Bitcoin has skilled a quiet weekend, with the worth remaining stagnant across the $96,500 degree for 5 consecutive days. This extended interval of consolidation highlights the present indecisive nature of the market. Bulls have been unable to reclaim management and push Bitcoin above the crucial $100K mark, whereas bears are additionally struggling to drive the worth decrease towards key demand ranges.

Associated Studying

The shortage of route has left traders and analysts watching intently for alerts of the subsequent main transfer. The broader market sentiment stays cautious, with many questioning whether or not Bitcoin can regain bullish momentum or if a deeper correction is on the horizon.

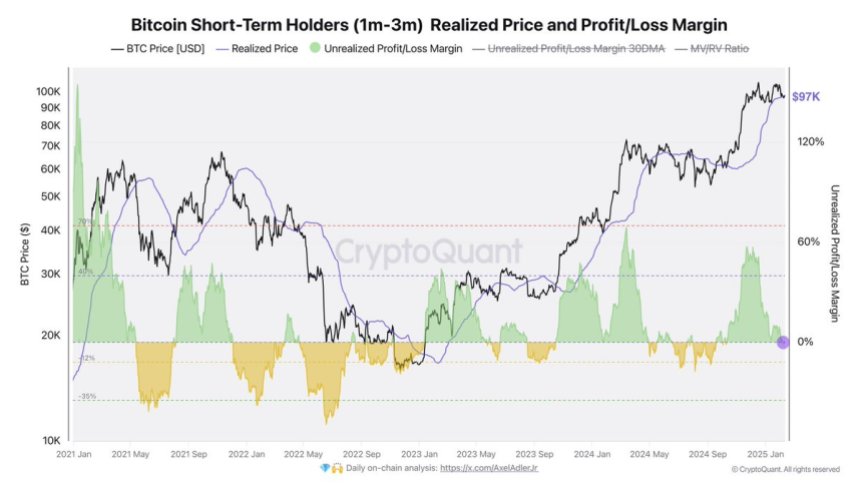

Key metrics shared by crypto professional Axel Adler on X present some perception into the present dynamics. In accordance with Adler, the $97K degree serves as a robust help zone, representing the common buy value for Bitcoin short-term holders. This means that a good portion of market members are nonetheless assured in Bitcoin’s potential to carry above this degree regardless of the dearth of upward momentum.

Bitcoin Demand Stays Robust As Indecision Drives The market

Bitcoin has been navigating by means of weeks, even months, of uncertainty and hypothesis, leaving traders divided about its short-term route. Bulls have struggled to push the worth again above the crucial $100K mark, whereas bears have been unable to interrupt beneath key help ranges. This stalemate has created a market characterised by indecision, with volatility persevering with to dominate value motion.

The absence of a transparent development has precipitated frustration amongst traders, a lot of whom had anticipated a stronger rally earlier this yr. As a substitute, Bitcoin has been consolidating inside a spread, bouncing between its $109K all-time excessive and help ranges round $90K. For now, the market appears caught on this section, with no instant catalyst to interrupt out.

High analyst Axel Adler has offered essential insights into the present dynamics. In accordance with Adler, the $97K degree is performing as robust help, because it represents the common buy value for short-term holders who’ve held their Bitcoin for one to a few months. This knowledge means that many market members are nonetheless assured in Bitcoin’s potential to carry this degree, at the same time as broader uncertainty looms.

If Bitcoin can maintain this help within the coming days, analysts anticipate a possible rally again towards vary highs round $109K. Nonetheless, failure to take care of this degree may pave the best way for additional draw back, testing decrease demand zones. For now, the market stays on edge, ready for Bitcoin’s subsequent decisive transfer.

Associated Studying

BTC Value Motion Particulars: Key Ranges

Bitcoin is at the moment buying and selling at $98,000 after spending the previous week in a good vary between the $100K psychological resistance and the $94,500 low. This range-bound value motion highlights indecision out there, as bulls and bears battle to realize management.

For Bitcoin to substantiate a short-term reversal and regain bullish momentum, bulls must reclaim the $98K mark as help and push decisively above the $100K degree. Breaking and holding above this crucial resistance may set the stage for a transfer towards larger value ranges, doubtlessly concentrating on all-time highs round $109K. A profitable reclaim of the $100K degree would sign renewed energy and confidence out there, sparking optimism amongst traders.

On the flip facet, failure to carry above the $95K help degree may open the door for additional draw back. A drop beneath $95K may ship Bitcoin into decrease demand zones, with the $90K degree performing as the subsequent key help. Such a transfer may additional gasoline bearish sentiment and prolong the present consolidation section.

Associated Studying

Because the market continues to consolidate, traders are intently monitoring these ranges for clues about Bitcoin’s subsequent transfer. With each bulls and bears testing their limits, the approaching days will probably decide the short-term route of BTC’s value.

Featured picture from Dall-E, chart from TradingView