Bitcoin (BTC) appears to be like poised to report its finest September in a decade, surging previous $65,000. This uncharacteristic worth appreciation could possibly be attributed to a number of key components.

Causes Behind Bitcoin’s Spectacular September Good points

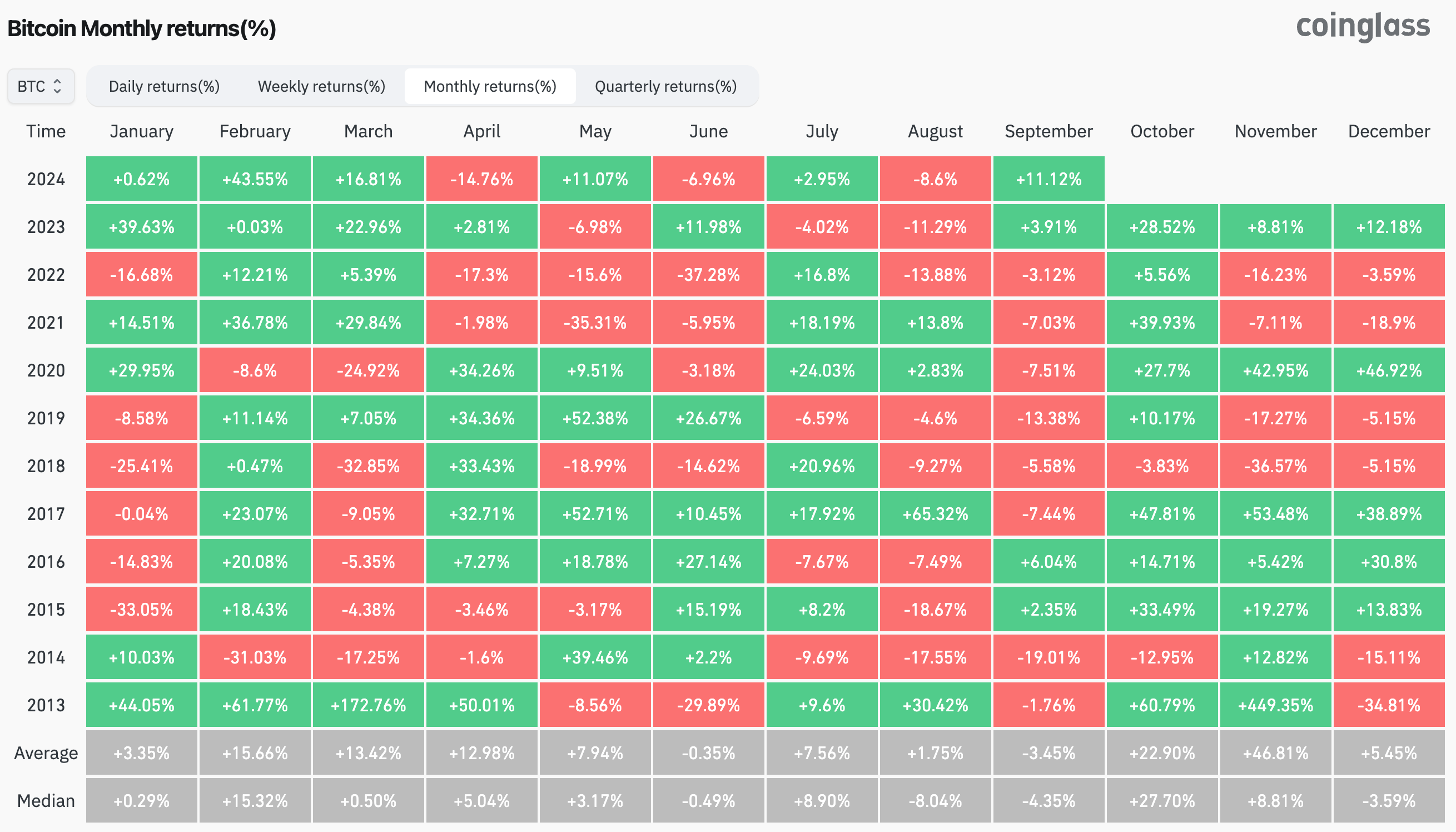

Traditionally, September has constantly been the worst month for BTC by way of worth efficiency. Nonetheless, the apex cryptocurrency is now on monitor to put up its finest September in not less than a decade, pushed by a number of macroeconomic developments.

Associated Studying

On September 18, the US Federal Reserve (Fed) initiated its rate of interest reduce cycle for the primary time in 4 years, slashing charges by 50 foundation factors (bps) in response to slowing inflation and rising unemployment.

The speed reduce instantly impacted risk-on belongings, together with BTC, which has appreciated by over 10% for the reason that reduce. As compared, Bitcoin’s common worth decline in September over the previous decade has been 3.45%, in response to the chart under from CoinGlass.

In accordance with the Fed’s choice, the European Central Financial institution (ECB) and the Folks’s Financial institution of China (PBoC) lowered borrowing prices to stimulate their respective economies. This additional propelled BTC’s worth in the direction of its earlier highs.

Bitcoin halving is one other key issue that would now be beginning to present its impact on the digital asset’s worth motion. Bitcoin underwent its halving earlier this 12 months in April, decreasing block affirmation rewards for miners from 6.25 BTC to three.125 BTC.

