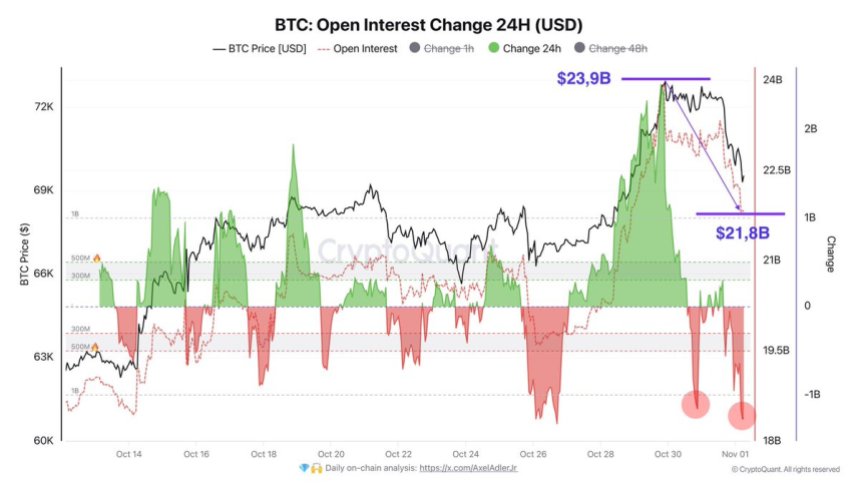

Bitcoin is presently buying and selling above $69,000, following a 6% pullback from its latest peak at $73,600. The latest surge in open curiosity has been a key think about driving BTC’s worth motion, with open curiosity reaching $23.9 billion on October 30, a major uptick that indicated excessive market engagement.

Nonetheless, prior to now 24 hours, knowledge from CryptoQuant reveals a $2.1 billion decline in open curiosity, signaling a shift as BTC’s worth retraces to decrease ranges.

Associated Studying

This cooling off has led analysts to intently look ahead to renewed shopping for curiosity from spot traders, which may present the gasoline wanted for BTC to rally as soon as extra. With Bitcoin hovering close to key assist ranges, a push from spot traders may doubtlessly set the stage for a robust rebound.

The following few days shall be pivotal as merchants and analysts alike await recent inflows which will reinforce BTC’s resilience and put together it for an additional take a look at of its all-time highs. As BTC holds round $69,000, market sentiment stays cautiously optimistic, with eyes on spot exercise to gauge whether or not this retracement part may quickly give strategy to renewed momentum.

Bitcoin Hype Slowing Down?

Bitcoin has lately captured market pleasure, coming inside 1% of its March all-time excessive and fueling hypothesis of an enormous breakout. Nonetheless, this momentum seems to be shedding steam, as BTC has but to ascertain a brand new excessive, and open curiosity—a measure of the entire worth of futures contracts—has begun to shrink.

Famend analyst Axel Adler lately shared key knowledge on X, revealing a $2.1 billion discount in open curiosity inside the final 24 hours. This decline, from a peak of $23.9 billion to $21.8 billion, signifies that speculative futures buying and selling alone will not be adequate to push Bitcoin to new heights.

Adler means that for Bitcoin to interrupt previous this barrier, spot traders—the market contributors who purchase BTC instantly slightly than by way of derivatives—should step in to drive demand. With futures markets retreating, recent shopping for from spot traders could possibly be the wanted catalyst to take Bitcoin above its all-time excessive and set the stage for additional positive factors.

Associated Studying

The timing is essential, as Bitcoin is presently buying and selling near its historic peak, and the upcoming U.S. election on November 5 provides one other layer of potential market volatility. Many market contributors are eyeing the election as a possible driver of a broader market rally, with a Bitcoin bull run presumably following a political catalyst.

For now, Bitcoin hovers slightly below its all-time excessive, and whereas the futures market pulls again, consideration shifts to identify shopping for as a key think about figuring out whether or not BTC can resume its upward trajectory. As BTC holds close to report ranges, the subsequent few days shall be pivotal in defining its short-term course and potential for a brand new bull part.

BTC Holding Above Key Ranges

Bitcoin is presently buying and selling above the important $69,000 mark, which beforehand acted as robust resistance since late July. Holding this stage as assist is important for bulls aiming to push BTC towards new all-time highs.

If Bitcoin manages to consolidate above $69,000, the stage could possibly be set for a breakthrough into uncharted territory and a worth discovery part. Nonetheless, ought to BTC retrace beneath this stage, it will sign that the asset wants further momentum to check and surpass its all-time excessive.

Within the occasion of a pullback, $66,500 stands out as the subsequent important assist. This stage would keep Bitcoin’s bullish construction whereas offering a stable base for a possible rebound. Such a dip may entice recent shopping for curiosity and add essential gasoline to Bitcoin’s rally, making ready the marketplace for a renewed try at worth discovery.

Associated Studying

As BTC hovers above this important assist stage, merchants are intently expecting indicators of sustained power or a wholesome retracement to solidify the bottom earlier than the subsequent leg up. Holding above $69,000 is essential, however even a short lived decline to $66,500 would hold Bitcoin’s broader bullish outlook intact.

Featured picture from Dall-E, chart from TradingView