Bearish buying and selling in bitcoin (BTC) markets continued late Monday because the asset briefly fell beneath $92,000 on profit-taking regardless of one other mammoth MicroStrategy buy, recovering to simply over $92,800 as of Asian morning hours Tuesday.

Some merchants anticipate the present value motion to doubtless proceed till February, weeks after president-elect Donald Trump takes workplace within the U.S. and units into movement a barrage of insurance policies that will assist the market.

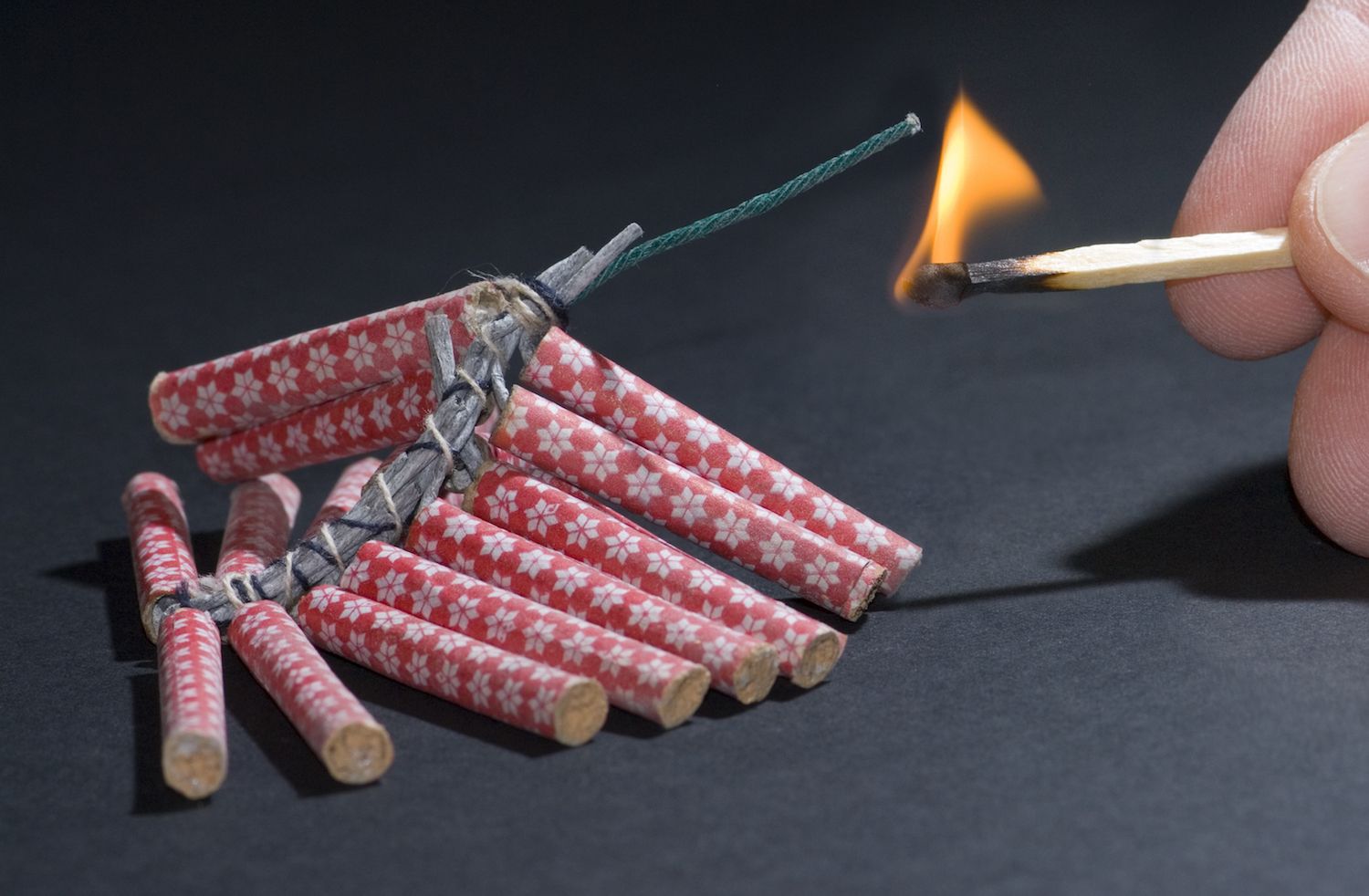

“We’re skeptical of any New Yr fireworks particularly with funding wholesome,” merchants at Singapore-based QCP Capital stated in a Telegram broadcast. “January’s common returns (+3.3%) are comparatively much like December’s (+4.8%), and we may anticipate spot to stay on this vary within the near-term earlier than issues begin to choose from Feb onwards.”

“Choices flows are additionally reflecting comparable sentiments with frontend vols drifting decrease and risk-reversals most bid for Calls in March, partly resulting from vital March (120k-130k) Calls purchased final Friday,” they added. This implies merchants are betting on bitcoin costs going up in March. They’re shopping for extra name choices (which revenue if the inventory rises) than put choices. The price of these choices goes down, exhibiting optimism for the March interval.

BTC is on monitor to finish December down 4%, its worst since 2021, as each retail traders and long-term holders money out positions after a 117% yearly surge. Elsewhere, readings of the U.S. Chicago PMI point out an financial slowdown, including stress in the marketplace that tends to be correlated to such information.

In what appears to have been its closing buy of the 12 months, Bitcoin growth firm MicroStrategy elevated its BTC stash for the eighth consecutive week on Monday, including one other 2,138 BTC for $209 million within the week ended Dec. 29. That introduced its complete holdings to 446,400 BTC.

However information of the shopping for did little to stem losses. BTC costs slumped within the hours following MicroStrategy’s announcement, whereas shares of the corporate fell 8% to their lowest since early November.

The autumn unfold over to majors, with ether (ETH), XRP, Solana’s SOL and Cardano’s ADA falling as a lot as 3% earlier than recovering. BNB Chain’s BNB was little modified, whereas memecoins dogecoin (DOGE) and shiba inu (SHIB) fell 5%.

The broad-based CoinDesk 20 (CD20), an index monitoring the most important tokens by market capitalization, minus stablecoins, misplaced 2.7% prior to now 24 hours.

Change-traded funds (ETFs) holding the asset recorded $420 million in outflows of their second-last day of buying and selling forward of the brand new 12 months, information reveals. Constancy’s FBTC misplaced $154 million to steer outflows, adopted by Grayscale’s GBTC at $130 million and BlackRock’s IBIT at $36 million.

The merchandise have recorded greater than $1.5 billion in web outflows since Dec. 19, pausing a formidable run within the first half of the month that noticed practically $2 billion in web inflows. Giant outflows can replicate a shift in investor sentiment, probably shifting towards a extra cautious or bearish outlook on bitcoin’s short-term efficiency.