By James Van Straten (All occasions ET except indicated in any other case)

The previous 24 hours have been among the many most hectic within the crypto trade for years, and this was mirrored in Thursday’s bitcoin (BTC) value, which whipsawed 2% to three% a number of occasions in a matter of minutes. Nonetheless, it managed to remain above the psychological $100,000 stage and is is at present round $105,000.

President Trump’s rhetoric is constant to assist weaken the greenback, which typically boosts threat property akin to cryptocurrencies. The DXY index, a measure of the U.S. forex in opposition to a basket of main commerce companions, has dropped to the bottom since Dec. 17, so that ought to give risk-on property a feel-good increase. U.S. bond yields and WTI crude oil are additionally heading down, with oil under $75 a barrel, the bottom in two weeks.

On the opposite aspect of the world, the Financial institution of Japan (BoJ) delivered on its promise with one other interest-rate improve, taking the coverage fee to 0.50%, the very best in additional than 16 years. That adopted a very popular inflation print, with headline inflation of three.6% from the earlier 12 months, the quickest since January 2023. The query is whether or not we’ll get a second iteration of the yen carry commerce unwind that occurred in August of final 12 months. Time will inform. Keep alert!

What to Watch

Crypto:

Jan. 25: First deadline for SEC choices on proposals for 4 spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Belief, that are all sponsored by Cboe BZX Change.

Jan. 29: Ice Open Community (ION) mainnet launch.

Feb. 4: MicroStrategy Inc. (MSTR) This autumn FY 2024 earnings report.

Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 pepecoin.

Feb. 5, 3:00 p.m.: Boba Community’s Holocene laborious fork community improve for its Ethereum-based L2 mainnet.

Macro

Jan. 24, 4:00 a.m.: S&P World releases January 2025 eurozone HCOB Buying Managers’ Index (Flash) reviews.

Composite PMI Est. 49.7 vs. Prev. 49.6.

Manufacturing PMI Est. 45.3 vs. Prev. 45.1.

Providers PMI Est. 51.5 vs. Prev. 51.6.

Jan. 24, 4:30 a.m.: S&P World releases January 2025’s U.Okay. Buying Managers’ Index (Flash) reviews.

Composite PMI Est. 50 vs. Prev. 50.4.

Manufacturing PMI Est. 47 vs. Prev. 47.

Providers PMI Est. 50.9 vs. Prev. 51.1.

Jan. 24, 9:45 a.m.: S&P World releases January 2025’s U.S. Buying Managers’ Index (Flash) reviews.

Composite PMI Prev. 55.4.

Manufacturing PMI Est. 49.6 vs. Prev. 49.4.

Providers PMI Est. 56.5 vs. Prev. 56.8.

Jan. 24, 10:00 a.m.: The College of Michigan releases January U.S. client sentiment information.

Index of Shopper Sentiment (Remaining) Est. 73.2 vs. Prev. 74.

Token Occasions

Governance votes & calls

Frax DAO is discussing a $5 million funding in World Liberty Monetary (WLFI), the crypto venture backed by the household of President Donald Trump.

Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD permits anybody to take part in validation and defend in opposition to malicious claims to an Arbitrum chain’s state.

Jan. 24: Hedera (HBAR) is internet hosting a neighborhood name at 11 a.m.

Unlocks

Jan. 31: Optimism (OP) to unlock 2.32% of circulating provide price $52.9 million.

Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating provide price $626 million.

Conferences:

Day 12 of 12: Swiss WEB3FEST Winter Version 2025 (Zug, Zurich, St. Moritz, Davos)

Day 5 of 5: World Financial Discussion board Annual Assembly (Davos-Klosters, Switzerland)

Day 1 of two: Adopting Bitcoin (Cape City, South Africa)

Jan. 25-26: Catstanbul 2025 (Istanbul). The primary neighborhood convention for Jupiter, a decentralized trade (DEX) aggregator constructed on Solana.

