As Bitcoin is presently nonetheless struggling to reclaim main highs, a current evaluation of its fundamentals has highlighted a attainable shopping for alternative for Bitcoin primarily based on insights from the Non-Realized Revenue metric.

A CryptoQuant analyst often known as Darkfost highlighted this metric’s significance in a current put up on the CryptoQuant QuickTake platform, mentioning what its development means for traders.

In response to the analyst, the Non-Realized Revenue metric provides a window into the unrealized beneficial properties or losses held by Bitcoin traders, which may affect future market actions.

Understanding The Present Zone In Non-Realized Income

The Non-Realized Revenue metric is commonly used to calculate the distinction between the present value of Bitcoin and the value at which every coin was final moved, with out accounting for cash which were bought.

Excessive values on this metric recommend that traders maintain vital unrealized income, which may result in elevated promoting strain as they could select to appreciate these beneficial properties.

Conversely, unfavourable values point out that many traders maintain positions at a loss, probably signaling a market backside and a beneficial entry level for brand new traders.

In response to the CryptoQuant analyst, the Non-Realized Revenue metric is generally within the unfavourable zone. This example implies that many Bitcoin holders are both at break-even factors or experiencing unrealized losses.

Traditionally, such circumstances have been related to market bottoms, the place the asset is taken into account undervalued. This state of affairs may current a strategic “alternative” for traders trying to enter the market or improve their holdings.

In response to Darkfost, what units the present market aside is that the unrealized income have reached unprecedented highs in comparison with earlier cycles, even whereas within the unfavourable zone.

This anomaly means that the continued market cycle might differ from previous Bitcoin patterns. The analyst cautions that whereas this might result in distinctive funding alternatives, it additionally introduces potential dangers because of the deviation from established developments.

Bitcoin Steady Wrestle Under $70,000

After briefly touching the $64,000 value degree yesterday, Bitcoin has confronted correction as soon as once more, falling again under this value mark—presently, the asset trades for $62,340, down by 1.8% up to now 24 hours.

This decline in efficiency from Bitcoin seems to have additionally dragged the worldwide crypto market cap together with it, with the general market cap valuation of crypto presently down by 3.3% up to now day to $2.26 trillion.

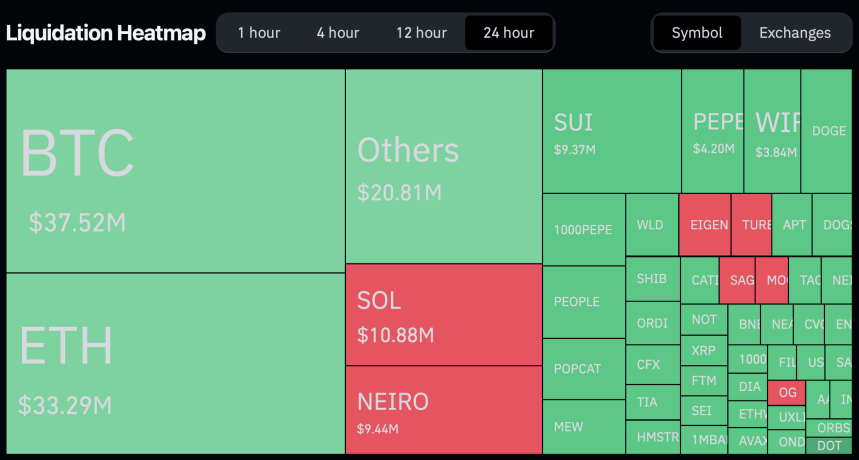

The plunge has had a extreme affect on merchants, most particularly those on lengthy positions. In response to knowledge from Coinglass, up to now 24 hours, 59,005 merchants have been liquidated, with the full liquidations sitting at $176.57 million.

Out of the full liquidations, lengthy positions account for $130 million, whereas brief positions account for under $45.91 million.

Featured picture created with DALL-E, Chart from TradingView