Cardano has surged over 10%, breaking a key resistance degree, and is now testing increased costs. Regardless of the bullish momentum, on-chain knowledge reveals that long-term holders are starting to take income. The ratio of each day on-chain transactions in revenue to loss has turned constructive, suggesting that many buyers are capitalizing on latest good points.

Associated Studying

Because the market continues to evolve, ADA strives to keep up its uptrend, buoyed by constructive sentiment and rising optimism for additional worth restoration. Nonetheless, this profit-taking exercise signifies that some buyers are cautiously locking in good points, probably resulting in short-term worth volatility.

With excessive expectations for a continued rally within the coming weeks, buyers are intently watching ADA’s efficiency to see if it may well maintain its momentum. The following few days will likely be crucial for confirming whether or not Cardano can maintain above these ranges and push towards new highs.

Cardano Lengthy-Time period Holders Promoting

Cardano is testing native provide ranges after a major surge, with buyers turning into cautious of their short-term methods.

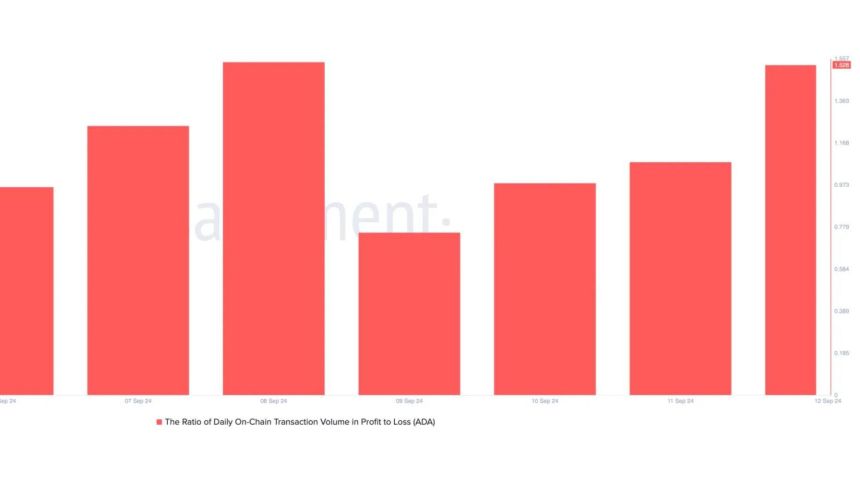

Yesterday, the ratio of each day on-chain transactions in revenue to loss reached 1.53, that means that for each ADA transaction leading to a loss, 1.53 transactions have generated income. This metric highlights that many buyers are benefiting from the latest worth good points, resulting in some long-term holders promoting their cash for revenue.

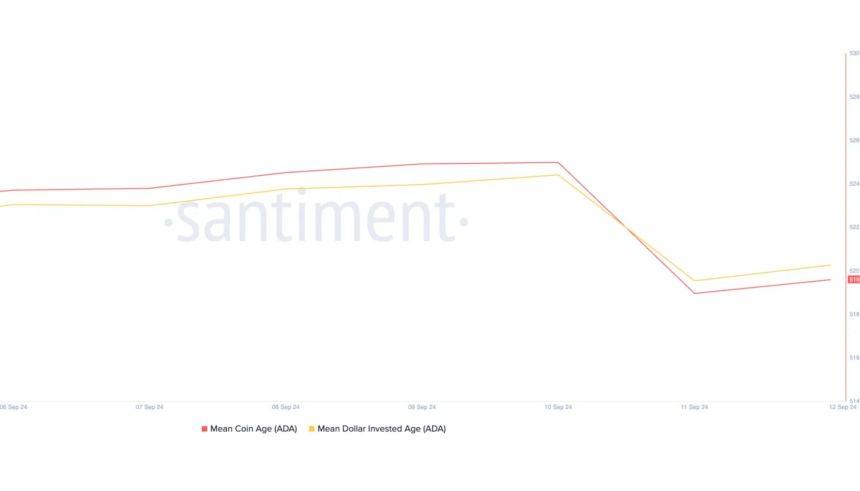

Information from Santiment helps this view, displaying a slight decline in Cardano’s Imply Coin Age and Imply Greenback Invested Age on September 11. These metrics observe long-term holders’ conduct, reflecting the common age of ADA cash and the quantity invested over time. A drop in these metrics means that holders who bought ADA at decrease costs at the moment are taking income, reducing the common age of the cash of their possession.

Regardless of this promoting stress, ADA nonetheless has the potential to keep up its bullish momentum if market circumstances proceed to push. Cardano might goal increased costs, however the cautious conduct from seasoned buyers alerts that the rally would possibly face resistance quickly.

Associated Studying: Is Chainlink (LINK) $12 Breakout Imminent? Information Reveals A Rising Open Curiosity

The approaching days will likely be essential for ADA, because it wants to carry above its present ranges to substantiate a continued uptrend. If patrons regain management and demand will increase, Cardano might break by key resistance ranges and intention for brand spanking new highs.

ADA Value Motion Particulars

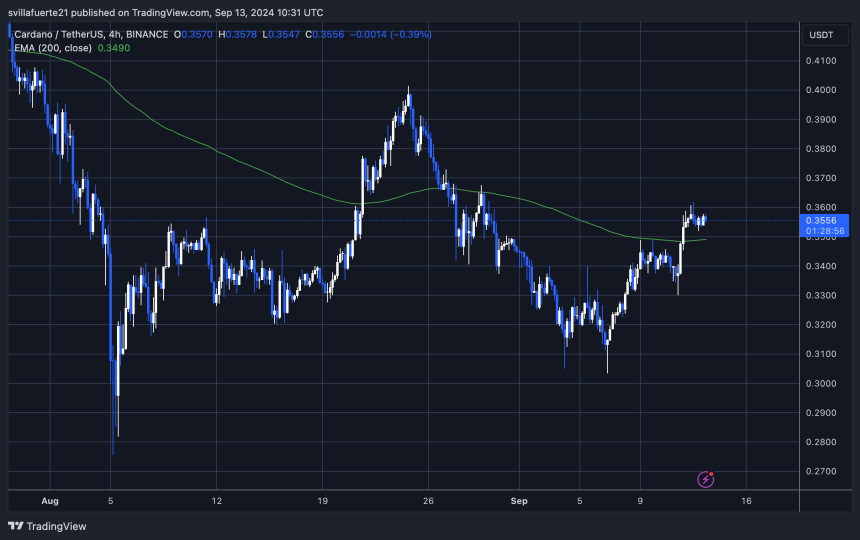

ADA trades at $0.3565 after testing a key resistance at $0.36. The worth has closed above the 4-hour 200 exponential transferring common (EMA) at $0.3490.

It is a important indicator of short-term energy that ADA had revered as resistance since early August. This profitable reclaim of the 4H 200 EMA is essential for sustaining the uptrend.

If ADA manages to retest this EMA and maintain it as assist, it might verify a short-term bullish pattern. Breaking and holding above this degree means that ADA might proceed to push upward. Buyers and analysts see the subsequent goal as being within the $0.38 to $0.40 vary.

Associated Studying

Nonetheless, if ADA loses this assist degree, the worth might drop to decrease demand zones, presumably retreating to round $0.33. This might sign a weakening present momentum and probably spark additional promoting stress.

Featured picture from Dall-E, chart from TradingView