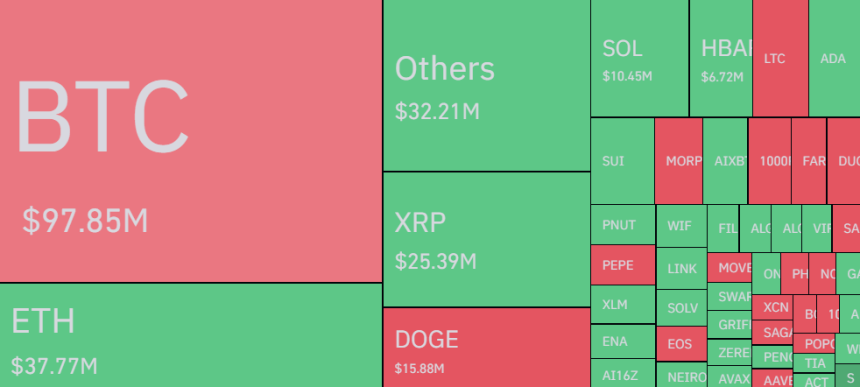

When it comes to the contribution to the derivatives flush by the person symbols, Bitcoin has as soon as once more come out on high with slightly below $98 million in liquidations.

Ethereum (ETH) and XRP (XRP) have rounded out the highest three with $37 million and $25 million in liquidations, respectively. This high three additionally occurs to be the highest three cash within the market cap record.

Quantity 4 in liquidations doesn’t match up in opposition to the market cap rating, nevertheless, because it’s in truth Dogecoin (DOGE) that has adopted XRP with virtually $16 million in contracts. The excessive contribution to the squeeze by the memecoin may very well be all the way down to the truth that its recognition means speculators get pushed to it greater than bigger altcoins like Solana (SOL).

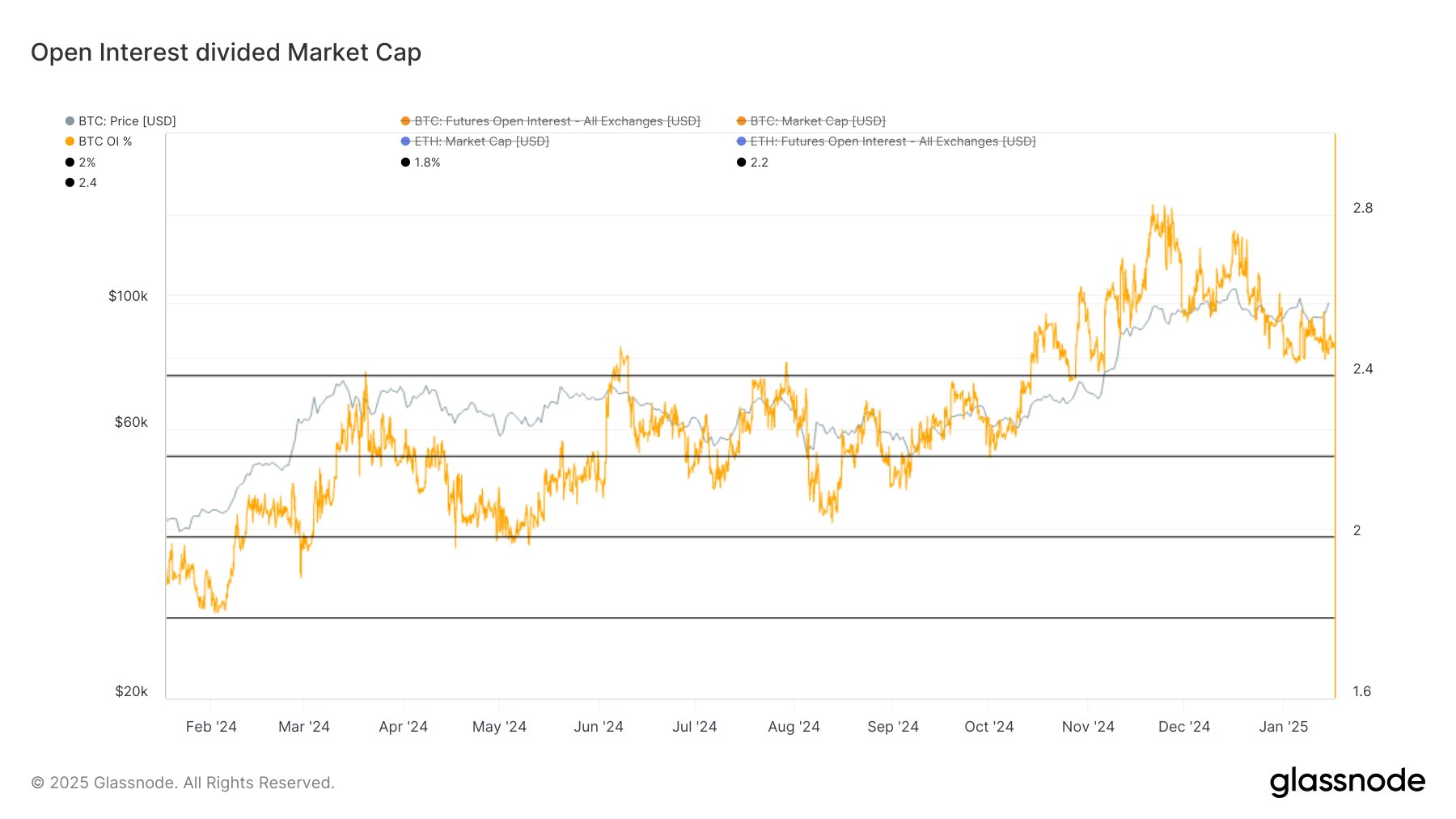

In another information, the Bitcoin Open Curiosity has gone down relative to the market cap just lately, as analyst James Van Straten has identified in an X put up.

The “Open Curiosity” refers to a measure of the overall quantity of Bitcoin-related derivatives positions which might be at the moment open on all centralized exchanges. A excessive quantity of speculative exercise usually results in volatility for the asset, so this metric’s ratio with the market cap ought to ideally keep low.

From the graph, it’s obvious that the ratio shot as much as a excessive of two.8% in November, however its worth as since cooled off to about 2.4%, a more healthy stage.

Bitcoin Value

Bitcoin’s newest restoration push has seen a continuation in the course of the previous day as its value has reached the $104,000 mark.