Bitcoin (BTC) just lately reached a brand new all-time excessive (ATH) of $93,477, because the main digital asset inches nearer to the extremely anticipated $100,000 goal. Notably, the continuing value rally has seen comparatively muted profit-taking, fueling hopes that BTC has additional room to surge.

Low Revenue-Taking For Bitcoin In Present Cycle

Based on a latest report by Glassnode, the present BTC value momentum is primarily pushed by sturdy spot demand and rising institutional curiosity. Notably, the victory of Republican US presidential candidate Donald Trump has added optimism to the digital belongings business.

Associated Studying

The report highlights that over 95% of Bitcoin’s provide is at the moment in revenue. Nonetheless, regardless of the excessive proportion of worthwhile holders, profit-taking has remained comparatively muted throughout this cycle.

Traditionally, month-to-month revenue realization has sometimes ranged between $30 and $50 billion throughout earlier Bitcoin ATH cycles. The present value discovery part has seen about $20.4 billion in realized revenue.

This comparatively low profit-taking degree within the present BTC ATH cycle suggests additional room for the BTC value to rise, probably reaching the $100,000 milestone earlier than demand wanes.

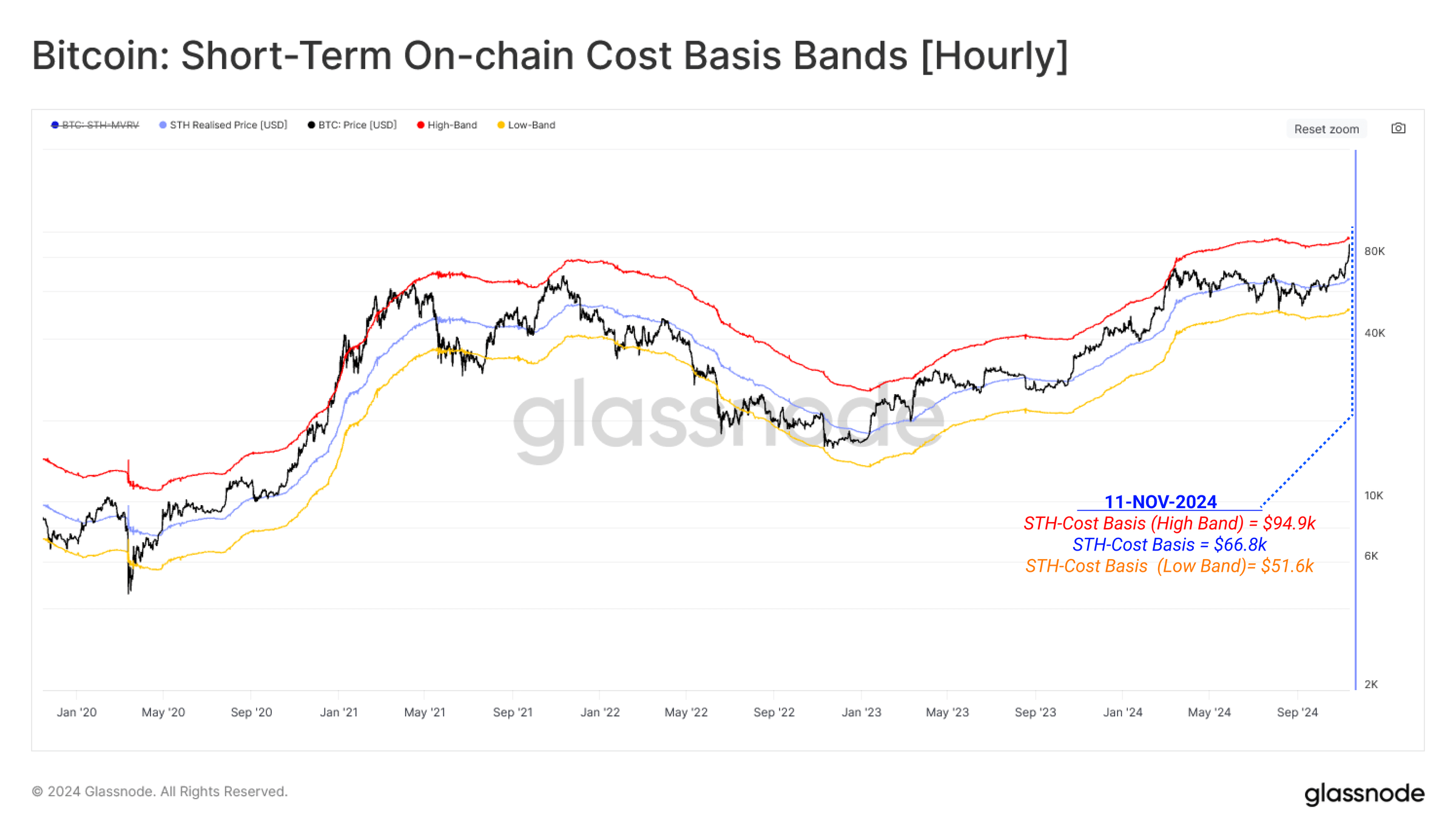

The chart under exhibits the associated fee foundation of recent BTC buyers, together with higher and decrease statistical bands. Based on the report, throughout an ATH part, BTC’s value repeatedly assessments the higher bands as new buyers enter the market at increased value factors.

As could be inferred from the above chart, BTC’s present spot value of $91,199 is just under its higher band of $94,900. Conserving monitor of value motion between these bands can present when the market value may be excessive sufficient to drive current holders to promote their holdings.

Extra Leverage Should Be Flushed Earlier than $100,000 BTC

Whereas BTC is buying and selling lower than 10% under the $100,000 degree, business consultants opine that extra leverage have to be flushed out earlier than the highest digital asset makes an attempt to hit the 6-figure goal.

Associated Studying

Knowledge from Coinglass exhibits that greater than $718 million value of crypto contracts had been liquidated previously 24 hours, impacting 202,074 merchants.

Notably, contract liquidations had been cut up fairly evenly between longs and shorts – 49.93% vs 50.07%, respectively – indicating that regardless of the sturdy bullish sentiment, there is no such thing as a clear buying and selling benefit.

Some business leaders stay optimistic about BTC’s future value motion. In October, the BTC mining agency CleanSpark CEO mentioned that the premier digital asset could peak at $200,000 within the subsequent 18 months.

Equally, BitMEX co-founder Arthur Hayes just lately predicted that BTC could hit $1 million beneath the Trump administration. BTC trades at $91,199 at press time, up 3.9% previously 24 hours.

Featured picture from Unsplash, Charts from Glassnode and TradingView.com