Some analysts raised their issues that Bitcoin may expertise a attainable crash which shall be pushed by the Chicago Mercantile Change (CME) hole resulting in an enormous drop in its worth.

Since Bitcoin must fill within the hole, crypto merchants predict it would push the firstborn cryptocurrency close to the crucial CME hole, suggesting that its worth might go as little as $77,000 per coin.

Associated Studying

Bitcoin Might Slide To $77,000

Crypto analyst Egrag Crypto prompt that the huge corrections that Bitcoin has been experiencing might trigger the coin to plunge to the $77,000 mark.

Egrag added that since October 2022, the flagship cryptocurrency has been subjected to about seven appreciable drops, including, “The common drop throughout these occasions is roughly 23.53%.”

#BTC Drop – Common Dump & CME (70K-74K): How & Why?

1⃣Common Drop:

Since October 2022, #BTC has skilled almost seven vital drops. Listed below are the share declines:1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%📊 The common drop throughout… pic.twitter.com/Vz6QiZlnzF

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

“From the present excessive of round 108,975, we’re taking a look at a possible drop to the decrease finish of the CME GAP (between 77K-80K). This represents a 25% decline, aligning properly with the typical drop noticed throughout this cycle,” Egrag mentioned in a put up.

Egrag additionally famous that the present 21 Weekly EMA is round $80,000, suggesting that “one other flash crash might be on the horizon.”

CME Hole At $80,000

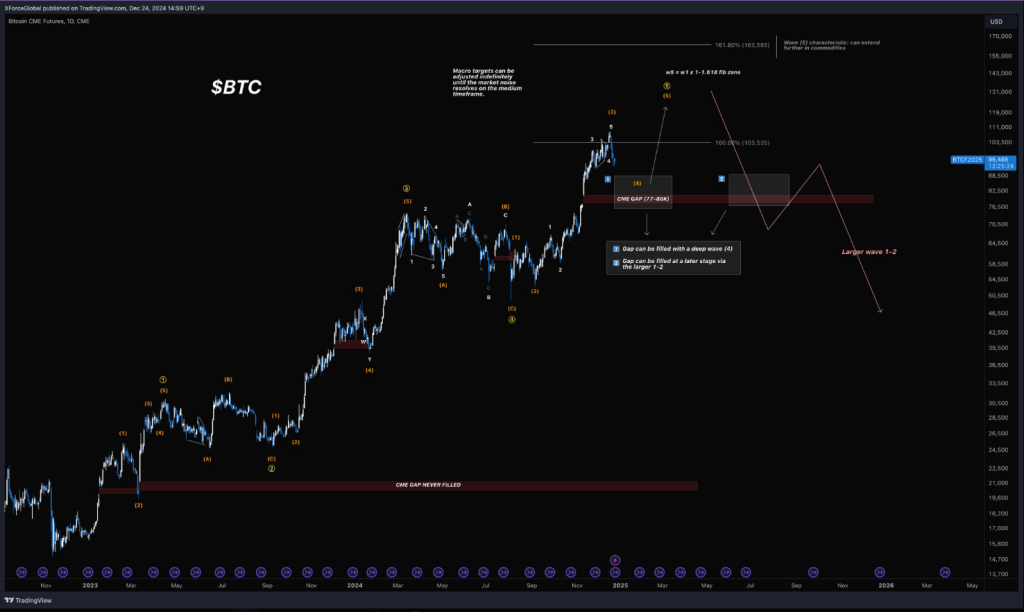

One other crypto analyst, XForceGlobal, reminded merchants that “there’s a 1D CME hole at $80,000.”

XForceGlobal mentioned that traditionally, 90% of day by day CME gaps bigger than have been ultimately crammed since 2018.

Only a pleasant reminder: there’s a 1D CME hole at $80,000.

Statistically, since 2018, with the rising curiosity in gaps, 90% of 1-Day timeframe gaps bigger than $1,000 have ultimately been crammed (ignore something beneath the 1D timeframe).

The tough half with CME gaps is… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

Nevertheless, the crypto analyst famous that it’s arduous to foretell the timing and technique of filling CME gaps.

“The tough half with CME gaps is that their timing and technique of filling stay unpredictable,” XForceGlobal mentioned in a put up.

The crypto analyst sees attainable eventualities to fill the CME gaps. In a single situation, XForceGlobal suggests it might be filed by a deep wave or wave-4 correction, bringing Bitcoin right down to the $77,000 to $80,000 degree.

In one other situation, XForceGlobal mentioned it may be crammed “at a later stage by way of the assumed 1-2 correction after we lastly end off this bull run’s impulse,” a situation which could outcome within the BTC to plummet to $46,000.

Associated Studying

A Market Dump In January?

Egrag believes that market makers may use the upcoming inauguration of President-elect Donald Trump to set off promoting stress for Bitcoin, contributing to its imminent crash.

“Market makers are identified for seizing alternatives throughout crises. Count on a market dump on Inauguration Day (January 20, 2025). This might be the right native high for a sell-off, seemingly leaving many newcomers in a panic,” the crypto analyst mentioned.

Egrag outlined two eventualities which may unfold from the present market situation, suggesting that in a single situation, Bitcoin might pump to $120,000 and later expertise a dump to the CME GAP earlier than “resuming the bull run in 2025.”

In one other attainable situation, the crypto analyst mentioned that BTC might drop to the CME hole of $70,000 to $75,000 degree earlier than the resumption of the bull run.

Featured picture from Pexels, chart from TradingView