Previous knowledge signifies that halving has usually been a bullish set off for Bitcoin as a result of ensuing provide shortage. For example, in Could 2020, BTC worth rose from roughly $8,900 earlier than the halving to greater than $64,000 by April 2021 – an 8x worth surge in lower than a 12 months.

In the meantime, US spot Bitcoin exchange-traded funds (ETFs) proceed to witness rising curiosity from retail and institutional traders alike, as they recorded $365.57 million in complete internet day by day inflows on September 26, the most important since late July. Since their launch, the cumulative internet influx for Bitcoin ETFs now totals $18.31 billion.

Cautious Optimism Key To Driving The BTC Wave

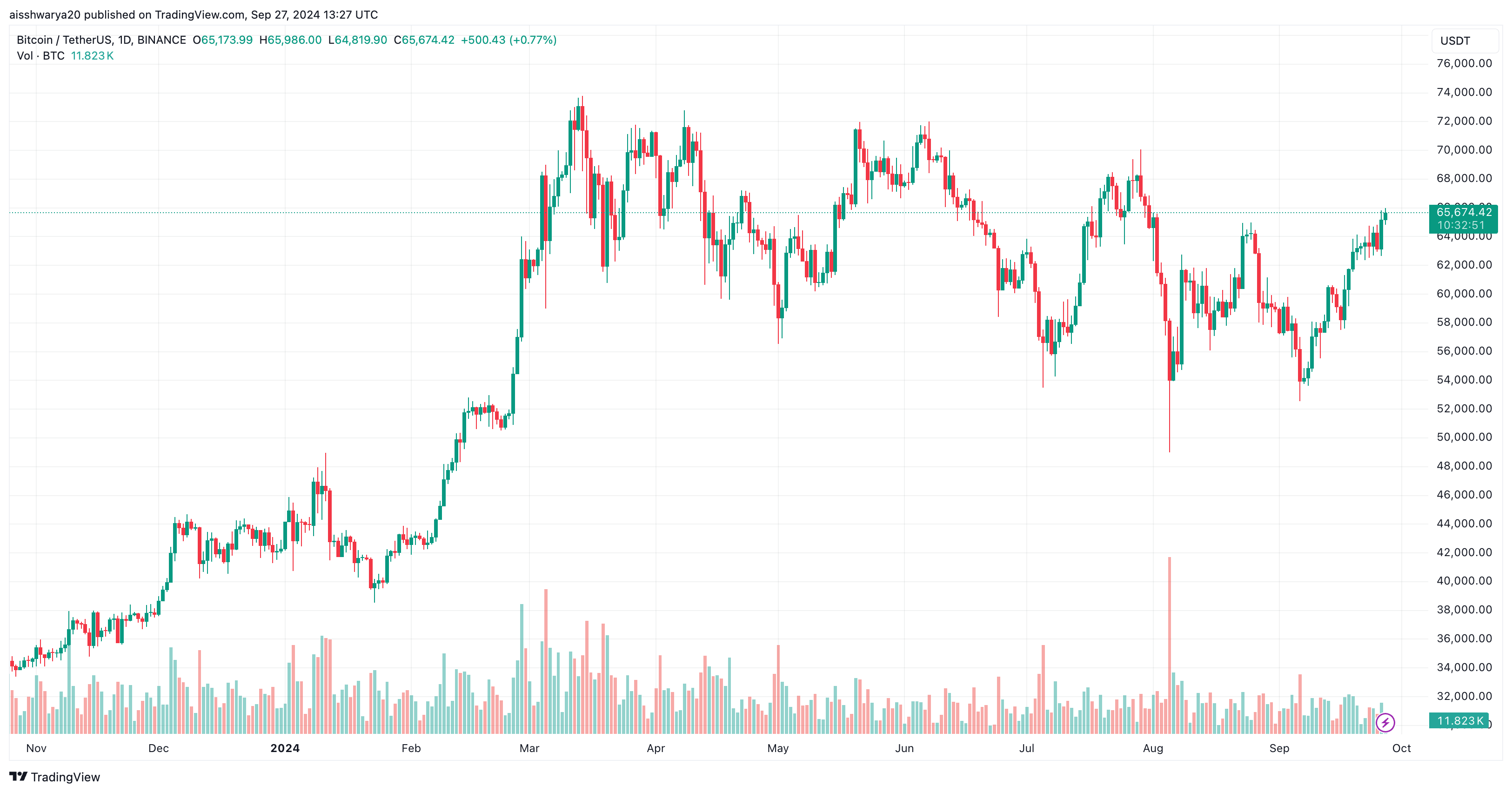

Whereas BTC seems to have shaken off its typical September hunch, it’s price highlighting that the main digital asset nonetheless wants to beat sure vital worth ranges earlier than hitting a brand new all-time-high (ATH).

Associated Studying

As beforehand reported, Bitcoin’s relative energy index (RSI) fell under 80 on the month-to-month chart, signaling that the cryptocurrency’s bullish momentum would possibly fade after an enthusiastic shopping for spree.

As well as, a latest report by crypto alternate Bitfinex famous that regardless of Bitcoin’s latest upward motion, it should decisively overcome a robust resistance stage of $65,200 to proceed its optimistic momentum. The excellent news for bulls is that BTC is holding regular at $65,674, up 2% within the final 24 hours.

Featured picture from Unsplash, Charts from CoinGlass.com and Tradingview.com