By James Van Straten (All instances ET except indicated in any other case)

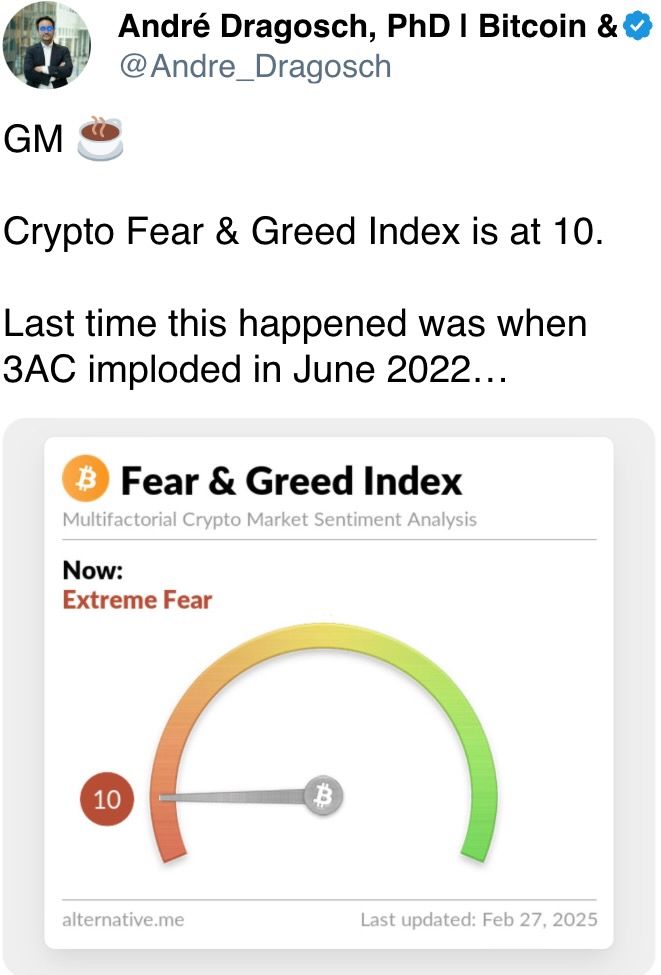

Two contradictory philosophies soar to thoughts when contemplating bitcoin’s (BTC) value motion of late.

Do you “purchase when there’s blood within the streets”? Or maybe “do not catch a falling knife.”?

