Bitcoin has confronted its first main correction since early November, dropping 13% from its all-time excessive of $108,364. This sudden pullback has despatched shockwaves throughout the crypto market, shifting sentiment from excessive bullishness to uncertainty and even worry. The sell-off has been significantly brutal for altcoins, a lot of that are bleeding onerous as Bitcoin struggles to regain momentum.

Associated Studying

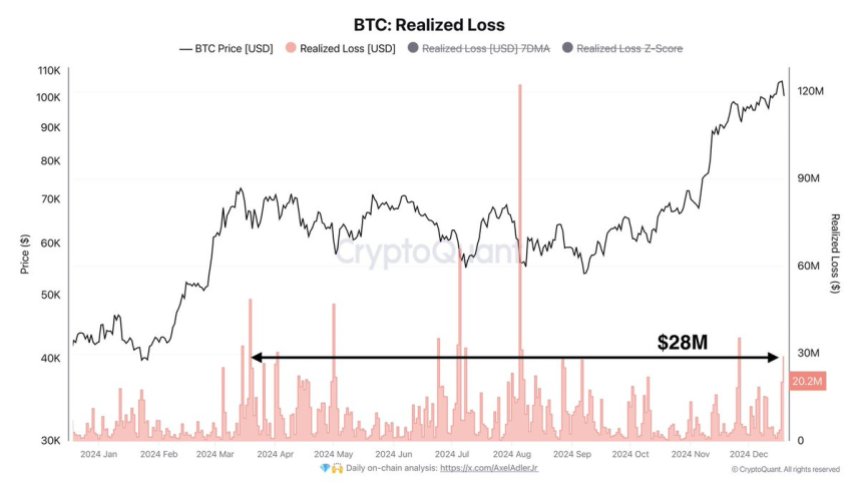

Key metrics from CryptoQuant spotlight the gravity of the state of affairs, with realized losses totaling $28.9 million—an alarming 3.2 instances larger than the weekly common. This spike in realized losses means that some traders exit positions because the market recalibrates after weeks of aggressive upward motion.

The large query now’s whether or not that is merely a wholesome correction in an in any other case bullish pattern or the beginning of a bigger downtrend. Merchants are carefully watching Bitcoin’s capability to carry crucial help ranges and the habits of altcoins, which regularly amplify Bitcoin’s value actions.

For now, the market stays at a crossroads, with the approaching days more likely to reveal whether or not Bitcoin can recuperate and resume its uptrend—or if this correction alerts a extra extended interval of weak spot.

Bitcoin Going through Promoting Strain

Bitcoin is below important promoting stress after two days of aggressive bearish exercise, marking a pivotal second for the market. The sudden sentiment shift has brought on many analysts and traders to show cautious, with some flipping bearish as Bitcoin’s current pattern begins to lose momentum. This correction has left the market questioning whether or not the present value motion is a pure pause or a precursor to deeper losses.

High analyst Axel Adler not too long ago shared insights on X, supported by compelling on-chain knowledge, highlighting that realized losses have surged to $28.9 million. This determine is 3.2 instances larger than the weekly common, indicating heightened promoting exercise. Adler’s evaluation underscores that whereas the sell-off may appear alarming, it’s in step with a wholesome market correction, particularly following Bitcoin’s outstanding rally to $108,300.

Adler notes that the present dip shouldn’t set off panic however as a substitute function a second of persistence for long-term holders. He emphasised that now’s a time to HODL except further bearish alerts emerge to recommend a extra extended downtrend. Corrections like this usually present the market with the mandatory gas for the subsequent leg up, as weaker palms exit and robust palms place themselves strategically.

Associated Studying

Worth motion stays crucial, with traders watching carefully to find out whether or not this correction solidifies a robust basis for future development or alerts additional draw back.

BTC Holding Bullish Construction (For Now)

Bitcoin is buying and selling at $94,400 following three consecutive days of aggressive promoting stress. Regardless of the obvious bearish sentiment gripping the market, BTC has managed to keep up its footing above the important thing help degree of $92,000. This help is essential because it clearly defines the continued uptrend. Holding above this degree suggests resilience and units the stage for a possible robust bounce if patrons regain management within the coming classes.

Whereas the current value motion displays uncertainty, the decline has not been as extreme because the market sentiment signifies. Destructive feelings have pushed many merchants to undertake a cautious stance, however BTC’s capability to remain above $92,000 exhibits underlying power available in the market construction.

Associated Studying

Nevertheless, sentiment stays a crucial market driver. Restoring confidence will probably be important for Bitcoin to reclaim larger ranges and resume its bullish momentum. If sentiment doesn’t enhance and costs proceed to drop, the chance of a deeper correction turns into extra possible. Shedding the $92,000 help might pave the best way for a retest of decrease ranges, probably inflicting further volatility.

Featured picture from Dall-E, chart from TradingView