In an evaluation shared on X, Kelly Greer, Vice President of Buying and selling at Galaxy Digital, presents a compelling argument for why the Bitcoin worth may surge to as excessive as $118,000 by the tip of the yr. Greer’s insights are grounded in a mixture of historic efficiency knowledge, present market dynamics, and broader macroeconomic components, all of which she believes are aligning to create a extremely favorable surroundings for Bitcoin.

Right here’s Why Bitcoin May Skyrocket To $118,000

Greer begins by highlighting Bitcoin’s sturdy historic efficiency within the fourth quarter (This autumn) of earlier years. She identified that since 2020, Bitcoin’s common This autumn return to its intra-quarter excessive watermark has been roughly 85%. This determine features a best-case state of affairs the place the return reached a staggering 230%, and a worst-case state of affairs with a 12% decline.

“BTC common This autumn return (to max [intra quarter high watermark, full q return]) since 2020 is +85% (worst -12%, greatest +230%)—press you to discover a stronger asymmetry,” Greer writes. This statistical asymmetry suggests a big potential upside in comparison with the draw back, making This autumn traditionally a interval of strong development for Bitcoin.

Associated Studying

A merely common This autumn with a worth enhance of 85% may imply a year-end worth of $118,000 for Bitcoin. If the BTC outperforms its file of 230%, the value may even rise effectively above $200,000.

Notably, Greer believes that the present market will not be absolutely positioned to make the most of this potential. She attributes this underallocation to some key components. Firstly, there’s apprehension surrounding the upcoming US presidential election scheduled for November 5. Secondly, different belongings comparable to gold and China’s A-shares are attracting important consideration and capital, probably diverting funding away from Bitcoin.

“I nonetheless don’t suppose the market is allotted accordingly—2024 is a novel case the place some portion of the market is underindexing on the This autumn asymmetry resulting from a) Nov 5 US election danger and/or b) different belongings are screaming (gold, China A-shares and so forth.),” Greer remarks.

Key Causes To Be Bullish On BTC

To assist her evaluation of the market’s present positioning, Greer cites her interactions with danger managers and famous particular market indicators. She talked about observing “low volatility and contained perp funding,” which means that merchants aren’t aggressively betting on important worth actions.

Past these market dynamics, Greer identifies a number of macroeconomic and industry-specific components that she believes are making a “broadly very constructive” backdrop for Bitcoin. One important level is the presence of international stimulus measures in main economies comparable to the USA and China, excluding Japan.

Greer additionally highlights that BNY Mellon, the world’s largest custodian financial institution, acquired a SAB 121 exemption. This exemption permits the financial institution to supply custody companies for Bitcoin with out the stringent capital necessities that beforehand made such companies much less engaging. Greer describes this improvement as “large and underappreciated,” noting that it’s going to “loosen financing in our {industry} considerably.”

Associated Studying

Moreover, Greer factors out that ETF flows have change into “very constructive.” Over the previous few days, spot BTC inflows have reaccelerated massively. Final Friday, web flows had been $494.8 million, making it the very best web influx day of the quarter and the very best web influx day since June 4th.

One other constructive indicator is that Bitcoin miners are coming into agreements with hyperscalers—large-scale cloud service suppliers. These partnerships can improve mining effectivity and cut back operational prices.

Greer additionally mentions that “provide overhangs [are] principally accomplished,” suggesting that giant sell-offs that would suppress the value are unlikely within the close to time period. Moreover, she anticipates that “demand from FTX money distros [is] across the nook,” implying that funds distributed from the FTX alternate may discover their method into Bitcoin investments, additional boosting demand.

Nevertheless, Greer additionally acknowledges potential dangers that would affect Bitcoin’s trajectory. These embody indicators from the Federal Reserve relating to financial coverage and the opportunity of a pullback in fairness markets. Such occasions may introduce volatility or dampen investor enthusiasm.

Nevertheless, she believes that the general sentiment stays constructive. “There are dangers after all—Fed signaling, equities pullback, what have you ever—however web web vibes are fairly good, and flows are simply getting began,” she remarks.

