Cardano has been within the limelight these days, not solely as a result of it has barely elevated in worth but additionally as a result of its forecasted surge. Based on predictions, ADA might surge up 16% and attain as excessive as $0.37 by October 2024. However what actually drew curiosity was the daring assertion of Cardano analyst Dan Gambardello, that ADA might rally a whopping 1,000% in opposition to Bitcoin.

Associated Studying

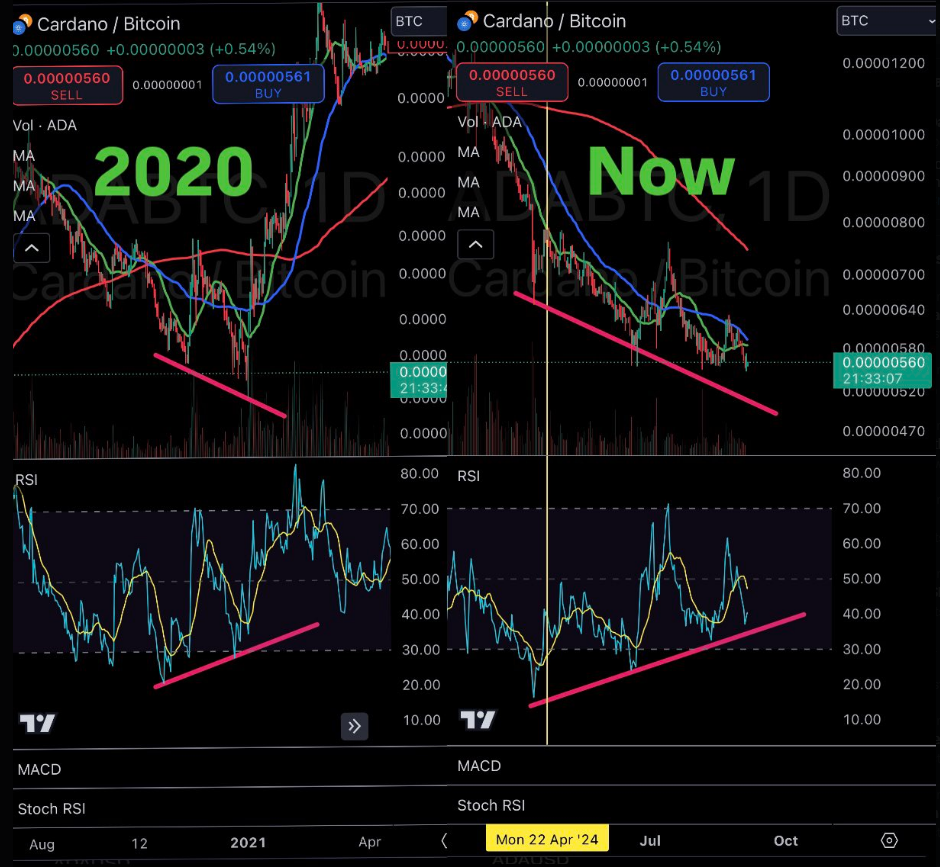

Gambardello’s forecast relies on a really related setup to the bullish divergence in 2020 that certainly triggered a powerful worth ascent. In truth, regardless of this optimism, general sentiment out there for Cardano stays conservative.

Though the worth acquire since then is inadequate to offset the 9% losses traders have suffered this week, it might present a restricted indication of accelerating momentum for the coin. ADA has simply recorded a modest acquire in worth of two.5% to $0.3263.

Analyst’s Bullish Case

Gambardello is optimistic primarily based on ADA/BTC’s technical chart. He pointed to a bullish divergence the place the worth of ADA retains making decrease lows, whereas the RSI and MACD are making greater lows-a signal that the downward momentum could possibly be weakening and a reversal may happen very quickly. Anybody who has adopted crypto worth actions is aware of this has been the precursor to many main rallies.

🚨 Insane bullish divergence on the ADA/BTC each day chart.

Final time this occurred 4 years in the past, Cardano rallied over 1,000% in opposition to Bitcoin. pic.twitter.com/cR0uqkIcTe

— Dan Gambardello (@cryptorecruitr) September 5, 2024

And he’s reasonably outspoken about his daring forecast, too. In a current X put up, Gambardello pinpointed how related circumstances have been set again in 2020: ADA was additionally struggling then, however the bullish divergence set off a significant rally in opposition to Bitcoin that took ADA to new all-time highs. If historical past repeats itself, we’d properly be an “insane” worth rally for ADA as soon as once more.

Market Sentiment: Bearish Or Bullish?

It isn’t all moonbound, although, for Cardano. If Gambardello’s rosy projection have been something to go by, the alternative may be stated by the broader market. Market sentiment in the meanwhile is surely bearish.

The Worry & Greed Index, one of many main barometers of investor confidence, rests at 22, indicating “Excessive Worry.” This in impact means most traders are nonetheless very skeptical about making an enormous transfer in ADA and threat urge for food stays very low.

Over the past 30 days, ADA has skilled some comparatively reasonable turbulence; solely 53% of its days are within the inexperienced. The worth motion hasn’t actually been constant, and this type of downward volatility might as properly scare away many potential traders looking for some extra sturdy pricing momentum.

Whereas the forecast for an increase by October 2024 is 16.24%, the present setting doesn’t actually stand to encourage a lot confidence. One could be considerably cheap at being hesitant, given the temperamental nature presently governing the markets.

Associated Studying

ADA Value Forecast

That leaves the traders to resolve on a troublesome matter. On one facet, the technicals Gambardello presents present a doable breakout. Conversely, the state of the market is considerably erratic, and usually the vibe is solely not optimistic. Perhaps traders could be higher off ready for extra persuasive proof of ADA’s subsequent motion and treading gently for now.

The following few weeks are going to be essential for Cardano. And although Gambardello’s prediction did handle to boost hope, the overall market nonetheless appears to overwhelm any instant bullish momentum. In the intervening time, warning may be the very best strategy, however the second ADA begins breaking out of its vary, issues can change fairly quick.

Featured picture from Medium, chart from TradingView