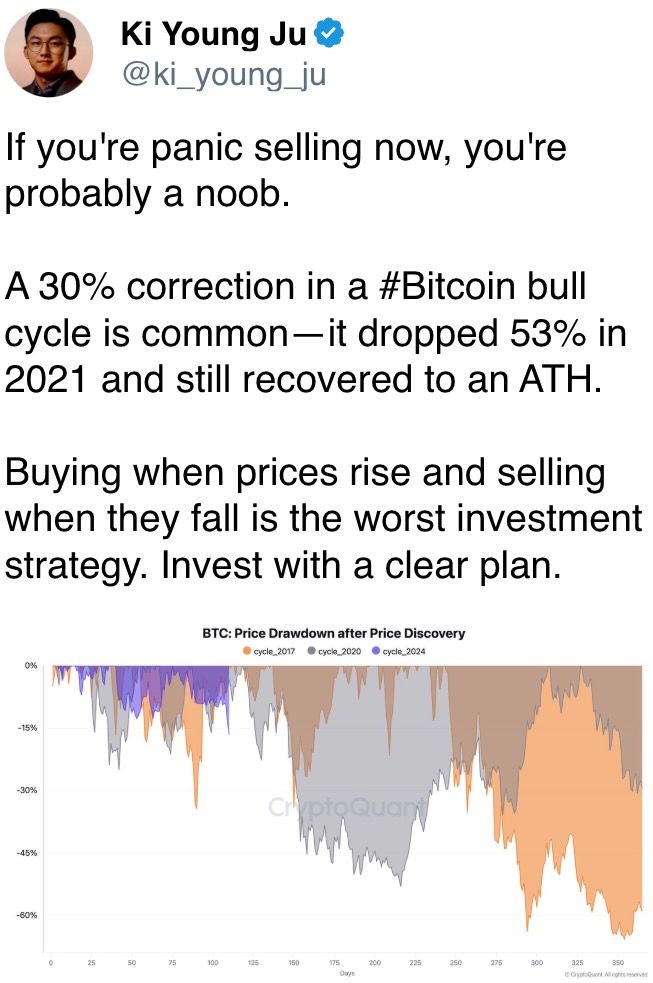

Which applies in immediately’s market, the day after the most important cryptocurrency posted its steepest three-day decline for the reason that collapse of FTX in 2022? The drop left BTC 25% under January’s all-time excessive, regardless of the arrival of President Donald Trump’s pro-crypto administration.

It is no shock the largest hack in crypto historical past has shaken investor sentiment. Add to that the memecoin frenzy, which pulled liquidity out of the broader market.

That mentioned, in earlier cycles so-called bull-market corrections have despatched bitcoin tumbling as a lot as 35%. Provided that BTC hasn’t had a significant pullback for the reason that yen carry commerce unwind final August, the present state of affairs is nearly regular.

CoinDesk analysis confirmed that bitcoin was buying and selling in a particularly tight vary for a significant interval, and a break within the channel was inevitable. On-chain knowledge tells us that bitcoin just lately bounced off its 200-day-moving common or roughly $81,800. Whereas short-term holders are promoting — panic gross sales, maybe? — on the highest degree since August, as a result of they’ve held BTC for 155 days or much less they’re normally seen as a sign of some type of capitulation available in the market.

BlackRock’s IBIT noticed file outflows on Wednesday. Nonetheless, it isn’t all dangerous information. An enormous enlargement deal was made for Core Scientific (CORZ), whereas MARA Holdings (MARA) reported sturdy earnings, with each shares greater than 10% earlier than the open. In the meantime, NVIDIA (NVDA) topped fourth-quarter estimates to calm traders’ nerves. Keep alert!

What to Watch

Crypto:

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet launch (“Mobius”).

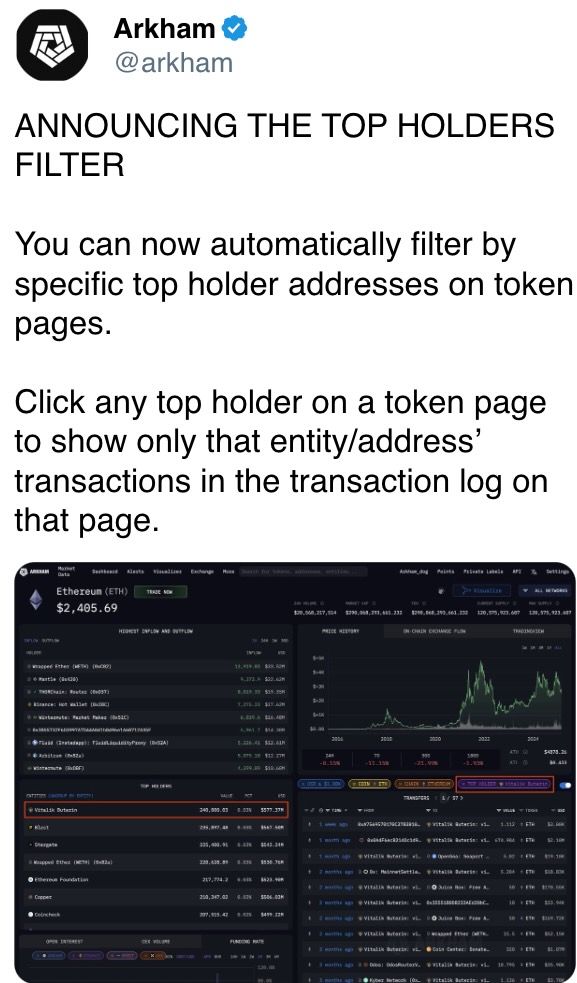

March 1: Spot buying and selling on the Arkham Change goes stay in 17 U.S. states.