Jan. 30, 12:30 p.m. to five:00 p.m.: Worldwide DeFi Day 2025 (on-line)

Jan 30-31: Plan B Discussion board (San Salvador, El Salvador)

Jan. 30 to Feb. 4: The Satoshi Roundtable (Dubai)

Feb. 3: Digital Property Discussion board (London)

Feb. 5-6: The 14th World Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico Metropolis)

Feb. 13-14: The 4th Version of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Join: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver)

Feb. 25: HederaCon 2025 (Denver)

Token Speak

By Shaurya Malwa

A humorous new decentralized autonomous group, FartStrategy (FSTR) DAO, is investing person funds into FARTCOIN.

The DAO is leveraging borrowed SOL to accumulate the token, providing buyers an opportunity to realize publicity to its value actions by way of FSTR.

If FSTR trades under its FARTCOIN backing, token holders can vote to dissolve the DAO, redeeming their share of FARTCOIN proportionally after settling any excellent money owed.

The VINE memecoin jumped to a $200 million market capitalization lower than 48 hours after issuance.

It was launched on the Solana blockchain by Rus Yusupov, one of many co-founders of the unique Vine app, and launched as a nostalgic tribute to the eponymous platform recognized for its six-second looping movies. Vine was a big cultural phenomenon earlier than closing in 2017.

There have been latest discussions round probably reviving the app, with Yusupov and technocrat Elon Musk expressing curiosity in its return.

Derivatives Positioning

TRX leads development in perpetual futures open curiosity in main cash.

Funding charges for majors stay under an annualized 10%, an indication the market is not overly speculative regardless of BTC buying and selling close to file highs on optimism about Trump’s crypto insurance policies.

BTC and ETH name skews have firmed up, with block flows that includes outright longs in larger strike BTC calls and a bull name unfold in ETH, involving calls at strikes $5K and $6K.

Market Actions:

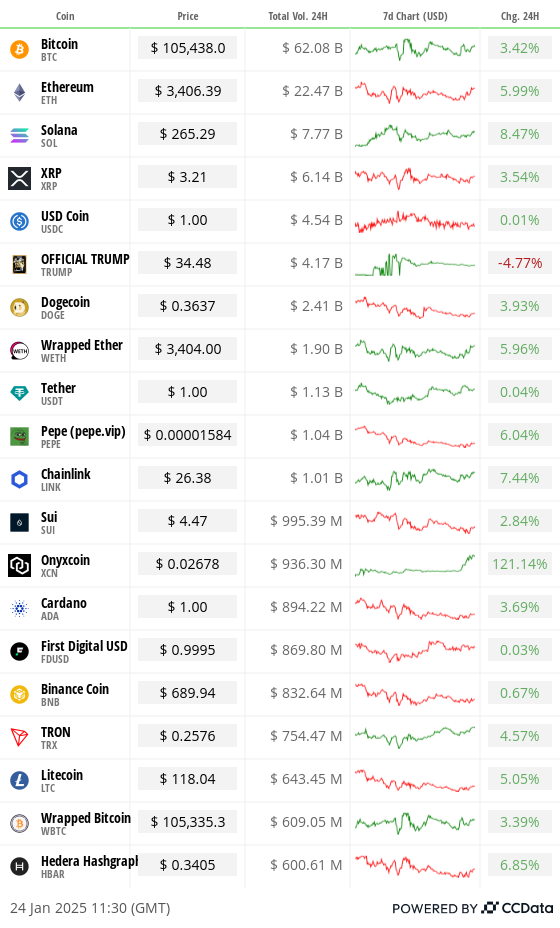

BTC is up 2 % from 4 p.m. ET Thursday to $105,450.57 (24hrs: +3.43%)

ETH is up 4.96% at $3,409.62 (24hrs: +6.18%)

