Chainlink (LINK) has lately proven resilience after a 35% retrace from its yearly highs, surging over 30% to check liquidity across the $23 mark. Regardless of this restoration, bearish sentiment continues to weigh closely on altcoins, and Chainlink is not any exception. The cryptocurrency has struggled to reclaim its native highs, elevating questions on whether or not the current rally has sufficient momentum to maintain additional beneficial properties.

Associated Studying

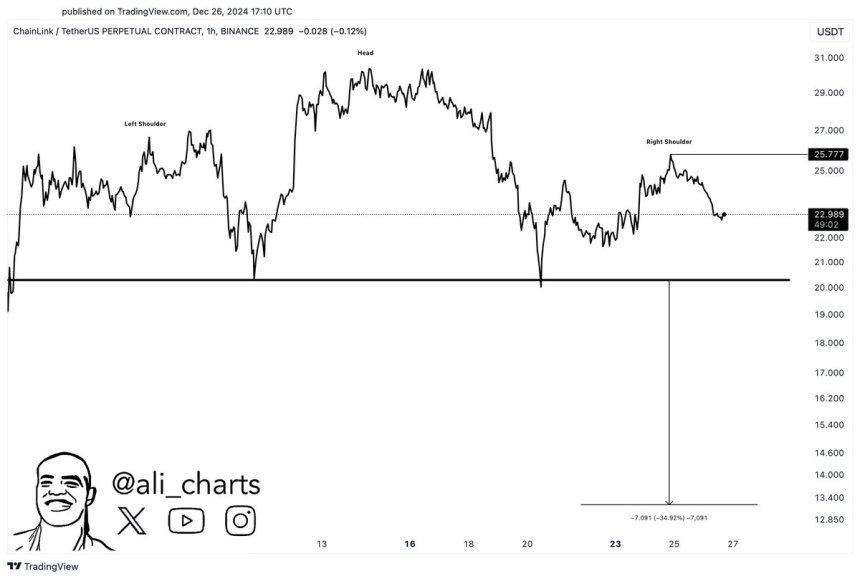

High analyst Ali Martinez offered an in depth technical evaluation on X, highlighting a essential sample that might dictate LINK’s subsequent transfer. In line with Martinez, Chainlink is forming a head-and-shoulders sample—a construction typically related to bearish reversals. If this sample is confirmed, LINK might face a big decline, doubtlessly dropping as little as $14 within the coming weeks.

This technical setup places Chainlink at a vital juncture, the place holding above present ranges is important to keep away from deeper corrections. Traders and merchants carefully monitor the value motion, with $23 as a key resistance stage. Whether or not LINK can overcome the bearish sentiment or succumb to additional draw back will probably depend upon broader market situations and its potential to invalidate the bearish sample. For now, Chainlink’s outlook stays unsure, preserving market members on edge.

Chainlink Worth Motion Exhibiting Weak spot

Chainlink (LINK) has confronted a difficult value surroundings since its drop from yearly highs, reflecting a broader bearish sentiment within the altcoin market. Regardless of displaying some restoration, LINK’s value motion has remained constrained, with important resistance forming across the $26 mark. Reclaiming this stage is crucial for invalidating bearish outlooks and reigniting bullish momentum.

High analyst Ali Martinez lately shared a technical evaluation on X, highlighting the potential formation of a head-and-shoulders sample. This bearish setup, if confirmed, might ship LINK plunging as little as $14. Such a transfer would symbolize a big draw back from present ranges and underline the challenges LINK faces in reclaiming its former highs.

Nevertheless, not all hope is misplaced. Martinez notes that holding above the $22 mark might present a powerful foothold for Chainlink to stabilize and doubtlessly reverse the bearish development. A decisive push above $27 would additional strengthen bullish momentum, signaling a possible return to a extra optimistic outlook.

Associated Studying

For now, the market stays riddled with indecision. Broader market situations, together with Bitcoin’s efficiency, will probably affect LINK’s course. If LINK can efficiently navigate these key ranges, it could overcome the bearish narrative and place itself for a extra sustained rally. Till then, warning stays warranted for merchants and buyers alike.

LINK Testing Liquidity

Chainlink (LINK) is presently buying and selling at $23 after efficiently testing demand on the $22 stage. Regardless of holding this important assist, the value motion lacks a definitive course, leaving merchants and buyers in a state of uncertainty. Bears seem to take care of management for now, with the current retrace from yearly highs weighing closely on sentiment. Nevertheless, the $22 mark has confirmed to be a resilient assist, suggesting that demand might surge at any second to reclaim the uptrend.

For LINK to interrupt free from this indecisive section, it should overcome the essential resistance at $26. A push above this stage would invalidate the present bearish outlook and sure ignite an enormous rally, with potential to revisit and surpass earlier highs. Such a transfer would restore confidence amongst merchants and will entice new consumers to gasoline additional momentum.

Associated Studying

On the draw back, failing to carry above $22 would expose LINK to elevated promoting strain, which might take a look at decrease assist ranges and delay the bearish development. For now, the market stays at a tipping level, with each bulls and bears ready for the following decisive transfer. The approaching days will probably be essential for LINK because it seeks to seek out course amid broader market uncertainty.

Featured picture from Dall-E, chart from TradingView