March 5 (provisional): At epoch 222464, testing of Ethereum’s Pectra improve on the Sepolia testnet begins.

Macro

Day 2 of two: 2025’s first G20 finance ministers and central financial institution governors assembly (Cape City, South Africa).

Feb. 27, 7:00 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases January employment knowledge.

Unemployment Charge Est. 6.6% vs. Prev. 6.2%

Feb. 27, 7:00 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases January employment knowledge

Unemployment Charge Est. 2.7% vs. Prev. 2.4%

Feb. 27, 8:30 a.m.: The U.S. Bureau of Financial Evaluation releases This fall GDP (2nd estimate).

Core PCE Costs QoQ Est. 2.5% vs. Prev. 2.2%

PCE Costs QoQ Est. 2.3% vs. Prev. 1.5%

GDP Progress Charge QoQ Est. 2.3% vs. Prev. 3.1%

Feb. 27, 8:30 a.m.: The U.S. Division of Labor releases Unemployment Insurance coverage Weekly claims for the week ended Feb. 22.

Preliminary Jobless Claims Est. 221K vs. Prev. 219K

Feb. 28, 8:30 a.m.: The U.S. Bureau of Financial Evaluation releases January private consumption knowledge.

Core PCE Worth Index MoM Est. 0.3% vs. Prev. 0.2%

Core PCE Worth Index YoY Est. 2.6% vs. Prev. 2.8%

PCE Worth Index MoM Est. 0.3% vs. Prev. 0.3%

PCE Worth Index YoY Est. 2.5% vs. Prev. 2.6%

Private Revenue MoM Est. 0.3% vs. Prev. 0.4%

Private Spending MoM Est. 0.1% vs. Prev. 0.7%

Earnings

March 6 (TBC): Bitfarms (BITF), $-0.04

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.03

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Occasions

Governances votes & calls

DYdX DAO is voting on distributing $1.5 million in DYDX tokens from the neighborhood treasury to qualifying customers in buying and selling season 9 as a part of its incentives program.

Feb. 27, 11 a.m.: IOTA (IOTA) to host an Ask Me Something (AMA) session with co-founder Dominik Schiener and Thoralf, senior software program engineer for its good contract platform and dev instruments.

Feb. 27, 2 p.m.: VeChain (VET) to cowl its month-to-month updates in a neighborhood name.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating provide value $36.67 million.

Mar. 1: DYdX to unlock 1.14% of circulating provide value $6.13 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating provide value $13.58 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating provide value $67.52 million.

Mar. 2: Ethena (ENA) to unlock 1.3% of circulating provide value $17.79 million.

Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating provide value $14.23 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating provide value $77.80 million.

Token Listings

Feb. 27: Venice token (VVV) to be listed on Kraken.

Feb. 28: Worldcoin (WLD) to be listed on Kraken.

Feb. 28: Zcash (ZEC) and Sprint (DASH) are being delisted from Bybit

Conferences

CoinDesk’s Consensus to happen in Toronto on Could 14-16. Use code DAYBOOK and save 15% on passes.

Day 5 of 8: ETHDenver 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest)

March 8: Bitcoin Alive (Sydney)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Subsequent Block Expo (Warsaw)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape City)

