Bitcoin has surged previous the $99,800 mark, setting one other all-time excessive because it inches nearer to the psychological $100,000 milestone. Regardless of briefly testing the extent, BTC has but to interrupt by way of, leaving traders and analysts eagerly anticipating the subsequent transfer. With demand remaining sturdy, the stage seems set for Bitcoin to push previous this key barrier within the coming days.

Associated Studying

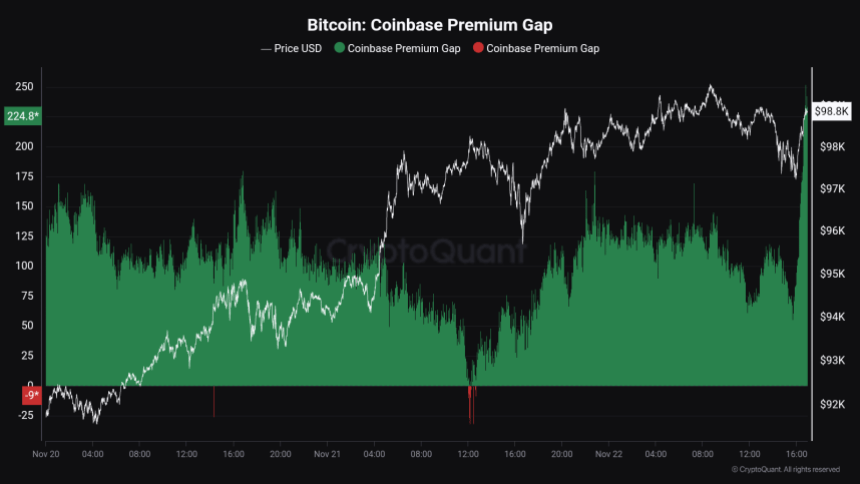

Current information from CryptoQuant highlights a big issue driving this rally: the Coinbase Premium Hole, which at present sits at $224. This metric, representing the value distinction between Bitcoin on Coinbase and different international exchanges, alerts robust shopping for exercise from US Coinbase traders.

The relentless upward momentum has additional solidified Bitcoin’s dominance within the crypto market, with many viewing the $100,000 degree as a important provide zone. Whereas the value has but to interrupt by way of, the continued rally displays a rising perception that Bitcoin’s parabolic bull section is way from over. Because the market approaches this pivotal second, all eyes stay on BTC’s means to maintain its momentum and declare new highs, setting the tone for the weeks forward.

Bitcoin Worth Motion Stays Sturdy

Bitcoin has been in an “solely up” section since November 5, displaying no indicators of weak spot because it constantly climbs to new heights. Even after failing to interrupt above the $100,000 mark yesterday, value motion stays extremely robust. Bulls are firmly in management, and if Bitcoin holds above important demand ranges, the long-anticipated $100,000 milestone may very well be breached inside hours.

CryptoQuant analyst Maartunn revealed that sturdy demand from US traders is a key driving drive behind this rally. In response to his information, the Coinbase Premium Hole—a metric that tracks the value distinction between Bitcoin on Coinbase and different international exchanges—stands at $224.

This constructive premium underscores US-based shopping for exercise as a big issue within the present bullish momentum. A excessive premium usually means that traders on Coinbase are prepared to pay the next value than others, a robust indicator of heightened demand.

Associated Studying

Because the market watches carefully, Bitcoin’s means to take care of its upward trajectory hinges on staying above important help ranges. The psychological resistance at $100,000 stays formidable, however the unyielding urge for food from US traders factors to continued energy within the days forward. With such stable fundamentals, many analysts imagine Bitcoin is poised for one more explosive rally as soon as the $100,000 barrier is decisively cleared.

BTC Rally Is Solely Beginning

Bitcoin is buying and selling at $98,800 after a failed breakout above the extremely anticipated $100,000 mark. Regardless of this short-term setback, value motion stays firmly bullish as BTC continues to carry above key demand ranges, displaying resilience and energy within the present market. The failure to retrace to decrease costs signifies that bullish momentum remains to be intact, maintaining traders optimistic a couple of potential breakthrough.

If BTC maintains its place above the important $95,000 help degree, the chance of a surge previous the $100,000 psychological barrier will increase considerably. Holding above this degree would sign robust purchaser curiosity and the potential for additional upside, paving the best way for Bitcoin to renew its upward trajectory within the close to time period.

Associated Studying

Nonetheless, if Bitcoin fails to carry above $95,000, a retrace to decrease demand zones would verify a short-term correction. Such a pullback might present the required gasoline for the subsequent rally, as it might permit the market to consolidate earlier than making one other try at breaking the $100,000 mark.

For now, all eyes stay on Bitcoin’s means to defend its key help ranges because the market anticipates the subsequent main transfer on this historic rally.

Featured picture from Dall-E, chart from TradingView