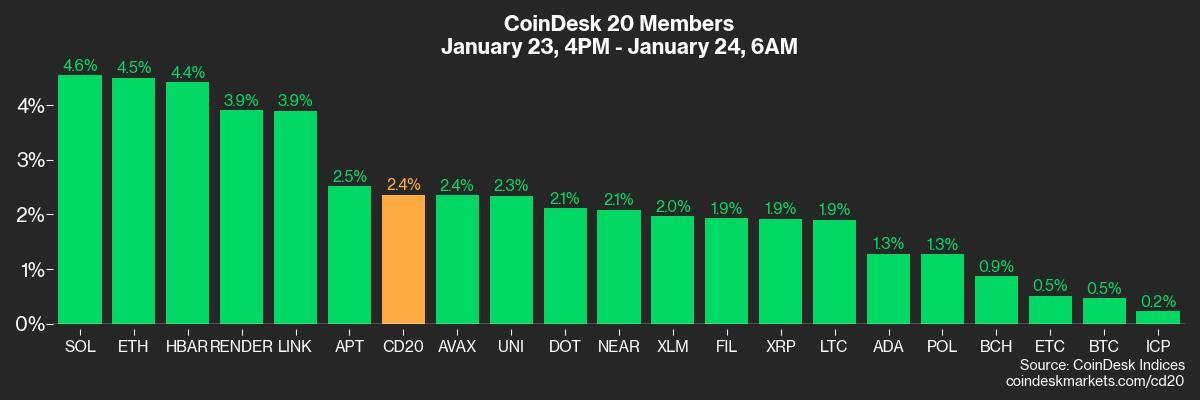

CoinDesk 20 is up 2.4% to three,988.16 (24hrs: +4.79%)

CESR Composite Staking Price is up 1 bp to three.16%

BTC funding fee is at 0.0069% (7.58% annualized) on Binance

DXY is down 0.48% at 107.53

Gold is up 0.68% at $2,775.28/oz

Silver is up 1.21% to $30.86/oz

Nikkei 225 closed unchanged at 39,931.98

Dangle Seng closed +1.86% to twenty,066.19

FTSE is down 0.33% at 8,537.12

Euro Stoxx 50 is up 0.73% at 5,255.47

DJIA closed on Thursday +0.92% to 44,565.07

S&P 500 closed +0.53 at 6,118.71

Nasdaq closed +0.22% at 20,053.68

S&P/TSX Composite Index closed +0.48% at 25,434.08

S&P 40 Latin America closed +0.57% at 2,310.35

U.S. 10-year Treasury was down 13 bps at 4.64%

E-mini S&P 500 futures are down 0.13% at 6,143.75

E-mini Nasdaq-100 futures are down 0.56% at 22,005.50

E-mini Dow Jones Industrial Common Index futures are unchanged at 44,709.00

Bitcoin Stats:

BTC Dominance: 58.51 (-0.11%)

Ethereum to bitcoin ratio: 0.032 (0.68%)

Hashrate (seven-day transferring common): 784 EH/s

Hashprice (spot): $61.0

Complete Charges: 6.8 BTC/ $104,070

CME Futures Open Curiosity: 191,645

BTC priced in gold: 38.1 oz

BTC vs gold market cap: 10.83%

Technical Evaluation

Ether appears have chalked out a falling wedge sample, characterised by two converging trendlines, representing a collection of decrease highs and decrease lows.

The converging nature of trendlines signifies that sellers are slowly shedding grip.

A breakout is claimed to symbolize a bullish pattern reversal.

Crypto Equities

MicroStrategy (MSTR): closed on Thursday at $373.12 (-1.11%), up 2.55% at $382.62 in pre-market.

Coinbase World (COIN): closed at $296.01 (+0.05%), up 2.16% at $302.39 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$33.94 (+3.44%)

MARA Holdings (MARA): closed at $19.95 (+1.32%), up 1.8% at $20.31 in pre-market.

Riot Platforms (RIOT): closed at $12.99 (-1.14%), up 2.62% at $13.33 in pre-market.

Core Scientific (CORZ): closed at $16.34 (+2.32%), up 1.04% at $16.51 in pre-market.

CleanSpark (CLSK): closed at $11.41 (+2.42%), up 2.19% at $11.67 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.65 (+0.47%), up 1.75% at $26.10 in pre-market.

Semler Scientific (SMLR): closed at $61.15 (-1.55%), down 10.89% at $54.49 in pre-market.