Token Discuss

By Shaurya Malwa

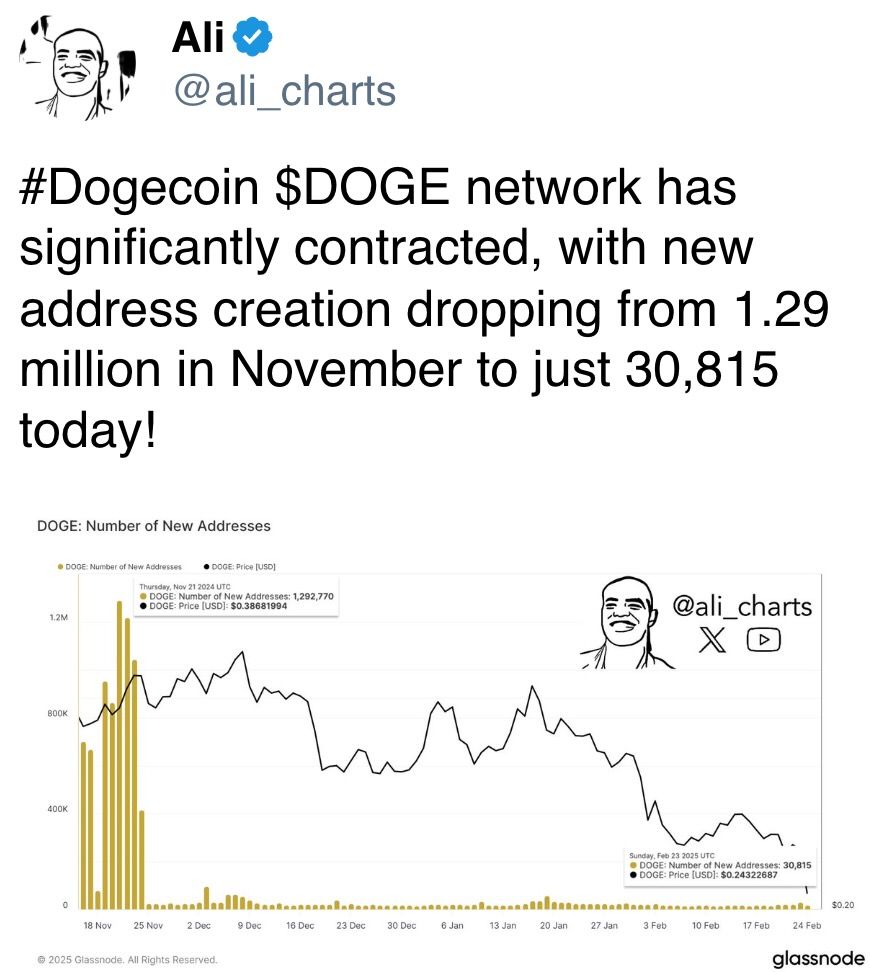

Pump.enjoyable, a Solana-based memecoin launchpad, has seen a pointy decline in token launches and graduations amid a falling market.

The platform hit a peak in October 2024, creating over 36,000 tokens in a day and producing a file $3 billion market cap for its ecosystem, however exercise has since plummeted, with each day token launches dropping greater than 60%.

Knowledge from Dune Analytics exhibits Pump.enjoyable’s token commencement price stays low at round 1%-2%, with many tokens failing to maintain worth post-launch, contributing to the downturn.

The decline comes as Solana’s SOL has dropped greater than 40% for the reason that begin of the 12 months.

Derivatives Positioning

Open curiosity in perceptual futures tied to APT, one of many best-performing cash of the previous 24 hours, has elevated, however funding charges and the cumulative quantity delta are destructive. That is an indication of merchants hedging draw back dangers.

SOL and LTC have additionally seen will increase in open curiosity, however with constructive funding charges.

BTC and ETH choices on Deribit now point out draw back considerations extending till the tip of March, whereas later expirations proceed to indicate a desire for name choices.

Block flows on Paradigm have been combined, with places and OTM name spreads lifted. The SOL March 7 expiry put choice on the $120 strike was bought.

Market Actions:

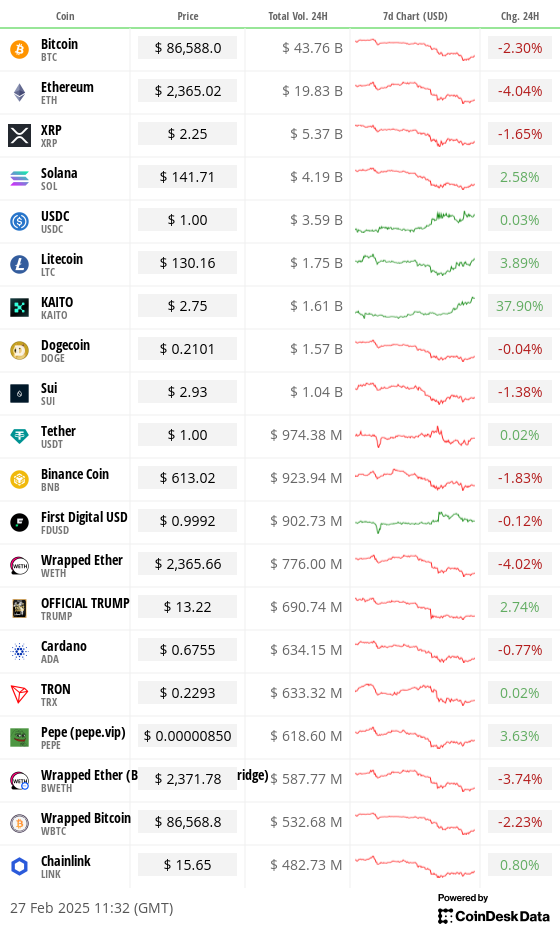

BTC is up 3% from 4 p.m. ET Wednesday at $86,735.19 (24hrs: -2.12%)

ETH is up 1.98% at $2,378.49 (24hrs: -3.49%)

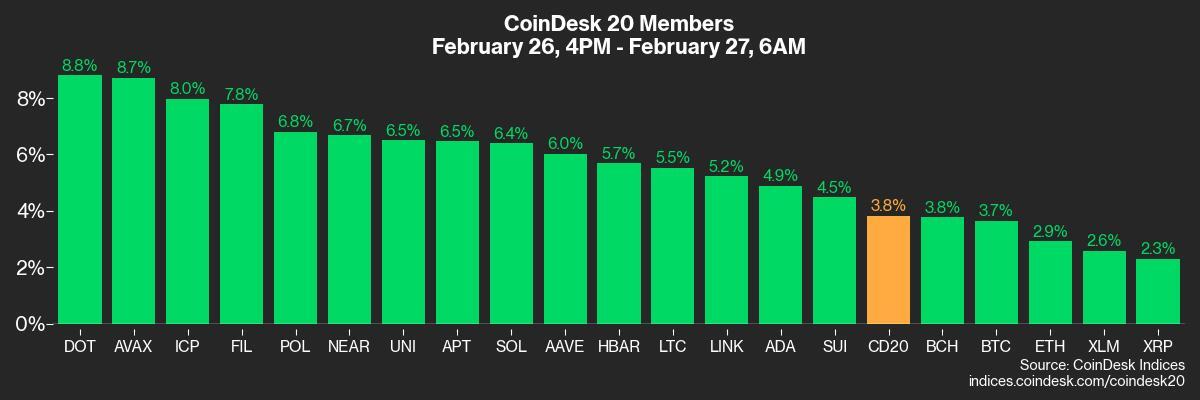

CoinDesk 20 is up 2.98% at 2,821.02 (24hrs: -1.13%)

Ether CESR Composite Staking Charge is down 26 bps at 3.02%

BTC funding price is at 0.0039% (4.26% annualized) on Binance

DXY is up 0.23% 106.66

Gold is down 0.77% at $2,893.59/oz

Silver is down 0.27% at $31.83/oz

Nikkei 225 closed +0.3% at 38,256.17

Cling Seng closed -0.29% at 23,718.29

FTSE is up 0.19% at 8,748.36

Euro Stoxx 50 is down 0.72% at 5,487.97

DJIA closed on Wednesday -0.43% at 43,433.12

S&P 500 closed unchanged at 5,956.06

Nasdaq closed +0.26% at 19,075.26

S&P/TSX Composite Index closed +0.49% at 25,328.36

S&P 40 Latin America closed -0.46% at 2,379.84

U.S. 10-year Treasury price is up 5 bps at 4.31%

E-mini S&P 500 futures are up 0.57% at 6,005.00

E-mini Nasdaq-100 futures are up 0.64% at 21,322.25

E-mini Dow Jones Industrial Common Index futures are up 0.24% at 43,612.00

Bitcoin Stats:

BTC Dominance: 60.77 (0.31%)

Ethereum to bitcoin ratio: 0.02744 (-1.05%)

Hashrate (seven-day transferring common): 766 EH/s

Hashprice (spot): $50.5

Complete Charges: 10.9 BTC / $915,415

CME Futures Open Curiosity: 155,270 BTC

BTC priced in gold: 29.6 oz

BTC vs gold market cap: 8.42%

Technical Evaluation

BTC’s double prime breakdown has uncovered the previous resistance-turned-support under $74,000.