Greer additionally describes Bitcoin as a “reflexive asset.” She explains, “BTC is the last word reflexive asset: worth -> flows -> worth.” Which means that as the value of Bitcoin will increase, it attracts extra funding flows, which in flip push the value even greater—a self-reinforcing cycle.

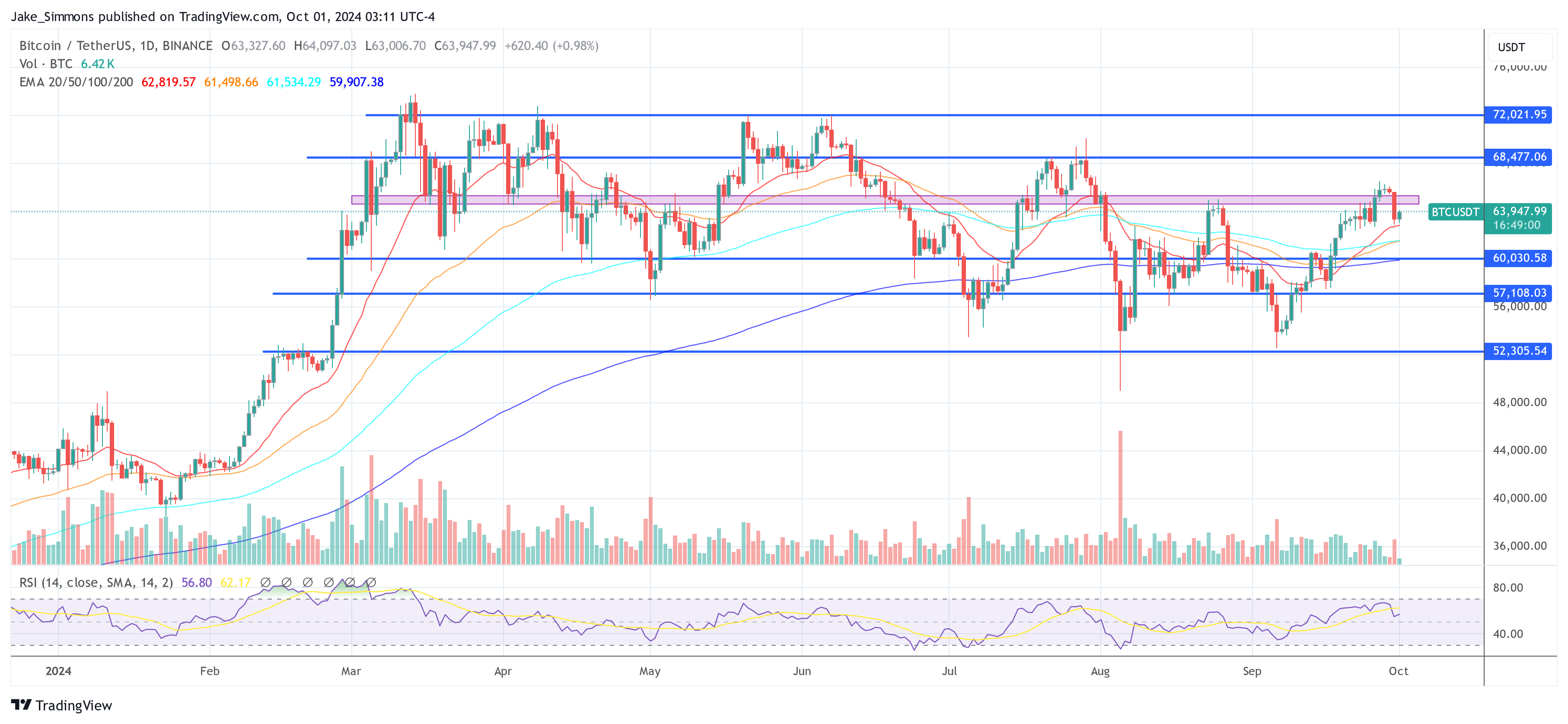

Greer notes that Bitcoin is coming into This autumn after breaking a key worth stage at $65,000. If the value had been to reclaim the $70,000 mark, she expects that the inflows would speed up as traders reply to the constructive momentum and recall the sturdy This autumn performances of earlier years.

At press time, BTC traded at $63,947.

Featured picture created with DALL.E, chart from TradingView.com