Exodus Motion (EXOD): closed at $44 (+7.32%), up 0.75% at $44.33 in pre-market.

ETF Flows

Spot BTC ETFs:

Each day internet move: $188.7 million

Cumulative internet flows: $39.42 billion

Complete BTC holdings ~ 1.169 million.

Spot ETH ETFs

Each day internet move: -$14.9 million

Cumulative internet flows: $2.79 billion

Complete ETH holdings ~ 3.663 million.

Supply: Farside Traders

In a single day Flows

Chart of the Day

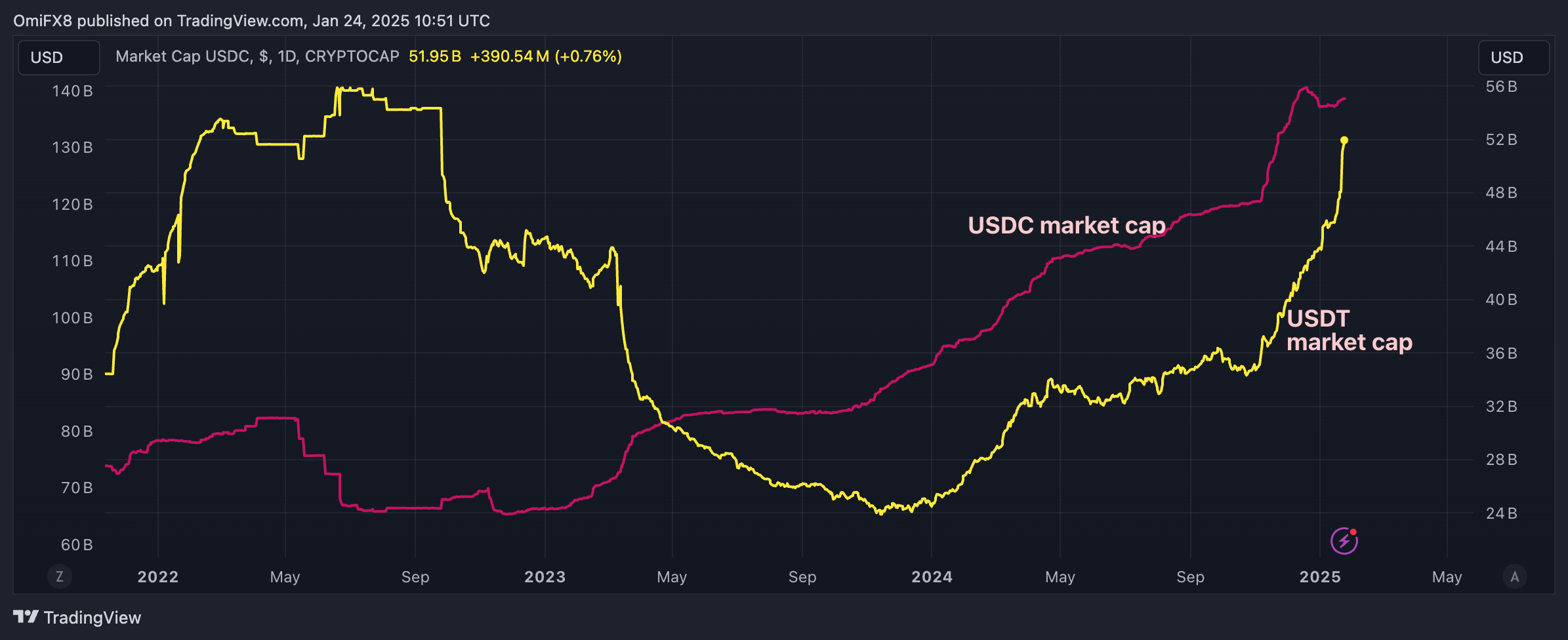

The market capitalization of Tether’s USDT, the world’s largest dollar-pegged stablecoin, has flattened close to $138 billion.

The USDC provide continues to extend and has risen to just about $52 billion this week, the very best since September 2022.