On the value chart, there isn’t any different assist between $90K and $74K.

Crypto Equities

MicroStrategy (MSTR): closed on Wednesday at $263.27 (+5.09%), up 2.82% at $270.70 in pre-market

Coinbase International (COIN): closed at $212.96 (+0.22%), up 3.22% at $219.81

Galaxy Digital Holdings (GLXY): closed at C$20.16 (+0.35%)

MARA Holdings (MARA): closed at $12.45 (+0.28%), up 12.93% at $14.06

Riot Platforms (RIOT): closed at $8.94 (-4.08%), up 3.69% at $9.27

Core Scientific (CORZ): closed at $10.02 (+2.66%), up 18.46% at $11.87

CleanSpark (CLSK): closed at $7.88 (-3.31%), up 3.43% at $8.15

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.22 (+1.06%)

Semler Scientific (SMLR): closed at $43.91 (+3.51%), up 1.41% at $44.53

Exodus Motion (EXOD): closed at $44.48 (+11.59%), up 8.48% at $48.25

ETF Flows

Spot BTC ETFs:

Each day web circulation: -$754.6 million

Cumulative web flows: $37.13 billion

Complete BTC holdings ~ 1,139 million.

Spot ETH ETFs

Each day web circulation: -$94.3 million

Cumulative web flows: $2.93 billion

Complete ETH holdings ~ 3.714 million.

Supply: Farside Traders

In a single day Flows

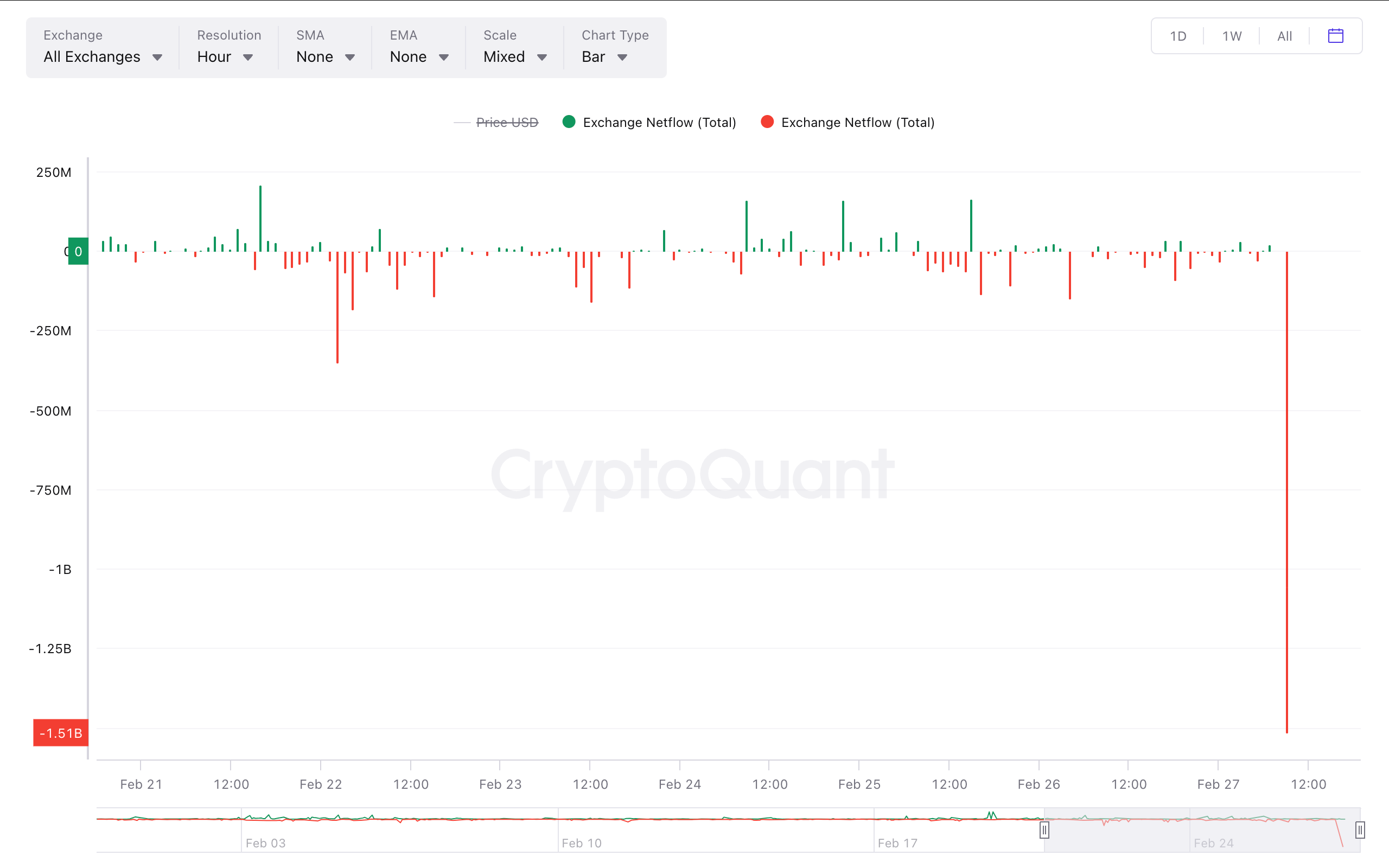

Chart of the Day

The chart exhibits a big outflow of the Tether’s dollar-pegged stablecoin USDT from centralized exchanges.

It could be an indication of merchants getting ready for deeper market downturns or rotation of liquidity out of centralized avenues into decentralized platforms.

Whereas You Had been Sleeping

Bitcoin Registers Largest 3-Day Worth Slide Since FTX Debacle. What Subsequent? (CoinDesk): The slide was pushed by tighter fiat liquidity and weakening institutional demand. Technical evaluation exhibits the value may drop to round $70,000.

FBI Seeks Crypto Trade Assist to Observe, Block Laundering of Bybit Hack Funds (CoinDesk): In a public service announcement, the Federal Bureau of Investigation (FBI) listed Ethereum addresses tied to crypto property just lately stolen from Bybit.

Metaplanet Seeks to Elevate Over $13M From Bond Sale to Purchase Extra Bitcoin (CoinDesk): Japanese agency Metaplanet Inc (3350) mentioned it’s elevating one other 2 billion yen ($13.3 million) by promoting further bizarre bonds with a 0% curiosity.

Traders Guess on Sharpest U.S.-Europe Inflation Divergence Since 2022 (Reuters): Knowledge from inflation swap markets suggests stronger progress and tariff pressures will hold U.S. inflation greater than within the eurozone, the place falling vitality prices will assist hold costs in verify.

Trump Shocks Europe Into Chasing Billions for Navy Buildup (Bloomberg): European leaders are overhauling protection funding by revising fiscal guidelines, enabling joint borrowing and repurposing restoration funds to spice up army capabilities amid rising safety challenges.

Trump Axes Chevron’s Venezuela Oil License, Citing Lack of Electoral Reforms (Reuters): President Trump introduced on Fact Social that he’s reversing a two-year-old Biden-era license that allowed Chevron (CVX) to function in Venezuela.

Argentina Memecoin Scandal Dents Milei’s Hunt for Election Allies (Reuters): President Milei’s promotion of the LIBRA token — which crashed shortly after launch — and the next investigations have difficult his efforts to construct political alliances forward of midterm elections.

Within the Ether