Whereas You Had been Sleeping

Bitcoin Regular Close to $104K After Financial institution of Japan Delivers Hawkish Price Hike (CoinDesk): Bitcoin held regular above $104,000 in early Asian hours Friday regardless of the Financial institution of Japan’s fee hike as markets eyed President Trump’s Thursday government order on crypto and potential U.S. coverage modifications.

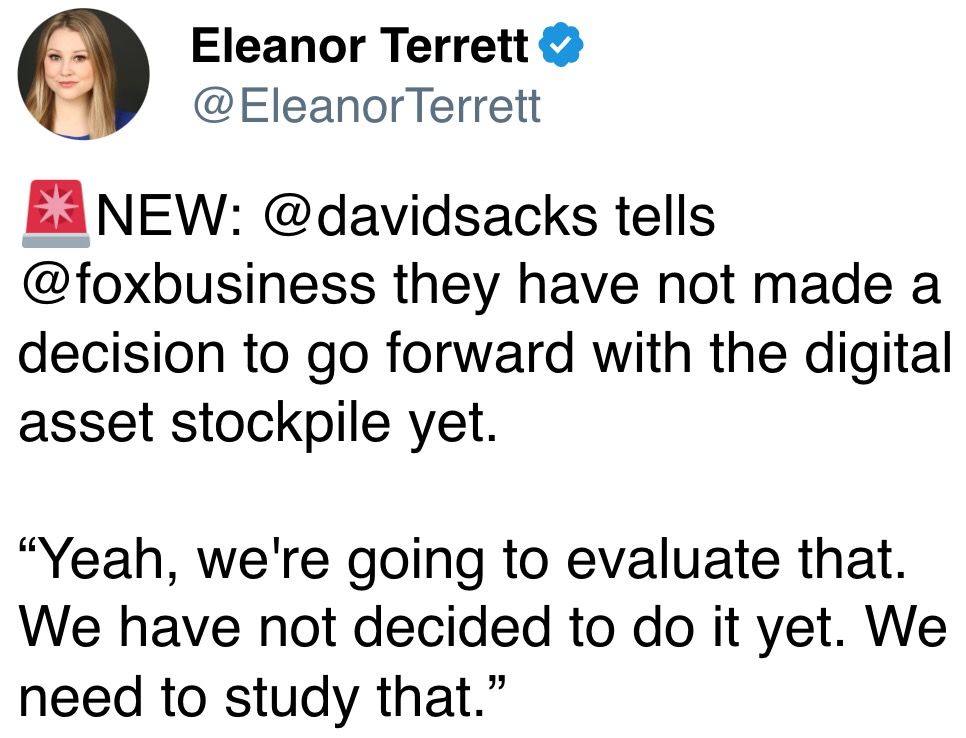

Trump Points Crypto Government Order to Pave U.S. Digital Property Path (CoinDesk): President Trump issued a pro-crypto government order, directing the creation of a digital asset framework, banning CBDC growth and contemplating a nationwide digital asset reserve.

Vitalik Buterin Requires Added Give attention to Ether as A part of the Community’s Scaling Plans (CoinDesk): In a Thursday submit, Ethereum co-founder Vitalik Buterin outlined methods to spice up the worth of ether together with utilizing it as collateral, implementing fee-burning incentives and rising momentary transaction information referred to as blobs.

Japan Hikes Charges, Solidifying Exit From Rock-Backside Borrowing Prices (Bloomberg): The Financial institution of Japan raised its key fee by 25 foundation factors to 0.5% on Friday, the very best in 17 years, strengthening the yen and lifting 10-year bond yields to 1.23%.

U.S. Shares at Most Costly Relative to Bonds Since Dotcom Period (Monetary Occasions): Shares within the S&P 500 hit file valuations, with the fairness threat premium turning unfavorable for the primary time since 2002 pushed by hovering demand for dominant tech corporations.

Trump 2.0 Is Going Nicely for China So Far. Can the Honeymoon Final? (CNN): In a Thursday interview, President Trump referred to as tariffs a “large energy” however advised offers may avert harder measures. Beijing cautiously welcomed the reprieve, eyeing negotiations whereas bracing for future tensions.

Within the Ether